Best HSA/FSA Approved Shoes & When They Qualify

Yulia Derdemezis

Head of Marketing at Flex

Updated: December 16, 2025

🚀 Fast Facts: Are shoes HSA/FSA eligible?

Shoes are HSA/FSA eligible if they are treating a specific medical condition

Typically shoes require an LMN to justify why they are necessary as part of your treatment

Buying these shoes from a dedicated HSA/FSA marketplace is the easiest way to find eligible shoes

Shoes are HSA/FSA eligible if they are treating a specific medical condition

Typically shoes require an LMN to justify why they are necessary as part of your treatment

Buying these shoes from a dedicated HSA/FSA marketplace is the easiest way to find eligible shoes

Shoes are HSA/FSA eligible if they are treating a specific medical condition

Typically shoes require an LMN to justify why they are necessary as part of your treatment

Buying these shoes from a dedicated HSA/FSA marketplace is the easiest way to find eligible shoes

Shoes are HSA/FSA eligible if they are treating a specific medical condition

Typically shoes require an LMN to justify why they are necessary as part of your treatment

Buying these shoes from a dedicated HSA/FSA marketplace is the easiest way to find eligible shoes

If you have a medical foot condition, you’ve probably wondered if your orthopedic shoes, inserts, or special shoes you need qualify as a medical expense. You may have funds sitting in your Health Savings Account (HSA) or Flexible Spending Account (FSA) and want to use them wisely instead of paying out of pocket.

This guide helps you understand HSA/FSA eligibility when it comes to footwear by covering the following:

How to buy shoes with an HSA or FSA online or through reimbursement

Other eligible foot health products you can buy with your HSA/FSA

Before diving into specific shoe types and product recommendations, it helps to understand the basic eligibility rules that apply to shoes under IRS guidelines. That foundation makes the rest of the guide easier to follow.

If you have a medical foot condition, you’ve probably wondered if your orthopedic shoes, inserts, or special shoes you need qualify as a medical expense. You may have funds sitting in your Health Savings Account (HSA) or Flexible Spending Account (FSA) and want to use them wisely instead of paying out of pocket.

This guide helps you understand HSA/FSA eligibility when it comes to footwear by covering the following:

How to buy shoes with an HSA or FSA online or through reimbursement

Other eligible foot health products you can buy with your HSA/FSA

Before diving into specific shoe types and product recommendations, it helps to understand the basic eligibility rules that apply to shoes under IRS guidelines. That foundation makes the rest of the guide easier to follow.

If you have a medical foot condition, you’ve probably wondered if your orthopedic shoes, inserts, or special shoes you need qualify as a medical expense. You may have funds sitting in your Health Savings Account (HSA) or Flexible Spending Account (FSA) and want to use them wisely instead of paying out of pocket.

This guide helps you understand HSA/FSA eligibility when it comes to footwear by covering the following:

How to buy shoes with an HSA or FSA online or through reimbursement

Other eligible foot health products you can buy with your HSA/FSA

Before diving into specific shoe types and product recommendations, it helps to understand the basic eligibility rules that apply to shoes under IRS guidelines. That foundation makes the rest of the guide easier to follow.

Are shoes HSA/FSA eligible?

Shoes can qualify for HSA and FSA spending, but only when they treat or manage a medical condition. The IRS limits these accounts to medical care, so everyday footwear and most running shoes do not qualify unless a provider documents a medical need. Eligibility depends on diagnosis and docs.

In most cases, standard athletic or casual shoes do not qualify. Running shoes usually fall into this category unless you need them to treat or manage a specific medical condition. When shoes serve a medical purpose rather than everyday use, eligibility becomes possible.

Do you always need a Letter of Medical Necessity to buy shoes with an HSA/FSA?

You usually need a Letter of Medical Necessity (LMN) when buying shoes with HSA or FSA funds. Under IRS rules, shoes count as dual-purpose items, meaning they serve medical and everyday use. An LMN confirms a licensed medical provider recommended the shoes to treat or manage a diagnosed condition.

The letter usually needs to include:

Your medical condition

Why the shoes are medically necessary

How long you need them

Some specialty shoes, such as certain diabetic or orthopedic shoes, may qualify without an LMN when sold as medical-grade products. Many running shoes still require documentation because they resemble everyday footwear. Understanding when you need an LMN helps you avoid denied claims and wasted time.

