Do HSA Funds Expire? (HSA Rollover Rules Explained)

Yulia Derdemezis

Head of Marketing at Flex

Updated: December 18, 2025

🚀 Fast Facts: Does your HSA have a “use or lose” rule

An HSA does not have a “use it or lose it” rule

Instead, funds carry over from year to year, and you can use them at any time you like

You’ll need the right documentation to claim previous medical expenses

An HSA does not have a “use it or lose it” rule

Instead, funds carry over from year to year, and you can use them at any time you like

You’ll need the right documentation to claim previous medical expenses

An HSA does not have a “use it or lose it” rule

Instead, funds carry over from year to year, and you can use them at any time you like

You’ll need the right documentation to claim previous medical expenses

An HSA does not have a “use it or lose it” rule

Instead, funds carry over from year to year, and you can use them at any time you like

You’ll need the right documentation to claim previous medical expenses

If you’ve ever checked your Health Savings Account (HSA) balance and wondered whether you need to rush to spend it, you’re not alone. Many people confuse HSAs with other benefit accounts and worry about losing their hard-earned funds. This guide clears up exactly how HSA funds work, whether they expire, and how you can confidently plan your spending.

Understanding how HSAs work gives you peace of mind and more control over your healthcare budget. Let’s start with the question that matters most and break down whether HSA funds ever expire.

If you’ve ever checked your Health Savings Account (HSA) balance and wondered whether you need to rush to spend it, you’re not alone. Many people confuse HSAs with other benefit accounts and worry about losing their hard-earned funds. This guide clears up exactly how HSA funds work, whether they expire, and how you can confidently plan your spending.

Understanding how HSAs work gives you peace of mind and more control over your healthcare budget. Let’s start with the question that matters most and break down whether HSA funds ever expire.

If you’ve ever checked your Health Savings Account (HSA) balance and wondered whether you need to rush to spend it, you’re not alone. Many people confuse HSAs with other benefit accounts and worry about losing their hard-earned funds. This guide clears up exactly how HSA funds work, whether they expire, and how you can confidently plan your spending.

Understanding how HSAs work gives you peace of mind and more control over your healthcare budget. Let’s start with the question that matters most and break down whether HSA funds ever expire.

Do HSA funds expire?

If you’re worried about losing your HSA balance, you can take a deep breath. Health Savings Accounts (HSAs) follow very different rules than many other workplace benefits, and the lack of expiration works in your favor. HSA funds do not expire at the end of the year. Your balance stays with you and continues to roll over year after year, as long as the money remains in your account.

This rollover feature makes HSAs one of the most flexible healthcare spending tools available. Before comparing HSAs to other accounts, it helps to address the most common misconception head-on.

Does an HSA have a ‘use it or lose it’ rule?

No, HSAs do not follow a “use it or lose it” rule like Flexible Savings Accounts (FSAs) do. Any money you contribute stays in your account until you choose to spend it, even years later. This is one of the biggest differences between HSAs and FSAs, since unused HSA funds never expire when the year ends.

Here’s what that means for you in practical terms:

Your HSA balance rolls over automatically every year

You can keep saving even if you don’t have many medical expenses right now

You decide when and how to use your funds, based on eligible healthcare needs

According to IRS guidance, HSA funds remain yours and can be used for qualified medical expenses at any time in the future. Because your money sticks around (earning your tax free interest as well), HSAs reward long-term planning instead of rushed spending. That flexibility becomes even more powerful once you understand how HSA fund expiration works in real life, which we’ll cover next.

If you’re worried about losing your HSA balance, you can take a deep breath. Health Savings Accounts (HSAs) follow very different rules than many other workplace benefits, and the lack of expiration works in your favor. HSA funds do not expire at the end of the year. Your balance stays with you and continues to roll over year after year, as long as the money remains in your account.

This rollover feature makes HSAs one of the most flexible healthcare spending tools available. Before comparing HSAs to other accounts, it helps to address the most common misconception head-on.

Does an HSA have a ‘use it or lose it’ rule?

No, HSAs do not follow a “use it or lose it” rule like Flexible Savings Accounts (FSAs) do. Any money you contribute stays in your account until you choose to spend it, even years later. This is one of the biggest differences between HSAs and FSAs, since unused HSA funds never expire when the year ends.

