Are Running Shoes HSA or FSA Eligible & Where to Buy Them

Yulia Derdemezis

Head of Marketing at Flex

Updated: December 13, 2025

Running with comfortable, supportive shoes helps you stay active, but if you live with foot, leg, or joint issues, your footwear can also help you treat it. If used for a medical treatment, eligible running shoes can be purchased using your Health Savings Accounts (HSAs) or Flexible Spending Accounts (FSAs).

The rules can feel confusing at first, but once you understand how eligibility works, you’ll know exactly when your benefits can cover athletic footwear and where to buy them online. To help you make the most of your tax-advantaged dollars, we’ll cover the following:

7 medical conditions that make running shoes HSA/FSA eligible

How to buy running shoes using your HSA or FSA directly or reimbursement

3 HSA & FSA approved running shoes and insoles you can buy using your plan directly

6 other HSA & FSA eligible foot health products you can buy online

Let’s start with the most important question—when running shoes actually qualify—so you can confidently decide how to use your HSA/FSA dollars.

Running with comfortable, supportive shoes helps you stay active, but if you live with foot, leg, or joint issues, your footwear can also help you treat it. If used for a medical treatment, eligible running shoes can be purchased using your Health Savings Accounts (HSAs) or Flexible Spending Accounts (FSAs).

The rules can feel confusing at first, but once you understand how eligibility works, you’ll know exactly when your benefits can cover athletic footwear and where to buy them online. To help you make the most of your tax-advantaged dollars, we’ll cover the following:

7 medical conditions that make running shoes HSA/FSA eligible

How to buy running shoes using your HSA or FSA directly or reimbursement

3 HSA & FSA approved running shoes and insoles you can buy using your plan directly

6 other HSA & FSA eligible foot health products you can buy online

Let’s start with the most important question—when running shoes actually qualify—so you can confidently decide how to use your HSA/FSA dollars.

Running with comfortable, supportive shoes helps you stay active, but if you live with foot, leg, or joint issues, your footwear can also help you treat it. If used for a medical treatment, eligible running shoes can be purchased using your Health Savings Accounts (HSAs) or Flexible Spending Accounts (FSAs).

The rules can feel confusing at first, but once you understand how eligibility works, you’ll know exactly when your benefits can cover athletic footwear and where to buy them online. To help you make the most of your tax-advantaged dollars, we’ll cover the following:

7 medical conditions that make running shoes HSA/FSA eligible

How to buy running shoes using your HSA or FSA directly or reimbursement

3 HSA & FSA approved running shoes and insoles you can buy using your plan directly

6 other HSA & FSA eligible foot health products you can buy online

Let’s start with the most important question—when running shoes actually qualify—so you can confidently decide how to use your HSA/FSA dollars.

Are running shoes HSA and FSA eligible?

Running shoes qualify as HSA/FSA-eligible only when they serve a medical purpose instead of general athletic use. The IRS requires that footwear provide treatment for a diagnosed medical condition, such as severe overpronation, Plantar Fasciitis, or chronic foot pain, before you can use tax-advantaged funds.

Most standard running shoes do not qualify on their own. However, when a medical provider recommends specific supportive or corrective footwear to address a condition, those shoes may become eligible. If that applies to you, you can buy therapeutic running shoes or orthotic shoes using your benefits.

Do you always need a Letter of Medical Necessity to buy running shoes with your HSA/FSA?

Yes, you almost always need a Letter of Medical Necessity (LMN) to use HSA or FSA funds on running shoes, because the IRS considers standard athletic shoes a dual-purpose item. To qualify, the shoes must be prescribed to treat a diagnosed medical condition, and a Letter of Medical Necessity is the documentation that confirms this.

An LMN explains why your footwear is part of a treatment plan rather than a lifestyle purchase. If you have a condition like Plantar Fasciitis, chronic knee pain, or severe overpronation, your provider may recommend specific supportive running shoes to correct your gait or reduce strain. Without written documentation, your plan administrator will most likely deny the expense.

Some therapeutic insoles or medical-grade orthotics may qualify without an LMN, depending on how your plan classifies them. But for running shoes themselves, an LMN is typically required.