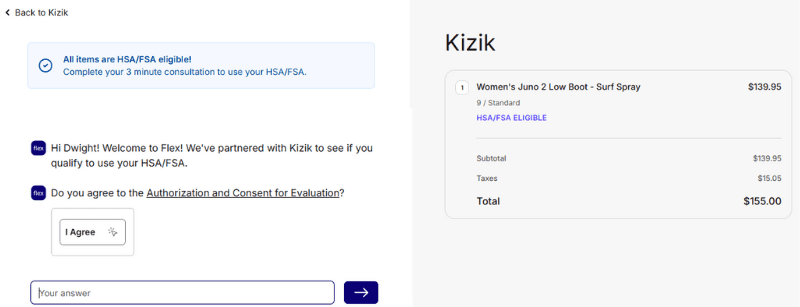

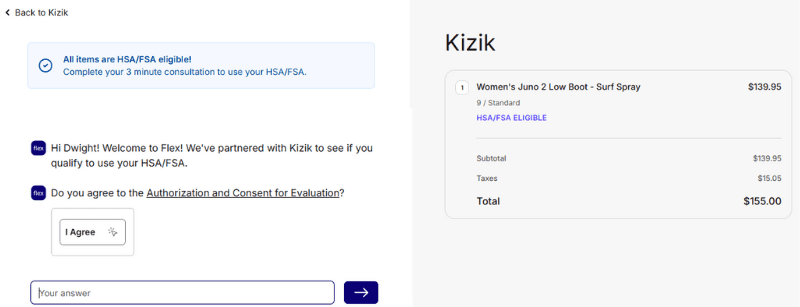

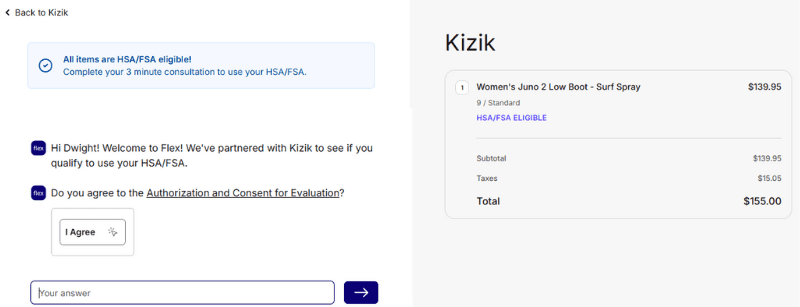

The Flex Marketplace features hundreds of brands offering HSA and FSA eligible products. Using Flex, you can get a Letter of Medical Necessity for your shoes right at checkout. These are some of our favorite online stores where you can get your LMN right away for footwear purchases: FitMyFoot, Kizik, and Andiem.

What most often makes a shoe not eligible to buy with an HSA/FSA?

Shoes are most often denied because they are purchased for general use rather than to treat a medical condition. When footwear is intended for everyday wear, workouts, or comfort without a documented diagnosis, HSA and FSA administrators typically classify it as a personal expense.

Running shoes fall into a gray area because many people wear them casually. That overlap creates extra scrutiny during reimbursement reviews.

Now that you know the baseline rules, let’s look at the specific types of shoes and shoe-related products that can qualify when used for medical reasons.

Shoes can qualify for HSA and FSA spending, but only when they treat or manage a medical condition. The IRS limits these accounts to medical care, so everyday footwear and most running shoes do not qualify unless a provider documents a medical need. Eligibility depends on diagnosis and docs.

In most cases, standard athletic or casual shoes do not qualify. Running shoes usually fall into this category unless you need them to treat or manage a specific medical condition. When shoes serve a medical purpose rather than everyday use, eligibility becomes possible.

Do you always need a Letter of Medical Necessity to buy shoes with an HSA/FSA?

You usually need a Letter of Medical Necessity (LMN) when buying shoes with HSA or FSA funds. Under IRS rules, shoes count as dual-purpose items, meaning they serve medical and everyday use. An LMN confirms a licensed medical provider recommended the shoes to treat or manage a diagnosed condition.

The letter usually needs to include:

Your medical condition

Why the shoes are medically necessary

How long you need them

Some specialty shoes, such as certain diabetic or orthopedic shoes, may qualify without an LMN when sold as medical-grade products. Many running shoes still require documentation because they resemble everyday footwear. Understanding when you need an LMN helps you avoid denied claims and wasted time.

The Flex Marketplace features hundreds of brands offering HSA and FSA eligible products. Using Flex, you can get a Letter of Medical Necessity for your shoes right at checkout. These are some of our favorite online stores where you can get your LMN right away for footwear purchases: FitMyFoot, Kizik, and Andiem.

What most often makes a shoe not eligible to buy with an HSA/FSA?

Shoes are most often denied because they are purchased for general use rather than to treat a medical condition. When footwear is intended for everyday wear, workouts, or comfort without a documented diagnosis, HSA and FSA administrators typically classify it as a personal expense.

Running shoes fall into a gray area because many people wear them casually. That overlap creates extra scrutiny during reimbursement reviews.

Now that you know the baseline rules, let’s look at the specific types of shoes and shoe-related products that can qualify when used for medical reasons.

Shoes can qualify for HSA and FSA spending, but only when they treat or manage a medical condition. The IRS limits these accounts to medical care, so everyday footwear and most running shoes do not qualify unless a provider documents a medical need. Eligibility depends on diagnosis and docs.

In most cases, standard athletic or casual shoes do not qualify. Running shoes usually fall into this category unless you need them to treat or manage a specific medical condition. When shoes serve a medical purpose rather than everyday use, eligibility becomes possible.

Do you always need a Letter of Medical Necessity to buy shoes with an HSA/FSA?

You usually need a Letter of Medical Necessity (LMN) when buying shoes with HSA or FSA funds. Under IRS rules, shoes count as dual-purpose items, meaning they serve medical and everyday use. An LMN confirms a licensed medical provider recommended the shoes to treat or manage a diagnosed condition.

