How to Buy Sunscreen with an HSA/FSA Plan in 2025

Sam O'Keefe

Co-founder & CEO of Flex

Updated: November 10, 2025

🚀 Fast Facts: HSA/FSA Sunscreen Eligibility

Most sunscreen products are eligible to be purchased using your HSA or FSA

To be eligible, a product must be SPF 15+, broad-spectrum, and be primarily for UV ray protection

Using Flex, you can pay for eligible sunscreens directly with your HSA/FSA at checkout

Most sunscreen products are eligible to be purchased using your HSA or FSA

To be eligible, a product must be SPF 15+, broad-spectrum, and be primarily for UV ray protection

Using Flex, you can pay for eligible sunscreens directly with your HSA/FSA at checkout

Most sunscreen products are eligible to be purchased using your HSA or FSA

To be eligible, a product must be SPF 15+, broad-spectrum, and be primarily for UV ray protection

Using Flex, you can pay for eligible sunscreens directly with your HSA/FSA at checkout

Most sunscreen products are eligible to be purchased using your HSA or FSA

To be eligible, a product must be SPF 15+, broad-spectrum, and be primarily for UV ray protection

Using Flex, you can pay for eligible sunscreens directly with your HSA/FSA at checkout

Summertime and the living’s easy… and sunny!

While we love the long days, it’s important to remember that the endless rays can be damaging to your skin if you’re not mindful. In fact, too much sun exposure can lead to sunburns, premature aging, and even skin cancer. That’s why most of us arm ourselves with sunscreen before we head out, lathering up to block out harmful ultraviolet (UV) light.

But what many people don’t know is that these purchases — which you’re going to make anyway — can be covered by your Health Savings Account (HSA) or Flexible Spending Account (FSA). In this article, we’ll cover all the key information, including:

How to buy sunscreen using your HSA or FSA directly or reimbursement

5 best HSA & FSA approved sunscreens you can buy using your plan directly

5 similar HSA & FSA eligible products that protect your skin health

Let’s teach you how to buy sunscreen using your HSA/FSA, potentially paying directly instead of paying out of pocket.

Summertime and the living’s easy… and sunny!

While we love the long days, it’s important to remember that the endless rays can be damaging to your skin if you’re not mindful. In fact, too much sun exposure can lead to sunburns, premature aging, and even skin cancer. That’s why most of us arm ourselves with sunscreen before we head out, lathering up to block out harmful ultraviolet (UV) light.

But what many people don’t know is that these purchases — which you’re going to make anyway — can be covered by your Health Savings Account (HSA) or Flexible Spending Account (FSA). In this article, we’ll cover all the key information, including:

How to buy sunscreen using your HSA or FSA directly or reimbursement

5 best HSA & FSA approved sunscreens you can buy using your plan directly

5 similar HSA & FSA eligible products that protect your skin health

Let’s teach you how to buy sunscreen using your HSA/FSA, potentially paying directly instead of paying out of pocket.

Summertime and the living’s easy… and sunny!

While we love the long days, it’s important to remember that the endless rays can be damaging to your skin if you’re not mindful. In fact, too much sun exposure can lead to sunburns, premature aging, and even skin cancer. That’s why most of us arm ourselves with sunscreen before we head out, lathering up to block out harmful ultraviolet (UV) light.

But what many people don’t know is that these purchases — which you’re going to make anyway — can be covered by your Health Savings Account (HSA) or Flexible Spending Account (FSA). In this article, we’ll cover all the key information, including:

How to buy sunscreen using your HSA or FSA directly or reimbursement

5 best HSA & FSA approved sunscreens you can buy using your plan directly

5 similar HSA & FSA eligible products that protect your skin health

Let’s teach you how to buy sunscreen using your HSA/FSA, potentially paying directly instead of paying out of pocket.

Is sunscreen FSA & HSA eligible?

Yes, most sunscreens are eligible to be covered by your HSA or FSA. To qualify, the product’s main function must be to protect your skin from UV rays, it must have an SPF of 15 or higher, it must offer broad-spectrum protection, and it must be approved by the FDA for purchase over-the-counter.

Keep in mind, this is only a minimum, and you can get sunscreen products with much higher SPF ratings, as well as other additional benefits (like water resistance) without impacting its eligibility. The American Academy of Dermatology Association (AAD) recommends consumers use a broad-spectrum sunscreen with a minimum SPF of 30 or higher, and suggests using a product with water resistance.

It’s important to note, not all products with SPF are automatically eligible, such as some moisturizers or cosmetics that offer sun protection. In most cases, the reason a sunscreen-related product would not qualify is if its primary purpose is not protection against UV rays. That being said, some dual-purpose products may still be eligible for coverage with a letter of medical necessity (LMN), even if their only purpose is not sun protection.

You may be asking yourself, why these standards?

It’s actually quite simple. It’s all about ensuring the products being expenses qualify as a medical expense in the eyes of the IRS.

According to the IRS, “medical care expenses must be primarily to alleviate or prevent a physical or mental disability or illness”. Since sunscreen alleviates and prevents physical illnesses like sunburns, sun poisoning, and even skin cancers, it qualifies as a personal health expense under this definition.

However, since medical expenses “don’t include expenses that are merely beneficial to general health”, some dual purpose products may not qualify, because the product is no longer primarily designed to alleviate or prevent a physical illness. This is commonly the case with cosmetic products that have sun protection benefits, as they are primarily a cosmetic item. This can also be the case for some products that serve as both a moisturizer and sunscreen.

But don’t fret! This doesn’t mean that these products are automatically disqualified from eligibility. A medical professional could deem that the product is primarily for protecting against UV rays, or that it’s a reasonable alternative for the patient to use based on their medical situation, resulting in exceptions to the standard. In these cases, a letter of medical necessity (LMN) may qualify the product to be purchased through your HSA or FSA.

Ultimately, the specific eligibility requirements for sunscreen ensure that any sunscreen product will meet the IRS’s requirement that it’s primary for a medical purpose.

What most often makes a sunscreen not HSA & FSA eligible?

Typically, the reason a sunscreen is not HSA or FSA eligible is because it is not primarily designed to prevent UV rays, and this is instead a secondary function of the product. This most commonly applies for cosmetic products that are not designed first and foremost to protect consumers from the sun.

There are actually three main factors that would make a sunscreen ineligible for purchase through an HSA:

1. If it has an SPF lower than 15

This is very straightforward, as it either meets this requirement or it doesn’t. This is probably the least common factor preventing a sunscreen from being eligible. In most cases, any product that’s labelled a sunscreen will have a minimum of SPF15.

Really, these standards meet minimum requirements for providing consumers protection for UV rays. The Sun Protection Factor (SPF) is itself a measure of a sunscreen’s ability to protect against UVB light. So the stronger the SPF rating, the greater the protection, which is why it’s a factor of consideration for a sunscreen’s eligibility.

2. If it does not offer broad spectrum protection

Again, the product either does or doesn’t offer this. This is a more common barrier, as there are many sunscreen products — even some with high SPF ratings — that do not offer broad-spectrum protection, and would therefore not qualify. However, it’s pretty straightforward to determine whether a product would or would not qualify based on this criteria.

SPF only protects against UVB light, so to make sure people are equally protected against UVA light, the FDA established the term “broad spectrum,” defining sunscreen that protects against both UVB and UVA light. In the interest of ensuring that the products that qualify or designed to protect consumers from UV rays, they need to be broad spectrum.

3. If it is not primarily used for protecting against UV rays

This is the most common reason a product is disqualified, because there is more grey area in determining what a product’s primary purpose is. This is also critical when determining whether dual purpose products qualify as a sunscreen product or not. For this reason, this is one of the most important factors for actually determining which products are actually eligible. These are also the most common cases where consumers will request a LMN to make a purchase eligible.