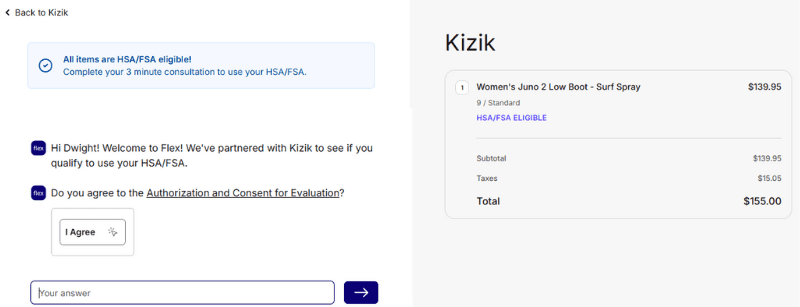

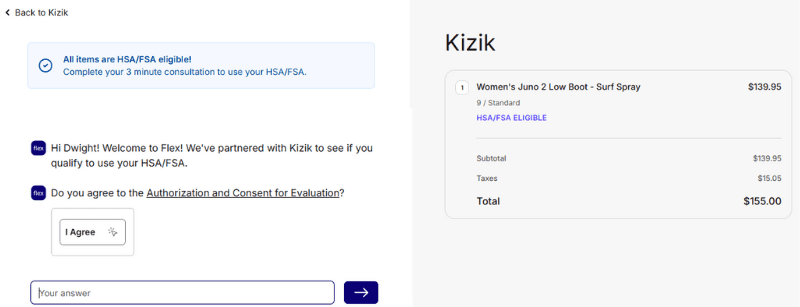

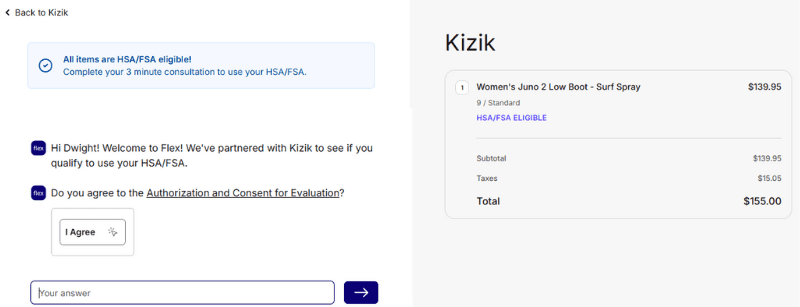

We feature hundreds of brands in the Flex Marketplace that offer HSA and FSA eligible products. Using Flex, you can get a Letter of Medical Necessity for your shoe purchase right at checkout, instead of waiting to see your doctor. Check out these stores where you can get your LMN right away: FitMyFoot, Kizik, and Andiem.

Running shoes qualify as HSA/FSA-eligible only when they serve a medical purpose instead of general athletic use. The IRS requires that footwear provide treatment for a diagnosed medical condition, such as severe overpronation, Plantar Fasciitis, or chronic foot pain, before you can use tax-advantaged funds.

Most standard running shoes do not qualify on their own. However, when a medical provider recommends specific supportive or corrective footwear to address a condition, those shoes may become eligible. If that applies to you, you can buy therapeutic running shoes or orthotic shoes using your benefits.

Do you always need a Letter of Medical Necessity to buy running shoes with your HSA/FSA?

Yes, you almost always need a Letter of Medical Necessity (LMN) to use HSA or FSA funds on running shoes, because the IRS considers standard athletic shoes a dual-purpose item. To qualify, the shoes must be prescribed to treat a diagnosed medical condition, and a Letter of Medical Necessity is the documentation that confirms this.

An LMN explains why your footwear is part of a treatment plan rather than a lifestyle purchase. If you have a condition like Plantar Fasciitis, chronic knee pain, or severe overpronation, your provider may recommend specific supportive running shoes to correct your gait or reduce strain. Without written documentation, your plan administrator will most likely deny the expense.

Some therapeutic insoles or medical-grade orthotics may qualify without an LMN, depending on how your plan classifies them. But for running shoes themselves, an LMN is typically required.

We feature hundreds of brands in the Flex Marketplace that offer HSA and FSA eligible products. Using Flex, you can get a Letter of Medical Necessity for your shoe purchase right at checkout, instead of waiting to see your doctor. Check out these stores where you can get your LMN right away: FitMyFoot, Kizik, and Andiem.

Running shoes qualify as HSA/FSA-eligible only when they serve a medical purpose instead of general athletic use. The IRS requires that footwear provide treatment for a diagnosed medical condition, such as severe overpronation, Plantar Fasciitis, or chronic foot pain, before you can use tax-advantaged funds.

