When Are Supplements HSA/FSA Eligible + Where To Buy

Yulia Derdemezis

Head of Marketing at Flex

Updated: December 16, 2025

🚀 Fast Facts: Are supplements HSA/FSA eligible?

Supplements can qualify as an HSA/FSA-eligible expense, depending on what they’re being used for

In almost all cases, you’ll need an LMN to explain what condition the supplements are alleviating

Buying supplements with an HSA/FSA card online is one of the best way to get them hassle-free

Supplements can qualify as an HSA/FSA-eligible expense, depending on what they’re being used for

In almost all cases, you’ll need an LMN to explain what condition the supplements are alleviating

Buying supplements with an HSA/FSA card online is one of the best way to get them hassle-free

Supplements can qualify as an HSA/FSA-eligible expense, depending on what they’re being used for

In almost all cases, you’ll need an LMN to explain what condition the supplements are alleviating

Buying supplements with an HSA/FSA card online is one of the best way to get them hassle-free

Supplements can qualify as an HSA/FSA-eligible expense, depending on what they’re being used for

In almost all cases, you’ll need an LMN to explain what condition the supplements are alleviating

Buying supplements with an HSA/FSA card online is one of the best way to get them hassle-free

Vitamins, minerals, and supplements are part of many daily health routines, but paying for them can raise questions when you’re using pre-tax health funds. Understanding when supplements qualify for Health Savings Account (HSA) and Flexible Spending Account (FSA) use can help you avoid denied claims and get more value from your benefits.

This guide breaks down how supplement eligibility works, which medical situations qualify, and how to purchase eligible products easily using your HSA or FSA.

Types of medical conditions that qualify supplements as HSA and FSA eligible

How to buy vitamins & supplements using your HSA or FSA funds

12 HSA & FSA approved supplements you can buy using your plan directly

With those basics in place, let’s start by looking at how the IRS defines supplement eligibility and when these products qualify for HSA and FSA spending.

Vitamins, minerals, and supplements are part of many daily health routines, but paying for them can raise questions when you’re using pre-tax health funds. Understanding when supplements qualify for Health Savings Account (HSA) and Flexible Spending Account (FSA) use can help you avoid denied claims and get more value from your benefits.

This guide breaks down how supplement eligibility works, which medical situations qualify, and how to purchase eligible products easily using your HSA or FSA.

Types of medical conditions that qualify supplements as HSA and FSA eligible

How to buy vitamins & supplements using your HSA or FSA funds

12 HSA & FSA approved supplements you can buy using your plan directly

With those basics in place, let’s start by looking at how the IRS defines supplement eligibility and when these products qualify for HSA and FSA spending.

Vitamins, minerals, and supplements are part of many daily health routines, but paying for them can raise questions when you’re using pre-tax health funds. Understanding when supplements qualify for Health Savings Account (HSA) and Flexible Spending Account (FSA) use can help you avoid denied claims and get more value from your benefits.

This guide breaks down how supplement eligibility works, which medical situations qualify, and how to purchase eligible products easily using your HSA or FSA.

Types of medical conditions that qualify supplements as HSA and FSA eligible

How to buy vitamins & supplements using your HSA or FSA funds

12 HSA & FSA approved supplements you can buy using your plan directly

With those basics in place, let’s start by looking at how the IRS defines supplement eligibility and when these products qualify for HSA and FSA spending.

Are supplements HSA and FSA eligible?

In most cases, supplements are not automatically HSA or FSA eligible. IRS guidelines treat vitamins, minerals, and dietary supplements as personal health items when used for general wellness or daily nutrition, so they typically do not qualify for reimbursement without a documented medical need.

The IRS distinguishes between medical care and general health expenses. Supplements often fall into the second category because they are widely available without a prescription and commonly used by people without a diagnosed condition. Even if a supplement provides health benefits, that alone does not make it eligible for HSA or FSA spending. Eligibility depends on how the supplement is used, not how it is advertised.

For example, supplements commonly taken for energy, immune support, muscle recovery, or daily nutrition are usually viewed as elective purchases. These items remain ineligible unless there is evidence that they are being used to address a specific medical issue.