This is probably the most important factor when determining eligibility, simply because this gets at the actual root of the IRS’s rules on what qualifies as a medical expense of any kind (not just for sunscreen).

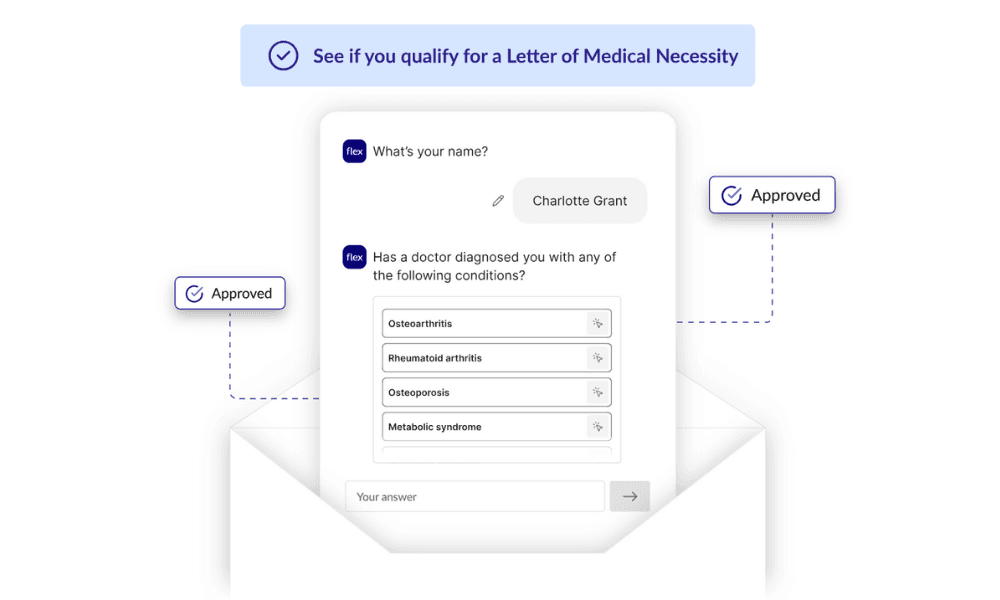

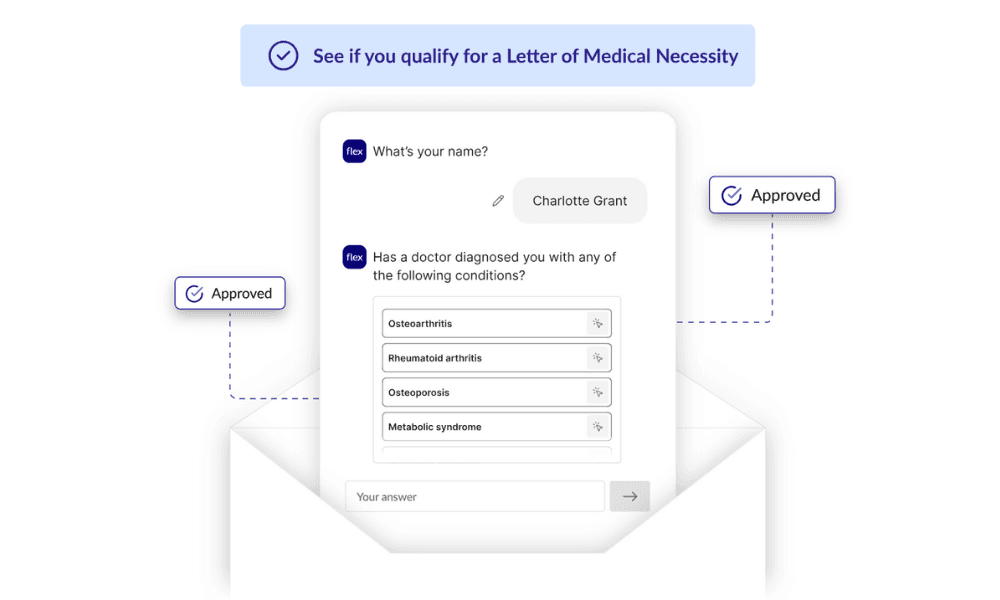

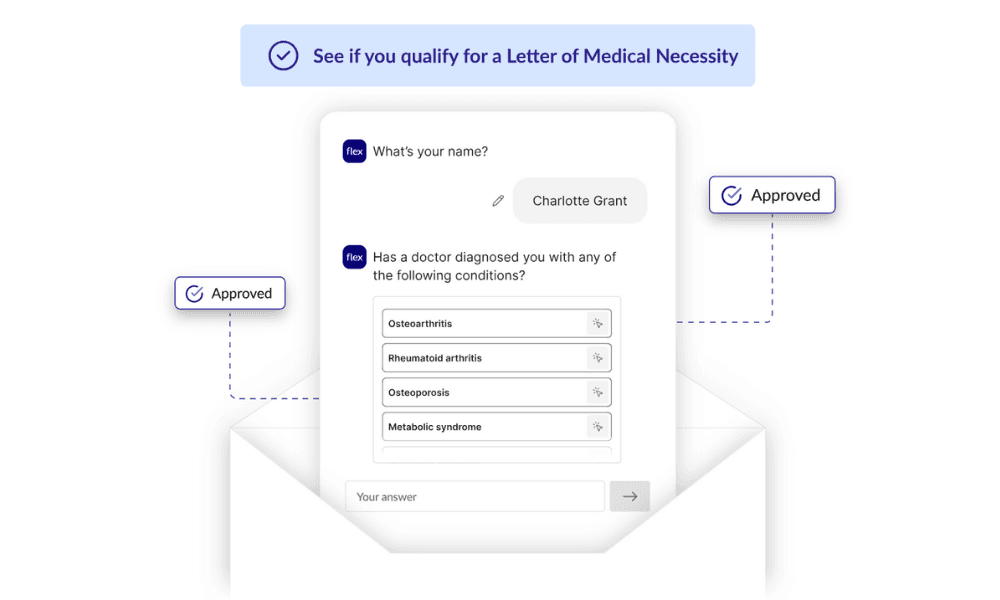

Do you need a Letter of Medical Necessity to buy sunscreen with your HSA/FSA?

No, a letter of medical necessity (LMN) is typically not needed to purchase sunscreen with an HSA or FSA, as most providers consider it an eligible expense. However, some dual purpose products — like moisturizers and cosmetic items — may require a letter of medical necessity to qualify.

What qualifies varies from provider to provider. Always check with your plan administrator to find out whether a sunscreen product is eligible under your plan, even if you have doubts. Some retailers also mark eligible products so it’s easier for consumers to find them in-store.

With Flex-powered checkouts on sunscreen providers like SunShield+ and Soleil Toujours, you don’t have to wait to find out if a product is eligible. We’ll let you know at checkout if it’s eligible or not - and let you pay for it with Flex using your HSAs or FSAs if it is. We also send you a letter of medical necessity (LMN) via email to validate your qualified purchase, just in case you need one for your records or didn’t qualify for direct payment.

When did sunscreen start to be HSA / FSA eligible?

Sunscreen became eligible for purchase through an HSA or FSA on March 27, 2020, when changes to the Coronavirus Aid, Relief, and Economic Security (CARES) Act modernized the FDA’s regulation of over-the-counter drugs. These changes meant that sunscreen — along with other health-related products — qualified as a medical expense and could be covered by HSA and FSA accounts.