Here’s what that means for you in practical terms:

Your HSA balance rolls over automatically every year

You can keep saving even if you don’t have many medical expenses right now

You decide when and how to use your funds, based on eligible healthcare needs

According to IRS guidance, HSA funds remain yours and can be used for qualified medical expenses at any time in the future. Because your money sticks around (earning your tax free interest as well), HSAs reward long-term planning instead of rushed spending. That flexibility becomes even more powerful once you understand how HSA fund expiration works in real life, which we’ll cover next.

If you’re worried about losing your HSA balance, you can take a deep breath. Health Savings Accounts (HSAs) follow very different rules than many other workplace benefits, and the lack of expiration works in your favor. HSA funds do not expire at the end of the year. Your balance stays with you and continues to roll over year after year, as long as the money remains in your account.

This rollover feature makes HSAs one of the most flexible healthcare spending tools available. Before comparing HSAs to other accounts, it helps to address the most common misconception head-on.

Does an HSA have a ‘use it or lose it’ rule?

No, HSAs do not follow a “use it or lose it” rule like Flexible Savings Accounts (FSAs) do. Any money you contribute stays in your account until you choose to spend it, even years later. This is one of the biggest differences between HSAs and FSAs, since unused HSA funds never expire when the year ends.

Here’s what that means for you in practical terms:

Your HSA balance rolls over automatically every year

You can keep saving even if you don’t have many medical expenses right now

You decide when and how to use your funds, based on eligible healthcare needs

According to IRS guidance, HSA funds remain yours and can be used for qualified medical expenses at any time in the future. Because your money sticks around (earning your tax free interest as well), HSAs reward long-term planning instead of rushed spending. That flexibility becomes even more powerful once you understand how HSA fund expiration works in real life, which we’ll cover next.

How HSA fund expiration works

Now that you know HSA funds do not expire, it helps to understand what actually happens to your money over time. This section explains how year-end rules work, what changes when the calendar resets, and how you can keep tabs on your balance.

Once you understand these mechanics, it becomes much easier to plan your spending without pressure or guesswork.

Do you lose HSA funds at the end of the year?

You do not lose HSA funds at the end of the year. Any unused balance automatically carries over into the next year with no action required on your part. Your HSA works more like a personal, tax-advantaged savings account than a temporary benefit. The money stays available whether you use it next month or decades later, as long as you spend it on qualified medical expenses.

At the end of the year, your remaining balance rolls over in full, your account stays active under your name, and your funds remain available even if you change jobs or health plans.

Why track HSAs by the year at all?

HSAs still follow a calendar year mainly to track contributions, not spending. The IRS sets annual contribution limits, and the calendar year helps determine how much you’re allowed to add to your Health Savings Account (HSA) during that period. Your spending timeline stays flexible, but contributions must stay within yearly limits for tax purposes.

How to check your HSA balance

Checking your HSA balance is usually quick and straightforward. Most HSA administrators give you multiple ways to view your available funds.

Common options include:

Logging into your HSA provider’s online portal

Using your provider’s mobile app

Reviewing monthly or quarterly account statements

Calling customer support for your HSA administrator

It’s a good habit to check your balance a few times a year, especially before making a larger eligible purchase. Knowing your available funds helps you avoid declined transactions and plan your spending more confidently.

Understanding how HSA funds carry over and how to track your balance removes the fear of losing money. With that clarity in place, the next step is learning how to use your HSA dollars intentionally and effectively throughout the year.

Now that you know HSA funds do not expire, it helps to understand what actually happens to your money over time. This section explains how year-end rules work, what changes when the calendar resets, and how you can keep tabs on your balance.

Once you understand these mechanics, it becomes much easier to plan your spending without pressure or guesswork.

Do you lose HSA funds at the end of the year?

You do not lose HSA funds at the end of the year. Any unused balance automatically carries over into the next year with no action required on your part. Your HSA works more like a personal, tax-advantaged savings account than a temporary benefit. The money stays available whether you use it next month or decades later, as long as you spend it on qualified medical expenses.

At the end of the year, your remaining balance rolls over in full, your account stays active under your name, and your funds remain available even if you change jobs or health plans.

Why track HSAs by the year at all?

HSAs still follow a calendar year mainly to track contributions, not spending. The IRS sets annual contribution limits, and the calendar year helps determine how much you’re allowed to add to your Health Savings Account (HSA) during that period. Your spending timeline stays flexible, but contributions must stay within yearly limits for tax purposes.

How to check your HSA balance

Checking your HSA balance is usually quick and straightforward. Most HSA administrators give you multiple ways to view your available funds.

