When & Where You Can Use Your HSA/FSA Funds For Pilates

Yulia Derdemezis

Head of Marketing at Flex

Updated: January 12, 2026

🚀 Fast Facts: Is pilates HSA/FSA eligible?

Pilates can be HSA/FSA eligible if it’s for a specific medical condition or ailment

Pilates often requires an LMN and clear justification as to why it’s part of your treatment plan

There are places online you can buy pilates classes and equipment using your HSA/FSA funds directly

Pilates has numerous health benefits backed by science, and can be useful to treat certain medical conditions like chronic pain or injuries. When you have available funds in your HSA (Health Savings Account) or FSA (Flexible Spending Account), you might be wondering whether you can allocate those to pilates classes, memberships, or equipment.

We’ve got you covered with this guide, where you’ll learn exactly how pilates fits into HSA and FSA rules, when documentation matters, and how to spend your pre-tax dollars with confidence. We’ll go over:

12 medical conditions that qualify pilates as HSA/FSA eligible

How to buy pilates services & equipment with your HSA/FSA directly or through reimbursement

HSA & FSA approved pilates studios and equipment you can buy using your plan directly

By the end, you’ll know when pilates qualifies as an eligible medical expense and how to find eligible classes, studios, and equipment in one place.

Let’s start by answering the most common question people ask when they want to use their Health Savings Accounts (HSAs) or Flexible Spending Accounts (FSAs) for pilates.

Is pilates HSA and FSA eligible?

Pilates can be HSA and FSA eligible, when used to treat or manage a documented medical condition, following the IRS rules for eligibility. Generally, whether it’s eligible or not depends on the purpose of the activity: pilates will be eligible if used as part of your treatment plan, and not when it’s done as an activity for general fitness or wellness.

To make this clearer, it helps to understand how documentation factors into pilates eligibility.

Do you need a Letter of Medical Necessity to purchase pilates with your HSA/FSA?

In most cases, you need a Letter of Medical Necessity (LMN) to use HSA/FSA funds for pilates. Because pilates is typically viewed as exercise, the IRS requires documentation showing it treats a diagnosed medical condition rather than supporting general fitness or wellness as medical care under federal rules.

A Letter of Medical Necessity is a written statement from a licensed healthcare provider that connects pilates directly to treatment. If you want to use your HSA/FSA for pilates-related expenses, you would require an LMN that explains why pilates is appropriate for your condition and how it supports your care plan. It would need to include:

Your diagnosed medical condition

Why pilates specifically helps treat or manage that condition

The recommended duration of treatment

Without an LMN, most pilates expenses are considered general fitness and are not eligible under HSA or FSA rules.

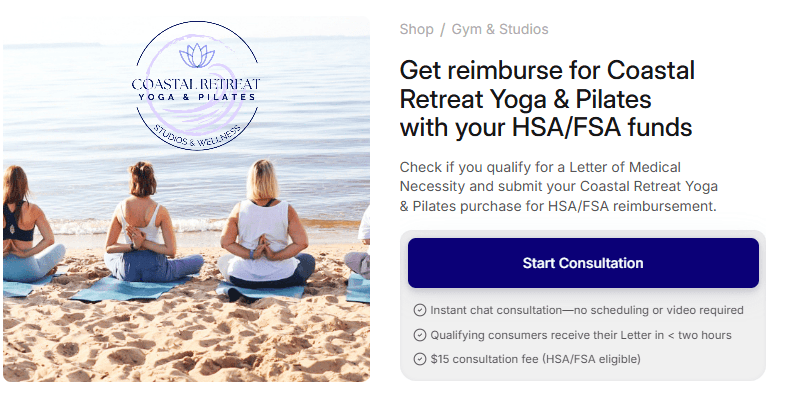

Pilates studios and online platforms in the Flex Marketplace help simplify this step by offering access to a Letter of Medical Necessity consultation right at checkout, like this one you can get from Coastal Retreat Yoga & Pilates in Maryland. Others require you to obtain one separately and submit it to your plan administrator.

Even if you can’t get your LMN online, once you receive one from a licensed medical professional, pilates can move from a denied expense to an approved use of your HSA or FSA funds. You want to ensure you have an eligible medical condition, or speak to your healthcare provider to see if you might qualify.