Yes, most sunscreens are eligible to be covered by your HSA or FSA. To qualify, the product’s main function must be to protect your skin from UV rays, it must have an SPF of 15 or higher, it must offer broad-spectrum protection, and it must be approved by the FDA for purchase over-the-counter.

Keep in mind, this is only a minimum, and you can get sunscreen products with much higher SPF ratings, as well as other additional benefits (like water resistance) without impacting its eligibility. The American Academy of Dermatology Association (AAD) recommends consumers use a broad-spectrum sunscreen with a minimum SPF of 30 or higher, and suggests using a product with water resistance.

It’s important to note, not all products with SPF are automatically eligible, such as some moisturizers or cosmetics that offer sun protection. In most cases, the reason a sunscreen-related product would not qualify is if its primary purpose is not protection against UV rays. That being said, some dual-purpose products may still be eligible for coverage with a letter of medical necessity (LMN), even if their only purpose is not sun protection.

You may be asking yourself, why these standards?

It’s actually quite simple. It’s all about ensuring the products being expenses qualify as a medical expense in the eyes of the IRS.

According to the IRS, “medical care expenses must be primarily to alleviate or prevent a physical or mental disability or illness”. Since sunscreen alleviates and prevents physical illnesses like sunburns, sun poisoning, and even skin cancers, it qualifies as a personal health expense under this definition.

However, since medical expenses “don’t include expenses that are merely beneficial to general health”, some dual purpose products may not qualify, because the product is no longer primarily designed to alleviate or prevent a physical illness. This is commonly the case with cosmetic products that have sun protection benefits, as they are primarily a cosmetic item. This can also be the case for some products that serve as both a moisturizer and sunscreen.

But don’t fret! This doesn’t mean that these products are automatically disqualified from eligibility. A medical professional could deem that the product is primarily for protecting against UV rays, or that it’s a reasonable alternative for the patient to use based on their medical situation, resulting in exceptions to the standard. In these cases, a letter of medical necessity (LMN) may qualify the product to be purchased through your HSA or FSA.

Ultimately, the specific eligibility requirements for sunscreen ensure that any sunscreen product will meet the IRS’s requirement that it’s primary for a medical purpose.

What most often makes a sunscreen not HSA & FSA eligible?

Typically, the reason a sunscreen is not HSA or FSA eligible is because it is not primarily designed to prevent UV rays, and this is instead a secondary function of the product. This most commonly applies for cosmetic products that are not designed first and foremost to protect consumers from the sun.

There are actually three main factors that would make a sunscreen ineligible for purchase through an HSA:

1. If it has an SPF lower than 15

This is very straightforward, as it either meets this requirement or it doesn’t. This is probably the least common factor preventing a sunscreen from being eligible. In most cases, any product that’s labelled a sunscreen will have a minimum of SPF15.

Really, these standards meet minimum requirements for providing consumers protection for UV rays. The Sun Protection Factor (SPF) is itself a measure of a sunscreen’s ability to protect against UVB light. So the stronger the SPF rating, the greater the protection, which is why it’s a factor of consideration for a sunscreen’s eligibility.

2. If it does not offer broad spectrum protection

Again, the product either does or doesn’t offer this. This is a more common barrier, as there are many sunscreen products — even some with high SPF ratings — that do not offer broad-spectrum protection, and would therefore not qualify. However, it’s pretty straightforward to determine whether a product would or would not qualify based on this criteria.

SPF only protects against UVB light, so to make sure people are equally protected against UVA light, the FDA established the term “broad spectrum,” defining sunscreen that protects against both UVB and UVA light. In the interest of ensuring that the products that qualify or designed to protect consumers from UV rays, they need to be broad spectrum.

3. If it is not primarily used for protecting against UV rays

This is the most common reason a product is disqualified, because there is more grey area in determining what a product’s primary purpose is. This is also critical when determining whether dual purpose products qualify as a sunscreen product or not. For this reason, this is one of the most important factors for actually determining which products are actually eligible. These are also the most common cases where consumers will request a LMN to make a purchase eligible.

This is probably the most important factor when determining eligibility, simply because this gets at the actual root of the IRS’s rules on what qualifies as a medical expense of any kind (not just for sunscreen).

Do you need a Letter of Medical Necessity to buy sunscreen with your HSA/FSA?

No, a letter of medical necessity (LMN) is typically not needed to purchase sunscreen with an HSA or FSA, as most providers consider it an eligible expense. However, some dual purpose products — like moisturizers and cosmetic items — may require a letter of medical necessity to qualify.

What qualifies varies from provider to provider. Always check with your plan administrator to find out whether a sunscreen product is eligible under your plan, even if you have doubts. Some retailers also mark eligible products so it’s easier for consumers to find them in-store.

With Flex-powered checkouts on sunscreen providers like SunShield+ and Soleil Toujours, you don’t have to wait to find out if a product is eligible. We’ll let you know at checkout if it’s eligible or not - and let you pay for it with Flex using your HSAs or FSAs if it is. We also send you a letter of medical necessity (LMN) via email to validate your qualified purchase, just in case you need one for your records or didn’t qualify for direct payment.

When did sunscreen start to be HSA / FSA eligible?

Sunscreen became eligible for purchase through an HSA or FSA on March 27, 2020, when changes to the Coronavirus Aid, Relief, and Economic Security (CARES) Act modernized the FDA’s regulation of over-the-counter drugs. These changes meant that sunscreen — along with other health-related products — qualified as a medical expense and could be covered by HSA and FSA accounts.

Yes, most sunscreens are eligible to be covered by your HSA or FSA. To qualify, the product’s main function must be to protect your skin from UV rays, it must have an SPF of 15 or higher, it must offer broad-spectrum protection, and it must be approved by the FDA for purchase over-the-counter.

Keep in mind, this is only a minimum, and you can get sunscreen products with much higher SPF ratings, as well as other additional benefits (like water resistance) without impacting its eligibility. The American Academy of Dermatology Association (AAD) recommends consumers use a broad-spectrum sunscreen with a minimum SPF of 30 or higher, and suggests using a product with water resistance.

It’s important to note, not all products with SPF are automatically eligible, such as some moisturizers or cosmetics that offer sun protection. In most cases, the reason a sunscreen-related product would not qualify is if its primary purpose is not protection against UV rays. That being said, some dual-purpose products may still be eligible for coverage with a letter of medical necessity (LMN), even if their only purpose is not sun protection.

You may be asking yourself, why these standards?

It’s actually quite simple. It’s all about ensuring the products being expenses qualify as a medical expense in the eyes of the IRS.

According to the IRS, “medical care expenses must be primarily to alleviate or prevent a physical or mental disability or illness”. Since sunscreen alleviates and prevents physical illnesses like sunburns, sun poisoning, and even skin cancers, it qualifies as a personal health expense under this definition.

However, since medical expenses “don’t include expenses that are merely beneficial to general health”, some dual purpose products may not qualify, because the product is no longer primarily designed to alleviate or prevent a physical illness. This is commonly the case with cosmetic products that have sun protection benefits, as they are primarily a cosmetic item. This can also be the case for some products that serve as both a moisturizer and sunscreen.

But don’t fret! This doesn’t mean that these products are automatically disqualified from eligibility. A medical professional could deem that the product is primarily for protecting against UV rays, or that it’s a reasonable alternative for the patient to use based on their medical situation, resulting in exceptions to the standard. In these cases, a letter of medical necessity (LMN) may qualify the product to be purchased through your HSA or FSA.

Ultimately, the specific eligibility requirements for sunscreen ensure that any sunscreen product will meet the IRS’s requirement that it’s primary for a medical purpose.

What most often makes a sunscreen not HSA & FSA eligible?

