How To Use Your FSA Money Before the End of the Year

Sam O'Keefe

Co-founder & CEO of Flex

Updated: November 27, 2025

🚀 Fast Facts: Using Your FSA Funds Before Year End

Typically, FSA funds reset at the end of the calendar year (on December 31st)

There are a few exceptions that allow you to spend funds beyond this date

Stocking stuffers and refilling healthcare products is a great way to spend FSA funds before the end of the year

While an FSA is an incredible financial tool, many people aren’t taking full advantage of it by using their full amounts before they expire each year. In 2023, U.S. workers forfeited approximately $4.5 billion in unspent FSA contributions. Suffice to say, employees are leaving a lot of unused FSA money on the table at the end of the year.

But you don’t have to! We’ll help you find ways to spend what’s left before the end of the year by covering the following:

6 creative ideas for how to spend FSA money before the end of the year

27 popular products & services you can make end of year FSA purchases on

How to check if you need to use your FSA dollars before the end of this year

We’ll start by explaining when FSA money expires and what the exceptions are so you don’t forfeit any funds at year end.

Do you have to use your FSA by the end of the year?

Yes, in general, you need to spend your FSA funds by the end of the year. However, there are a few exceptions that allow you to submit expenses for the previous year or pay using your previous year’s FSA funds. But for the most part, FSA funds are limited to each year.

When does FSA money expire?

Your FSA money expires on the final day of your plan year, and for most people, that’s December 31st. In rare cases, your plan end date may fall on another date, such as your employment date, the date your company started offering the FSA, or another date defined by your employer.

Most FSA providers offer either a grace period or rollover amount, which enables you to use some funds from a previous year. But excluding these exceptions, your FSA funds will expire on December 31st of each year.

What is an FSA runout period vs grace period vs rollover amount?

A rollover amount, grace period, and runout period are all benefits that are built into the structure of an FSA plan. Essentially, they define how members can claim their FSA funds. It’s important to understand how these benefits work so that you can get the most out of your FSA amounts.

Let’s look at what each of these is:

Run-out period refers to the length of time you’re still allowed to submit claims from the previous year. After this point, all old claims can no longer be submitted

Grace period refers to a length of time after the plan year ends under which you are still allowed to spend remaining funds

Rollover amount refers to a limited amount of unused funds that can be carried over to the next plan year

A run-out period doesn't actually let you make purchases in the following year, it simply allows you to claim expenses that you made towards the end of the previous year. For example, if you’re off for the entire holiday break, but you have a dental appointment on December 27th, you don’t have to claim that immediately. You’ll be able to submit the expense when you return in January, as the expense itself was made in the previous year.

Alternatively, a grace period gives you a window of time where you can still make a claim to spend unused funds in the following year. This lets you tap into unused funds by making expenses that fall under the next year. Similarly, rollover amount allows you to carry over unused funds to the next year. These funds can be used at any time, but will not carry over to a second year, so you’ll need to spend them before you hit the next rollover date.

How much FSA can carry over to next year?

The amount you can carry over varies by provider, but the IRS sets a maximum amount. For 2025, this was $660 (up from $640 in 2024).

Rollover is not cumulative, so you can only carry it over for one year. For example, let’s say you contribute $1,000 to your FSA at the start of the year. If you spend $600 in this year, you’d be left with a remaining $400, which would rollover to the next year. Let’s say you only end up spending $300 in this second year. Technically, you’d still have $100 left over. Since that money carried over, it can’t carry over to Year 3, so you’d lose it at the end of Year 2.

If you’re close to losing your previous year rollover amounts, or this years’ funds are expiring, check out the Flex Marketplace where hundreds of online retailers allow you to pay for their products directly with your FSA plans at checkout, and can provide a Letter of Medical Necessity when needed so you are eligible to purchase the products.

What happens to unspent FSA dollars at the end of the year?

Aside from the exceptions outlined above, unspent FSA funds are forfeited after the benefit period ends, which is typically at the end of the year. This is commonly referred to as the “use it or lose it” rule. The funds, aside from whatever carry over or grace period is allowed, are then turned over to your employer.

To ensure this doesn’t happen, you’ll want to be thoughtful about the amount you contribute to your FSA.