The letter usually needs to include:

Your medical condition

Why the shoes are medically necessary

How long you need them

Some specialty shoes, such as certain diabetic or orthopedic shoes, may qualify without an LMN when sold as medical-grade products. Many running shoes still require documentation because they resemble everyday footwear. Understanding when you need an LMN helps you avoid denied claims and wasted time.

The Flex Marketplace features hundreds of brands offering HSA and FSA eligible products. Using Flex, you can get a Letter of Medical Necessity for your shoes right at checkout. These are some of our favorite online stores where you can get your LMN right away for footwear purchases: FitMyFoot, Kizik, and Andiem.

What most often makes a shoe not eligible to buy with an HSA/FSA?

Shoes are most often denied because they are purchased for general use rather than to treat a medical condition. When footwear is intended for everyday wear, workouts, or comfort without a documented diagnosis, HSA and FSA administrators typically classify it as a personal expense.

Running shoes fall into a gray area because many people wear them casually. That overlap creates extra scrutiny during reimbursement reviews.

Now that you know the baseline rules, let’s look at the specific types of shoes and shoe-related products that can qualify when used for medical reasons.

9 types of HSA/FSA eligible shoes & footwear products

Some shoes and foot-related products can qualify for HSA and FSA spending when you use them to treat or manage a medical condition. Eligibility depends on the product’s medical purpose and whether you have documentation, such as a Letter of Medical Necessity, when required.

Below are common shoe categories and foot health products that often qualify, along with notes on when documentation is typically needed.

1. Running shoes

Running shoes can qualify when a medical provider recommends them to address a specific condition, such as joint pain, gait issues, or chronic foot disorders. Importantly, running shoes won’t qualify if they are for regular use, even if you use them to workout. Without documentation tying the shoes to treatment, most plans treat running shoes as a personal expense.

2. Orthopedic shoes

Orthopedic shoes are designed to support abnormal foot structure or mobility limitations. These shoes often qualify because they serve a clear medical purpose. Some orthopedic shoes may qualify without an LMN when sold as medical-grade footwear, though many plans still request documentation.

3. Work shoes

Work shoes can qualify when they function as medical footwear rather than job-required gear. Examples include safety shoes modified for orthotic use or shoes prescribed to relieve pain during long periods of standing. An LMN usually helps establish that the purchase supports treatment instead of workplace comfort.

4. Insoles and orthotics

Insoles, inserts, and orthotics frequently qualify for HSA and FSA spending. Custom orthotics prescribed by a provider almost always qualify. Over-the-counter insoles may require an LMN unless they are clearly marketed for medical treatment.

5. Sandals

Therapeutic sandals can qualify when they provide medical support, such as arch stabilization or pressure relief. These sandals often require an LMN because standard sandals serve everyday wear. Casual or fashion sandals do not qualify.

6. Specialty men’s or women’s shoes

Any specialty men’s or women’s shoes qualify under the same rules as all footwear. Eligibility depends on medical necessity, not gender or style. Medical-grade men’s or women’s shoes, including orthopedic or therapeutic options, may qualify with proper documentation.

7. Compression boots

Compression boots used to improve circulation or manage recovery from a diagnosed condition may qualify. These products often require an LMN due to their dual-purpose nature. Plans review these items closely, so documentation matters.

8. Diabetic shoes

Diabetic shoes often qualify because they help prevent complications related to diabetes. Many plans treat them as eligible medical footwear. Some diabetic shoes qualify without an LMN, though requirements vary by plan administrator.

9. Plantar Fasciitis shoes

Shoes designed to relieve Plantar Fasciitis symptoms can qualify when a provider recommends them as part of treatment. An LMN usually supports eligibility. General athletic shoes marketed for comfort alone do not meet this standard.

Understanding which shoe types qualify sets the stage for the next step: knowing which medical conditions commonly support HSA and FSA approval for shoes.

Some shoes and foot-related products can qualify for HSA and FSA spending when you use them to treat or manage a medical condition. Eligibility depends on the product’s medical purpose and whether you have documentation, such as a Letter of Medical Necessity, when required.

Below are common shoe categories and foot health products that often qualify, along with notes on when documentation is typically needed.

1. Running shoes

Running shoes can qualify when a medical provider recommends them to address a specific condition, such as joint pain, gait issues, or chronic foot disorders. Importantly, running shoes won’t qualify if they are for regular use, even if you use them to workout. Without documentation tying the shoes to treatment, most plans treat running shoes as a personal expense.

2. Orthopedic shoes

Orthopedic shoes are designed to support abnormal foot structure or mobility limitations. These shoes often qualify because they serve a clear medical purpose. Some orthopedic shoes may qualify without an LMN when sold as medical-grade footwear, though many plans still request documentation.

3. Work shoes

Work shoes can qualify when they function as medical footwear rather than job-required gear. Examples include safety shoes modified for orthotic use or shoes prescribed to relieve pain during long periods of standing. An LMN usually helps establish that the purchase supports treatment instead of workplace comfort.