Typically, the reason a sunscreen is not HSA or FSA eligible is because it is not primarily designed to prevent UV rays, and this is instead a secondary function of the product. This most commonly applies for cosmetic products that are not designed first and foremost to protect consumers from the sun.

There are actually three main factors that would make a sunscreen ineligible for purchase through an HSA:

1. If it has an SPF lower than 15

This is very straightforward, as it either meets this requirement or it doesn’t. This is probably the least common factor preventing a sunscreen from being eligible. In most cases, any product that’s labelled a sunscreen will have a minimum of SPF15.

Really, these standards meet minimum requirements for providing consumers protection for UV rays. The Sun Protection Factor (SPF) is itself a measure of a sunscreen’s ability to protect against UVB light. So the stronger the SPF rating, the greater the protection, which is why it’s a factor of consideration for a sunscreen’s eligibility.

2. If it does not offer broad spectrum protection

Again, the product either does or doesn’t offer this. This is a more common barrier, as there are many sunscreen products — even some with high SPF ratings — that do not offer broad-spectrum protection, and would therefore not qualify. However, it’s pretty straightforward to determine whether a product would or would not qualify based on this criteria.

SPF only protects against UVB light, so to make sure people are equally protected against UVA light, the FDA established the term “broad spectrum,” defining sunscreen that protects against both UVB and UVA light. In the interest of ensuring that the products that qualify or designed to protect consumers from UV rays, they need to be broad spectrum.

3. If it is not primarily used for protecting against UV rays

This is the most common reason a product is disqualified, because there is more grey area in determining what a product’s primary purpose is. This is also critical when determining whether dual purpose products qualify as a sunscreen product or not. For this reason, this is one of the most important factors for actually determining which products are actually eligible. These are also the most common cases where consumers will request a LMN to make a purchase eligible.

This is probably the most important factor when determining eligibility, simply because this gets at the actual root of the IRS’s rules on what qualifies as a medical expense of any kind (not just for sunscreen).

Do you need a Letter of Medical Necessity to buy sunscreen with your HSA/FSA?

No, a letter of medical necessity (LMN) is typically not needed to purchase sunscreen with an HSA or FSA, as most providers consider it an eligible expense. However, some dual purpose products — like moisturizers and cosmetic items — may require a letter of medical necessity to qualify.

What qualifies varies from provider to provider. Always check with your plan administrator to find out whether a sunscreen product is eligible under your plan, even if you have doubts. Some retailers also mark eligible products so it’s easier for consumers to find them in-store.

With Flex-powered checkouts on sunscreen providers like SunShield+ and Soleil Toujours, you don’t have to wait to find out if a product is eligible. We’ll let you know at checkout if it’s eligible or not - and let you pay for it with Flex using your HSAs or FSAs if it is. We also send you a letter of medical necessity (LMN) via email to validate your qualified purchase, just in case you need one for your records or didn’t qualify for direct payment.

When did sunscreen start to be HSA / FSA eligible?

Sunscreen became eligible for purchase through an HSA or FSA on March 27, 2020, when changes to the Coronavirus Aid, Relief, and Economic Security (CARES) Act modernized the FDA’s regulation of over-the-counter drugs. These changes meant that sunscreen — along with other health-related products — qualified as a medical expense and could be covered by HSA and FSA accounts.

Types of sunscreen and their HSA & FSA eligibility

There are a wide range of sunscreen products on the market, with different ingredients (chemical vs mineral-based) and different use cases (children’s, reef-safe, etc.). There are also a wide range of other skincare products that offer skincare protection, but that doesn’t necessarily mean they’re eligible to be paid for with your HSA/FSA.

Below, we look at whether specific types of sunscreen products are commonly eligible to be purchased using an HSA or FSA based on the HSA/FSA sunscreen rules.

Tinted sunscreen: Yes, since tinted sunscreen is primarily used to protect your skin against the sun, it would typically be eligible, as long as it has a minimum SPF of 15.

Moisturizer sunscreen: Yes, since a moisturizer sunscreen is primarily used by consumers that are looking for protection from sun damage, it would usually be eligible. Be careful of moisturizers with SPF ratings lower than 15, as these will not be eligible.

Korean sunscreen: Yes, most Korean sunscreens have high standards for offering high-quality skin care, and would be eligible for purchase through an FSA/HSA as long as they are bought over-the-counter.

Sunscreen for vacations: Yes. What you’re using the sunscreen product for doesn’t determine its eligibility, it’s actually sun protection properties do. So, as long as it’s a sunscreen product that meets the standard requirements, you can use it however you want!

Reef-safe sunscreen: Yes. A product’s eligibility is not tied to the ingredients used to make it, but its protective properties. As long as a reef-safe sunscreen meets the eligibility criteria, it would be eligible for payment using your HSA/FSA.

Sunscreen oils: Yes. The ingredients used to make the sunscreen do not disqualify it from being eligible. As long as a sunscreen oil meets the standard requirements, it would be eligible for purchase through your HSA/FSA.

Tanning oils: Yes, most tanning products are used primarily for sun protection while in the sun, and would therefore be eligible. Just make sure that you get a product that has an SPF of 15 or higher, as many tanning oils have low SPF ratings. This one is often in question, as customers are willfully exposing them to sunlight — but that’s no different than someone spending the day at the beach or the park). As long as it meets the minimum requirements, it should still qualify as a sunscreen product and be eligible to purchase with your HSA/FSA.

Cosmetic products: Many modern cosmetic products offer some form of sun protection, some even meeting the minimum HSA/FSA sunscreen requirements. However, not all of these products meet the requirement for being primarily for protection against UV rays, and therefore do not actually qualify as a medical expense. For example, while a lip stick may offer some form of sun protection, it is not primarily designed to protect against UV rays, which would likely disqualify it from being HSA/FSA eligible.

Most products that are marketed as a sunscreen would be eligible, as their primary function is sun protection. As long as these products are broad spectrum and have a minimum SPF of 15, they would be eligible. It gets more murky when you get into dual purpose products and products that aren’t actually marketed as sunscreens.

There are a wide range of sunscreen products on the market, with different ingredients (chemical vs mineral-based) and different use cases (children’s, reef-safe, etc.). There are also a wide range of other skincare products that offer skincare protection, but that doesn’t necessarily mean they’re eligible to be paid for with your HSA/FSA.

Below, we look at whether specific types of sunscreen products are commonly eligible to be purchased using an HSA or FSA based on the HSA/FSA sunscreen rules.

Tinted sunscreen: Yes, since tinted sunscreen is primarily used to protect your skin against the sun, it would typically be eligible, as long as it has a minimum SPF of 15.

Moisturizer sunscreen: Yes, since a moisturizer sunscreen is primarily used by consumers that are looking for protection from sun damage, it would usually be eligible. Be careful of moisturizers with SPF ratings lower than 15, as these will not be eligible.

Korean sunscreen: Yes, most Korean sunscreens have high standards for offering high-quality skin care, and would be eligible for purchase through an FSA/HSA as long as they are bought over-the-counter.

Sunscreen for vacations: Yes. What you’re using the sunscreen product for doesn’t determine its eligibility, it’s actually sun protection properties do. So, as long as it’s a sunscreen product that meets the standard requirements, you can use it however you want!

Reef-safe sunscreen: Yes. A product’s eligibility is not tied to the ingredients used to make it, but its protective properties. As long as a reef-safe sunscreen meets the eligibility criteria, it would be eligible for payment using your HSA/FSA.

Sunscreen oils: Yes. The ingredients used to make the sunscreen do not disqualify it from being eligible. As long as a sunscreen oil meets the standard requirements, it would be eligible for purchase through your HSA/FSA.

