Merchant Resources

Brand Building: How to Get Your Products on the HSA/FSA Eligible List

Follow our blueprint to tap into this $150B market

Published: March 20, 2024

Last edited: Mar 20, 2024

Sam O'Keefe

Co-founder & CEO of Flex

Overview

Overview

Overview

Overview

You’ve determined you want to make your product or service HSA and FSA-eligible (a wise decision considering these represent a $150+ billion with a “b” market). Great!

So how do you do it?

In this guide, we outline the steps and resources necessary to qualify, from defining terminology to breaking down the industry guidelines to when, where and how to apply.

What We’ll Cover About Making Your Products HSA/FSA Eligible

What are HSA/FSA-Eligible Items?

First, let's start with items and services that are already approved for HSA and FSA spending.

According to the IRS, eligible Health Savings Account (HSA) and Flexible Spending Account (FSA) items that are defined as qualified medical care expenses “must be [used] primarily to alleviate or prevent a physical or mental disability or illness”. This includes things like annual doctor’s visits, lab fees, prescription medications, and eyeglasses, among many other items.

However, when it comes to wellness, fitness, nutrition, and other health-related products or services — items that may not be on the standard qualifying list — consumers may still be able to use their HSA or FSA.

Letters of Medical Necessity (potentially) allow consumers to purchase non-preapproved medical expenses

The IRS allows doctors and medical professionals to recommend individualized interventions as long as they meet the criteria of diagnosis, cure, mitigation, treatment, or prevention of a specific medical condition.

To qualify certain purchases for HSA or FSA spending, a doctor needs to write a Letter of Medical Necessity, or LOMN, which deems a product or service medically necessary for a patient. LOMNs are then reviewed by HSA/FSA administrators, and are approved or rejected in accordance with IRS regulations.

(Note that even if an HSA/FSA administrator approves the LOMN, it's possible that should an IRS audit occur, they may still find that the documentation does not make the item eligible.)

Ultimately, even if your item or service does not fall under the standard IRS guidelines, consumers may still be able to pay for them with their HSA or FSA. In order to qualify for this, you'll first need to register and comply with SIGIS.

Steps to Accepting HSA/FSA Payments on Your Website

Three (sort of) simple steps

To simplify things, here are three steps you need to take in order to accept HSA/FSA payments on your website:

Complete a Merchant Certification with SIGIS

Implement an IIAS using the standard published by SIGIS or use a SIGIS-certified Third-Party Servicer (TPS)/POS Vendor

Submit your products to the SIGIS Eligible Product List

What is SIGIS?

To accept HSA/FSA payments on your website or in your store you need to register with SIGIS and go through the Merchant Certification process.

The Special Interest Group for IIAS Standards (SIGIS) is a non-profit that helps craft the industry standard that allows medical expenses not on the pre-approved IRS list to be covered by HSAs and FSAs.

They work with benefit plan administrators, merchants, and other SIGIS Members to create best practices, guidelines, and recommendations to help members become and stay FSA, HSA, and HRA compliant.

However, SIGIS only clarifies which items qualify for HSA and FSA spending at an industry level (the Eligible Product List). When it comes to actually using HSA or FSA funds, the purchase needs to be verified against the Eligible Product List (a process commonly known as "substantiation" or "auto-substantion"), which is where an Inventory Information Approval System (IIAS) comes in.

What is an IIAS?

An IIAS is a tool that actually allows items to be purchased at the point of sale at the consumer level.

IIAS stands for Inventory Information Approval System. Essentially, it is a validation technology that pharmacies, grocery stores, retailers and ecommerce businesses are required to have in order to verify that purchases made with an HSA or FSA debit card are for eligible medical expenses.

This system reviews the inventory control information (e.g., UPC or SKU number) of the items being purchased against an established list of eligible medical products — the SIGIS Eligible Product List (which we’ll talk about next). If an item does not qualify as an eligible medical expense, consumers will not be able to use their HSA/FSA card.

Do I need an IIAS?

The short answer is, yes.*

If you are a brand, retailer or service provider and intend to accept HSA/FSA debit cards, then yes, you will need an IIAS. You can either implement this yourself or you can use a payment processor that has an IIAS to substantiate purchases against the SIGIS Eligible Product List. For example, Shopify Pay and Stripe do not offer this functionality, while Flex does.