Differences between HSAs and FSAs for purchasing supplements

While HSAs and FSAs follow the same IRS eligibility rules, how claims are reviewed can differ slightly depending on the plan administrator. Some FSAs apply stricter upfront checks, especially for supplements, while HSAs often rely on the account holder to justify eligibility if audited later.

This difference affects how supplements are purchased. FSA users may need approval or documentation before buying, while HSA users may purchase first and retain records for future verification.

Do you need a Letter of Medical Necessity to buy supplements with your HSA/FSA?

Documentation is central to supplement HSA/FSA eligibility. HSA and FSA administrators often require proof that the supplement was medically necessary at the time of purchase. This proof usually comes in the form of a Letter of Medical Necessity (LMN) written by a licensed healthcare provider.

An LMN typically explains:

The diagnosed condition

Why the supplement is required for treatment

How long the supplement is expected to be used

Without this documentation, claims for supplements are frequently denied, even if the product itself seems health-related.

In most cases, supplements are not automatically HSA or FSA eligible. IRS guidelines treat vitamins, minerals, and dietary supplements as personal health items when used for general wellness or daily nutrition, so they typically do not qualify for reimbursement without a documented medical need.

The IRS distinguishes between medical care and general health expenses. Supplements often fall into the second category because they are widely available without a prescription and commonly used by people without a diagnosed condition. Even if a supplement provides health benefits, that alone does not make it eligible for HSA or FSA spending. Eligibility depends on how the supplement is used, not how it is advertised.

For example, supplements commonly taken for energy, immune support, muscle recovery, or daily nutrition are usually viewed as elective purchases. These items remain ineligible unless there is evidence that they are being used to address a specific medical issue.

Differences between HSAs and FSAs for purchasing supplements

While HSAs and FSAs follow the same IRS eligibility rules, how claims are reviewed can differ slightly depending on the plan administrator. Some FSAs apply stricter upfront checks, especially for supplements, while HSAs often rely on the account holder to justify eligibility if audited later.

This difference affects how supplements are purchased. FSA users may need approval or documentation before buying, while HSA users may purchase first and retain records for future verification.

Do you need a Letter of Medical Necessity to buy supplements with your HSA/FSA?

Documentation is central to supplement HSA/FSA eligibility. HSA and FSA administrators often require proof that the supplement was medically necessary at the time of purchase. This proof usually comes in the form of a Letter of Medical Necessity (LMN) written by a licensed healthcare provider.

An LMN typically explains:

The diagnosed condition

Why the supplement is required for treatment

How long the supplement is expected to be used

Without this documentation, claims for supplements are frequently denied, even if the product itself seems health-related.

In most cases, supplements are not automatically HSA or FSA eligible. IRS guidelines treat vitamins, minerals, and dietary supplements as personal health items when used for general wellness or daily nutrition, so they typically do not qualify for reimbursement without a documented medical need.

The IRS distinguishes between medical care and general health expenses. Supplements often fall into the second category because they are widely available without a prescription and commonly used by people without a diagnosed condition. Even if a supplement provides health benefits, that alone does not make it eligible for HSA or FSA spending. Eligibility depends on how the supplement is used, not how it is advertised.

For example, supplements commonly taken for energy, immune support, muscle recovery, or daily nutrition are usually viewed as elective purchases. These items remain ineligible unless there is evidence that they are being used to address a specific medical issue.

Differences between HSAs and FSAs for purchasing supplements

While HSAs and FSAs follow the same IRS eligibility rules, how claims are reviewed can differ slightly depending on the plan administrator. Some FSAs apply stricter upfront checks, especially for supplements, while HSAs often rely on the account holder to justify eligibility if audited later.

This difference affects how supplements are purchased. FSA users may need approval or documentation before buying, while HSA users may purchase first and retain records for future verification.

Do you need a Letter of Medical Necessity to buy supplements with your HSA/FSA?

Documentation is central to supplement HSA/FSA eligibility. HSA and FSA administrators often require proof that the supplement was medically necessary at the time of purchase. This proof usually comes in the form of a Letter of Medical Necessity (LMN) written by a licensed healthcare provider.

An LMN typically explains:

The diagnosed condition

Why the supplement is required for treatment

How long the supplement is expected to be used

Without this documentation, claims for supplements are frequently denied, even if the product itself seems health-related.

