Are Vitamins FSA/HSA Eligible & What You Can Buy

Yulia Derdemezis

Head of Marketing at Flex

Updated: January 24, 2026

🚀 Fast Facts: Are vitamins HSA/FSA eligible?

Yes, vitamins can be eligible to be purchased through an HSA/FSA, but it must be for a specific medical condition

In almost all cases, you’ll need a Letter of Medical Necessity to justify why the expense is part of your treatment plan

Brand selection is important, with brands marketed towards true medical conditions having a greater chance of approval

Yes, vitamins can be eligible to be purchased through an HSA/FSA, but it must be for a specific medical condition

In almost all cases, you’ll need a Letter of Medical Necessity to justify why the expense is part of your treatment plan

Brand selection is important, with brands marketed towards true medical conditions having a greater chance of approval

Yes, vitamins can be eligible to be purchased through an HSA/FSA, but it must be for a specific medical condition

In almost all cases, you’ll need a Letter of Medical Necessity to justify why the expense is part of your treatment plan

Brand selection is important, with brands marketed towards true medical conditions having a greater chance of approval

Yes, vitamins can be eligible to be purchased through an HSA/FSA, but it must be for a specific medical condition

In almost all cases, you’ll need a Letter of Medical Necessity to justify why the expense is part of your treatment plan

Brand selection is important, with brands marketed towards true medical conditions having a greater chance of approval

Vitamins sit in a confusing gray area when it comes to Health Savings Accounts (HSAs) and Flexible Spending Accounts (FSAs). You might see vitamins everywhere you shop, but that does not mean your HSA or FSA will automatically cover them. This guide clears up the confusion so you can understand when vitamins qualify, when extra documentation is required, and how to buy eligible options without wasting time or money.

Here’s what this article will walk you through:

Do you need a Letter of Medical Necessity to buy vitamins with your HSA or FSA?

5 types of medical conditions that qualify vitamins as HSA and FSA eligible

How to buy HSA/FSA eligible vitamins using funds directly or through reimbursement

Understanding the rules upfront helps you avoid denied transactions and frustrating reimbursement claims. Let’s start by answering the most common question people ask about vitamins and HSA or FSA eligibility.

Vitamins sit in a confusing gray area when it comes to Health Savings Accounts (HSAs) and Flexible Spending Accounts (FSAs). You might see vitamins everywhere you shop, but that does not mean your HSA or FSA will automatically cover them. This guide clears up the confusion so you can understand when vitamins qualify, when extra documentation is required, and how to buy eligible options without wasting time or money.

Here’s what this article will walk you through:

Do you need a Letter of Medical Necessity to buy vitamins with your HSA or FSA?

5 types of medical conditions that qualify vitamins as HSA and FSA eligible

How to buy HSA/FSA eligible vitamins using funds directly or through reimbursement

Understanding the rules upfront helps you avoid denied transactions and frustrating reimbursement claims. Let’s start by answering the most common question people ask about vitamins and HSA or FSA eligibility.

Vitamins sit in a confusing gray area when it comes to Health Savings Accounts (HSAs) and Flexible Spending Accounts (FSAs). You might see vitamins everywhere you shop, but that does not mean your HSA or FSA will automatically cover them. This guide clears up the confusion so you can understand when vitamins qualify, when extra documentation is required, and how to buy eligible options without wasting time or money.

Here’s what this article will walk you through:

Do you need a Letter of Medical Necessity to buy vitamins with your HSA or FSA?

5 types of medical conditions that qualify vitamins as HSA and FSA eligible

How to buy HSA/FSA eligible vitamins using funds directly or through reimbursement

Understanding the rules upfront helps you avoid denied transactions and frustrating reimbursement claims. Let’s start by answering the most common question people ask about vitamins and HSA or FSA eligibility.

Are vitamins HSA and FSA eligible?

Vitamins are not automatically HSA/FSA eligible, because the IRS separates everyday wellness from medical care. Vitamins are only an HSA/FSA eligible expense when you use them to treat or manage a diagnosed medical condition, not when used strictly for prevention.