Common options include:

Logging into your HSA provider’s online portal

Using your provider’s mobile app

Reviewing monthly or quarterly account statements

Calling customer support for your HSA administrator

It’s a good habit to check your balance a few times a year, especially before making a larger eligible purchase. Knowing your available funds helps you avoid declined transactions and plan your spending more confidently.

Understanding how HSA funds carry over and how to track your balance removes the fear of losing money. With that clarity in place, the next step is learning how to use your HSA dollars intentionally and effectively throughout the year.

Now that you know HSA funds do not expire, it helps to understand what actually happens to your money over time. This section explains how year-end rules work, what changes when the calendar resets, and how you can keep tabs on your balance.

Once you understand these mechanics, it becomes much easier to plan your spending without pressure or guesswork.

Do you lose HSA funds at the end of the year?

You do not lose HSA funds at the end of the year. Any unused balance automatically carries over into the next year with no action required on your part. Your HSA works more like a personal, tax-advantaged savings account than a temporary benefit. The money stays available whether you use it next month or decades later, as long as you spend it on qualified medical expenses.

At the end of the year, your remaining balance rolls over in full, your account stays active under your name, and your funds remain available even if you change jobs or health plans.

Why track HSAs by the year at all?

HSAs still follow a calendar year mainly to track contributions, not spending. The IRS sets annual contribution limits, and the calendar year helps determine how much you’re allowed to add to your Health Savings Account (HSA) during that period. Your spending timeline stays flexible, but contributions must stay within yearly limits for tax purposes.

How to check your HSA balance

Checking your HSA balance is usually quick and straightforward. Most HSA administrators give you multiple ways to view your available funds.

Common options include:

Logging into your HSA provider’s online portal

Using your provider’s mobile app

Reviewing monthly or quarterly account statements

Calling customer support for your HSA administrator

It’s a good habit to check your balance a few times a year, especially before making a larger eligible purchase. Knowing your available funds helps you avoid declined transactions and plan your spending more confidently.

Understanding how HSA funds carry over and how to track your balance removes the fear of losing money. With that clarity in place, the next step is learning how to use your HSA dollars intentionally and effectively throughout the year.

Ways to effectively spend your HSA funds

Because HSA funds do not expire, you have the flexibility to spend them thoughtfully instead of rushing purchases. A clear plan helps you use your HSA dollars on expenses you already have, while also preparing for future healthcare needs. The goal is to treat your HSA as an everyday tool, not a last-minute account you only think about once a year.

1. Start by covering predictable medical expenses

Many people overlook how many routine costs qualify for HSA spending. Using your HSA for expenses you already pay out of pocket helps stretch your budget. Common examples include:

Doctor and specialist visits

Prescription medications

Dental and vision care

Copays, coinsurance, and deductibles

Paying for these expenses with HSA funds frees up cash in your regular checking account.

2. Use your HSA for eligible everyday products

HSAs cover far more than office visits and prescriptions. Many everyday health products qualify, which makes it easier to use your funds consistently. Examples include:

First aid supplies

Pain relief and allergy products

Vision and hearing care items

At-home health and wellness products

Shopping through the Flex Marketplace makes this easier by letting you browse HSA-eligible products across hundreds of trusted online stores. Instead of guessing what qualifies, you can shop confidently using your HSA funds.

3. Plan ahead for larger or future expenses

You can also use your HSA strategically for bigger healthcare costs that may come later. Since your balance carries over, saving now can reduce financial stress down the road. This approach works well for:

Planned dental or orthodontic work

Vision correction procedures

Ongoing therapy or treatment costs

Future medical expenses in retirement

Some HSA providers even allow you to invest a portion of your balance tax-free, which can help long-term savings grow.

4. Keep receipts and stay organized

Even when you pay directly with your HSA card, keeping records is a smart habit. Clear documentation helps if your HSA administrator ever asks for proof of eligibility. Helpful tips include:

Saving digital receipts in a dedicated folder

Using your HSA provider’s expense tracking tools

Noting the date and purpose of each purchase

Staying organized protects your tax benefits and keeps everything stress-free. When you approach spending with intention, your HSA becomes a powerful financial resource instead of unused money sitting on the sidelines.

Next, it helps to look at specific product and service categories where your HSA funds can go the furthest.

Because HSA funds do not expire, you have the flexibility to spend them thoughtfully instead of rushing purchases. A clear plan helps you use your HSA dollars on expenses you already have, while also preparing for future healthcare needs. The goal is to treat your HSA as an everyday tool, not a last-minute account you only think about once a year.