*The caveat here is that if you have a healthcare-related merchant category code (MCC), you won't need an IIAS. However, most non-healthcare institutions, merchants, and consumer brands won't qualify for a healthcare-related MCC. Still, we explain what MCCs are next.

What are merchant category codes (MCCs)?

(We know, a lot of acronyms 😅)

An MCC classifies the type of goods or services a business offers for tax reporting purposes. They are four-digit numbers that are key for payment processing.

Traditionally, HSAs and FSAs were used to cover expenses at doctor’s offices, hospitals, pharmacies, dentists, vision care offices, and other medical care providers. These institutions by default have merchant category codes (MCC) related to healthcare and therefore typically fall under the standard IRS guidelines of eligible medical expenses (and can accept HSA or FSA cards).

Here are some health-related MCC examples:

5975 – Hearing Aids-Sales, Service, Supply Stores

5976 – Orthopedic Goods-Artificial Limb Stores

8021 – Dentists, Orthodontists

8041 – Chiropractors

8043 – Opticians, Optical Goods, and Eyeglasses

8071 – Dental and Medical Laboratories

8099 – Health Practitioners, Medical Services-not elsewhere classified

Healthcare-related MCCs tell card networks that your products and services are directly related to the medical needs of patients.

Since most merchants and consumer brands have non-healthcare-related MCCs, therefore, the easiest way to accept HSA or FSA payments is to implement an IIAS or use a payment processor that can substantiate purchases for you (like Flex).

What is the Eligible Product List (EPL)?

Developed by SIGIS, the industry-vetted Eligible Product List comprises health care/medical products and services that qualify for purchase with an FSA or HSA debit card. It is continually updated and reviewed by benefit plan administrators, merchants, and other SIGIS Members.

SIGIS also publishes general guidelines for potential members to review to determine whether they should submit or not. Merchants can see the categories of items that are considered:

Eligible

Not eligible: Products that are strictly for general health, cosmetic, or personal hygiene purposes

Dual-purpose: Products that have both a medical and personal hygiene, cosmetic or general health purpose, and which are therefore not considered eligible by the IRS, but which may qualify with a LOMN

The publication also provides rationale for why some products are eligible and others are not.

Note that the exact list is only published to SIGIS member organizations and is used by IIAS providers to validate eligible products.

Determining if Your Product Should Be Submitted to the EPL

Before applying to the EPL, consider if your product is a health care or medical-related item.

The IRS publication outlines specific HSA and FSA eligible items, including most over-the-counter products found at pharmacies, like cold medicines, menstrual products, thermometers, and at-home COVID-19 test kits. Recent additions include certain wearable devices with medical purposes and at-home lab testing kits, along with accessories like charging stations or refillable components.

What about subscriptions or memberships?

The eligibility for subscriptions or memberships — such as software apps that are necessary for using a medical or health care device — is determined by SIGIS and their review committees. These committees interpret IRS guidelines to decide product eligibility.

Subscriptions may be considered if they are necessary to use a medical or health care device or serve a medical purpose themselves. For example, say a blood pressure cuff submits readings to an app and that app is the only way to access the blood pressure information. In these cases, the app and subsequent subscription may be considered for the Eligible Product List.

(Note that this is a newer category that SIGIS is evaluating so the criteria and evaluation process is a work in progress.)

Now that you’ve determined that your product or service qualifies, here are the steps to submit to the EPL.

How to Get Your Product on the EPL:

The process begins by becoming a member of SIGIS. Completing an application form on their website and paying the membership fee.

In your member portal, you'll find options to submit your product to the EPL, either manually or by uploading a CSV file, the latter being useful for multiple products.

For each product, you'll need to provide a 14-digit GTIN, a UPC code, the product's name, a rationale for its addition, the product URL, and a fine line code, which categorizes your submission. SIGIS offers a reference document to help identify the correct fine line code.

Complete your submission. SIGIS reviews submissions monthly and releases an updated EPL the following month.

Common mistakes when submitting your product to the EPL

The most common mistake when submitting to the Eligible Product List is not including a thorough rationale explaining how your product treats or manages a medical condition.

This information must help the committee understand the how and why your product or service should be considered a qualified medical expense. Remember that medical expenses “are the costs of diagnosis, cure, mitigation, treatment, or prevention of disease, and for the purpose of affecting any part or function of the body,” according to the IRS.