Tanning oils: Yes, most tanning products are used primarily for sun protection while in the sun, and would therefore be eligible. Just make sure that you get a product that has an SPF of 15 or higher, as many tanning oils have low SPF ratings. This one is often in question, as customers are willfully exposing them to sunlight — but that’s no different than someone spending the day at the beach or the park). As long as it meets the minimum requirements, it should still qualify as a sunscreen product and be eligible to purchase with your HSA/FSA.

Cosmetic products: Many modern cosmetic products offer some form of sun protection, some even meeting the minimum HSA/FSA sunscreen requirements. However, not all of these products meet the requirement for being primarily for protection against UV rays, and therefore do not actually qualify as a medical expense. For example, while a lip stick may offer some form of sun protection, it is not primarily designed to protect against UV rays, which would likely disqualify it from being HSA/FSA eligible.

Most products that are marketed as a sunscreen would be eligible, as their primary function is sun protection. As long as these products are broad spectrum and have a minimum SPF of 15, they would be eligible. It gets more murky when you get into dual purpose products and products that aren’t actually marketed as sunscreens.

There are a wide range of sunscreen products on the market, with different ingredients (chemical vs mineral-based) and different use cases (children’s, reef-safe, etc.). There are also a wide range of other skincare products that offer skincare protection, but that doesn’t necessarily mean they’re eligible to be paid for with your HSA/FSA.

Below, we look at whether specific types of sunscreen products are commonly eligible to be purchased using an HSA or FSA based on the HSA/FSA sunscreen rules.

Tinted sunscreen: Yes, since tinted sunscreen is primarily used to protect your skin against the sun, it would typically be eligible, as long as it has a minimum SPF of 15.

Moisturizer sunscreen: Yes, since a moisturizer sunscreen is primarily used by consumers that are looking for protection from sun damage, it would usually be eligible. Be careful of moisturizers with SPF ratings lower than 15, as these will not be eligible.

Korean sunscreen: Yes, most Korean sunscreens have high standards for offering high-quality skin care, and would be eligible for purchase through an FSA/HSA as long as they are bought over-the-counter.

Sunscreen for vacations: Yes. What you’re using the sunscreen product for doesn’t determine its eligibility, it’s actually sun protection properties do. So, as long as it’s a sunscreen product that meets the standard requirements, you can use it however you want!

Reef-safe sunscreen: Yes. A product’s eligibility is not tied to the ingredients used to make it, but its protective properties. As long as a reef-safe sunscreen meets the eligibility criteria, it would be eligible for payment using your HSA/FSA.

Sunscreen oils: Yes. The ingredients used to make the sunscreen do not disqualify it from being eligible. As long as a sunscreen oil meets the standard requirements, it would be eligible for purchase through your HSA/FSA.

Tanning oils: Yes, most tanning products are used primarily for sun protection while in the sun, and would therefore be eligible. Just make sure that you get a product that has an SPF of 15 or higher, as many tanning oils have low SPF ratings. This one is often in question, as customers are willfully exposing them to sunlight — but that’s no different than someone spending the day at the beach or the park). As long as it meets the minimum requirements, it should still qualify as a sunscreen product and be eligible to purchase with your HSA/FSA.

Cosmetic products: Many modern cosmetic products offer some form of sun protection, some even meeting the minimum HSA/FSA sunscreen requirements. However, not all of these products meet the requirement for being primarily for protection against UV rays, and therefore do not actually qualify as a medical expense. For example, while a lip stick may offer some form of sun protection, it is not primarily designed to protect against UV rays, which would likely disqualify it from being HSA/FSA eligible.

Most products that are marketed as a sunscreen would be eligible, as their primary function is sun protection. As long as these products are broad spectrum and have a minimum SPF of 15, they would be eligible. It gets more murky when you get into dual purpose products and products that aren’t actually marketed as sunscreens.

How to buy sunscreen using your HSA or FSA directly or reimbursement

There are really two main methods for buying sunscreen — or any product for that matter — using your HSA or FSA. The most common is making a claim for reimbursement after buying the product out-of-pocket, and these legacy solutions require a lot more manual work for reimbursement, and more paperwork to fill out.

Providers — like Flex — give you the ability to pay directly from your HSA/FSA, just like you would a debit or credit card.

Let’s look at both in a little more detail.