1. Start by covering predictable medical expenses

Many people overlook how many routine costs qualify for HSA spending. Using your HSA for expenses you already pay out of pocket helps stretch your budget. Common examples include:

Doctor and specialist visits

Prescription medications

Dental and vision care

Copays, coinsurance, and deductibles

Paying for these expenses with HSA funds frees up cash in your regular checking account.

2. Use your HSA for eligible everyday products

HSAs cover far more than office visits and prescriptions. Many everyday health products qualify, which makes it easier to use your funds consistently. Examples include:

First aid supplies

Pain relief and allergy products

Vision and hearing care items

At-home health and wellness products

Shopping through the Flex Marketplace makes this easier by letting you browse HSA-eligible products across hundreds of trusted online stores. Instead of guessing what qualifies, you can shop confidently using your HSA funds.

3. Plan ahead for larger or future expenses

You can also use your HSA strategically for bigger healthcare costs that may come later. Since your balance carries over, saving now can reduce financial stress down the road. This approach works well for:

Planned dental or orthodontic work

Vision correction procedures

Ongoing therapy or treatment costs

Future medical expenses in retirement

Some HSA providers even allow you to invest a portion of your balance tax-free, which can help long-term savings grow.

4. Keep receipts and stay organized

Even when you pay directly with your HSA card, keeping records is a smart habit. Clear documentation helps if your HSA administrator ever asks for proof of eligibility. Helpful tips include:

Saving digital receipts in a dedicated folder

Using your HSA provider’s expense tracking tools

Noting the date and purpose of each purchase

Staying organized protects your tax benefits and keeps everything stress-free. When you approach spending with intention, your HSA becomes a powerful financial resource instead of unused money sitting on the sidelines.

Next, it helps to look at specific product and service categories where your HSA funds can go the furthest.

Because HSA funds do not expire, you have the flexibility to spend them thoughtfully instead of rushing purchases. A clear plan helps you use your HSA dollars on expenses you already have, while also preparing for future healthcare needs. The goal is to treat your HSA as an everyday tool, not a last-minute account you only think about once a year.

1. Start by covering predictable medical expenses

Many people overlook how many routine costs qualify for HSA spending. Using your HSA for expenses you already pay out of pocket helps stretch your budget. Common examples include:

Doctor and specialist visits

Prescription medications

Dental and vision care

Copays, coinsurance, and deductibles

Paying for these expenses with HSA funds frees up cash in your regular checking account.

2. Use your HSA for eligible everyday products

HSAs cover far more than office visits and prescriptions. Many everyday health products qualify, which makes it easier to use your funds consistently. Examples include:

First aid supplies

Pain relief and allergy products

Vision and hearing care items

At-home health and wellness products

Shopping through the Flex Marketplace makes this easier by letting you browse HSA-eligible products across hundreds of trusted online stores. Instead of guessing what qualifies, you can shop confidently using your HSA funds.

3. Plan ahead for larger or future expenses

You can also use your HSA strategically for bigger healthcare costs that may come later. Since your balance carries over, saving now can reduce financial stress down the road. This approach works well for:

Planned dental or orthodontic work

Vision correction procedures

Ongoing therapy or treatment costs

Future medical expenses in retirement

Some HSA providers even allow you to invest a portion of your balance tax-free, which can help long-term savings grow.

4. Keep receipts and stay organized

Even when you pay directly with your HSA card, keeping records is a smart habit. Clear documentation helps if your HSA administrator ever asks for proof of eligibility. Helpful tips include:

Saving digital receipts in a dedicated folder

Using your HSA provider’s expense tracking tools

Noting the date and purpose of each purchase

Staying organized protects your tax benefits and keeps everything stress-free. When you approach spending with intention, your HSA becomes a powerful financial resource instead of unused money sitting on the sidelines.

Next, it helps to look at specific product and service categories where your HSA funds can go the furthest.

25 popular products and services to use your HSA on

HSA funds can cover a wide range of products and services that support your physical and everyday health. Knowing which brands qualify makes it easier to spend confidently instead of letting your balance sit unused.

The Flex Marketplace brings these options together in one place, so you can browse HSA-eligible brands, understand what they offer, and pay online with your HSA card instantly.