Can you use your FSA from this year for expenses next year?

No. Aside from a few exceptions, you aren’t able to use your FSA funds for expenses for a future year. The only exception is the grace period and rollover amount, which allows you to expense claims made within the first period of the year and use a portion of funds remaining from the previous year.

6 creative ideas for how to spend FSA money before the end of the year

The deadline is coming up fast, and you may be in a crunch to spend what’s left of your FSA funds before they expire. But how do you do that with just a month left? Luckily, we’ve got some creative ways to spend your FSA funds at the end of the year.

1. Take action on things you’ve been putting off

If you have a hefty amount of FSA money left at the end of the year, it’s a good time to buy something or schedule an appointment you’ve been putting off. Whether that’s a new pair of prescription glasses or a major dental surgery, it’s a way of getting something you desperately need.

2. Spend additional funds on your family

Don’t just think about what you need at the end of the year, think about what your family needs too. FSA funds can be used on family members, including your spouse, children, and dependents. Make sure to leverage your funds to spread this care out across all members of your family. Take the whole family for a dental cleaning, get an essential piece of exercise equipment, or restock on vacation supplies for the upcoming year.

For example, a CAROL Stationary Bike or PowerBlock adjustable dumbbells might be a great household addition the whole family can benefit from.

3. Get household holiday gifts

Just because you’re buying healthcare products doesn’t mean they don’t make good gifts. A lot of products that qualify to be paid for with your FSA make great household holiday gifts. Things like sunscreen, skincare products, or fitness equipment can be used for the whole family.

4. Get a headstart on your New Years’ resolutions

Don’t wait until the New Year to get started on your resolution goals. Get started in December by using up that last bit of FSA money to get a gym membership, exercise equipment, a yoga mat, or a weight loss program. This way, you’ll be ready to go for the next year, without needing to use up a chunk of your funds in January.

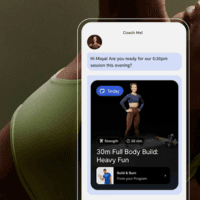

The FitBod Workout App can be a great way to enhance your at-home workouts, or if you’re in the Bay Area, you could take up cycling with a road-ready cycling bike from Mike’s Bikes.

5. Stockpile your medicine cabinet

Check your medicine cabinet for anything that’s run out or is about to expire. Don’t wait to refill these orders in January, spending your entire FSA in a single month. Instead, use your remaining FSA funds at the end of the year to fill up your medicine cabinet for the year to come.

This way, you’re not using up funds in the first few months of the year on products you’re going to need to buy or replace anyway. Get yourself a first-aid kit, bandages, nasal spray, eye drops, pain killers, and other medicines that are eligible to be purchased through your FSA.

6. Prepare for summer!

With December coming up, summer is the last thing on your mind, but thinking ahead to summer vacation is a great way to spend additional FSA funds that will otherwise run out. Many sun protection and skincare products actually qualify to be purchased using an FSA, so buying products you’ll need for summer vacation is a great way to make use of end of the year FSA funds. Grab sunscreen (Clé de Peau Beauté is one of our favorites!), lip balm, bug spray, and more.

27 popular products & services you can make end of year FSA purchases on

If you’re looking for some inspiration on what to spend your FSA on before your funds expire this year, some online shops will let you pay directly with your FSA card or plan at checkout, which can save you a lot of time, as well as the headache of waiting for reimbursement—especially if you don’t have a grace period.

Certain FSA-eligible items require a Letter of Medical Necessity (LMN), but some shops (like the ones we’ve listed below) can help you get one instantly at checkout, and sent to you within 24 hours, so you have more options for what you can spend your FSA on.