Most standard running shoes do not qualify on their own. However, when a medical provider recommends specific supportive or corrective footwear to address a condition, those shoes may become eligible. If that applies to you, you can buy therapeutic running shoes or orthotic shoes using your benefits.

Do you always need a Letter of Medical Necessity to buy running shoes with your HSA/FSA?

Yes, you almost always need a Letter of Medical Necessity (LMN) to use HSA or FSA funds on running shoes, because the IRS considers standard athletic shoes a dual-purpose item. To qualify, the shoes must be prescribed to treat a diagnosed medical condition, and a Letter of Medical Necessity is the documentation that confirms this.

An LMN explains why your footwear is part of a treatment plan rather than a lifestyle purchase. If you have a condition like Plantar Fasciitis, chronic knee pain, or severe overpronation, your provider may recommend specific supportive running shoes to correct your gait or reduce strain. Without written documentation, your plan administrator will most likely deny the expense.

Some therapeutic insoles or medical-grade orthotics may qualify without an LMN, depending on how your plan classifies them. But for running shoes themselves, an LMN is typically required.

We feature hundreds of brands in the Flex Marketplace that offer HSA and FSA eligible products. Using Flex, you can get a Letter of Medical Necessity for your shoe purchase right at checkout, instead of waiting to see your doctor. Check out these stores where you can get your LMN right away: FitMyFoot, Kizik, and Andiem.

7 medical conditions that make running shoes HSA/FSA eligible

Running shoes can qualify as HSA/FSA-eligible when they are part of a treatment plan for a diagnosed medical condition that affects your feet, ankles, knees, hips, or overall gait. These conditions often require specialized support, stability, or shock absorption, which standard running shoes do not always provide.

Here are some of the most common medical conditions that may justify HSA/FSA eligibility:

Plantar Fasciitis: If you experience heel pain or arch irritation, your provider may recommend running shoes with enhanced arch support or cushioning to reduce strain on the plantar fascia. These shoes help manage inflammation and make day-to-day movement more comfortable.

Overpronation or Supination: Abnormal gait patterns (whether your foot rolls inward or outward) can create joint stress that leads to chronic pain. Corrective running shoes that stabilize your stride or improve alignment may be medically necessary.

Flat feet or high arches: Structural foot issues often require targeted support. Your provider may prescribe motion-control shoes or models designed to balance your arch height, which can reduce pain and prevent long-term complications.

Achilles Tendonitis: When the tendon connecting your calf to your heel becomes irritated, supportive running shoes with heel lift or improved cushioning can reduce tension and support healing.

Chronic knee, hip, or lower back pain: Improper foot mechanics often affect your entire kinetic chain. If your provider identifies footwear as part of your treatment plan for joint or lower back pain, certain running shoes may qualify.

Diabetic foot concerns: Some people with diabetes need shoes that reduce pressure points or support safer movement. In specific cases, therapeutic running shoes may be recommended.

Recovery after injury or surgery: If you’re recovering from a foot, ankle, or lower-limb injury, your provider may prescribe footwear that supports rehabilitation and reduces re-injury risk.

When running shoes are used to correct or treat an underlying medical issue, they are more likely to qualify for HSA or FSA spending, especially when paired with an LMN from your provider.

Next, you’ll learn how to use your HSA or FSA to purchase these shoes directly or through reimbursement.

Running shoes can qualify as HSA/FSA-eligible when they are part of a treatment plan for a diagnosed medical condition that affects your feet, ankles, knees, hips, or overall gait. These conditions often require specialized support, stability, or shock absorption, which standard running shoes do not always provide.

Here are some of the most common medical conditions that may justify HSA/FSA eligibility:

Plantar Fasciitis: If you experience heel pain or arch irritation, your provider may recommend running shoes with enhanced arch support or cushioning to reduce strain on the plantar fascia. These shoes help manage inflammation and make day-to-day movement more comfortable.

Overpronation or Supination: Abnormal gait patterns (whether your foot rolls inward or outward) can create joint stress that leads to chronic pain. Corrective running shoes that stabilize your stride or improve alignment may be medically necessary.

Flat feet or high arches: Structural foot issues often require targeted support. Your provider may prescribe motion-control shoes or models designed to balance your arch height, which can reduce pain and prevent long-term complications.

Achilles Tendonitis: When the tendon connecting your calf to your heel becomes irritated, supportive running shoes with heel lift or improved cushioning can reduce tension and support healing.