Under IRS guidance, vitamins purchased for general health, immune support, or daily nutrition do not qualify as medical expenses. These products fall into the same category as food or wellness items, even when they appear health-related. That distinction explains why some vitamin purchases go through smoothly while others get denied. Eligibility always depends on the medical purpose behind the purchase.

Vitamins are not automatically HSA/FSA eligible, because the IRS separates everyday wellness from medical care. Vitamins are only an HSA/FSA eligible expense when you use them to treat or manage a diagnosed medical condition, not when used strictly for prevention.

Under IRS guidance, vitamins purchased for general health, immune support, or daily nutrition do not qualify as medical expenses. These products fall into the same category as food or wellness items, even when they appear health-related. That distinction explains why some vitamin purchases go through smoothly while others get denied. Eligibility always depends on the medical purpose behind the purchase.

Vitamins are not automatically HSA/FSA eligible, because the IRS separates everyday wellness from medical care. Vitamins are only an HSA/FSA eligible expense when you use them to treat or manage a diagnosed medical condition, not when used strictly for prevention.

Under IRS guidance, vitamins purchased for general health, immune support, or daily nutrition do not qualify as medical expenses. These products fall into the same category as food or wellness items, even when they appear health-related. That distinction explains why some vitamin purchases go through smoothly while others get denied. Eligibility always depends on the medical purpose behind the purchase.

Do you need a Letter of Medical Necessity to buy vitamins with your HSA or FSA?

Yes, in most cases, you need a Letter of Medical Necessity (LMN) to buy vitamins with your HSA or FSA. The IRS treats most vitamins as general wellness items, so coverage only applies when a licensed provider documents that the vitamin treats a diagnosed medical condition rather than provides everyday nutrition.

An LMN explains why a specific vitamin is medically necessary for your condition and how it fits into your treatment plan. This documentation allows plan administrators to approve vitamins that would otherwise be considered ineligible.

You should request an LMN when any of the following apply to you, which may make you eligible:

The vitamin treats a diagnosed deficiency or condition

The vitamin supports management of a chronic or ongoing medical issue

The product you want to use looks like a general supplement, but serves a medical purpose

You usually do not need an LMN when the vitamin is bundled with an eligible medical service or clearly classified as treatment-based by your plan, though these situations are less common.