Be sure to review similar products and services on the EPL as the publication provides explanations for why some products are eligible and others are not.

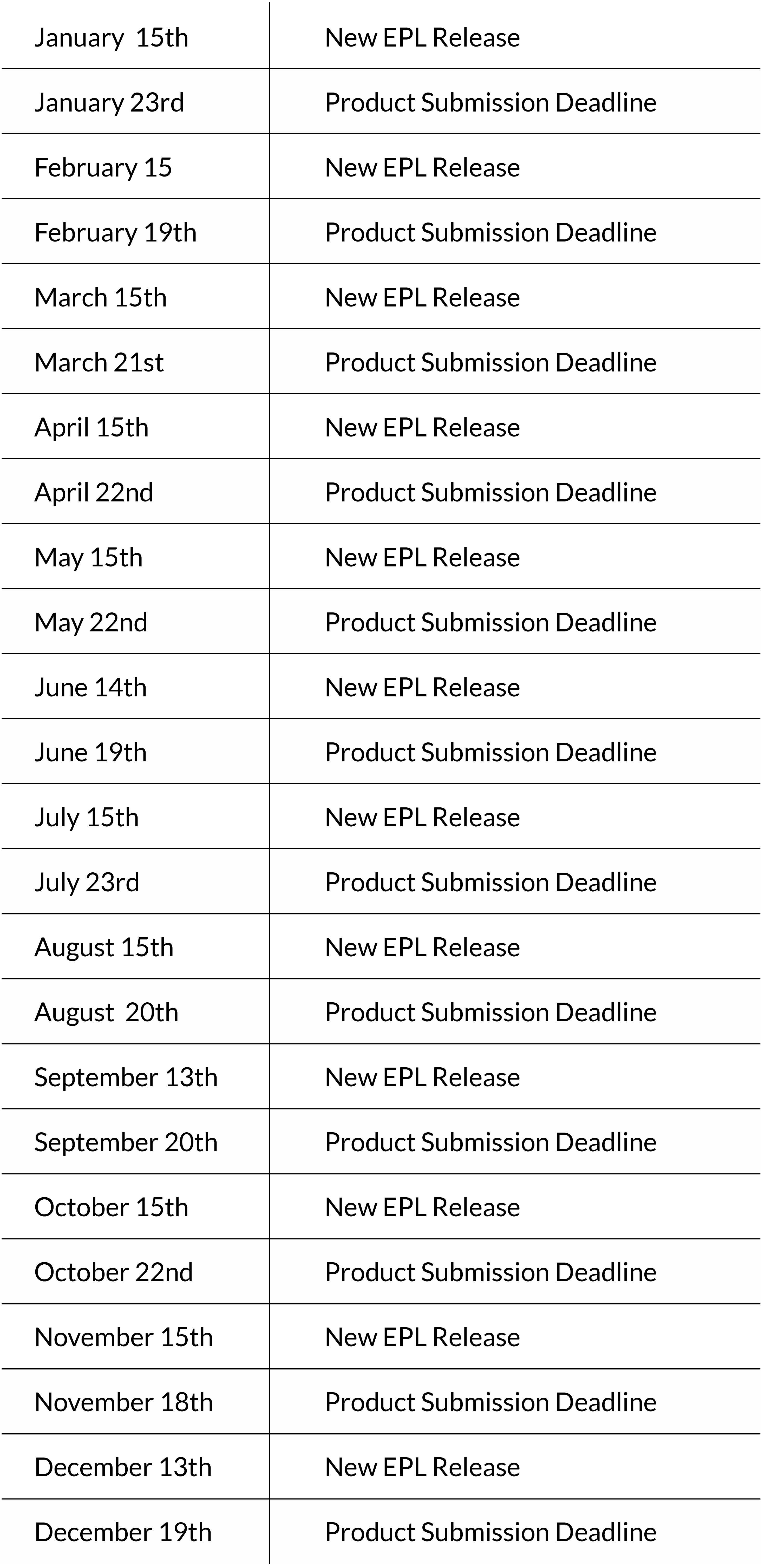

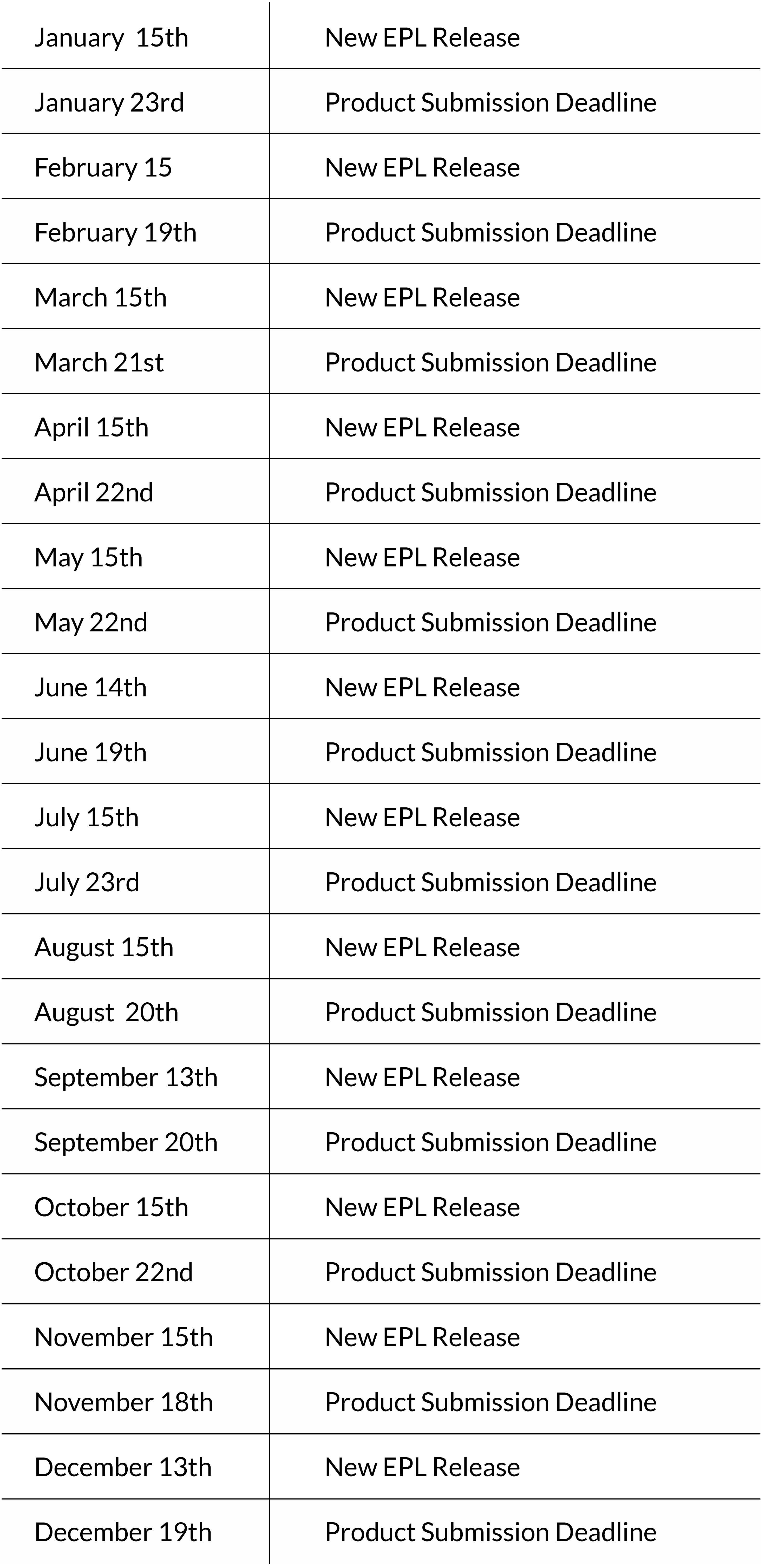

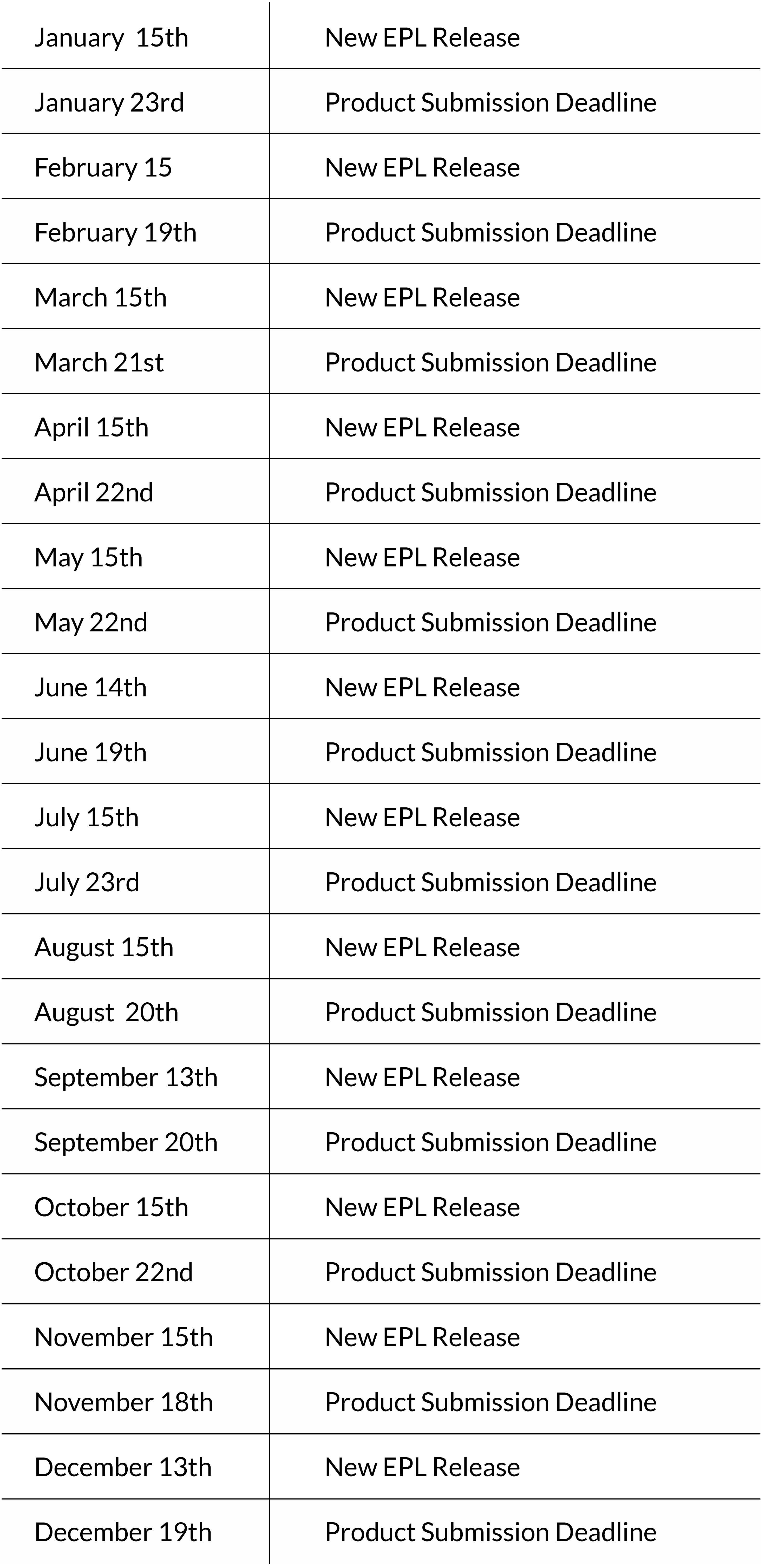

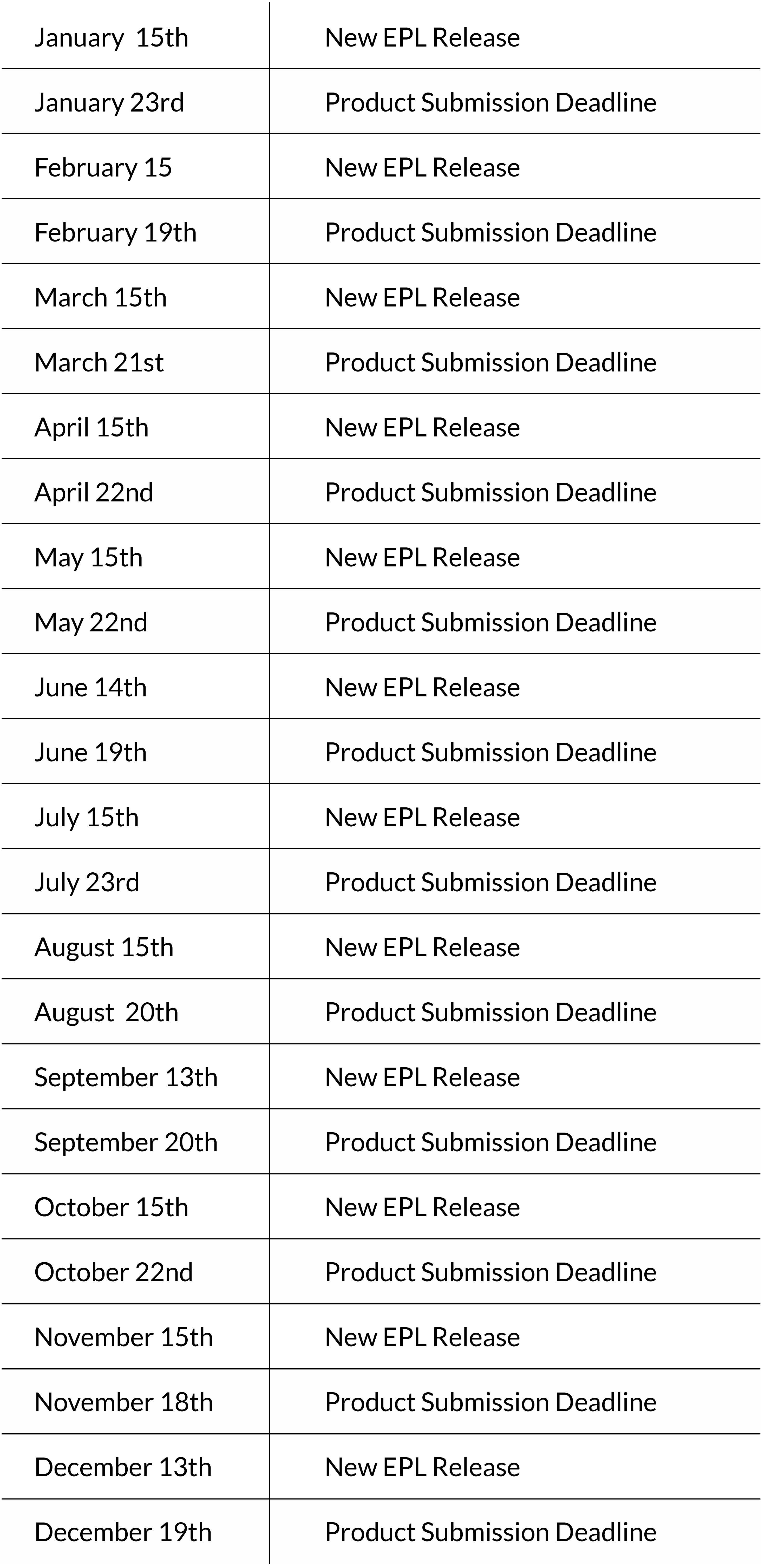

Important dates and deadlines

In your SIGIS member portal, the submission dates and EPL release dates will be published. You want to pay attention to the deadlines to ensure that your products are considered in a timely manner.

We’ve included the 2024 dates here for your reference:

Your HSA and FSA Partner: How Flex Can Help

As you can imagine, there is a lot of nuance when applying to the EPL, and understanding past precedent and best practices helps.

If you're listed in the Flex Market or use Flex for processing FSA and HSA payments, we, as a SIGIS member, can submit your products on your behalf. Contact Flex if you’d like them to handle your EPL submission.

You’ve determined you want to make your product or service HSA and FSA-eligible (a wise decision considering these represent a $150+ billion with a “b” market). Great!

So how do you do it?

In this guide, we outline the steps and resources necessary to qualify, from defining terminology to breaking down the industry guidelines to when, where and how to apply.

What We’ll Cover About Making Your Products HSA/FSA Eligible

What are HSA/FSA-Eligible Items?

First, let's start with items and services that are already approved for HSA and FSA spending.

According to the IRS, eligible Health Savings Account (HSA) and Flexible Spending Account (FSA) items that are defined as qualified medical care expenses “must be [used] primarily to alleviate or prevent a physical or mental disability or illness”. This includes things like annual doctor’s visits, lab fees, prescription medications, and eyeglasses, among many other items.