Fitness and exercise products, services, and apps

Fitness-focused HSA-eligible brands often support strength, mobility, rehabilitation, or guided movement. These options help you invest in physical health using pre-tax dollars.

Product | Description |

|---|---|

| YourReformer specializes in high-quality Pilates reformers and accessories designed for home use. Their products focus on low-impact strength, flexibility, and core stability, making them a strong option for injury prevention and controlled movement training. |

| Tempo offers smart home gym systems that combine strength equipment with guided, on-screen coaching. Their programs emphasize proper form, progressive training, and structured workouts that adapt to your fitness level over time. |

| Mike’s Bikes provides bicycles, cycling gear, and accessories that support cardiovascular fitness and active lifestyles. Their offerings range from commuter bikes to performance-focused models and essential riding equipment. |

| iFit delivers app-based fitness memberships that include guided workouts, training plans, and global classes. The platform integrates with connected equipment and supports cardio, strength, and recovery-focused routines. |

| Powerblock is known for adjustable dumbbells and space-saving strength equipment. Their products allow you to scale resistance gradually, making home strength training more accessible and efficient. |

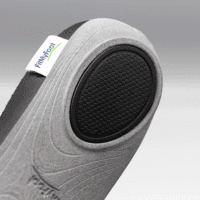

Home wellness products, clothing, and footwear

Home wellness and supportive gear often focuses on posture, recovery, comfort, or injury prevention. These products fit naturally into daily routines.

Product | Description |

|---|---|

| Forme designs posture-supporting activewear that encourages proper alignment throughout the day. Their clothing integrates subtle resistance to help reduce strain during movement and everyday wear. |

| FitMyFoot offers custom orthotics and supportive insoles tailored to individual foot needs. Their products aim to improve comfort, balance, and alignment for walking, standing, and physical activity. |

| Ikigai Cases offers thoughtfully designed medicine and pill cases that help you organize daily prescriptions and supplements. Their cases focus on portability, durability, and discreet design, making it easier to manage medications at home or on the go. |

| Therabody is widely known for percussion massage devices and recovery tools. Their products support muscle relief, circulation, and faster recovery after physical activity. |

| Ribcap creates discreet protective headwear designed to help reduce injury risk. Their products combine comfort and safety for daily activities and light physical movement. |

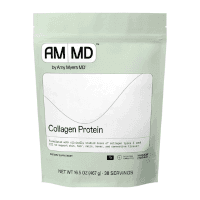

Supplements, nutrition, and general health products

Some nutrition and health-focused products qualify for HSA spending when they support specific health needs. These brands focus on targeted wellness support.

Product | Description |

|---|---|

| Biome Secret offers gut health supplements designed to support digestion and microbiome balance. Their formulations focus on restoring digestive function and overall wellness. |

| The Pause Life provides supplements and wellness products created to support women during menopause. Their offerings address symptoms related to hormonal changes and overall health during this stage of life. |

| Wellspring Meds operates as a licensed pharmacy offering prescription and over-the-counter health products. Their services focus on accessibility, transparency, and medically appropriate care. |

| Amy Myers MD offers physician-formulated supplements focused on gut health, immune support, and thyroid function. The brand emphasizes research-backed ingredients and targeted health solutions. |

| Biolyte produces medical-grade hydration drinks designed to support electrolyte balance. These products are often used for recovery, illness, or dehydration support. |

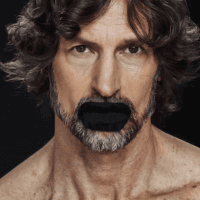

Sleep wellness products

Sleep-focused products often qualify for HSA use because they support rest, recovery, and overall health. These brands address comfort and sleep quality.

Product | Description |

|---|---|

| BedJet offers climate-controlled bedding systems that regulate temperature throughout the night. Their products help address overheating, night sweats, and sleep discomfort. |

| Hostage Tape creates mouth tape products designed to encourage nasal breathing during sleep. These products aim to support better airflow and sleep consistency. |

| Ozlo Sleep designs smart sleep earbuds that block noise and play soothing audio. Their products help create a quieter sleep environment without traditional earplug discomfort. |

| Chilipad® by Sleepme offers temperature-controlled sleep systems that regulate mattress and bedding temperature. These systems help maintain an ideal sleep environment all night long. |

| UBlockout specializes in blackout window shades designed to block out light and create a darker sleep environment. Their adjustable, easy-to-install shades help support deeper, more consistent sleep by reducing light exposure in bedrooms and nurseries.. |

Skincare products

Some skincare products qualify for HSA use when they address medical or skin health concerns rather than cosmetic goals. These brands offer health-focused options.