Chronic knee, hip, or lower back pain: Improper foot mechanics often affect your entire kinetic chain. If your provider identifies footwear as part of your treatment plan for joint or lower back pain, certain running shoes may qualify.

Diabetic foot concerns: Some people with diabetes need shoes that reduce pressure points or support safer movement. In specific cases, therapeutic running shoes may be recommended.

Recovery after injury or surgery: If you’re recovering from a foot, ankle, or lower-limb injury, your provider may prescribe footwear that supports rehabilitation and reduces re-injury risk.

When running shoes are used to correct or treat an underlying medical issue, they are more likely to qualify for HSA or FSA spending, especially when paired with an LMN from your provider.

Next, you’ll learn how to use your HSA or FSA to purchase these shoes directly or through reimbursement.

Running shoes can qualify as HSA/FSA-eligible when they are part of a treatment plan for a diagnosed medical condition that affects your feet, ankles, knees, hips, or overall gait. These conditions often require specialized support, stability, or shock absorption, which standard running shoes do not always provide.

Here are some of the most common medical conditions that may justify HSA/FSA eligibility:

Plantar Fasciitis: If you experience heel pain or arch irritation, your provider may recommend running shoes with enhanced arch support or cushioning to reduce strain on the plantar fascia. These shoes help manage inflammation and make day-to-day movement more comfortable.

Overpronation or Supination: Abnormal gait patterns (whether your foot rolls inward or outward) can create joint stress that leads to chronic pain. Corrective running shoes that stabilize your stride or improve alignment may be medically necessary.

Flat feet or high arches: Structural foot issues often require targeted support. Your provider may prescribe motion-control shoes or models designed to balance your arch height, which can reduce pain and prevent long-term complications.

Achilles Tendonitis: When the tendon connecting your calf to your heel becomes irritated, supportive running shoes with heel lift or improved cushioning can reduce tension and support healing.

Chronic knee, hip, or lower back pain: Improper foot mechanics often affect your entire kinetic chain. If your provider identifies footwear as part of your treatment plan for joint or lower back pain, certain running shoes may qualify.

Diabetic foot concerns: Some people with diabetes need shoes that reduce pressure points or support safer movement. In specific cases, therapeutic running shoes may be recommended.

Recovery after injury or surgery: If you’re recovering from a foot, ankle, or lower-limb injury, your provider may prescribe footwear that supports rehabilitation and reduces re-injury risk.

When running shoes are used to correct or treat an underlying medical issue, they are more likely to qualify for HSA or FSA spending, especially when paired with an LMN from your provider.

Next, you’ll learn how to use your HSA or FSA to purchase these shoes directly or through reimbursement.

How to buy running shoes using your HSA or FSA directly or through reimbursement

If your provider prescribes running shoes for a medical condition, you have two ways to use your HSA or FSA funds. Both methods depend on your plan’s rules, the documentation you provide, and whether you purchase from a store that accepts HSA/FSA payments directly.

Using your benefits at checkout is often the most convenient option, especially when you shop through the Flex Marketplace, where eligible products are clearly identified and can be purchased instantly with your HSA or FSA card. If a store doesn’t accept HSA/FSA payments, you can still use your benefits by submitting a reimbursement claim (just be sure to keep your LMN and itemized receipt).

Before breaking down each method, it’s helpful to understand that both options rely on proper documentation. Your LMN and receipt work together to justify your purchase and ensure compliance with IRS guidelines.