However, when it comes to wellness, fitness, nutrition, and other health-related products or services — items that may not be on the standard qualifying list — consumers may still be able to use their HSA or FSA.

Letters of Medical Necessity (potentially) allow consumers to purchase non-preapproved medical expenses

The IRS allows doctors and medical professionals to recommend individualized interventions as long as they meet the criteria of diagnosis, cure, mitigation, treatment, or prevention of a specific medical condition.

To qualify certain purchases for HSA or FSA spending, a doctor needs to write a Letter of Medical Necessity, or LOMN, which deems a product or service medically necessary for a patient. LOMNs are then reviewed by HSA/FSA administrators, and are approved or rejected in accordance with IRS regulations.

(Note that even if an HSA/FSA administrator approves the LOMN, it's possible that should an IRS audit occur, they may still find that the documentation does not make the item eligible.)

Ultimately, even if your item or service does not fall under the standard IRS guidelines, consumers may still be able to pay for them with their HSA or FSA. In order to qualify for this, you'll first need to register and comply with SIGIS.

Steps to Accepting HSA/FSA Payments on Your Website

Three (sort of) simple steps

To simplify things, here are three steps you need to take in order to accept HSA/FSA payments on your website:

Complete a Merchant Certification with SIGIS

Implement an IIAS using the standard published by SIGIS or use a SIGIS-certified Third-Party Servicer (TPS)/POS Vendor

Submit your products to the SIGIS Eligible Product List

What is SIGIS?

To accept HSA/FSA payments on your website or in your store you need to register with SIGIS and go through the Merchant Certification process.

The Special Interest Group for IIAS Standards (SIGIS) is a non-profit that helps craft the industry standard that allows medical expenses not on the pre-approved IRS list to be covered by HSAs and FSAs.

They work with benefit plan administrators, merchants, and other SIGIS Members to create best practices, guidelines, and recommendations to help members become and stay FSA, HSA, and HRA compliant.

However, SIGIS only clarifies which items qualify for HSA and FSA spending at an industry level (the Eligible Product List). When it comes to actually using HSA or FSA funds, the purchase needs to be verified against the Eligible Product List (a process commonly known as "substantiation" or "auto-substantion"), which is where an Inventory Information Approval System (IIAS) comes in.

What is an IIAS?

An IIAS is a tool that actually allows items to be purchased at the point of sale at the consumer level.

IIAS stands for Inventory Information Approval System. Essentially, it is a validation technology that pharmacies, grocery stores, retailers and ecommerce businesses are required to have in order to verify that purchases made with an HSA or FSA debit card are for eligible medical expenses.

This system reviews the inventory control information (e.g., UPC or SKU number) of the items being purchased against an established list of eligible medical products — the SIGIS Eligible Product List (which we’ll talk about next). If an item does not qualify as an eligible medical expense, consumers will not be able to use their HSA/FSA card.

Do I need an IIAS?

The short answer is, yes.*

If you are a brand, retailer or service provider and intend to accept HSA/FSA debit cards, then yes, you will need an IIAS. You can either implement this yourself or you can use a payment processor that has an IIAS to substantiate purchases against the SIGIS Eligible Product List. For example, Shopify Pay and Stripe do not offer this functionality, while Flex does.

*The caveat here is that if you have a healthcare-related merchant category code (MCC), you won't need an IIAS. However, most non-healthcare institutions, merchants, and consumer brands won't qualify for a healthcare-related MCC. Still, we explain what MCCs are next.

What are merchant category codes (MCCs)?

(We know, a lot of acronyms 😅)

An MCC classifies the type of goods or services a business offers for tax reporting purposes. They are four-digit numbers that are key for payment processing.

Traditionally, HSAs and FSAs were used to cover expenses at doctor’s offices, hospitals, pharmacies, dentists, vision care offices, and other medical care providers. These institutions by default have merchant category codes (MCC) related to healthcare and therefore typically fall under the standard IRS guidelines of eligible medical expenses (and can accept HSA or FSA cards).