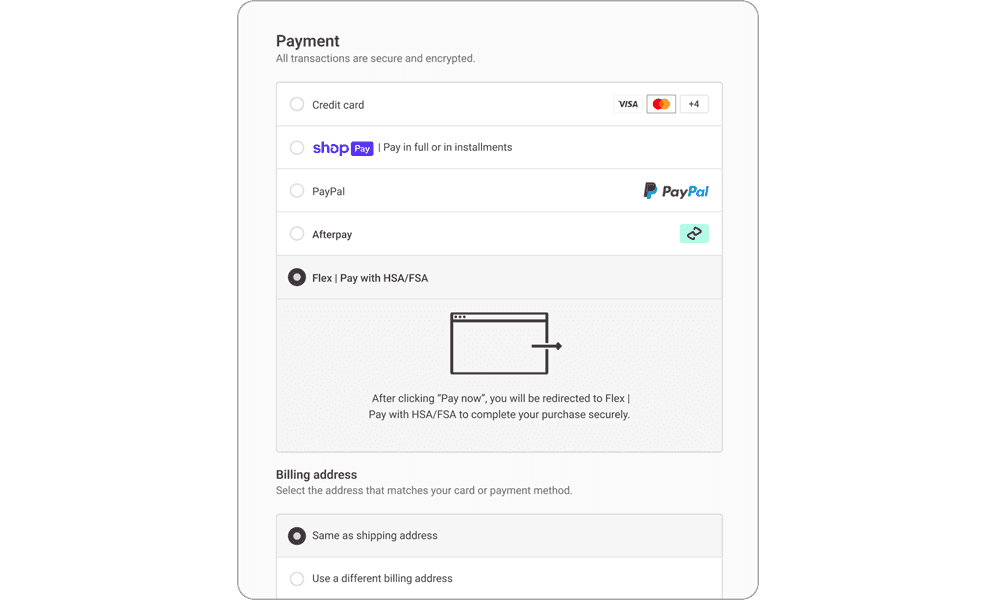

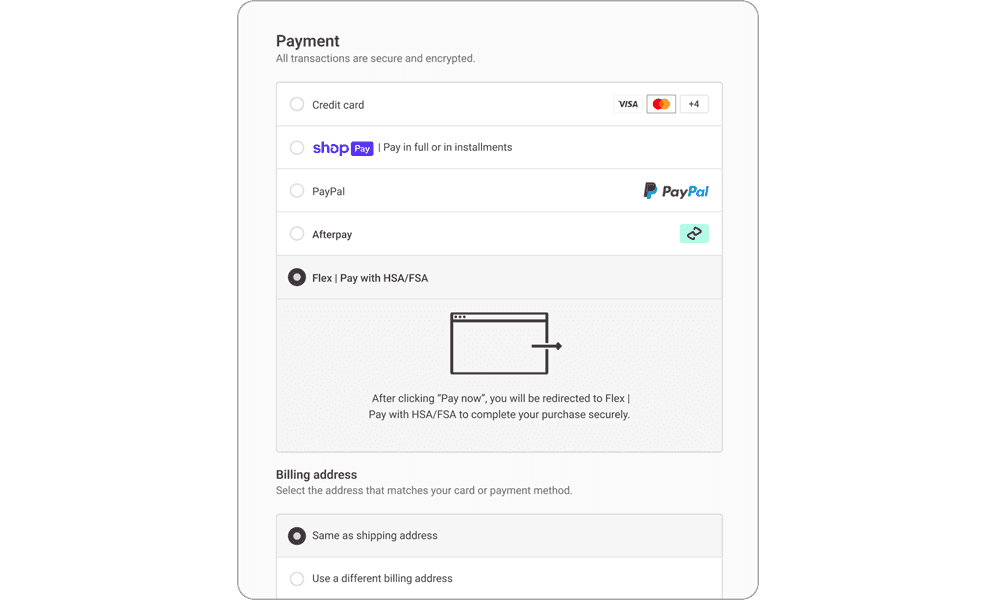

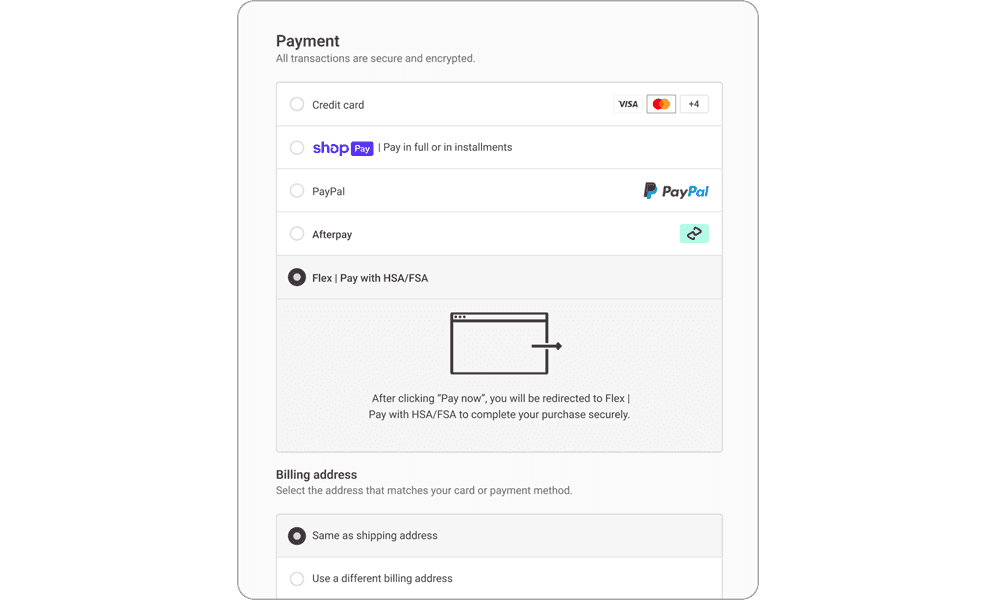

1. Pay with your HSA/FSA directly at checkout

Some providers (like us here at Flex) let you make payments directly from your HSA or FSA on eligible products, the same way you would with your debit or credit card.

This means the funds come directly from your HSA/FSA in real-time so you never have to pay out of pocket or wait for the reimbursement. You also don’t have to worry about a claim for reimbursement being denied. Our auto-substantiation feature validates all HSA/FSA payments electronically, without the need for an LMN.

Bottom line — if a product is available for purchase through Flex, it’s eligible to be paid for using your HSA/FSA. If there is any question as to whether an LMN is necessary, we’ll automatically issue one — in cases where it’s authorized, of course — and send it to you by email.

You can also easily split the payment and pay via multiple methods with our Split Cart Checkout feature. This means you can apply any amount you want to your HSA/FSA, and pay the rest via whatever payment method you like (like a debit or credit card). This makes it easy to use your HSA/FSA funds where you want.

All you have to do is choose Flex as your payment option during checkout and we’ll handle the rest!

2. Make a reimbursement claim

Not all retailers enable HSA and FSA payments. In many cases, you’ll need to pay for the item out-of-pocket, and then make a claim for reimbursement. You’ll still get the full amount back, but you’ll need to wait for the claim (and payment) to be processed before this happens.

You’ll need to provide proof of the purchase to your provider as well, so you’ll need to keep your receipt. Digital transactions can make this much easier to manage, as you’ll always have a digital paper trail of your transactions.

This is the standard process for many HSA and FSA accounts. The challenge is that it means you’re always stuck juggling a pile of receipts and you always have to pay for the items upfront.

It also means you have to make multiple claims, or stack up a pile of claims that you can do in a batch at the end of the month. Either way, you’ve got a handful of paper receipts to muddle through, and any misplaced receipts could mean you’re no longer able to get reimbursed.

There are really two main methods for buying sunscreen — or any product for that matter — using your HSA or FSA. The most common is making a claim for reimbursement after buying the product out-of-pocket, and these legacy solutions require a lot more manual work for reimbursement, and more paperwork to fill out.

Providers — like Flex — give you the ability to pay directly from your HSA/FSA, just like you would a debit or credit card.

Let’s look at both in a little more detail.

1. Pay with your HSA/FSA directly at checkout

Some providers (like us here at Flex) let you make payments directly from your HSA or FSA on eligible products, the same way you would with your debit or credit card.

This means the funds come directly from your HSA/FSA in real-time so you never have to pay out of pocket or wait for the reimbursement. You also don’t have to worry about a claim for reimbursement being denied. Our auto-substantiation feature validates all HSA/FSA payments electronically, without the need for an LMN.

Bottom line — if a product is available for purchase through Flex, it’s eligible to be paid for using your HSA/FSA. If there is any question as to whether an LMN is necessary, we’ll automatically issue one — in cases where it’s authorized, of course — and send it to you by email.

You can also easily split the payment and pay via multiple methods with our Split Cart Checkout feature. This means you can apply any amount you want to your HSA/FSA, and pay the rest via whatever payment method you like (like a debit or credit card). This makes it easy to use your HSA/FSA funds where you want.

All you have to do is choose Flex as your payment option during checkout and we’ll handle the rest!

2. Make a reimbursement claim

Not all retailers enable HSA and FSA payments. In many cases, you’ll need to pay for the item out-of-pocket, and then make a claim for reimbursement. You’ll still get the full amount back, but you’ll need to wait for the claim (and payment) to be processed before this happens.

You’ll need to provide proof of the purchase to your provider as well, so you’ll need to keep your receipt. Digital transactions can make this much easier to manage, as you’ll always have a digital paper trail of your transactions.

This is the standard process for many HSA and FSA accounts. The challenge is that it means you’re always stuck juggling a pile of receipts and you always have to pay for the items upfront.

It also means you have to make multiple claims, or stack up a pile of claims that you can do in a batch at the end of the month. Either way, you’ve got a handful of paper receipts to muddle through, and any misplaced receipts could mean you’re no longer able to get reimbursed.

There are really two main methods for buying sunscreen — or any product for that matter — using your HSA or FSA. The most common is making a claim for reimbursement after buying the product out-of-pocket, and these legacy solutions require a lot more manual work for reimbursement, and more paperwork to fill out.

Providers — like Flex — give you the ability to pay directly from your HSA/FSA, just like you would a debit or credit card.

Let’s look at both in a little more detail.

1. Pay with your HSA/FSA directly at checkout

Some providers (like us here at Flex) let you make payments directly from your HSA or FSA on eligible products, the same way you would with your debit or credit card.

This means the funds come directly from your HSA/FSA in real-time so you never have to pay out of pocket or wait for the reimbursement. You also don’t have to worry about a claim for reimbursement being denied. Our auto-substantiation feature validates all HSA/FSA payments electronically, without the need for an LMN.

Bottom line — if a product is available for purchase through Flex, it’s eligible to be paid for using your HSA/FSA. If there is any question as to whether an LMN is necessary, we’ll automatically issue one — in cases where it’s authorized, of course — and send it to you by email.