4. Insoles and orthotics

Insoles, inserts, and orthotics frequently qualify for HSA and FSA spending. Custom orthotics prescribed by a provider almost always qualify. Over-the-counter insoles may require an LMN unless they are clearly marketed for medical treatment.

5. Sandals

Therapeutic sandals can qualify when they provide medical support, such as arch stabilization or pressure relief. These sandals often require an LMN because standard sandals serve everyday wear. Casual or fashion sandals do not qualify.

6. Specialty men’s or women’s shoes

Any specialty men’s or women’s shoes qualify under the same rules as all footwear. Eligibility depends on medical necessity, not gender or style. Medical-grade men’s or women’s shoes, including orthopedic or therapeutic options, may qualify with proper documentation.

7. Compression boots

Compression boots used to improve circulation or manage recovery from a diagnosed condition may qualify. These products often require an LMN due to their dual-purpose nature. Plans review these items closely, so documentation matters.

8. Diabetic shoes

Diabetic shoes often qualify because they help prevent complications related to diabetes. Many plans treat them as eligible medical footwear. Some diabetic shoes qualify without an LMN, though requirements vary by plan administrator.

9. Plantar Fasciitis shoes

Shoes designed to relieve Plantar Fasciitis symptoms can qualify when a provider recommends them as part of treatment. An LMN usually supports eligibility. General athletic shoes marketed for comfort alone do not meet this standard.

Understanding which shoe types qualify sets the stage for the next step: knowing which medical conditions commonly support HSA and FSA approval for shoes.

Some shoes and foot-related products can qualify for HSA and FSA spending when you use them to treat or manage a medical condition. Eligibility depends on the product’s medical purpose and whether you have documentation, such as a Letter of Medical Necessity, when required.

Below are common shoe categories and foot health products that often qualify, along with notes on when documentation is typically needed.

1. Running shoes

Running shoes can qualify when a medical provider recommends them to address a specific condition, such as joint pain, gait issues, or chronic foot disorders. Importantly, running shoes won’t qualify if they are for regular use, even if you use them to workout. Without documentation tying the shoes to treatment, most plans treat running shoes as a personal expense.

2. Orthopedic shoes

Orthopedic shoes are designed to support abnormal foot structure or mobility limitations. These shoes often qualify because they serve a clear medical purpose. Some orthopedic shoes may qualify without an LMN when sold as medical-grade footwear, though many plans still request documentation.

3. Work shoes

Work shoes can qualify when they function as medical footwear rather than job-required gear. Examples include safety shoes modified for orthotic use or shoes prescribed to relieve pain during long periods of standing. An LMN usually helps establish that the purchase supports treatment instead of workplace comfort.

4. Insoles and orthotics

Insoles, inserts, and orthotics frequently qualify for HSA and FSA spending. Custom orthotics prescribed by a provider almost always qualify. Over-the-counter insoles may require an LMN unless they are clearly marketed for medical treatment.

5. Sandals

Therapeutic sandals can qualify when they provide medical support, such as arch stabilization or pressure relief. These sandals often require an LMN because standard sandals serve everyday wear. Casual or fashion sandals do not qualify.

6. Specialty men’s or women’s shoes

Any specialty men’s or women’s shoes qualify under the same rules as all footwear. Eligibility depends on medical necessity, not gender or style. Medical-grade men’s or women’s shoes, including orthopedic or therapeutic options, may qualify with proper documentation.

7. Compression boots

Compression boots used to improve circulation or manage recovery from a diagnosed condition may qualify. These products often require an LMN due to their dual-purpose nature. Plans review these items closely, so documentation matters.

8. Diabetic shoes

Diabetic shoes often qualify because they help prevent complications related to diabetes. Many plans treat them as eligible medical footwear. Some diabetic shoes qualify without an LMN, though requirements vary by plan administrator.

9. Plantar Fasciitis shoes

Shoes designed to relieve Plantar Fasciitis symptoms can qualify when a provider recommends them as part of treatment. An LMN usually supports eligibility. General athletic shoes marketed for comfort alone do not meet this standard.

Understanding which shoe types qualify sets the stage for the next step: knowing which medical conditions commonly support HSA and FSA approval for shoes.

8 medical conditions that make shoes HSA/FSA approved

Shoes become eligible for HSA and FSA spending when they help treat or manage a diagnosed medical condition. The condition establishes medical necessity, which separates eligible footwear from everyday shoes.

Below are common conditions that often support approval when a licensed medical provider recommends specific shoes as part of treatment.

Plantar fasciitis: Plantar fasciitis causes heel and arch pain that often worsens with walking or standing. Providers may recommend supportive or therapeutic shoes to reduce strain on the plantar fascia. With documentation, shoes designed to relieve plantar fasciitis symptoms can qualify.

Diabetes: Diabetes can lead to nerve damage, poor circulation, and foot ulcers. Medical providers often recommend specialized shoes to reduce pressure points and prevent complications. Diabetic shoes frequently qualify and sometimes do not require an LMN, depending on the plan.

Flat feet or overpronation: Flat feet and overpronation can contribute to pain in the feet, knees, hips, or lower back. Supportive shoes may help correct alignment and reduce discomfort. An LMN usually connects the shoes to treatment for eligibility.