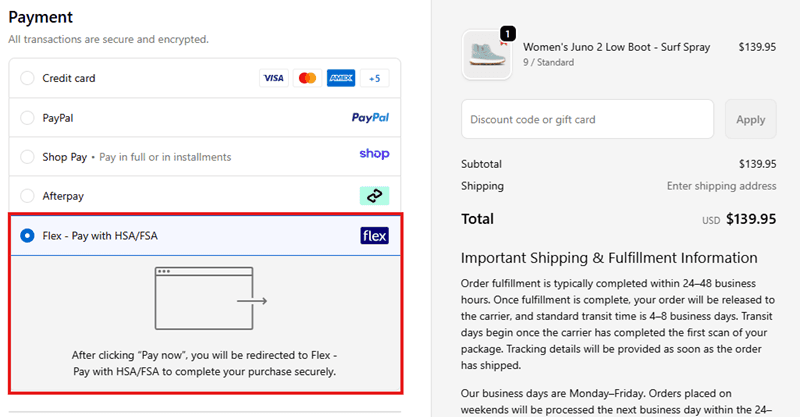

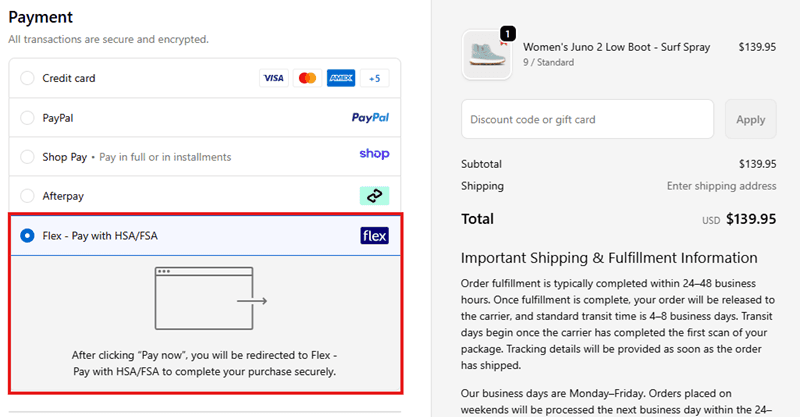

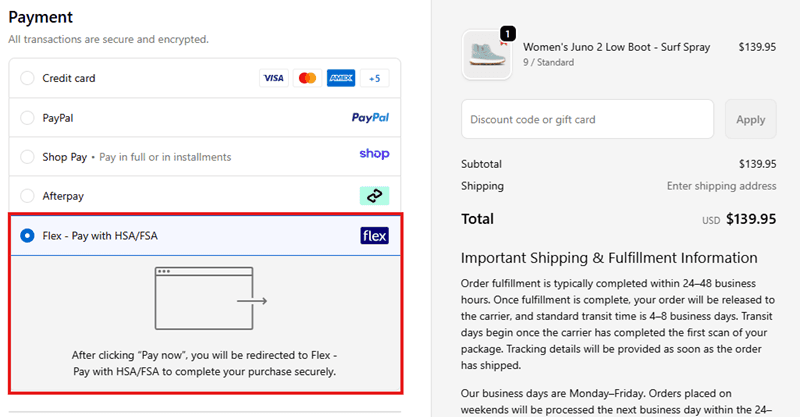

1. Pay with your HSA/FSA directly at checkout

Paying with your HSA or FSA card at checkout is the easiest and fastest way to purchase eligible running shoes. This option works when the retailer accepts HSA/FSA cards and the product qualifies under IRS rules.

Using your HSA or FSA card avoids the need to pay out of pocket, file paperwork, or wait for reimbursement. It also gives you immediate confirmation that your purchase went through, which removes uncertainty around whether your plan administrator will approve it.

The Flex Marketplace features brands that accept HSA & FSA payments, making it one of the most convenient ways to pay directly. We support HSA/FSA cards automatically and help you filter products by eligibility, so you browse items you know you can buy with HSA/FSA funds.

2. Make a reimbursement claim

If the retailer doesn’t accept HSA/FSA cards at checkout, you can still use your benefits by paying upfront and submitting a reimbursement claim. This process requires two things: your LMN (when running shoes are prescribed) and an itemized receipt showing exactly what you purchased.

Once you submit these documents through your HSA or FSA portal, your administrator reviews them to confirm eligibility. If approved, you’ll receive reimbursement by direct deposit or check, depending on your plan. This method takes more time, but it allows you to shop anywhere, including local running stores or specialty retailers that don’t accept HSA/FSA cards.

If your provider prescribes running shoes for a medical condition, you have two ways to use your HSA or FSA funds. Both methods depend on your plan’s rules, the documentation you provide, and whether you purchase from a store that accepts HSA/FSA payments directly.

Using your benefits at checkout is often the most convenient option, especially when you shop through the Flex Marketplace, where eligible products are clearly identified and can be purchased instantly with your HSA or FSA card. If a store doesn’t accept HSA/FSA payments, you can still use your benefits by submitting a reimbursement claim (just be sure to keep your LMN and itemized receipt).

Before breaking down each method, it’s helpful to understand that both options rely on proper documentation. Your LMN and receipt work together to justify your purchase and ensure compliance with IRS guidelines.

1. Pay with your HSA/FSA directly at checkout

Paying with your HSA or FSA card at checkout is the easiest and fastest way to purchase eligible running shoes. This option works when the retailer accepts HSA/FSA cards and the product qualifies under IRS rules.