Types of medical conditions that qualify supplements as HSA and FSA eligible

Supplements may qualify for HSA and FSA use when they are recommended to treat or manage a diagnosed medical condition. Eligibility depends on medical intent and proper documentation, not general nutrition or wellness goals. Below are common medical situations where supplements are often considered eligible.

Clinically diagnosed nutrient deficiencies: Supplements such as iron, vitamin D, vitamin B12, or calcium may qualify when lab testing confirms a deficiency and supplementation is part of treatment.

Pregnancy-related medical needs: Certain supplements, including folic acid, may qualify when recommended to address pregnancy-related medical risks rather than routine prenatal nutrition.

Gastrointestinal and absorption disorders: Digestive enzymes, electrolyte supplements, or targeted vitamins may qualify when used to manage conditions that limit nutrient absorption.

Bone, joint, and musculoskeletal conditions: Calcium, vitamin D, magnesium, or joint-support supplements may qualify when recommended to support treatment for diagnosed bone or joint disorders.

Cardiovascular-related conditions: Supplements such as prescription-strength omega-3s or potassium may qualify when used under medical guidance to manage heart-related conditions.

Neurological and migraine-related conditions: Certain supplements, including magnesium or B-complex vitamins, may qualify when recommended as part of treatment for diagnosed neurological conditions.

Chronic conditions requiring ongoing management: Supplements may qualify for long-term conditions such as thyroid disorders, autoimmune conditions, or recovery from illness when documentation supports medical necessity.

Medical uses that typically do not qualify: Supplements taken for general immunity, fitness performance, energy, weight management, or daily wellness usually remain ineligible without a documented medical need.

This overview helps clarify when supplements may qualify for HSA or FSA use. Next, we’ll explain how to purchase eligible vitamins and supplements using your HSA or FSA directly or through reimbursement.

Supplements may qualify for HSA and FSA use when they are recommended to treat or manage a diagnosed medical condition. Eligibility depends on medical intent and proper documentation, not general nutrition or wellness goals. Below are common medical situations where supplements are often considered eligible.

Clinically diagnosed nutrient deficiencies: Supplements such as iron, vitamin D, vitamin B12, or calcium may qualify when lab testing confirms a deficiency and supplementation is part of treatment.

Pregnancy-related medical needs: Certain supplements, including folic acid, may qualify when recommended to address pregnancy-related medical risks rather than routine prenatal nutrition.

Gastrointestinal and absorption disorders: Digestive enzymes, electrolyte supplements, or targeted vitamins may qualify when used to manage conditions that limit nutrient absorption.

Bone, joint, and musculoskeletal conditions: Calcium, vitamin D, magnesium, or joint-support supplements may qualify when recommended to support treatment for diagnosed bone or joint disorders.

Cardiovascular-related conditions: Supplements such as prescription-strength omega-3s or potassium may qualify when used under medical guidance to manage heart-related conditions.

Neurological and migraine-related conditions: Certain supplements, including magnesium or B-complex vitamins, may qualify when recommended as part of treatment for diagnosed neurological conditions.

Chronic conditions requiring ongoing management: Supplements may qualify for long-term conditions such as thyroid disorders, autoimmune conditions, or recovery from illness when documentation supports medical necessity.

Medical uses that typically do not qualify: Supplements taken for general immunity, fitness performance, energy, weight management, or daily wellness usually remain ineligible without a documented medical need.

This overview helps clarify when supplements may qualify for HSA or FSA use. Next, we’ll explain how to purchase eligible vitamins and supplements using your HSA or FSA directly or through reimbursement.

Supplements may qualify for HSA and FSA use when they are recommended to treat or manage a diagnosed medical condition. Eligibility depends on medical intent and proper documentation, not general nutrition or wellness goals. Below are common medical situations where supplements are often considered eligible.

Clinically diagnosed nutrient deficiencies: Supplements such as iron, vitamin D, vitamin B12, or calcium may qualify when lab testing confirms a deficiency and supplementation is part of treatment.

Pregnancy-related medical needs: Certain supplements, including folic acid, may qualify when recommended to address pregnancy-related medical risks rather than routine prenatal nutrition.

Gastrointestinal and absorption disorders: Digestive enzymes, electrolyte supplements, or targeted vitamins may qualify when used to manage conditions that limit nutrient absorption.