Arthritis: Arthritis can affect foot joints and limit mobility. Cushioned or supportive shoes may help reduce pain and stiffness during daily movement. Shoes prescribed to manage arthritis symptoms often qualify with proper documentation.

Chronic foot pain: Chronic foot pain may stem from nerve issues, inflammation, or structural problems. Providers sometimes recommend specific footwear to manage symptoms and improve function. Eligibility depends on showing the shoes address the diagnosed cause of pain.

Achilles tendonitis: Achilles tendonitis causes pain and stiffness near the heel. Shoes with heel support or cushioning may reduce strain during walking or running. An LMN usually supports eligibility for these shoes.

Bunions or hammertoes: Bunions and hammertoes can make standard shoes painful. Medical providers may recommend footwear with added space or structural support. When shoes help prevent worsening of the condition, they may qualify with documentation.

Post-surgery recovery: After foot or ankle surgery, providers may recommend specific shoes to support healing. These shoes often qualify because they assist with recovery. Clear documentation ties the footwear to post-operative care.

Once you know which conditions support eligibility, the next step is understanding how to actually purchase shoes using your HSA or FSA, either at checkout or through reimbursement.

Shoes become eligible for HSA and FSA spending when they help treat or manage a diagnosed medical condition. The condition establishes medical necessity, which separates eligible footwear from everyday shoes.

Below are common conditions that often support approval when a licensed medical provider recommends specific shoes as part of treatment.

Plantar fasciitis: Plantar fasciitis causes heel and arch pain that often worsens with walking or standing. Providers may recommend supportive or therapeutic shoes to reduce strain on the plantar fascia. With documentation, shoes designed to relieve plantar fasciitis symptoms can qualify.

Diabetes: Diabetes can lead to nerve damage, poor circulation, and foot ulcers. Medical providers often recommend specialized shoes to reduce pressure points and prevent complications. Diabetic shoes frequently qualify and sometimes do not require an LMN, depending on the plan.

Flat feet or overpronation: Flat feet and overpronation can contribute to pain in the feet, knees, hips, or lower back. Supportive shoes may help correct alignment and reduce discomfort. An LMN usually connects the shoes to treatment for eligibility.

Arthritis: Arthritis can affect foot joints and limit mobility. Cushioned or supportive shoes may help reduce pain and stiffness during daily movement. Shoes prescribed to manage arthritis symptoms often qualify with proper documentation.

Chronic foot pain: Chronic foot pain may stem from nerve issues, inflammation, or structural problems. Providers sometimes recommend specific footwear to manage symptoms and improve function. Eligibility depends on showing the shoes address the diagnosed cause of pain.

Achilles tendonitis: Achilles tendonitis causes pain and stiffness near the heel. Shoes with heel support or cushioning may reduce strain during walking or running. An LMN usually supports eligibility for these shoes.

Bunions or hammertoes: Bunions and hammertoes can make standard shoes painful. Medical providers may recommend footwear with added space or structural support. When shoes help prevent worsening of the condition, they may qualify with documentation.

Post-surgery recovery: After foot or ankle surgery, providers may recommend specific shoes to support healing. These shoes often qualify because they assist with recovery. Clear documentation ties the footwear to post-operative care.

Once you know which conditions support eligibility, the next step is understanding how to actually purchase shoes using your HSA or FSA, either at checkout or through reimbursement.

Shoes become eligible for HSA and FSA spending when they help treat or manage a diagnosed medical condition. The condition establishes medical necessity, which separates eligible footwear from everyday shoes.

Below are common conditions that often support approval when a licensed medical provider recommends specific shoes as part of treatment.

Plantar fasciitis: Plantar fasciitis causes heel and arch pain that often worsens with walking or standing. Providers may recommend supportive or therapeutic shoes to reduce strain on the plantar fascia. With documentation, shoes designed to relieve plantar fasciitis symptoms can qualify.

Diabetes: Diabetes can lead to nerve damage, poor circulation, and foot ulcers. Medical providers often recommend specialized shoes to reduce pressure points and prevent complications. Diabetic shoes frequently qualify and sometimes do not require an LMN, depending on the plan.

Flat feet or overpronation: Flat feet and overpronation can contribute to pain in the feet, knees, hips, or lower back. Supportive shoes may help correct alignment and reduce discomfort. An LMN usually connects the shoes to treatment for eligibility.

Arthritis: Arthritis can affect foot joints and limit mobility. Cushioned or supportive shoes may help reduce pain and stiffness during daily movement. Shoes prescribed to manage arthritis symptoms often qualify with proper documentation.

Chronic foot pain: Chronic foot pain may stem from nerve issues, inflammation, or structural problems. Providers sometimes recommend specific footwear to manage symptoms and improve function. Eligibility depends on showing the shoes address the diagnosed cause of pain.

Achilles tendonitis: Achilles tendonitis causes pain and stiffness near the heel. Shoes with heel support or cushioning may reduce strain during walking or running. An LMN usually supports eligibility for these shoes.

Bunions or hammertoes: Bunions and hammertoes can make standard shoes painful. Medical providers may recommend footwear with added space or structural support. When shoes help prevent worsening of the condition, they may qualify with documentation.