Check out the Flex Marketplace for 400+ retailers with FSA-eligible products in their online stores, or here are some you might not have known about:

Fitness and exercise products & services

Product | Description |

|---|---|

| A very accessible gym that’s open 24 hours a day, with hundreds of locations worldwide. |

| Pilates reformer equipment that makes at-home pilates accessible to all. |

| An AI-powered stationary bike that gives the benefits of a 45-minute run in just 8 minutes. |

| A wearable biosensor that can analyze sweat and improve athletic performance. |

| AI virtual training home gym bundle that helps lower the costs of working out. |

| A training platform that attaches to any fitness equipment you have to enhance workouts. |

| Adjustable dumbbells that make at-home workouts easier and save space. |

| Enhance your GLP1 weight loss journey with this telehealth coaching program. |

Sleep wellness products

Product | Description |

|---|---|

| Temperature regulated bedding and products, including their flagship product—the Snug Topper. |

| Air-based heating and cooling technology to give you a better night’s sleep. |

| The first non-audible sleep tech, offering low frequency binaural beats to help you sleep better. |

| Blackout shades that are custom-made for your space and keep light out so you can sleep soundly. |

| Mouth tape and nose strips that help prevent snoring to give you a restful sleep. |

Footwear, clothing, or home wellness products

Product | Description |

|---|---|

| Support the unique contours of your feet with these personalized insoles and sandals. |

| This air purifier captures 99.9% of particles, down to 0.1 microns using HEPA filters. |

| This therapeutic massage gun can help with workout recovery or chronic pain issues. |

| Posture-correcting clothing including shorts, scrubs, leggings, bras, and more. |

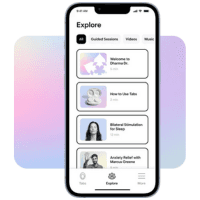

| Achieve calm in 3-minutes with this drug-free anxiety treatment solution. |

| A bilateral stimulation device that supports healing, growth, and transformation. |

| Advanced compression therapy device that helps with workout recovery, edema, and vein relief. |

Supplements and nutrition products

Product | Description |

|---|---|

| Health app with a proven method for people with challenging schedules, stress levels, or lack of energy. |

| Dr. Mary Claire Haver’s supplements and health resources for women experiencing menopause. |

| Daily hormone & digestion ‘bites’ to help supplement essential nutrients you’re missing.. |

| Functional medicine supplements to support auto-immune and gut health. |

Skincare products

Product | Description |

|---|---|

| Founded in 1872 in Ginza, Tokyo, and is one of the world’s biggest names in Skincare. |

| Sensitive skincare body washes and solutions for the whole family. |

| A red light therapy mask that can help you achieve younger looking skin. |

How to check if you need to use your FSA dollars before the end of this year

Before you empty what’s left of your FSA, you’ll want to find out how much you need to actually use before the year ends. If you have a rollover amount or a grace period, you may not have to spend as much as you think. Here’s how to check how much FSA funds you need to use before the end of the year:

1. Review your plan to check your rollover amount

First, verify precisely how much your rollover amount is. How much you’re allowed to roll over will have a huge bearing on how much pressure you have to use it up. If you can carry over $1,000, you may not need to worry about spending every extra dollar you have. But if you can only carry over $200, you may want to squeeze every last penny out of your annual allocation.

Either way, knowing your exact rollover amount will be crucial for knowing how much you have to spend by the end of the year.

2. Verify rollover amount conditions and eligibility period

Check your plan details to understand exactly how your rollover works. You’ll want to know when the eligibility period ends and what conditions or restrictions apply to your annual FSA amounts.

3. Check if your plan offers a grace period to offer you more time

Some plans offer a grace period, allowing you to continue to spend a short period into the next year. This could be as little as a few weeks or as long as a few months. For example, an annual plan that ends on December 31st may allow you to claim expenses made until March 31st of the following year.

4. Calculate how much money you need to spend before the end of the year

Now that you know exactly how your plan works and precisely how much you can rollover, you can calculate how much you need to spend before the end of the year. To find out how much you need to spend before the end of the year, take the total amount you have for the year, subtract what you’ve already spent this year, subtract the amount you’re allowed to rollover, and subtract the amount you can use during a grace period (if you have one). Then you simply need to find ways to spend this amount.

If you have a lot of money left in your account, it’s good to look at getting a new pair of prescription glasses, completing overdue dental work, or purchasing exercise equipment. If you have a smaller amount, you may be able to simply fill your medicine cabinet or get some items for your summer vacation (like sunscreen or skincare products).

If you’re looking for more ways to spend your FSA before the end of the year, check out our Flex Marketplace to find products that are eligible to purchase with your FSA.

Related content from Flex

HSA/FSA ELIGIBLE SHOPPING

Shop the Flex HSA/FSA Marketplace

Shop Now