You can also easily split the payment and pay via multiple methods with our Split Cart Checkout feature. This means you can apply any amount you want to your HSA/FSA, and pay the rest via whatever payment method you like (like a debit or credit card). This makes it easy to use your HSA/FSA funds where you want.

All you have to do is choose Flex as your payment option during checkout and we’ll handle the rest!

2. Make a reimbursement claim

Not all retailers enable HSA and FSA payments. In many cases, you’ll need to pay for the item out-of-pocket, and then make a claim for reimbursement. You’ll still get the full amount back, but you’ll need to wait for the claim (and payment) to be processed before this happens.

You’ll need to provide proof of the purchase to your provider as well, so you’ll need to keep your receipt. Digital transactions can make this much easier to manage, as you’ll always have a digital paper trail of your transactions.

This is the standard process for many HSA and FSA accounts. The challenge is that it means you’re always stuck juggling a pile of receipts and you always have to pay for the items upfront.

It also means you have to make multiple claims, or stack up a pile of claims that you can do in a batch at the end of the month. Either way, you’ve got a handful of paper receipts to muddle through, and any misplaced receipts could mean you’re no longer able to get reimbursed.

5 best HSA & FSA approved sunscreens you can buy using your plan directly

When selecting an HSA or FSA-approved sunscreen, you want something that fits the eligibility criteria, offers you the opportunity to pay using your HSA/FSA plan directly. We’ve compiled a list of the 5 best sunscreens you can buy right now using your HSA/FSA card directly. Just go to the shop, choose your item, and select “Pay using HSA/FSA with Flex” to pay using your plan.

Product | Description |

|---|---|

| SunShield+ Tinted Sunscreen Moisturizer |

| Shiseido Ultimate Sun Protector Lotion |

| Soleil Toujours Face Glow Tinted Moisturizer |

| Sabiya in Water Sunscreen |

| Freaks of Nature Peak Performance SPF Stick |

Remember to check out with Flex to pay directly with your HSA/FSA at any of these stores!

When selecting an HSA or FSA-approved sunscreen, you want something that fits the eligibility criteria, offers you the opportunity to pay using your HSA/FSA plan directly. We’ve compiled a list of the 5 best sunscreens you can buy right now using your HSA/FSA card directly. Just go to the shop, choose your item, and select “Pay using HSA/FSA with Flex” to pay using your plan.

Product | Description |

|---|---|

| SunShield+ Tinted Sunscreen Moisturizer |

| Shiseido Ultimate Sun Protector Lotion |

| Soleil Toujours Face Glow Tinted Moisturizer |

| Sabiya in Water Sunscreen |

| Freaks of Nature Peak Performance SPF Stick |

Remember to check out with Flex to pay directly with your HSA/FSA at any of these stores!

When selecting an HSA or FSA-approved sunscreen, you want something that fits the eligibility criteria, offers you the opportunity to pay using your HSA/FSA plan directly. We’ve compiled a list of the 5 best sunscreens you can buy right now using your HSA/FSA card directly. Just go to the shop, choose your item, and select “Pay using HSA/FSA with Flex” to pay using your plan.

Product | Description |

|---|---|

| SunShield+ Tinted Sunscreen Moisturizer |

| Shiseido Ultimate Sun Protector Lotion |

| Soleil Toujours Face Glow Tinted Moisturizer |

| Sabiya in Water Sunscreen |

| Freaks of Nature Peak Performance SPF Stick |

Remember to check out with Flex to pay directly with your HSA/FSA at any of these stores!

How do I choose the right sunscreen to buy with my HSA/FSA?

Fortunately, there are not many restrictions on the types of sunscreen products you can purchase as a medical expense. That means there are a lot of options out there when deciding — so how do you make the right choice?

We explore a few of the main things to consider when choosing the right sunscreen:

1. Choose the right type of sunscreen

There are actually many different types of sunscreens made from a variety of ingredients. Most common are chemical sunscreens, which absorb UV radiation, and mineral-based sunscreens, which block or reflect UV light.

Chemical products are often more lightweight, but can irritate those with sensitive skin. Mineral products tend to be thicker, but can be more prone to clogging pores.

The right sunscreen for you will depend on a variety of factors, including your skin type, sensitivity, and personal preferences. You’ll also want to think about how active you’ll be while wearing it, if you’ll be exposed to water, and what the ingredients are before determining what’s best for you.

Importantly, the ingredients used don’t disqualify a product from being eligible under your HSA or FSA, so choose whatever type of product you prefer for your personal needs and health circumstances.

2. Find a product that suits your use case

Make sure the product you buy is well-suited for the activity you’ll be doing in the sun. Limitations on what qualifies are not restrictive, so it’s okay to get a higher quality product with additional benefits, as long as it meets the standard requirements. You won’t be penalized for buying a higher SPF product or one with additional benefits.

Whether you plan on being by the pool or the ocean, if you’re going swimming you’ll want something that is water resistant. The same goes for any activity that will lead to a lot of perspiration. If you do outdoor work or are playing sports that will lead to a lot of sweating, a water resistant or sport option is recommended. If you’re just spending a long day out in the sun, you may want a product that is long-lasting (but still be sure to reapply regularly!). If you’re someone that isn’t exposed to the sun as often, a product with a higher SPF rating will offer more protection.

Again, as long as you meet the minimum requirements, you’re free to get sunscreen products with additional benefits that are tailored to your use case and health situation.

3. Find a reef-safe or biodegradable option

As we’ve already said, the ingredients used don’t disqualify a product from being eligible. If you want to use a reef-safe or environmentally conscious sunscreen product, you’re free to do that. Just make sure that the product meets the minimum eligibility requirements.

4. Choose a product eligible for direct payment

Why waste time submitting reimbursement claims and worrying about whether they’ll be approved? Instead, choose a product that’s eligible to be purchased directly through your HSA/FSA. This way, you don’t have to pay out-of-pocket or wait to see if the claim will be approved. You know it’s approved because it’s available for direct payment and funds come straight out of your account — no hassle.

Fortunately, there are not many restrictions on the types of sunscreen products you can purchase as a medical expense. That means there are a lot of options out there when deciding — so how do you make the right choice?

We explore a few of the main things to consider when choosing the right sunscreen:

1. Choose the right type of sunscreen

There are actually many different types of sunscreens made from a variety of ingredients. Most common are chemical sunscreens, which absorb UV radiation, and mineral-based sunscreens, which block or reflect UV light.

Chemical products are often more lightweight, but can irritate those with sensitive skin. Mineral products tend to be thicker, but can be more prone to clogging pores.

The right sunscreen for you will depend on a variety of factors, including your skin type, sensitivity, and personal preferences. You’ll also want to think about how active you’ll be while wearing it, if you’ll be exposed to water, and what the ingredients are before determining what’s best for you.

Importantly, the ingredients used don’t disqualify a product from being eligible under your HSA or FSA, so choose whatever type of product you prefer for your personal needs and health circumstances.

2. Find a product that suits your use case

Make sure the product you buy is well-suited for the activity you’ll be doing in the sun. Limitations on what qualifies are not restrictive, so it’s okay to get a higher quality product with additional benefits, as long as it meets the standard requirements. You won’t be penalized for buying a higher SPF product or one with additional benefits.

Whether you plan on being by the pool or the ocean, if you’re going swimming you’ll want something that is water resistant. The same goes for any activity that will lead to a lot of perspiration. If you do outdoor work or are playing sports that will lead to a lot of sweating, a water resistant or sport option is recommended. If you’re just spending a long day out in the sun, you may want a product that is long-lasting (but still be sure to reapply regularly!). If you’re someone that isn’t exposed to the sun as often, a product with a higher SPF rating will offer more protection.