Bone, joint, and musculoskeletal conditions: Calcium, vitamin D, magnesium, or joint-support supplements may qualify when recommended to support treatment for diagnosed bone or joint disorders.

Cardiovascular-related conditions: Supplements such as prescription-strength omega-3s or potassium may qualify when used under medical guidance to manage heart-related conditions.

Neurological and migraine-related conditions: Certain supplements, including magnesium or B-complex vitamins, may qualify when recommended as part of treatment for diagnosed neurological conditions.

Chronic conditions requiring ongoing management: Supplements may qualify for long-term conditions such as thyroid disorders, autoimmune conditions, or recovery from illness when documentation supports medical necessity.

Medical uses that typically do not qualify: Supplements taken for general immunity, fitness performance, energy, weight management, or daily wellness usually remain ineligible without a documented medical need.

This overview helps clarify when supplements may qualify for HSA or FSA use. Next, we’ll explain how to purchase eligible vitamins and supplements using your HSA or FSA directly or through reimbursement.

How to buy vitamins & supplements using your HSA or FSA funds

Once you understand which supplements qualify, the next step is knowing how to pay for them correctly using your HSA or FSA. There are two primary options: paying directly at checkout or purchasing out of pocket and submitting a reimbursement claim later. Each method follows the same eligibility rules but works differently in practice.

1. Pay with your HSA/FSA directly at checkout

Paying directly at checkout is often the simplest option when buying eligible supplements. Many retailers and online HSA/FSA shops clearly label products that qualify and accept HSA or FSA cards as a form of payment. When using this method:

The supplement must meet IRS eligibility requirements

A Letter of Medical Necessity may be required for approval

The retailer may prompt you to confirm medical use

It’s still important to save receipts and documentation, especially for HSAs, since account holders are responsible for proving eligibility if audited.

To simplify the process, find supplement brands that accept HSA/FSA payments through the Flex Marketplace.

2. Make a reimbursement claim

Reimbursement is another common way to use HSA or FSA funds for supplements, particularly when purchasing from a standard retailer that does not accept HSA or FSA cards.

With this approach, you pay out of pocket using a personal payment method and then submit a claim through your HSA/FSA administrator, receiving a reimbursement later on.

Reimbursement claims typically require:

An itemized receipt showing the supplement name and purchase date that confirms purchase was within your plan’s coverage period

A Letter of Medical Necessity if the supplement is condition-based

Processing times vary by plan, and incomplete documentation can delay approval. FSAs often have stricter submission deadlines, while HSAs offer more flexibility since funds do not expire.

Once you understand which supplements qualify, the next step is knowing how to pay for them correctly using your HSA or FSA. There are two primary options: paying directly at checkout or purchasing out of pocket and submitting a reimbursement claim later. Each method follows the same eligibility rules but works differently in practice.

1. Pay with your HSA/FSA directly at checkout

Paying directly at checkout is often the simplest option when buying eligible supplements. Many retailers and online HSA/FSA shops clearly label products that qualify and accept HSA or FSA cards as a form of payment. When using this method:

The supplement must meet IRS eligibility requirements

A Letter of Medical Necessity may be required for approval

The retailer may prompt you to confirm medical use

It’s still important to save receipts and documentation, especially for HSAs, since account holders are responsible for proving eligibility if audited.

To simplify the process, find supplement brands that accept HSA/FSA payments through the Flex Marketplace.

2. Make a reimbursement claim

Reimbursement is another common way to use HSA or FSA funds for supplements, particularly when purchasing from a standard retailer that does not accept HSA or FSA cards.

With this approach, you pay out of pocket using a personal payment method and then submit a claim through your HSA/FSA administrator, receiving a reimbursement later on.

Reimbursement claims typically require:

An itemized receipt showing the supplement name and purchase date that confirms purchase was within your plan’s coverage period

A Letter of Medical Necessity if the supplement is condition-based

Processing times vary by plan, and incomplete documentation can delay approval. FSAs often have stricter submission deadlines, while HSAs offer more flexibility since funds do not expire.

Once you understand which supplements qualify, the next step is knowing how to pay for them correctly using your HSA or FSA. There are two primary options: paying directly at checkout or purchasing out of pocket and submitting a reimbursement claim later. Each method follows the same eligibility rules but works differently in practice.