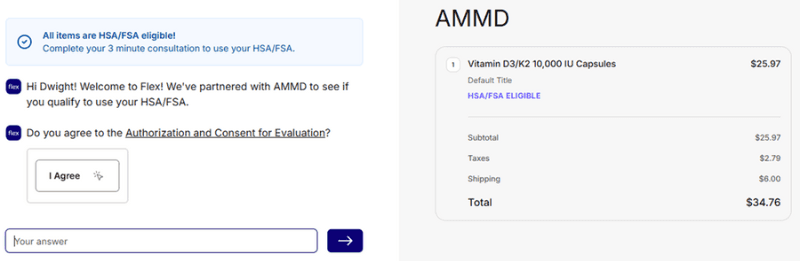

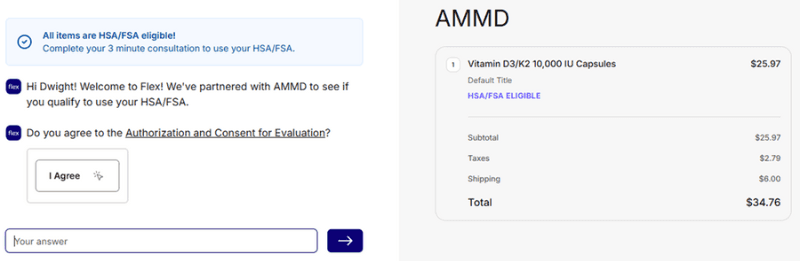

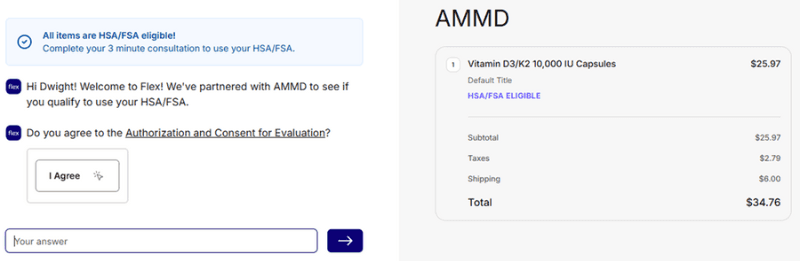

Needing a Letter of Medical Necessity for the vitamins you take doesn’t have to slow you down. Some online checkout experiences provided by our merchants in the Flex Marketplace can guide you through eligibility questions right at checkout. Check out Biogena One or Amy Myers MD for the option to request an LMN when making your vitamin purchase.

Yes, in most cases, you need a Letter of Medical Necessity (LMN) to buy vitamins with your HSA or FSA. The IRS treats most vitamins as general wellness items, so coverage only applies when a licensed provider documents that the vitamin treats a diagnosed medical condition rather than provides everyday nutrition.

An LMN explains why a specific vitamin is medically necessary for your condition and how it fits into your treatment plan. This documentation allows plan administrators to approve vitamins that would otherwise be considered ineligible.

You should request an LMN when any of the following apply to you, which may make you eligible:

The vitamin treats a diagnosed deficiency or condition

The vitamin supports management of a chronic or ongoing medical issue

The product you want to use looks like a general supplement, but serves a medical purpose

You usually do not need an LMN when the vitamin is bundled with an eligible medical service or clearly classified as treatment-based by your plan, though these situations are less common.

Needing a Letter of Medical Necessity for the vitamins you take doesn’t have to slow you down. Some online checkout experiences provided by our merchants in the Flex Marketplace can guide you through eligibility questions right at checkout. Check out Biogena One or Amy Myers MD for the option to request an LMN when making your vitamin purchase.

Yes, in most cases, you need a Letter of Medical Necessity (LMN) to buy vitamins with your HSA or FSA. The IRS treats most vitamins as general wellness items, so coverage only applies when a licensed provider documents that the vitamin treats a diagnosed medical condition rather than provides everyday nutrition.

An LMN explains why a specific vitamin is medically necessary for your condition and how it fits into your treatment plan. This documentation allows plan administrators to approve vitamins that would otherwise be considered ineligible.

You should request an LMN when any of the following apply to you, which may make you eligible:

The vitamin treats a diagnosed deficiency or condition

The vitamin supports management of a chronic or ongoing medical issue

The product you want to use looks like a general supplement, but serves a medical purpose

You usually do not need an LMN when the vitamin is bundled with an eligible medical service or clearly classified as treatment-based by your plan, though these situations are less common.

Needing a Letter of Medical Necessity for the vitamins you take doesn’t have to slow you down. Some online checkout experiences provided by our merchants in the Flex Marketplace can guide you through eligibility questions right at checkout. Check out Biogena One or Amy Myers MD for the option to request an LMN when making your vitamin purchase.

5 types of medical conditions that qualify vitamins as HSA and FSA eligible

When a medical condition exists, vitamins can move into eligible territory with proper documentation. Below are some common conditions that might make your vitamin purchase HSA/FSA eligible.

Nutrient deficiencies: When lab work confirms a deficiency, vitamins used to correct that deficiency may qualify. Examples include iron for anemia or vitamin D for a diagnosed deficiency.

Pregnancy-related medical conditions: Vitamins may qualify when recommended to address a specific pregnancy-related issue. Routine prenatal vitamins without documentation usually do not qualify.

Digestive or absorption disorders: Conditions that limit nutrient absorption may require targeted supplementation. Vitamins prescribed for celiac disease, Crohn’s disease, or post-surgical care may qualify.

Chronic conditions requiring supplementation: Some long-term conditions rely on vitamins as part of treatment. Eligibility depends on a provider clearly linking the vitamin to the diagnosed condition.