Using your HSA or FSA card avoids the need to pay out of pocket, file paperwork, or wait for reimbursement. It also gives you immediate confirmation that your purchase went through, which removes uncertainty around whether your plan administrator will approve it.

The Flex Marketplace features brands that accept HSA & FSA payments, making it one of the most convenient ways to pay directly. We support HSA/FSA cards automatically and help you filter products by eligibility, so you browse items you know you can buy with HSA/FSA funds.

2. Make a reimbursement claim

If the retailer doesn’t accept HSA/FSA cards at checkout, you can still use your benefits by paying upfront and submitting a reimbursement claim. This process requires two things: your LMN (when running shoes are prescribed) and an itemized receipt showing exactly what you purchased.

Once you submit these documents through your HSA or FSA portal, your administrator reviews them to confirm eligibility. If approved, you’ll receive reimbursement by direct deposit or check, depending on your plan. This method takes more time, but it allows you to shop anywhere, including local running stores or specialty retailers that don’t accept HSA/FSA cards.

If your provider prescribes running shoes for a medical condition, you have two ways to use your HSA or FSA funds. Both methods depend on your plan’s rules, the documentation you provide, and whether you purchase from a store that accepts HSA/FSA payments directly.

Using your benefits at checkout is often the most convenient option, especially when you shop through the Flex Marketplace, where eligible products are clearly identified and can be purchased instantly with your HSA or FSA card. If a store doesn’t accept HSA/FSA payments, you can still use your benefits by submitting a reimbursement claim (just be sure to keep your LMN and itemized receipt).

Before breaking down each method, it’s helpful to understand that both options rely on proper documentation. Your LMN and receipt work together to justify your purchase and ensure compliance with IRS guidelines.

1. Pay with your HSA/FSA directly at checkout

Paying with your HSA or FSA card at checkout is the easiest and fastest way to purchase eligible running shoes. This option works when the retailer accepts HSA/FSA cards and the product qualifies under IRS rules.

Using your HSA or FSA card avoids the need to pay out of pocket, file paperwork, or wait for reimbursement. It also gives you immediate confirmation that your purchase went through, which removes uncertainty around whether your plan administrator will approve it.

The Flex Marketplace features brands that accept HSA & FSA payments, making it one of the most convenient ways to pay directly. We support HSA/FSA cards automatically and help you filter products by eligibility, so you browse items you know you can buy with HSA/FSA funds.

2. Make a reimbursement claim

If the retailer doesn’t accept HSA/FSA cards at checkout, you can still use your benefits by paying upfront and submitting a reimbursement claim. This process requires two things: your LMN (when running shoes are prescribed) and an itemized receipt showing exactly what you purchased.

Once you submit these documents through your HSA or FSA portal, your administrator reviews them to confirm eligibility. If approved, you’ll receive reimbursement by direct deposit or check, depending on your plan. This method takes more time, but it allows you to shop anywhere, including local running stores or specialty retailers that don’t accept HSA/FSA cards.

3 HSA & FSA approved running shoes and insoles you can buy using your plan directly

When your provider recommends specific footwear as part of your treatment plan, choosing brands that focus on comfort, alignment, or supportive design can make your purchase more effective. Below are several companies known for products commonly used to support foot and gait-related conditions—and that you can buy using your HSA or FSA when medically necessary.

Product | Description |

|---|---|

| FitMyFoot specializes in custom 3D‑printed insoles and supportive sandals designed to improve alignment and relieve pressure throughout the foot. Their insoles are often used for conditions like Plantar Fasciitis, flat feet, and chronic heel pain. Since they’re custom‑made based on your foot scan, they offer targeted support that pairs well with an LMN. |

| Kizik is best known for its hands‑free slip‑on shoes, which feature supportive cushioning and structured designs that can benefit people with mobility challenges, joint pain, or balance concerns. Their easy-on entry is especially helpful if bending or tying laces causes discomfort. While not all styles qualify, certain supportive models may be eligible when prescribed for a medical condition. |

| Andheim creates minimalist, recovery‑focused footwear designed to help with natural foot movement and reduce strain after long periods of walking or running. Their shoes and supportive footbeds are often used by people managing arch fatigue, posture issues, or general foot discomfort. They can serve as part of a broader treatment plan when your provider recommends footwear that encourages healthier movement patterns. |

When your provider recommends specific footwear as part of your treatment plan, choosing brands that focus on comfort, alignment, or supportive design can make your purchase more effective. Below are several companies known for products commonly used to support foot and gait-related conditions—and that you can buy using your HSA or FSA when medically necessary.