Are pilates reformers or memberships also HSA/FSA eligible?

Per the IRS eligible rules, whether pilates is eligible or not is specific to your medical condition and treatment plan, not necessarily the way you perform the pilates. In general, a studio membership, pay-per-attend classes, at-home class membership, or at-home pilates reformer equipment would all be eligible if you follow the eligibility rules and they apply to you, as they enable you to do pilates as part of your treatment plan.

Clothing worn to do pilates, or smaller pilates accessories like magic circles, resistance bands, balls, and rollers would likely not be eligible, and they wouldn’t be necessary for your treatment plan. For something like this to be eligible, it would have to be specifically documented in your Letter of Medical Necessity why you need the item, and how it is an essential part of your treatment plan.

12 medical conditions that qualify pilates as HSA/FSA eligible

Pilates can qualify for HSA and FSA use when a licensed healthcare provider recommends it to treat or manage a diagnosed medical condition. Pilates generally does not qualify when it’s used only for general fitness, weight loss, or stress relief without a diagnosed medical condition. Eligibility depends on medical purpose and proper documentation, not overall wellness benefits.

Below are common medical conditions that often qualify pilates as an eligible expense when supported by a Letter of Medical Necessity (LMN).

Chronic lower back pain: Pilates may help improve core strength and stability to support pain management and mobility.

Herniated or bulging discs: Providers sometimes recommend pilates to support controlled movement and spinal alignment during treatment.

Sciatica: Pilates can be used to help manage nerve-related pain when included in a documented care plan.

Joint injuries or post-surgical recovery: Pilates may support rehabilitation for knees, hips, shoulders, or other joints following injury or surgery.

Chronic neck or shoulder pain: Some treatment plans include pilates to address muscle imbalance and limited range of motion.

Arthritis-related stiffness or joint pain: Pilates may be recommended to maintain flexibility and support joint function.

Fibromyalgia: Providers may include pilates as part of a broader pain management approach when documented appropriately.

Balance or coordination disorders: Pilates can support stability and controlled movement for certain neurological or balance-related conditions.

Post-stroke recovery support: In some cases, pilates is used to help improve functional movement as part of a supervised recovery plan.

Pelvic floor dysfunction: Pilates may be recommended to support targeted muscle engagement and recovery.

Diastasis recti: Postpartum pilates can qualify when prescribed to support abdominal muscle separation recovery.

Pregnancy-related back or joint pain: Pilates may qualify when a provider documents its role in managing specific prenatal symptoms.

In these situations, pilates supports medical care rather than general exercise, which aligns with IRS eligibility rules. Now that you know which conditions commonly qualify, the next step is understanding how to buy pilates using your HSA or FSA, either by paying directly or requesting reimbursement.

How to buy pilates services & equipment with your HSA/FSA directly or through reimbursement

Once you know what pilates qualifies as an eligible HSA/FSA expense for you, you have two main ways you can use the funds to purchase pilates memberships, classes, or equipment. You can either pay directly at checkout with your benefits card or pay out of pocket and request reimbursement later.

The best option depends on where you’re purchasing pilates services or equipment and how your plan administrator handles claims. Below is a clear breakdown of both methods so you can choose what works best for you.

1. Pay with your HSA/FSA directly at checkout

Paying directly with your HSA or FSA card is the simplest option when it’s available, and some online stores offer the ability to do this right at checkout. You can use your pre-tax funds right away by paying with your HSA/FSA card at checkout, without filing paperwork after the purchase.

You can pay for pilates with an HSA/FSA directly when:

The pilates studio or provider accepts HSA or FSA cards

The service or product qualifies as a medical expense

A Letter of Medical Necessity (LMN) is already on file or provided during checkout