Product | Description |

|---|---|

| Lure Essentials offers skincare tools and products designed to support facial care and skin maintenance. Their focus is on functional skincare routines that promote healthy skin. |

| PMD Beauty provides personal skincare devices focused on cleansing, exfoliation, and skin upkeep. Their tools support consistent at-home skin care treatments. |

| Popmask is known for self-heating eye masks designed to relieve eye strain and dryness. These products support eye comfort, especially for screen-heavy days. |

| Freaks of Nature creates performance-focused skincare products designed to protect and restore skin. Their formulations emphasize durability and skin barrier support. |

| Clé de Peau Beauté offers dermatologist-inspired skincare products that focus on skin health and treatment. Their line includes targeted products designed to support long-term skin care needs. |

HSA funds can cover a wide range of products and services that support your physical and everyday health. Knowing which brands qualify makes it easier to spend confidently instead of letting your balance sit unused.

The Flex Marketplace brings these options together in one place, so you can browse HSA-eligible brands, understand what they offer, and pay online with your HSA card instantly.

Fitness and exercise products, services, and apps

Fitness-focused HSA-eligible brands often support strength, mobility, rehabilitation, or guided movement. These options help you invest in physical health using pre-tax dollars.

Product | Description |

|---|---|

| YourReformer specializes in high-quality Pilates reformers and accessories designed for home use. Their products focus on low-impact strength, flexibility, and core stability, making them a strong option for injury prevention and controlled movement training. |

| Tempo offers smart home gym systems that combine strength equipment with guided, on-screen coaching. Their programs emphasize proper form, progressive training, and structured workouts that adapt to your fitness level over time. |

| Mike’s Bikes provides bicycles, cycling gear, and accessories that support cardiovascular fitness and active lifestyles. Their offerings range from commuter bikes to performance-focused models and essential riding equipment. |

| iFit delivers app-based fitness memberships that include guided workouts, training plans, and global classes. The platform integrates with connected equipment and supports cardio, strength, and recovery-focused routines. |

| Powerblock is known for adjustable dumbbells and space-saving strength equipment. Their products allow you to scale resistance gradually, making home strength training more accessible and efficient. |

Home wellness products, clothing, and footwear

Home wellness and supportive gear often focuses on posture, recovery, comfort, or injury prevention. These products fit naturally into daily routines.

Product | Description |

|---|---|

| Forme designs posture-supporting activewear that encourages proper alignment throughout the day. Their clothing integrates subtle resistance to help reduce strain during movement and everyday wear. |

| FitMyFoot offers custom orthotics and supportive insoles tailored to individual foot needs. Their products aim to improve comfort, balance, and alignment for walking, standing, and physical activity. |

| Ikigai Cases offers thoughtfully designed medicine and pill cases that help you organize daily prescriptions and supplements. Their cases focus on portability, durability, and discreet design, making it easier to manage medications at home or on the go. |

| Therabody is widely known for percussion massage devices and recovery tools. Their products support muscle relief, circulation, and faster recovery after physical activity. |

| Ribcap creates discreet protective headwear designed to help reduce injury risk. Their products combine comfort and safety for daily activities and light physical movement. |

Supplements, nutrition, and general health products

Some nutrition and health-focused products qualify for HSA spending when they support specific health needs. These brands focus on targeted wellness support.

Product | Description |

|---|---|

| Biome Secret offers gut health supplements designed to support digestion and microbiome balance. Their formulations focus on restoring digestive function and overall wellness. |

| The Pause Life provides supplements and wellness products created to support women during menopause. Their offerings address symptoms related to hormonal changes and overall health during this stage of life. |

| Wellspring Meds operates as a licensed pharmacy offering prescription and over-the-counter health products. Their services focus on accessibility, transparency, and medically appropriate care. |

| Amy Myers MD offers physician-formulated supplements focused on gut health, immune support, and thyroid function. The brand emphasizes research-backed ingredients and targeted health solutions. |

| Biolyte produces medical-grade hydration drinks designed to support electrolyte balance. These products are often used for recovery, illness, or dehydration support. |

Sleep wellness products

Sleep-focused products often qualify for HSA use because they support rest, recovery, and overall health. These brands address comfort and sleep quality.