Product | Description |

|---|---|

| FitMyFoot specializes in custom 3D‑printed insoles and supportive sandals designed to improve alignment and relieve pressure throughout the foot. Their insoles are often used for conditions like Plantar Fasciitis, flat feet, and chronic heel pain. Since they’re custom‑made based on your foot scan, they offer targeted support that pairs well with an LMN. |

| Kizik is best known for its hands‑free slip‑on shoes, which feature supportive cushioning and structured designs that can benefit people with mobility challenges, joint pain, or balance concerns. Their easy-on entry is especially helpful if bending or tying laces causes discomfort. While not all styles qualify, certain supportive models may be eligible when prescribed for a medical condition. |

| Andheim creates minimalist, recovery‑focused footwear designed to help with natural foot movement and reduce strain after long periods of walking or running. Their shoes and supportive footbeds are often used by people managing arch fatigue, posture issues, or general foot discomfort. They can serve as part of a broader treatment plan when your provider recommends footwear that encourages healthier movement patterns. |

When your provider recommends specific footwear as part of your treatment plan, choosing brands that focus on comfort, alignment, or supportive design can make your purchase more effective. Below are several companies known for products commonly used to support foot and gait-related conditions—and that you can buy using your HSA or FSA when medically necessary.

Product | Description |

|---|---|

| FitMyFoot specializes in custom 3D‑printed insoles and supportive sandals designed to improve alignment and relieve pressure throughout the foot. Their insoles are often used for conditions like Plantar Fasciitis, flat feet, and chronic heel pain. Since they’re custom‑made based on your foot scan, they offer targeted support that pairs well with an LMN. |

| Kizik is best known for its hands‑free slip‑on shoes, which feature supportive cushioning and structured designs that can benefit people with mobility challenges, joint pain, or balance concerns. Their easy-on entry is especially helpful if bending or tying laces causes discomfort. While not all styles qualify, certain supportive models may be eligible when prescribed for a medical condition. |

| Andheim creates minimalist, recovery‑focused footwear designed to help with natural foot movement and reduce strain after long periods of walking or running. Their shoes and supportive footbeds are often used by people managing arch fatigue, posture issues, or general foot discomfort. They can serve as part of a broader treatment plan when your provider recommends footwear that encourages healthier movement patterns. |

6 other HSA & FSA eligible foot health products you can buy online

In addition to shoes, check out these other products that can help with a variety of foot health issues.

Product | Description |

|---|---|

| The Toe Spacer focuses on alignment tools that help correct toe positioning and relieve pressure caused by bunions, hammertoes, and foot crowding. These products are commonly used alongside or instead of supportive running shoes when providers recommend reducing strain on the forefoot. |

| Copper Compression offers braces, sleeves, and compression gear designed to support joints and reduce inflammation. For runners managing pain or recovering from injury, these products can serve as alternatives when providers recommend limiting running shoe use and focusing on joint stabilization. |

| BYEBUNS specializes in bunion relief products that reduce pressure and friction around the big toe joint. These tools are often used as alternatives to specialized running shoes when providers focus on relieving bunion-related pain without changing footwear. |

| Ezy Wrap produces adjustable compression wraps designed to stabilize joints and manage swelling. These wraps are commonly used when providers recommend supportive alternatives to running shoes during injury recovery or flare-ups. |

| BetterGuard offers smart ankle braces designed to help prevent and manage ankle injuries. For runners with chronic instability, these braces can act as an alternative to specialized running shoes by providing external support and reducing injury risk. |

| Paingone produces drug-free electrotherapy devices designed to help relieve foot and heel pain, including discomfort linked to Plantar Fasciitis. While not a footwear product, Paingone devices are often used as an alternative or complement to medically approved running shoes when providers focus on pain management rather than structural correction. |

In addition to shoes, check out these other products that can help with a variety of foot health issues.