Post-surgical recovery: Vitamins prescribed to support healing or address deficiencies after surgery may qualify, especially when nutrient absorption or recovery is affected.

Understanding how conditions qualify helps you avoid denied claims and unnecessary paperwork. It also leads directly into the documentation rules that often apply.

When a medical condition exists, vitamins can move into eligible territory with proper documentation. Below are some common conditions that might make your vitamin purchase HSA/FSA eligible.

Nutrient deficiencies: When lab work confirms a deficiency, vitamins used to correct that deficiency may qualify. Examples include iron for anemia or vitamin D for a diagnosed deficiency.

Pregnancy-related medical conditions: Vitamins may qualify when recommended to address a specific pregnancy-related issue. Routine prenatal vitamins without documentation usually do not qualify.

Digestive or absorption disorders: Conditions that limit nutrient absorption may require targeted supplementation. Vitamins prescribed for celiac disease, Crohn’s disease, or post-surgical care may qualify.

Chronic conditions requiring supplementation: Some long-term conditions rely on vitamins as part of treatment. Eligibility depends on a provider clearly linking the vitamin to the diagnosed condition.

Post-surgical recovery: Vitamins prescribed to support healing or address deficiencies after surgery may qualify, especially when nutrient absorption or recovery is affected.

Understanding how conditions qualify helps you avoid denied claims and unnecessary paperwork. It also leads directly into the documentation rules that often apply.

When a medical condition exists, vitamins can move into eligible territory with proper documentation. Below are some common conditions that might make your vitamin purchase HSA/FSA eligible.

Nutrient deficiencies: When lab work confirms a deficiency, vitamins used to correct that deficiency may qualify. Examples include iron for anemia or vitamin D for a diagnosed deficiency.

Pregnancy-related medical conditions: Vitamins may qualify when recommended to address a specific pregnancy-related issue. Routine prenatal vitamins without documentation usually do not qualify.

Digestive or absorption disorders: Conditions that limit nutrient absorption may require targeted supplementation. Vitamins prescribed for celiac disease, Crohn’s disease, or post-surgical care may qualify.

Chronic conditions requiring supplementation: Some long-term conditions rely on vitamins as part of treatment. Eligibility depends on a provider clearly linking the vitamin to the diagnosed condition.

Post-surgical recovery: Vitamins prescribed to support healing or address deficiencies after surgery may qualify, especially when nutrient absorption or recovery is affected.

Understanding how conditions qualify helps you avoid denied claims and unnecessary paperwork. It also leads directly into the documentation rules that often apply.

How to buy HSA/FSA eligible vitamins using funds directly or through reimbursement

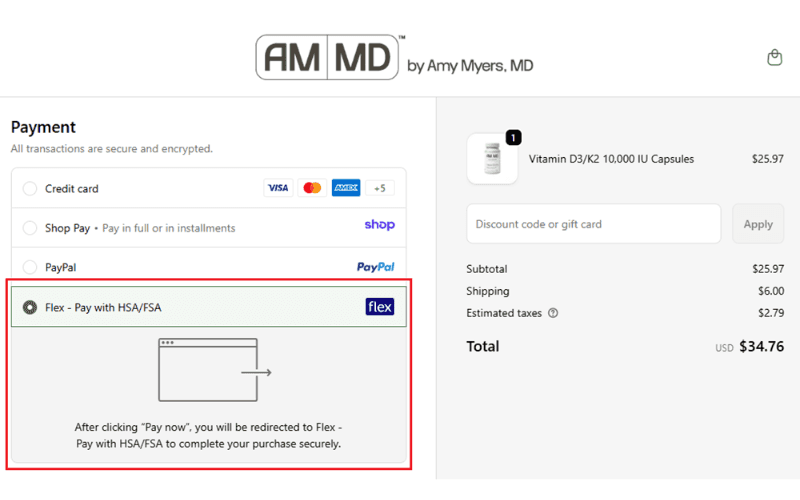

Once you know a vitamin purchase qualifies for you, the next step is choosing how to pay for it. You typically have two options: paying with your HSA or FSA card directly at checkout (when available), or paying out of pocket and requesting reimbursement later. Both methods work under IRS rules, but paying directly cuts out a lot of time and effort.