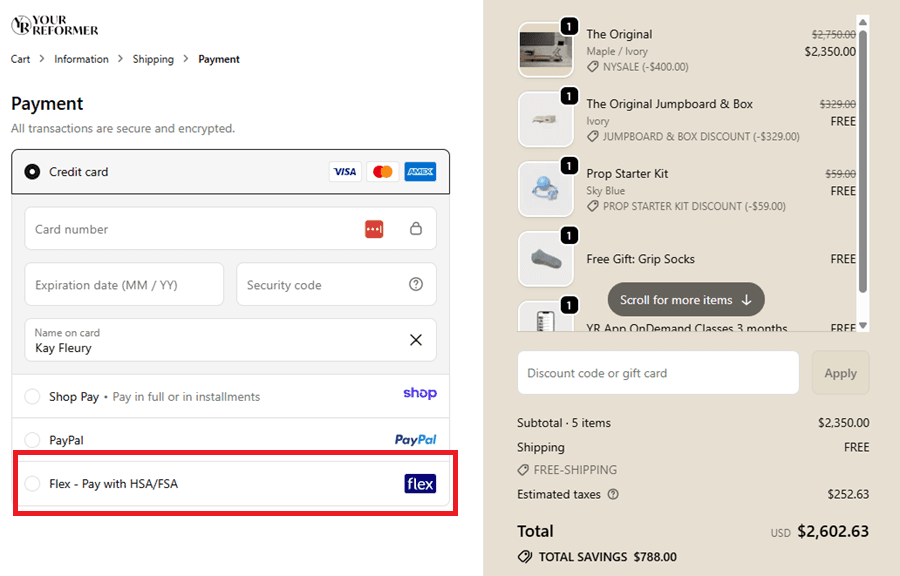

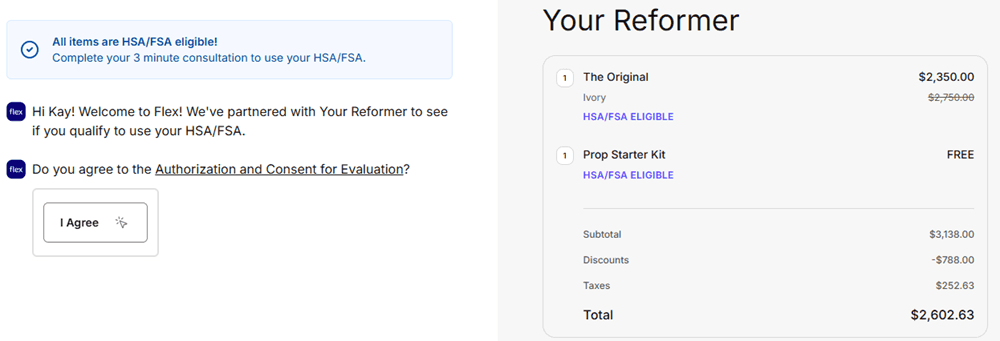

Here’s an example of one of our favorite pilates reformer machine providers YourReformer, and how you can pay at checkout:

Simply select “Pay with HSA/FSA” at any checkout that allows you, and enter your payment information. If you require a Letter of Medical Necessity, some sites will even let you check if you qualify for HSA/FSA eligibility. Follow the prompts to complete your consultation to see if you qualify.

When this option is available, your purchase feels similar to using a regular debit card. Your HSA or FSA funds are deducted immediately, and you avoid reimbursement delays. This approach saves time and reduces the risk of claim denials.

Many of our pilates partners in the Flex Marketplace help streamline this process by bringing together pilates-related products and services that support HSA and FSA payments online.

Instead of calling studios or guessing at checkout, you can browse eligible options in one place and pay instantly using your HSA or FSA card. You can also complete a consultation with many of our pilates providers right at checkout to obtain your Letter of Medical Necessity before you make any purchases.

2. Submit a purchase you made for reimbursement with your HSA/FSA provider

Reimbursement is common when a pilates provider does not accept HSA or FSA cards directly. In this case, you pay out of pocket first and request repayment from your account later using the process required by your HSA/FSA provider.

Here’s how reimbursement usually works:

Pay for pilates sessions or equipment using a personal card

Save your receipt and proof of payment

Submit a claim through your HSA or FSA administrator

Include your Letter of Medical Necessity if required

Some people prefer reimbursement for local studios or private instructors who don’t support direct benefits payments. Still, it adds extra steps compared to paying directly at checkout. You also want to make sure you have your LMN before you buy anything, otherwise your purchase will not qualify as HSA/FSA-eligible.

Now that you know how to pay for pilates, it helps to see which pilates studios and equipment commonly support HSA and FSA spending directly.