Post-surgery recovery: After foot or ankle surgery, providers may recommend specific shoes to support healing. These shoes often qualify because they assist with recovery. Clear documentation ties the footwear to post-operative care.

Once you know which conditions support eligibility, the next step is understanding how to actually purchase shoes using your HSA or FSA, either at checkout or through reimbursement.

How to buy shoes with an HSA or FSA online or through reimbursement

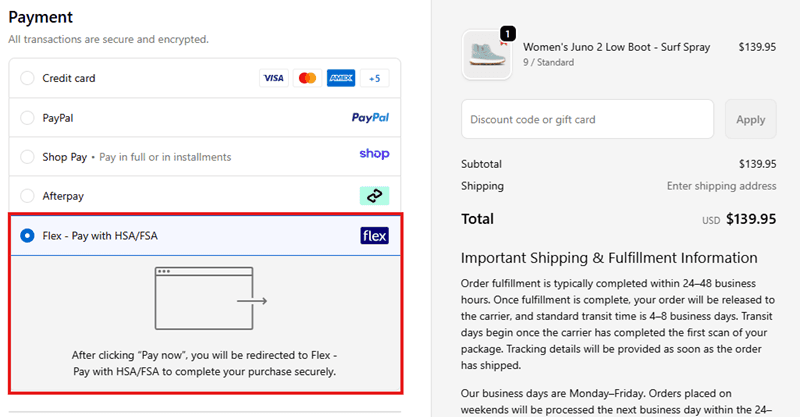

Once you know your shoes qualify, the next step is choosing how to pay. You typically have two options: paying directly with your HSA or FSA card at checkout or paying out of pocket and submitting a reimbursement claim later.

The best option depends on where you shop and how your plan handles eligibility verification.

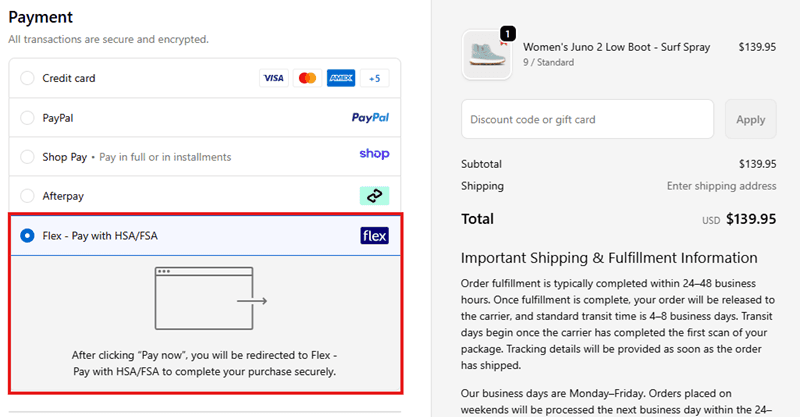

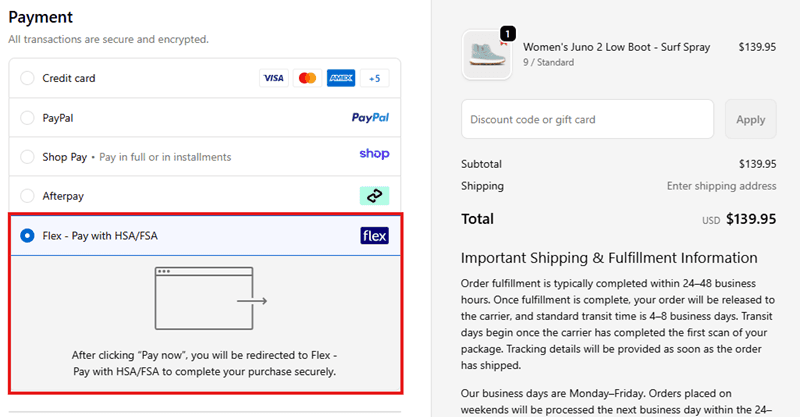

Pay with your HSA/FSA directly at checkout

Paying directly at checkout is the simplest option when a retailer accepts HSA and FSA cards. This method removes the need to file paperwork after your purchase.

This approach works well if:

You want to avoid reimbursement forms

Your account has available funds

The product eligibility is clearly supported

Direct checkout saves time and gives you immediate confirmation that your purchase qualifies.

The Flex Marketplace features footwear brands that accept HSA & FSA payments right at checkout, making it one of the most convenient ways to pay directly.

Make a reimbursement claim

Reimbursement works when a retailer does not accept HSA or FSA cards directly. You pay with a personal credit or debit card, then submit a claim to your plan administrator.

To file a successful reimbursement, you usually need:

An itemized receipt with proof of when you purchased it

A Letter of Medical Necessity, if required

Some shoppers use this method when buying from specialty shoe brands that do not process HSA or FSA payments at checkout. The process takes longer, and approval depends on your documentation.

If you want a faster option, the Flex Marketplace reduces the need for reimbursement by letting you purchase eligible shoes online and use your HSA or FSA funds right away.