1. Pay with your HSA/FSA directly at checkout

Paying directly at checkout is often the simplest option when buying eligible supplements. Many retailers and online HSA/FSA shops clearly label products that qualify and accept HSA or FSA cards as a form of payment. When using this method:

The supplement must meet IRS eligibility requirements

A Letter of Medical Necessity may be required for approval

The retailer may prompt you to confirm medical use

It’s still important to save receipts and documentation, especially for HSAs, since account holders are responsible for proving eligibility if audited.

To simplify the process, find supplement brands that accept HSA/FSA payments through the Flex Marketplace.

2. Make a reimbursement claim

Reimbursement is another common way to use HSA or FSA funds for supplements, particularly when purchasing from a standard retailer that does not accept HSA or FSA cards.

With this approach, you pay out of pocket using a personal payment method and then submit a claim through your HSA/FSA administrator, receiving a reimbursement later on.

Reimbursement claims typically require:

An itemized receipt showing the supplement name and purchase date that confirms purchase was within your plan’s coverage period

A Letter of Medical Necessity if the supplement is condition-based

Processing times vary by plan, and incomplete documentation can delay approval. FSAs often have stricter submission deadlines, while HSAs offer more flexibility since funds do not expire.

12 HSA & FSA approved supplements you can buy using your plan directly

Finding supplements that work with your HSA or FSA is easier when you shop brands that focus on condition-specific formulations and medical use. The brands below offer supplements that are commonly eligible when tied to a diagnosed condition and supported by proper documentation, such as a Letter of Medical Necessity.

Product | Description |

|---|---|

| Amy Myers MD offers supplements frequently used in autoimmune, thyroid, and gut-related treatment plans. Eligibility depends on documented medical use tied to a diagnosed condition. |