Top 12 HSA & FSA approved pilates studios and equipment you can purchase online

Once pilates qualifies as a medical expense, choosing well-known studios and equipment brands can make HSA and FSA spending smoother. The providers below focus heavily on pilates services or equipment commonly used in therapeutic, rehabilitation, or medically supported programs.

Eligibility still depends on medical purpose and, in many cases, having a Letter of Medical Necessity (LMN) before you make your purchase. These brands are frequently used by people spending HSA or FSA funds for pilates-related care.

Product | Description |

|---|---|

| YourReformer specializes in at-home pilates reformers designed for guided and structured use. These reformers are often used in provider-recommended programs that support rehabilitation, core stability, or injury recovery. With an LMN, YourReformer equipment may qualify for HSA or FSA spending. |

| Balanced Body is one of the most recognized names in pilates equipment. Its reformers, chairs, and accessories are widely used in physical therapy clinics and rehabilitation-focused studios. When recommended for treatment or recovery, Balanced Body equipment is commonly purchased with HSA or FSA funds. |

| Elevate Pilates, 1 location in San Francisco, California Elevate Pilates focuses on structured pilates instruction, including reformer-based sessions. The studio often works with clients who use pilates as part of a recovery or treatment plan, making it a potential option for HSA or FSA reimbursement with proper documentation. |

| ATX Pilates, 2 locations in Austin, Texas ATX Pilates provides pilates classes and private sessions with an emphasis on form, alignment, and controlled movement. These services may qualify for HSA or FSA use when pilates is recommended to manage pain, improve mobility, or support rehabilitation. |

| Coastal Retreat Yoga & Pilates, 1 location in Easton, Delaware Coastal Retreat Yoga & Pilates offers pilates services alongside other movement practices. Pilates sessions may qualify for HSA or FSA spending when used to treat a specific medical condition and supported by an LMN. |

| Legacy Pilates produces professional-grade pilates apparatus used in studios and clinical environments. Its equipment supports controlled, therapeutic movement and may qualify for HSA or FSA purchase when recommended by a healthcare provider. |

| Sonny Pilates, 1 location in Pleasantville, New York Sonny Pilates offers pilates instruction that can support injury recovery, mobility improvement, or pain management. With appropriate medical documentation, these sessions may be eligible for HSA or FSA reimbursement. |

| The Edge Pilates, 1 location in Fort Mill, South Carolina The Edge Pilates delivers reformer-based and mat pilates sessions often used by clients following structured treatment or recovery plans. Eligibility depends on medical necessity and supporting documentation. |

| The House Pilates, 1 location in Camas, Washington The House Pilates provides pilates classes and private sessions that may qualify for HSA or FSA use when pilates supports a diagnosed medical condition rather than general fitness. |

| Marathon Pilates, 2 locations in Nashville Marathon Pilates focuses on pilates programs that support strength, mobility, and recovery. These services may be eligible for HSA or FSA spending when included in a provider-recommended care plan. |

| Vitality Pilates, 3 locations in Seattle, Washington Vitality Pilates offers pilates instruction designed to support functional movement and symptom management. With an LMN, eligible sessions may be purchased using HSA or FSA funds. |

Not every studio or brand accepts HSA or FSA cards directly, and reimbursement rules vary by plan. Tracking eligibility on your own can take time.

The Flex Marketplace makes this easier by bringing together pilates products and services that support HSA and FSA spending. You can browse eligible options in one place, pay online with your HSA or FSA card when available, or get a Letter of Medical Necessity consultation online while shopping to make sure you are eligible before making your purchases.

In summary

Pilates can qualify as an HSA or FSA-eligible expense when it supports the treatment or management of a medical condition and includes proper documentation. Understanding when eligibility applies helps you avoid denied claims and use your healthcare dollars with purpose.

Once you know whether pilates qualifies as an eligible expense for you, the bigger challenge is figuring out where and how to spend your funds. That’s where the Flex Marketplace stands out as the easiest option.

Instead of searching across multiple sites or guessing at checkout, you can browse pilates products and services that support HSA and FSA spending in one place. And when available, you can pay online with your HSA or FSA card instantly, without waiting for reimbursement, or complete a consultation to check if you’re eligible before you make your purchase!

Related content from Flex

HSA/FSA ELIGIBLE SHOPPING

Shop the Flex HSA/FSA Marketplace

Shop Now