Product | Description |

|---|---|

| BedJet offers climate-controlled bedding systems that regulate temperature throughout the night. Their products help address overheating, night sweats, and sleep discomfort. |

| Hostage Tape creates mouth tape products designed to encourage nasal breathing during sleep. These products aim to support better airflow and sleep consistency. |

| Ozlo Sleep designs smart sleep earbuds that block noise and play soothing audio. Their products help create a quieter sleep environment without traditional earplug discomfort. |

| Chilipad® by Sleepme offers temperature-controlled sleep systems that regulate mattress and bedding temperature. These systems help maintain an ideal sleep environment all night long. |

| UBlockout specializes in blackout window shades designed to block out light and create a darker sleep environment. Their adjustable, easy-to-install shades help support deeper, more consistent sleep by reducing light exposure in bedrooms and nurseries.. |

Skincare products

Some skincare products qualify for HSA use when they address medical or skin health concerns rather than cosmetic goals. These brands offer health-focused options.

Product | Description |

|---|---|

| Lure Essentials offers skincare tools and products designed to support facial care and skin maintenance. Their focus is on functional skincare routines that promote healthy skin. |

| PMD Beauty provides personal skincare devices focused on cleansing, exfoliation, and skin upkeep. Their tools support consistent at-home skin care treatments. |

| Popmask is known for self-heating eye masks designed to relieve eye strain and dryness. These products support eye comfort, especially for screen-heavy days. |

| Freaks of Nature creates performance-focused skincare products designed to protect and restore skin. Their formulations emphasize durability and skin barrier support. |

| Clé de Peau Beauté offers dermatologist-inspired skincare products that focus on skin health and treatment. Their line includes targeted products designed to support long-term skin care needs. |

HSA funds can cover a wide range of products and services that support your physical and everyday health. Knowing which brands qualify makes it easier to spend confidently instead of letting your balance sit unused.

The Flex Marketplace brings these options together in one place, so you can browse HSA-eligible brands, understand what they offer, and pay online with your HSA card instantly.

Fitness and exercise products, services, and apps

Fitness-focused HSA-eligible brands often support strength, mobility, rehabilitation, or guided movement. These options help you invest in physical health using pre-tax dollars.

Product | Description |

|---|---|

| YourReformer specializes in high-quality Pilates reformers and accessories designed for home use. Their products focus on low-impact strength, flexibility, and core stability, making them a strong option for injury prevention and controlled movement training. |

| Tempo offers smart home gym systems that combine strength equipment with guided, on-screen coaching. Their programs emphasize proper form, progressive training, and structured workouts that adapt to your fitness level over time. |

| Mike’s Bikes provides bicycles, cycling gear, and accessories that support cardiovascular fitness and active lifestyles. Their offerings range from commuter bikes to performance-focused models and essential riding equipment. |

| iFit delivers app-based fitness memberships that include guided workouts, training plans, and global classes. The platform integrates with connected equipment and supports cardio, strength, and recovery-focused routines. |

| Powerblock is known for adjustable dumbbells and space-saving strength equipment. Their products allow you to scale resistance gradually, making home strength training more accessible and efficient. |

Home wellness products, clothing, and footwear

Home wellness and supportive gear often focuses on posture, recovery, comfort, or injury prevention. These products fit naturally into daily routines.

Product | Description |

|---|---|

| Forme designs posture-supporting activewear that encourages proper alignment throughout the day. Their clothing integrates subtle resistance to help reduce strain during movement and everyday wear. |

| FitMyFoot offers custom orthotics and supportive insoles tailored to individual foot needs. Their products aim to improve comfort, balance, and alignment for walking, standing, and physical activity. |

| Ikigai Cases offers thoughtfully designed medicine and pill cases that help you organize daily prescriptions and supplements. Their cases focus on portability, durability, and discreet design, making it easier to manage medications at home or on the go. |

| Therabody is widely known for percussion massage devices and recovery tools. Their products support muscle relief, circulation, and faster recovery after physical activity. |

| Ribcap creates discreet protective headwear designed to help reduce injury risk. Their products combine comfort and safety for daily activities and light physical movement. |

Supplements, nutrition, and general health products

Some nutrition and health-focused products qualify for HSA spending when they support specific health needs. These brands focus on targeted wellness support.