Here are some health-related MCC examples:

5975 – Hearing Aids-Sales, Service, Supply Stores

5976 – Orthopedic Goods-Artificial Limb Stores

8021 – Dentists, Orthodontists

8041 – Chiropractors

8043 – Opticians, Optical Goods, and Eyeglasses

8071 – Dental and Medical Laboratories

8099 – Health Practitioners, Medical Services-not elsewhere classified

Healthcare-related MCCs tell card networks that your products and services are directly related to the medical needs of patients.

Since most merchants and consumer brands have non-healthcare-related MCCs, therefore, the easiest way to accept HSA or FSA payments is to implement an IIAS or use a payment processor that can substantiate purchases for you (like Flex).

What is the Eligible Product List (EPL)?

Developed by SIGIS, the industry-vetted Eligible Product List comprises health care/medical products and services that qualify for purchase with an FSA or HSA debit card. It is continually updated and reviewed by benefit plan administrators, merchants, and other SIGIS Members.

SIGIS also publishes general guidelines for potential members to review to determine whether they should submit or not. Merchants can see the categories of items that are considered:

Eligible

Not eligible: Products that are strictly for general health, cosmetic, or personal hygiene purposes

Dual-purpose: Products that have both a medical and personal hygiene, cosmetic or general health purpose, and which are therefore not considered eligible by the IRS, but which may qualify with a LOMN

The publication also provides rationale for why some products are eligible and others are not.

Note that the exact list is only published to SIGIS member organizations and is used by IIAS providers to validate eligible products.

Determining if Your Product Should Be Submitted to the EPL

Before applying to the EPL, consider if your product is a health care or medical-related item.

The IRS publication outlines specific HSA and FSA eligible items, including most over-the-counter products found at pharmacies, like cold medicines, menstrual products, thermometers, and at-home COVID-19 test kits. Recent additions include certain wearable devices with medical purposes and at-home lab testing kits, along with accessories like charging stations or refillable components.

What about subscriptions or memberships?

The eligibility for subscriptions or memberships — such as software apps that are necessary for using a medical or health care device — is determined by SIGIS and their review committees. These committees interpret IRS guidelines to decide product eligibility.

Subscriptions may be considered if they are necessary to use a medical or health care device or serve a medical purpose themselves. For example, say a blood pressure cuff submits readings to an app and that app is the only way to access the blood pressure information. In these cases, the app and subsequent subscription may be considered for the Eligible Product List.

(Note that this is a newer category that SIGIS is evaluating so the criteria and evaluation process is a work in progress.)

Now that you’ve determined that your product or service qualifies, here are the steps to submit to the EPL.

How to Get Your Product on the EPL:

The process begins by becoming a member of SIGIS. Completing an application form on their website and paying the membership fee.

In your member portal, you'll find options to submit your product to the EPL, either manually or by uploading a CSV file, the latter being useful for multiple products.

For each product, you'll need to provide a 14-digit GTIN, a UPC code, the product's name, a rationale for its addition, the product URL, and a fine line code, which categorizes your submission. SIGIS offers a reference document to help identify the correct fine line code.

Complete your submission. SIGIS reviews submissions monthly and releases an updated EPL the following month.

Common mistakes when submitting your product to the EPL

The most common mistake when submitting to the Eligible Product List is not including a thorough rationale explaining how your product treats or manages a medical condition.

This information must help the committee understand the how and why your product or service should be considered a qualified medical expense. Remember that medical expenses “are the costs of diagnosis, cure, mitigation, treatment, or prevention of disease, and for the purpose of affecting any part or function of the body,” according to the IRS.

Be sure to review similar products and services on the EPL as the publication provides explanations for why some products are eligible and others are not.

Important dates and deadlines

In your SIGIS member portal, the submission dates and EPL release dates will be published. You want to pay attention to the deadlines to ensure that your products are considered in a timely manner.

We’ve included the 2024 dates here for your reference:

Your HSA and FSA Partner: How Flex Can Help

As you can imagine, there is a lot of nuance when applying to the EPL, and understanding past precedent and best practices helps.

If you're listed in the Flex Market or use Flex for processing FSA and HSA payments, we, as a SIGIS member, can submit your products on your behalf. Contact Flex if you’d like them to handle your EPL submission.

Flex is the easiest way for direct to consumer brands and retailers to accept HSA/FSA for their products. From fitness and nutrition, to sleep and mental health, Flex takes a holistic view of healthcare and enables consumers to use their pre-tax money to do the same.