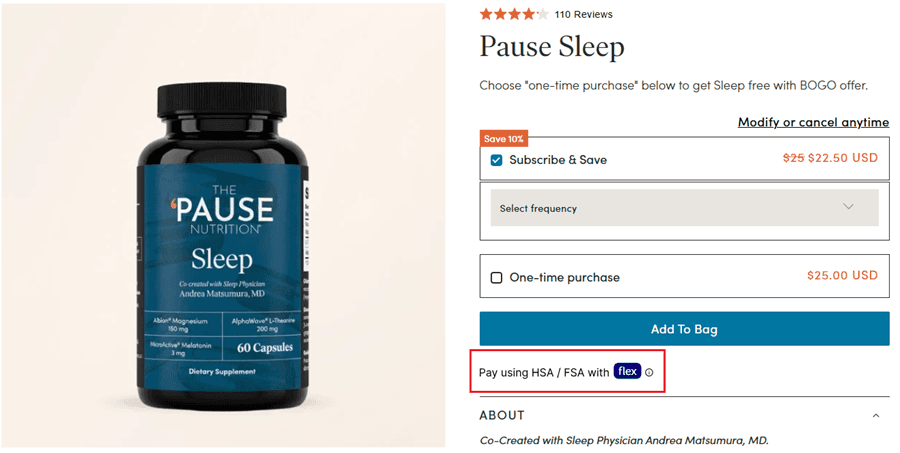

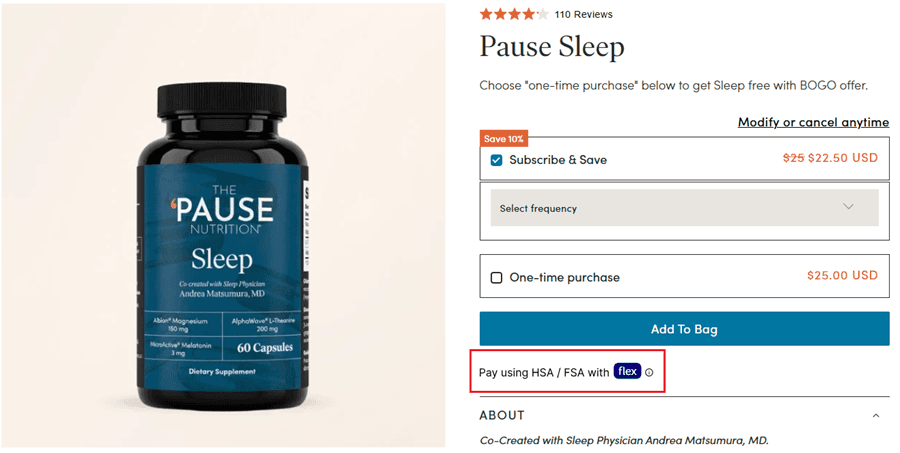

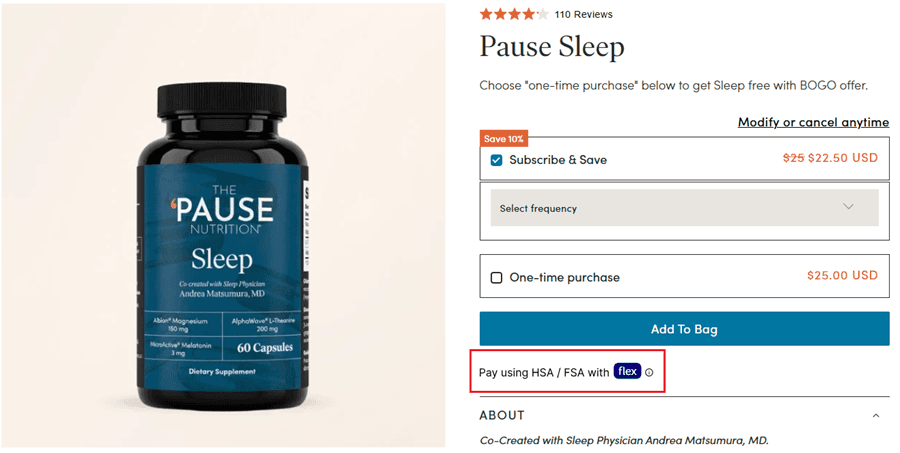

| The ‘Pause Life focuses on supplements formulated for menopause-related symptoms. When recommended by a healthcare provider to address hormone-related medical concerns, these products may qualify for HSA or FSA use. |

| GutPersonal delivers personalized probiotic and gut-health supplements based on individual health profiles. Supplements may qualify when tied to treatment for diagnosed digestive conditions. |

| Wellspring Meds specializes in condition-focused supplements often used for metabolic health and blood sugar management. Their targeted formulations are commonly purchased with HSA or FSA funds when recommended as part of a medical treatment plan. |

| Biome Secret offers gut-health supplements designed to support digestive balance and microbiome-related conditions. These products may qualify when used to manage diagnosed gastrointestinal or absorption disorders. |

| Rootless provides plant-based, medical-grade supplements aimed at addressing specific nutrient deficiencies. Their products may qualify when used to correct deficiencies confirmed by clinical testing. |

| Biolyte produces medical hydration and electrolyte supplements often used for dehydration related to illness or gastrointestinal conditions. These products may qualify when used for medical hydration support. |

| Osh Wellness focuses on supplements designed to support hormone balance and metabolic health. Products may be eligible when recommended for specific medical concerns rather than general wellness. |

| Curalife offers supplements commonly used for blood sugar management. When incorporated into a documented medical plan for diabetes or related conditions, these supplements may qualify for HSA or FSA spending. |

| iCalm specializes in supplements used to support stress-related medical conditions. Eligibility depends on provider documentation linking use to a diagnosed condition. |

| Neeshi provides supplements aimed at supporting women’s hormonal health. These products may qualify when recommended to manage diagnosed hormone-related conditions. |

| Saltivate offers electrolyte supplements often used for hydration support related to medical conditions. Eligibility is strongest when use is connected to a documented health need rather than everyday hydration. |

Finding supplements that work with your HSA or FSA is easier when you shop brands that focus on condition-specific formulations and medical use. The brands below offer supplements that are commonly eligible when tied to a diagnosed condition and supported by proper documentation, such as a Letter of Medical Necessity.