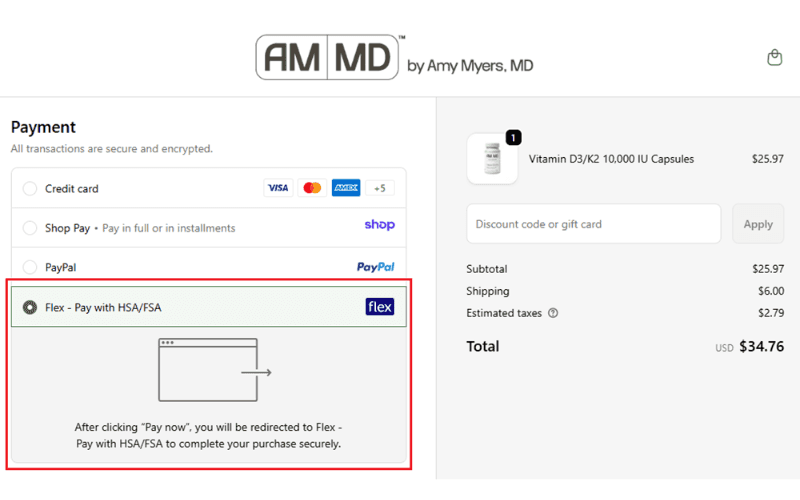

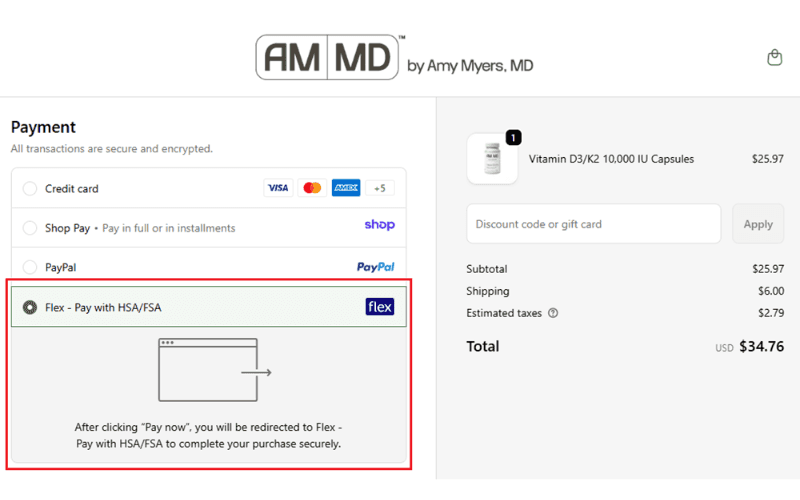

1. Pay with your HSA or FSA directly at checkout

Paying directly with your HSA or FSA card is the simplest way to buy FSA/HSA eligible vitamins. When the merchant supports HSA/FSA card payments, your purchase is confirmed instantly and you avoid reimbursement paperwork.

This option works best when the vitamin is clearly eligible or paired with required documentation at checkout. You get immediate confirmation that your purchase qualifies.

You can make this process easier by shopping through the Flex Marketplace, which brings together hundreds of online stores selling HSA/FSA-eligible products. Instead of guessing which vitamins qualify, you can browse options that already qualify, and checkout with your HSA/FSA card right away.

See it firsthand in one of our favorite shops for vitamins and supplements, Amy Myers MD:

Key advantages of paying directly include:

No out-of-pocket spending

No reimbursement forms to submit

Faster access to your vitamins

For many people, this approach removes the biggest barriers to using HSA and FSA funds.

2. Make a reimbursement claim

Reimbursement works when a store does not accept HSA or FSA cards or when you pay with a regular credit card. You buy the vitamin first, then submit a claim to your plan administrator.