Once you know your shoes qualify, the next step is choosing how to pay. You typically have two options: paying directly with your HSA or FSA card at checkout or paying out of pocket and submitting a reimbursement claim later.

The best option depends on where you shop and how your plan handles eligibility verification.

Pay with your HSA/FSA directly at checkout

Paying directly at checkout is the simplest option when a retailer accepts HSA and FSA cards. This method removes the need to file paperwork after your purchase.

This approach works well if:

You want to avoid reimbursement forms

Your account has available funds

The product eligibility is clearly supported

Direct checkout saves time and gives you immediate confirmation that your purchase qualifies.

The Flex Marketplace features footwear brands that accept HSA & FSA payments right at checkout, making it one of the most convenient ways to pay directly.

Make a reimbursement claim

Reimbursement works when a retailer does not accept HSA or FSA cards directly. You pay with a personal credit or debit card, then submit a claim to your plan administrator.

To file a successful reimbursement, you usually need:

An itemized receipt with proof of when you purchased it

A Letter of Medical Necessity, if required

Some shoppers use this method when buying from specialty shoe brands that do not process HSA or FSA payments at checkout. The process takes longer, and approval depends on your documentation.

If you want a faster option, the Flex Marketplace reduces the need for reimbursement by letting you purchase eligible shoes online and use your HSA or FSA funds right away.

Once you know your shoes qualify, the next step is choosing how to pay. You typically have two options: paying directly with your HSA or FSA card at checkout or paying out of pocket and submitting a reimbursement claim later.

The best option depends on where you shop and how your plan handles eligibility verification.

Pay with your HSA/FSA directly at checkout

Paying directly at checkout is the simplest option when a retailer accepts HSA and FSA cards. This method removes the need to file paperwork after your purchase.

This approach works well if:

You want to avoid reimbursement forms

Your account has available funds

The product eligibility is clearly supported

Direct checkout saves time and gives you immediate confirmation that your purchase qualifies.

The Flex Marketplace features footwear brands that accept HSA & FSA payments right at checkout, making it one of the most convenient ways to pay directly.

Make a reimbursement claim

Reimbursement works when a retailer does not accept HSA or FSA cards directly. You pay with a personal credit or debit card, then submit a claim to your plan administrator.

To file a successful reimbursement, you usually need:

An itemized receipt with proof of when you purchased it

A Letter of Medical Necessity, if required

Some shoppers use this method when buying from specialty shoe brands that do not process HSA or FSA payments at checkout. The process takes longer, and approval depends on your documentation.

If you want a faster option, the Flex Marketplace reduces the need for reimbursement by letting you purchase eligible shoes online and use your HSA or FSA funds right away.

Best HSA/FSA approved shoes you can buy online

Here are some brands that offer footwear and foot-related products you may be able to purchase with HSA or FSA funds when used for a medically necessary purpose:

Product | Description |

|---|---|

| Offers hands-free supportive shoes that help people with mobility or strength limitations. These shoes often qualify for HSA/FSA use at checkout when eligibility is confirmed. |

| Provides structured athletic footwear with enhanced support. These shoes can be eligible when a medical provider recommends them to address a diagnosed condition. |

| Creates custom-fit insoles and personalized shoe products based on a smartphone scan. These tailored products can qualify for reimbursement with documentation supporting medical necessity. |

Here are some brands that offer footwear and foot-related products you may be able to purchase with HSA or FSA funds when used for a medically necessary purpose:

Product | Description |

|---|---|

| Offers hands-free supportive shoes that help people with mobility or strength limitations. These shoes often qualify for HSA/FSA use at checkout when eligibility is confirmed. |

| Provides structured athletic footwear with enhanced support. These shoes can be eligible when a medical provider recommends them to address a diagnosed condition. |

| Creates custom-fit insoles and personalized shoe products based on a smartphone scan. These tailored products can qualify for reimbursement with documentation supporting medical necessity. |

Here are some brands that offer footwear and foot-related products you may be able to purchase with HSA or FSA funds when used for a medically necessary purpose:

Product | Description |

|---|---|

| Offers hands-free supportive shoes that help people with mobility or strength limitations. These shoes often qualify for HSA/FSA use at checkout when eligibility is confirmed. |

| Provides structured athletic footwear with enhanced support. These shoes can be eligible when a medical provider recommends them to address a diagnosed condition. |

| Creates custom-fit insoles and personalized shoe products based on a smartphone scan. These tailored products can qualify for reimbursement with documentation supporting medical necessity. |

Other eligible foot health products you can buy with your HSA/FSA

In addition to shoes, many foot health products can qualify for HSA or FSA spending when they help treat or manage a diagnosed medical condition. These products support comfort, recovery, and overall foot health.