Product | Description |

|---|---|

| Biome Secret offers gut health supplements designed to support digestion and microbiome balance. Their formulations focus on restoring digestive function and overall wellness. |

| The Pause Life provides supplements and wellness products created to support women during menopause. Their offerings address symptoms related to hormonal changes and overall health during this stage of life. |

| Wellspring Meds operates as a licensed pharmacy offering prescription and over-the-counter health products. Their services focus on accessibility, transparency, and medically appropriate care. |

| Amy Myers MD offers physician-formulated supplements focused on gut health, immune support, and thyroid function. The brand emphasizes research-backed ingredients and targeted health solutions. |

| Biolyte produces medical-grade hydration drinks designed to support electrolyte balance. These products are often used for recovery, illness, or dehydration support. |

Sleep wellness products

Sleep-focused products often qualify for HSA use because they support rest, recovery, and overall health. These brands address comfort and sleep quality.

Product | Description |

|---|---|

| BedJet offers climate-controlled bedding systems that regulate temperature throughout the night. Their products help address overheating, night sweats, and sleep discomfort. |

| Hostage Tape creates mouth tape products designed to encourage nasal breathing during sleep. These products aim to support better airflow and sleep consistency. |

| Ozlo Sleep designs smart sleep earbuds that block noise and play soothing audio. Their products help create a quieter sleep environment without traditional earplug discomfort. |

| Chilipad® by Sleepme offers temperature-controlled sleep systems that regulate mattress and bedding temperature. These systems help maintain an ideal sleep environment all night long. |

| UBlockout specializes in blackout window shades designed to block out light and create a darker sleep environment. Their adjustable, easy-to-install shades help support deeper, more consistent sleep by reducing light exposure in bedrooms and nurseries.. |

Skincare products

Some skincare products qualify for HSA use when they address medical or skin health concerns rather than cosmetic goals. These brands offer health-focused options.

Product | Description |

|---|---|

| Lure Essentials offers skincare tools and products designed to support facial care and skin maintenance. Their focus is on functional skincare routines that promote healthy skin. |

| PMD Beauty provides personal skincare devices focused on cleansing, exfoliation, and skin upkeep. Their tools support consistent at-home skin care treatments. |

| Popmask is known for self-heating eye masks designed to relieve eye strain and dryness. These products support eye comfort, especially for screen-heavy days. |

| Freaks of Nature creates performance-focused skincare products designed to protect and restore skin. Their formulations emphasize durability and skin barrier support. |

| Clé de Peau Beauté offers dermatologist-inspired skincare products that focus on skin health and treatment. Their line includes targeted products designed to support long-term skin care needs. |

In summary

HSA funds do not expire, and that flexibility gives you control over how and when you spend your healthcare dollars. Because there’s no year-end deadline, you can focus on using your HSA intentionally instead of rushing purchases out of fear. When you understand how HSAs work, it becomes easier to plan for everyday expenses, future care, and long-term health needs. From fitness and sleep products to wellness tools and eligible skincare, your HSA can support far more of your life than you might expect.

If you’re ready to start using your balance, the Flex Marketplace offers one of the easiest ways to do it. You can browse hundreds of HSA-eligible brands in one place and pay with your HSA card.

HSA funds do not expire, and that flexibility gives you control over how and when you spend your healthcare dollars. Because there’s no year-end deadline, you can focus on using your HSA intentionally instead of rushing purchases out of fear. When you understand how HSAs work, it becomes easier to plan for everyday expenses, future care, and long-term health needs. From fitness and sleep products to wellness tools and eligible skincare, your HSA can support far more of your life than you might expect.

If you’re ready to start using your balance, the Flex Marketplace offers one of the easiest ways to do it. You can browse hundreds of HSA-eligible brands in one place and pay with your HSA card.

HSA funds do not expire, and that flexibility gives you control over how and when you spend your healthcare dollars. Because there’s no year-end deadline, you can focus on using your HSA intentionally instead of rushing purchases out of fear. When you understand how HSAs work, it becomes easier to plan for everyday expenses, future care, and long-term health needs. From fitness and sleep products to wellness tools and eligible skincare, your HSA can support far more of your life than you might expect.

If you’re ready to start using your balance, the Flex Marketplace offers one of the easiest ways to do it. You can browse hundreds of HSA-eligible brands in one place and pay with your HSA card.

Related content from Flex

More content from Flex

HSA/FSA ELIGIBLE SHOPPING

Shop the Flex HSA/FSA Marketplace

Discover HSA/FSA-eligible brands and products

Use your pre-tax HSA/FSA dollars at checkout

Improve your health and wellness with products you’ll love

Shop Now

Shop Now

Shop Now