To get approved, you typically need:

An itemized receipt

Proof the vitamin treats a diagnosed condition

A Letter of Medical Necessity, when required

This option adds extra steps and processing time, which can delay access to your funds. It also increases the risk of denial if you haven’t obtained your Letter of Medical Necessity before you make the purchase.

When possible, many people prefer to avoid reimbursement by shopping for eligible products through the Flex Marketplace, where direct payment helps keep things simple and compliant.

Let’s look at some examples of HSA/FSA-approved vitamins you can buy directly using your plan.

Once you know a vitamin purchase qualifies for you, the next step is choosing how to pay for it. You typically have two options: paying with your HSA or FSA card directly at checkout (when available), or paying out of pocket and requesting reimbursement later. Both methods work under IRS rules, but paying directly cuts out a lot of time and effort.

1. Pay with your HSA or FSA directly at checkout

Paying directly with your HSA or FSA card is the simplest way to buy FSA/HSA eligible vitamins. When the merchant supports HSA/FSA card payments, your purchase is confirmed instantly and you avoid reimbursement paperwork.

This option works best when the vitamin is clearly eligible or paired with required documentation at checkout. You get immediate confirmation that your purchase qualifies.

You can make this process easier by shopping through the Flex Marketplace, which brings together hundreds of online stores selling HSA/FSA-eligible products. Instead of guessing which vitamins qualify, you can browse options that already qualify, and checkout with your HSA/FSA card right away.

See it firsthand in one of our favorite shops for vitamins and supplements, Amy Myers MD:

Key advantages of paying directly include:

No out-of-pocket spending

No reimbursement forms to submit

Faster access to your vitamins

For many people, this approach removes the biggest barriers to using HSA and FSA funds.

2. Make a reimbursement claim

Reimbursement works when a store does not accept HSA or FSA cards or when you pay with a regular credit card. You buy the vitamin first, then submit a claim to your plan administrator.

To get approved, you typically need:

An itemized receipt

Proof the vitamin treats a diagnosed condition

A Letter of Medical Necessity, when required

This option adds extra steps and processing time, which can delay access to your funds. It also increases the risk of denial if you haven’t obtained your Letter of Medical Necessity before you make the purchase.

When possible, many people prefer to avoid reimbursement by shopping for eligible products through the Flex Marketplace, where direct payment helps keep things simple and compliant.

Let’s look at some examples of HSA/FSA-approved vitamins you can buy directly using your plan.

Once you know a vitamin purchase qualifies for you, the next step is choosing how to pay for it. You typically have two options: paying with your HSA or FSA card directly at checkout (when available), or paying out of pocket and requesting reimbursement later. Both methods work under IRS rules, but paying directly cuts out a lot of time and effort.

1. Pay with your HSA or FSA directly at checkout

Paying directly with your HSA or FSA card is the simplest way to buy FSA/HSA eligible vitamins. When the merchant supports HSA/FSA card payments, your purchase is confirmed instantly and you avoid reimbursement paperwork.

This option works best when the vitamin is clearly eligible or paired with required documentation at checkout. You get immediate confirmation that your purchase qualifies.

You can make this process easier by shopping through the Flex Marketplace, which brings together hundreds of online stores selling HSA/FSA-eligible products. Instead of guessing which vitamins qualify, you can browse options that already qualify, and checkout with your HSA/FSA card right away.

See it firsthand in one of our favorite shops for vitamins and supplements, Amy Myers MD:

Key advantages of paying directly include:

No out-of-pocket spending

No reimbursement forms to submit

Faster access to your vitamins

For many people, this approach removes the biggest barriers to using HSA and FSA funds.

2. Make a reimbursement claim

Reimbursement works when a store does not accept HSA or FSA cards or when you pay with a regular credit card. You buy the vitamin first, then submit a claim to your plan administrator.

To get approved, you typically need:

An itemized receipt

Proof the vitamin treats a diagnosed condition

A Letter of Medical Necessity, when required

This option adds extra steps and processing time, which can delay access to your funds. It also increases the risk of denial if you haven’t obtained your Letter of Medical Necessity before you make the purchase.