Below are some brands that offer eligible items you can consider:

Product | Description |

|---|---|

| Provides toe spacers and alignment tools designed to relieve pain from conditions like bunions and toe deformities. These products can qualify when recommended by a provider. |

| Offers electronic pain relief devices aimed at reducing foot and lower-body pain through targeted stimulation. When used for diagnosed conditions, these devices may qualify for reimbursement. |

| Specializes in spacers that help improve toe alignment and ease discomfort from overlapping or misaligned toes. With medical documentation, these spacers often qualify. |

| Makes compression sleeves and socks that support circulation and reduce swelling. These products can qualify when used to manage conditions like edema or chronic pain. |

| Offers easy-to-use wraps and braces that support joints and soft tissue around the foot and ankle. These products can be eligible when prescribed to support injury recovery or chronic conditions. |

| Provides foot braces and supports designed to help with conditions like plantar fasciitis or tendon strain. With a provider’s recommendation, these supports can qualify for HSA/FSA reimbursement. |

In addition to shoes, many foot health products can qualify for HSA or FSA spending when they help treat or manage a diagnosed medical condition. These products support comfort, recovery, and overall foot health.

Below are some brands that offer eligible items you can consider:

Product | Description |

|---|---|

| Provides toe spacers and alignment tools designed to relieve pain from conditions like bunions and toe deformities. These products can qualify when recommended by a provider. |

| Offers electronic pain relief devices aimed at reducing foot and lower-body pain through targeted stimulation. When used for diagnosed conditions, these devices may qualify for reimbursement. |

| Specializes in spacers that help improve toe alignment and ease discomfort from overlapping or misaligned toes. With medical documentation, these spacers often qualify. |

| Makes compression sleeves and socks that support circulation and reduce swelling. These products can qualify when used to manage conditions like edema or chronic pain. |

| Offers easy-to-use wraps and braces that support joints and soft tissue around the foot and ankle. These products can be eligible when prescribed to support injury recovery or chronic conditions. |

| Provides foot braces and supports designed to help with conditions like plantar fasciitis or tendon strain. With a provider’s recommendation, these supports can qualify for HSA/FSA reimbursement. |

In addition to shoes, many foot health products can qualify for HSA or FSA spending when they help treat or manage a diagnosed medical condition. These products support comfort, recovery, and overall foot health.

Below are some brands that offer eligible items you can consider:

Product | Description |

|---|---|

| Provides toe spacers and alignment tools designed to relieve pain from conditions like bunions and toe deformities. These products can qualify when recommended by a provider. |

| Offers electronic pain relief devices aimed at reducing foot and lower-body pain through targeted stimulation. When used for diagnosed conditions, these devices may qualify for reimbursement. |

| Specializes in spacers that help improve toe alignment and ease discomfort from overlapping or misaligned toes. With medical documentation, these spacers often qualify. |

| Makes compression sleeves and socks that support circulation and reduce swelling. These products can qualify when used to manage conditions like edema or chronic pain. |

| Offers easy-to-use wraps and braces that support joints and soft tissue around the foot and ankle. These products can be eligible when prescribed to support injury recovery or chronic conditions. |

| Provides foot braces and supports designed to help with conditions like plantar fasciitis or tendon strain. With a provider’s recommendation, these supports can qualify for HSA/FSA reimbursement. |

In summary

Running shoes and foot health products can qualify for HSA and FSA spending when they treat or manage a medical condition. The key is understanding eligibility rules, knowing when a Letter of Medical Necessity is required, and keeping the right documentation on hand.

You give yourself the best chance of approval by choosing products with a clear medical purpose and shopping through places that clearly identify eligibility. The Flex Marketplace simplifies this process by helping you find HSA/FSA-eligible shoes and foot care products in one place, with options to pay online using your HSA or FSA card.

If you have unused funds, putting them toward supportive footwear and foot health products can be a practical way to care for your body while using pre-tax dollars. With the right approach, you can spend confidently and avoid reimbursement headaches.

Running shoes and foot health products can qualify for HSA and FSA spending when they treat or manage a medical condition. The key is understanding eligibility rules, knowing when a Letter of Medical Necessity is required, and keeping the right documentation on hand.

You give yourself the best chance of approval by choosing products with a clear medical purpose and shopping through places that clearly identify eligibility. The Flex Marketplace simplifies this process by helping you find HSA/FSA-eligible shoes and foot care products in one place, with options to pay online using your HSA or FSA card.

If you have unused funds, putting them toward supportive footwear and foot health products can be a practical way to care for your body while using pre-tax dollars. With the right approach, you can spend confidently and avoid reimbursement headaches.

Running shoes and foot health products can qualify for HSA and FSA spending when they treat or manage a medical condition. The key is understanding eligibility rules, knowing when a Letter of Medical Necessity is required, and keeping the right documentation on hand.

You give yourself the best chance of approval by choosing products with a clear medical purpose and shopping through places that clearly identify eligibility. The Flex Marketplace simplifies this process by helping you find HSA/FSA-eligible shoes and foot care products in one place, with options to pay online using your HSA or FSA card.

If you have unused funds, putting them toward supportive footwear and foot health products can be a practical way to care for your body while using pre-tax dollars. With the right approach, you can spend confidently and avoid reimbursement headaches.

Related content from Flex

More content from Flex

HSA/FSA ELIGIBLE SHOPPING

Shop the Flex HSA/FSA Marketplace

Discover HSA/FSA-eligible brands and products

Use your pre-tax HSA/FSA dollars at checkout

Improve your health and wellness with products you’ll love

Shop Now

Shop Now

Shop Now