Again, as long as you meet the minimum requirements, you’re free to get sunscreen products with additional benefits that are tailored to your use case and health situation.

3. Find a reef-safe or biodegradable option

As we’ve already said, the ingredients used don’t disqualify a product from being eligible. If you want to use a reef-safe or environmentally conscious sunscreen product, you’re free to do that. Just make sure that the product meets the minimum eligibility requirements.

4. Choose a product eligible for direct payment

Why waste time submitting reimbursement claims and worrying about whether they’ll be approved? Instead, choose a product that’s eligible to be purchased directly through your HSA/FSA. This way, you don’t have to pay out-of-pocket or wait to see if the claim will be approved. You know it’s approved because it’s available for direct payment and funds come straight out of your account — no hassle.

Fortunately, there are not many restrictions on the types of sunscreen products you can purchase as a medical expense. That means there are a lot of options out there when deciding — so how do you make the right choice?

We explore a few of the main things to consider when choosing the right sunscreen:

1. Choose the right type of sunscreen

There are actually many different types of sunscreens made from a variety of ingredients. Most common are chemical sunscreens, which absorb UV radiation, and mineral-based sunscreens, which block or reflect UV light.

Chemical products are often more lightweight, but can irritate those with sensitive skin. Mineral products tend to be thicker, but can be more prone to clogging pores.

The right sunscreen for you will depend on a variety of factors, including your skin type, sensitivity, and personal preferences. You’ll also want to think about how active you’ll be while wearing it, if you’ll be exposed to water, and what the ingredients are before determining what’s best for you.

Importantly, the ingredients used don’t disqualify a product from being eligible under your HSA or FSA, so choose whatever type of product you prefer for your personal needs and health circumstances.

2. Find a product that suits your use case

Make sure the product you buy is well-suited for the activity you’ll be doing in the sun. Limitations on what qualifies are not restrictive, so it’s okay to get a higher quality product with additional benefits, as long as it meets the standard requirements. You won’t be penalized for buying a higher SPF product or one with additional benefits.

Whether you plan on being by the pool or the ocean, if you’re going swimming you’ll want something that is water resistant. The same goes for any activity that will lead to a lot of perspiration. If you do outdoor work or are playing sports that will lead to a lot of sweating, a water resistant or sport option is recommended. If you’re just spending a long day out in the sun, you may want a product that is long-lasting (but still be sure to reapply regularly!). If you’re someone that isn’t exposed to the sun as often, a product with a higher SPF rating will offer more protection.

Again, as long as you meet the minimum requirements, you’re free to get sunscreen products with additional benefits that are tailored to your use case and health situation.

3. Find a reef-safe or biodegradable option

As we’ve already said, the ingredients used don’t disqualify a product from being eligible. If you want to use a reef-safe or environmentally conscious sunscreen product, you’re free to do that. Just make sure that the product meets the minimum eligibility requirements.

4. Choose a product eligible for direct payment

Why waste time submitting reimbursement claims and worrying about whether they’ll be approved? Instead, choose a product that’s eligible to be purchased directly through your HSA/FSA. This way, you don’t have to pay out-of-pocket or wait to see if the claim will be approved. You know it’s approved because it’s available for direct payment and funds come straight out of your account — no hassle.

5 similar HSA & FSA eligible products that protect your skin health

There are plenty of other skincare and sun products out there that are both eligible for HSA/FSA, and that you can purchase right away using your plan directly by going to the stores below, adding items to your cart, and then at checkout, select “Pay using HSA/FSA with Flex” to pay using your HSA or FSA plan directly.

Product | |

|---|---|

| Soleil Toujours Protect Makeup Setting Spray SPF 30 |

| N1o1 Age-Defiance Serum |

| Lumivisage 7-color LED Face Mask |

| Lure Essentials Lymphatic Cream |

| Amriore EyeLift Mask |

If any of these products require a Letter of Medical Necessity to be eligible on your HSA/FSA plan, you can get one immediately at checkout using Flex—no appointment or waiting required. Receive your Letter of Medical Necessity, valid for 12 months, via email within 24 hours.

There are plenty of other skincare and sun products out there that are both eligible for HSA/FSA, and that you can purchase right away using your plan directly by going to the stores below, adding items to your cart, and then at checkout, select “Pay using HSA/FSA with Flex” to pay using your HSA or FSA plan directly.

Product | |

|---|---|

| Soleil Toujours Protect Makeup Setting Spray SPF 30 |

| N1o1 Age-Defiance Serum |

| Lumivisage 7-color LED Face Mask |

| Lure Essentials Lymphatic Cream |

| Amriore EyeLift Mask |

If any of these products require a Letter of Medical Necessity to be eligible on your HSA/FSA plan, you can get one immediately at checkout using Flex—no appointment or waiting required. Receive your Letter of Medical Necessity, valid for 12 months, via email within 24 hours.

There are plenty of other skincare and sun products out there that are both eligible for HSA/FSA, and that you can purchase right away using your plan directly by going to the stores below, adding items to your cart, and then at checkout, select “Pay using HSA/FSA with Flex” to pay using your HSA or FSA plan directly.

Product | |

|---|---|

| Soleil Toujours Protect Makeup Setting Spray SPF 30 |

| N1o1 Age-Defiance Serum |

| Lumivisage 7-color LED Face Mask |

| Lure Essentials Lymphatic Cream |

| Amriore EyeLift Mask |

If any of these products require a Letter of Medical Necessity to be eligible on your HSA/FSA plan, you can get one immediately at checkout using Flex—no appointment or waiting required. Receive your Letter of Medical Necessity, valid for 12 months, via email within 24 hours.

In most cases, sunscreen products qualify as a medical expense, and are eligible to be purchased using your HSA or FSA. With Flex, you can pay directly from your HSA/FSA funds when you make a purchase at a pharmacy, grocery store, or major retailer with your HSA/FSA debit card. If you don’t have that option, you can also pay for it out of pocket and get promptly reimbursed by making a claim.

Just look for Flex as an option during the checkout process to easily pay from your HSA/FSA. To save you the hassle of wondering if a product is eligible or not, shop directly from our list of eligible skincare products.

In most cases, sunscreen products qualify as a medical expense, and are eligible to be purchased using your HSA or FSA. With Flex, you can pay directly from your HSA/FSA funds when you make a purchase at a pharmacy, grocery store, or major retailer with your HSA/FSA debit card. If you don’t have that option, you can also pay for it out of pocket and get promptly reimbursed by making a claim.

Just look for Flex as an option during the checkout process to easily pay from your HSA/FSA. To save you the hassle of wondering if a product is eligible or not, shop directly from our list of eligible skincare products.

In most cases, sunscreen products qualify as a medical expense, and are eligible to be purchased using your HSA or FSA. With Flex, you can pay directly from your HSA/FSA funds when you make a purchase at a pharmacy, grocery store, or major retailer with your HSA/FSA debit card. If you don’t have that option, you can also pay for it out of pocket and get promptly reimbursed by making a claim.

Just look for Flex as an option during the checkout process to easily pay from your HSA/FSA. To save you the hassle of wondering if a product is eligible or not, shop directly from our list of eligible skincare products.

Related content from Flex

More content from Flex

HSA/FSA ELIGIBLE SHOPPING

Shop the Flex HSA/FSA Marketplace

Discover HSA/FSA-eligible brands and products

Use your pre-tax HSA/FSA dollars at checkout

Improve your health and wellness with products you’ll love

Shop Now

Shop Now

Shop Now