When possible, many people prefer to avoid reimbursement by shopping for eligible products through the Flex Marketplace, where direct payment helps keep things simple and compliant.

Let’s look at some examples of HSA/FSA-approved vitamins you can buy directly using your plan.

Top 5 online stores that sell HSA & FSA-approved vitamins

Buying eligible vitamins feels easier when you start with brands that already understand HSA and FSA rules. These companies have already made sure their products are eligible, and offer you the option to pay for your items at checkout using your funds directly.

Product | Description |

| Advanced Nutrition by Zahler offers a wide range of targeted supplements designed to address specific needs such as deficiencies, prenatal support, and condition-focused nutrition. Their products are often used under provider guidance, which makes it easier to justify a medical purpose when using HSA or FSA funds. Clear labeling and single-ingredient options also help with documentation and eligibility review. |

| Biogena One specializes in practitioner-grade supplements formulated for precise therapeutic use. Many of their vitamins focus on bioavailability and condition-specific dosing, which aligns well with treatment-based eligibility. These products often fit naturally into care plans where supplementation supports a diagnosed condition rather than general health. |

| Amy Myers MD supplements are designed around functional medicine principles and condition-driven protocols. These vitamins are frequently paired with diagnostic testing or provider recommendations, which strengthens the connection to medical care. That focus can make eligibility easier to support when documentation is required for HSA or FSA use. |

| DotFit products are commonly used in clinical, fitness, and wellness practices where supplementation supports treatment or recovery goals. Their formulations often address specific deficiencies or health needs rather than daily nutrition. This practitioner-oriented approach helps position vitamins as part of a treatment plan when using benefits funds. |

| Vibrant Health focuses on condition-specific powders, capsules, and blends used alongside diagnostic insights. Many of their products support targeted nutritional needs tied to absorption, digestion, or chronic conditions. That emphasis can help distinguish medical use from general supplementation during eligibility review. |

Eligibility still depends on medical purpose and documentation, but these brands make it easier to connect vitamins to treatment rather than prevention.

Why brand selection matters for vitamin HSA/FSA eligibility

Two vitamins with similar ingredients can receive very different treatment under HSA and FSA rules. When shopping, eligibility rules, documentation requirements, and reimbursement paperwork can quickly turn a simple vitamin purchase into a hassle. It’s best to rely on brands that emphasize clinical use, provider guidance, and condition-focused formulations make it easier to demonstrate medical purpose.

When shopping, look for brands that advertise their HSA/FSA eligibility, like the ones you can find in the Flex Marketplace. We bring together hundreds of trusted brands and stores that sell HSA/FSA-eligible products, including vitamins tied to medical use. You can browse confidently, pay directly with your benefits card, and skip the reimbursement process altogether.

Buying eligible vitamins feels easier when you start with brands that already understand HSA and FSA rules. These companies have already made sure their products are eligible, and offer you the option to pay for your items at checkout using your funds directly.

Product | Description |

| Advanced Nutrition by Zahler offers a wide range of targeted supplements designed to address specific needs such as deficiencies, prenatal support, and condition-focused nutrition. Their products are often used under provider guidance, which makes it easier to justify a medical purpose when using HSA or FSA funds. Clear labeling and single-ingredient options also help with documentation and eligibility review. |

| Biogena One specializes in practitioner-grade supplements formulated for precise therapeutic use. Many of their vitamins focus on bioavailability and condition-specific dosing, which aligns well with treatment-based eligibility. These products often fit naturally into care plans where supplementation supports a diagnosed condition rather than general health. |

| Amy Myers MD supplements are designed around functional medicine principles and condition-driven protocols. These vitamins are frequently paired with diagnostic testing or provider recommendations, which strengthens the connection to medical care. That focus can make eligibility easier to support when documentation is required for HSA or FSA use. |

| DotFit products are commonly used in clinical, fitness, and wellness practices where supplementation supports treatment or recovery goals. Their formulations often address specific deficiencies or health needs rather than daily nutrition. This practitioner-oriented approach helps position vitamins as part of a treatment plan when using benefits funds. |

| Vibrant Health focuses on condition-specific powders, capsules, and blends used alongside diagnostic insights. Many of their products support targeted nutritional needs tied to absorption, digestion, or chronic conditions. That emphasis can help distinguish medical use from general supplementation during eligibility review. |

Eligibility still depends on medical purpose and documentation, but these brands make it easier to connect vitamins to treatment rather than prevention.