Product | Description |

|---|---|

| The Toe Spacer focuses on alignment tools that help correct toe positioning and relieve pressure caused by bunions, hammertoes, and foot crowding. These products are commonly used alongside or instead of supportive running shoes when providers recommend reducing strain on the forefoot. |

| Copper Compression offers braces, sleeves, and compression gear designed to support joints and reduce inflammation. For runners managing pain or recovering from injury, these products can serve as alternatives when providers recommend limiting running shoe use and focusing on joint stabilization. |

| BYEBUNS specializes in bunion relief products that reduce pressure and friction around the big toe joint. These tools are often used as alternatives to specialized running shoes when providers focus on relieving bunion-related pain without changing footwear. |

| Ezy Wrap produces adjustable compression wraps designed to stabilize joints and manage swelling. These wraps are commonly used when providers recommend supportive alternatives to running shoes during injury recovery or flare-ups. |

| BetterGuard offers smart ankle braces designed to help prevent and manage ankle injuries. For runners with chronic instability, these braces can act as an alternative to specialized running shoes by providing external support and reducing injury risk. |

| Paingone produces drug-free electrotherapy devices designed to help relieve foot and heel pain, including discomfort linked to Plantar Fasciitis. While not a footwear product, Paingone devices are often used as an alternative or complement to medically approved running shoes when providers focus on pain management rather than structural correction. |

In addition to shoes, check out these other products that can help with a variety of foot health issues.

Product | Description |

|---|---|

| The Toe Spacer focuses on alignment tools that help correct toe positioning and relieve pressure caused by bunions, hammertoes, and foot crowding. These products are commonly used alongside or instead of supportive running shoes when providers recommend reducing strain on the forefoot. |

| Copper Compression offers braces, sleeves, and compression gear designed to support joints and reduce inflammation. For runners managing pain or recovering from injury, these products can serve as alternatives when providers recommend limiting running shoe use and focusing on joint stabilization. |

| BYEBUNS specializes in bunion relief products that reduce pressure and friction around the big toe joint. These tools are often used as alternatives to specialized running shoes when providers focus on relieving bunion-related pain without changing footwear. |

| Ezy Wrap produces adjustable compression wraps designed to stabilize joints and manage swelling. These wraps are commonly used when providers recommend supportive alternatives to running shoes during injury recovery or flare-ups. |

| BetterGuard offers smart ankle braces designed to help prevent and manage ankle injuries. For runners with chronic instability, these braces can act as an alternative to specialized running shoes by providing external support and reducing injury risk. |

| Paingone produces drug-free electrotherapy devices designed to help relieve foot and heel pain, including discomfort linked to Plantar Fasciitis. While not a footwear product, Paingone devices are often used as an alternative or complement to medically approved running shoes when providers focus on pain management rather than structural correction. |

In summary

Using your HSA or FSA to purchase running shoes is possible when your footwear addresses a diagnosed medical condition and supports a treatment plan recommended by your provider. With the right documentation, including a Letter of Medical Necessity, you can put your benefits toward footwear that helps relieve pain, improve alignment, or support healthier movement.

The Flex Marketplace makes it easy to browse verified eligible footwear and checkout instantly with your benefits card, saving you time and helping you stay compliant. If you want a convenient, trustworthy way to spend your HSA or FSA dollars on supportive running shoes, our marketplace is one of the best places to start.

Using your HSA or FSA to purchase running shoes is possible when your footwear addresses a diagnosed medical condition and supports a treatment plan recommended by your provider. With the right documentation, including a Letter of Medical Necessity, you can put your benefits toward footwear that helps relieve pain, improve alignment, or support healthier movement.

The Flex Marketplace makes it easy to browse verified eligible footwear and checkout instantly with your benefits card, saving you time and helping you stay compliant. If you want a convenient, trustworthy way to spend your HSA or FSA dollars on supportive running shoes, our marketplace is one of the best places to start.

Using your HSA or FSA to purchase running shoes is possible when your footwear addresses a diagnosed medical condition and supports a treatment plan recommended by your provider. With the right documentation, including a Letter of Medical Necessity, you can put your benefits toward footwear that helps relieve pain, improve alignment, or support healthier movement.

The Flex Marketplace makes it easy to browse verified eligible footwear and checkout instantly with your benefits card, saving you time and helping you stay compliant. If you want a convenient, trustworthy way to spend your HSA or FSA dollars on supportive running shoes, our marketplace is one of the best places to start.

Related content from Flex

More content from Flex

HSA/FSA ELIGIBLE SHOPPING

Shop the Flex HSA/FSA Marketplace

Discover HSA/FSA-eligible brands and products

Use your pre-tax HSA/FSA dollars at checkout

Improve your health and wellness with products you’ll love

Shop Now

Shop Now

Shop Now