Why brand selection matters for vitamin HSA/FSA eligibility

Two vitamins with similar ingredients can receive very different treatment under HSA and FSA rules. When shopping, eligibility rules, documentation requirements, and reimbursement paperwork can quickly turn a simple vitamin purchase into a hassle. It’s best to rely on brands that emphasize clinical use, provider guidance, and condition-focused formulations make it easier to demonstrate medical purpose.

When shopping, look for brands that advertise their HSA/FSA eligibility, like the ones you can find in the Flex Marketplace. We bring together hundreds of trusted brands and stores that sell HSA/FSA-eligible products, including vitamins tied to medical use. You can browse confidently, pay directly with your benefits card, and skip the reimbursement process altogether.

Buying eligible vitamins feels easier when you start with brands that already understand HSA and FSA rules. These companies have already made sure their products are eligible, and offer you the option to pay for your items at checkout using your funds directly.

Product | Description |

| Advanced Nutrition by Zahler offers a wide range of targeted supplements designed to address specific needs such as deficiencies, prenatal support, and condition-focused nutrition. Their products are often used under provider guidance, which makes it easier to justify a medical purpose when using HSA or FSA funds. Clear labeling and single-ingredient options also help with documentation and eligibility review. |

| Biogena One specializes in practitioner-grade supplements formulated for precise therapeutic use. Many of their vitamins focus on bioavailability and condition-specific dosing, which aligns well with treatment-based eligibility. These products often fit naturally into care plans where supplementation supports a diagnosed condition rather than general health. |

| Amy Myers MD supplements are designed around functional medicine principles and condition-driven protocols. These vitamins are frequently paired with diagnostic testing or provider recommendations, which strengthens the connection to medical care. That focus can make eligibility easier to support when documentation is required for HSA or FSA use. |

| DotFit products are commonly used in clinical, fitness, and wellness practices where supplementation supports treatment or recovery goals. Their formulations often address specific deficiencies or health needs rather than daily nutrition. This practitioner-oriented approach helps position vitamins as part of a treatment plan when using benefits funds. |

| Vibrant Health focuses on condition-specific powders, capsules, and blends used alongside diagnostic insights. Many of their products support targeted nutritional needs tied to absorption, digestion, or chronic conditions. That emphasis can help distinguish medical use from general supplementation during eligibility review. |

Eligibility still depends on medical purpose and documentation, but these brands make it easier to connect vitamins to treatment rather than prevention.

Why brand selection matters for vitamin HSA/FSA eligibility

Two vitamins with similar ingredients can receive very different treatment under HSA and FSA rules. When shopping, eligibility rules, documentation requirements, and reimbursement paperwork can quickly turn a simple vitamin purchase into a hassle. It’s best to rely on brands that emphasize clinical use, provider guidance, and condition-focused formulations make it easier to demonstrate medical purpose.

When shopping, look for brands that advertise their HSA/FSA eligibility, like the ones you can find in the Flex Marketplace. We bring together hundreds of trusted brands and stores that sell HSA/FSA-eligible products, including vitamins tied to medical use. You can browse confidently, pay directly with your benefits card, and skip the reimbursement process altogether.

Related content from Flex

More content from Flex

HSA/FSA ELIGIBLE SHOPPING

Shop the Flex HSA/FSA Marketplace

Discover HSA/FSA-eligible brands and products

Use your pre-tax HSA/FSA dollars at checkout

Improve your health and wellness with products you’ll love

Shop Now

Shop Now

Shop Now