Product | Description |

|---|---|

| Amy Myers MD offers supplements frequently used in autoimmune, thyroid, and gut-related treatment plans. Eligibility depends on documented medical use tied to a diagnosed condition. |

| The ‘Pause Life focuses on supplements formulated for menopause-related symptoms. When recommended by a healthcare provider to address hormone-related medical concerns, these products may qualify for HSA or FSA use. |

| GutPersonal delivers personalized probiotic and gut-health supplements based on individual health profiles. Supplements may qualify when tied to treatment for diagnosed digestive conditions. |

| Wellspring Meds specializes in condition-focused supplements often used for metabolic health and blood sugar management. Their targeted formulations are commonly purchased with HSA or FSA funds when recommended as part of a medical treatment plan. |

| Biome Secret offers gut-health supplements designed to support digestive balance and microbiome-related conditions. These products may qualify when used to manage diagnosed gastrointestinal or absorption disorders. |

| Rootless provides plant-based, medical-grade supplements aimed at addressing specific nutrient deficiencies. Their products may qualify when used to correct deficiencies confirmed by clinical testing. |

| Biolyte produces medical hydration and electrolyte supplements often used for dehydration related to illness or gastrointestinal conditions. These products may qualify when used for medical hydration support. |

| Osh Wellness focuses on supplements designed to support hormone balance and metabolic health. Products may be eligible when recommended for specific medical concerns rather than general wellness. |

| Curalife offers supplements commonly used for blood sugar management. When incorporated into a documented medical plan for diabetes or related conditions, these supplements may qualify for HSA or FSA spending. |

| iCalm specializes in supplements used to support stress-related medical conditions. Eligibility depends on provider documentation linking use to a diagnosed condition. |

| Neeshi provides supplements aimed at supporting women’s hormonal health. These products may qualify when recommended to manage diagnosed hormone-related conditions. |

| Saltivate offers electrolyte supplements often used for hydration support related to medical conditions. Eligibility is strongest when use is connected to a documented health need rather than everyday hydration. |

Finding supplements that work with your HSA or FSA is easier when you shop brands that focus on condition-specific formulations and medical use. The brands below offer supplements that are commonly eligible when tied to a diagnosed condition and supported by proper documentation, such as a Letter of Medical Necessity.

Product | Description |

|---|---|

| Amy Myers MD offers supplements frequently used in autoimmune, thyroid, and gut-related treatment plans. Eligibility depends on documented medical use tied to a diagnosed condition. |

| The ‘Pause Life focuses on supplements formulated for menopause-related symptoms. When recommended by a healthcare provider to address hormone-related medical concerns, these products may qualify for HSA or FSA use. |

| GutPersonal delivers personalized probiotic and gut-health supplements based on individual health profiles. Supplements may qualify when tied to treatment for diagnosed digestive conditions. |

| Wellspring Meds specializes in condition-focused supplements often used for metabolic health and blood sugar management. Their targeted formulations are commonly purchased with HSA or FSA funds when recommended as part of a medical treatment plan. |

| Biome Secret offers gut-health supplements designed to support digestive balance and microbiome-related conditions. These products may qualify when used to manage diagnosed gastrointestinal or absorption disorders. |

| Rootless provides plant-based, medical-grade supplements aimed at addressing specific nutrient deficiencies. Their products may qualify when used to correct deficiencies confirmed by clinical testing. |

| Biolyte produces medical hydration and electrolyte supplements often used for dehydration related to illness or gastrointestinal conditions. These products may qualify when used for medical hydration support. |

| Osh Wellness focuses on supplements designed to support hormone balance and metabolic health. Products may be eligible when recommended for specific medical concerns rather than general wellness. |

| Curalife offers supplements commonly used for blood sugar management. When incorporated into a documented medical plan for diabetes or related conditions, these supplements may qualify for HSA or FSA spending. |

| iCalm specializes in supplements used to support stress-related medical conditions. Eligibility depends on provider documentation linking use to a diagnosed condition. |

| Neeshi provides supplements aimed at supporting women’s hormonal health. These products may qualify when recommended to manage diagnosed hormone-related conditions. |

| Saltivate offers electrolyte supplements often used for hydration support related to medical conditions. Eligibility is strongest when use is connected to a documented health need rather than everyday hydration. |

In summary

When shopping for supplements through HSA or FSA channels, always confirm eligibility, keep receipts, and retain any required medical documentation. This approach helps ensure compliant purchases and smoother reimbursement if needed.

Supplements can qualify for HSA and FSA use when they are tied to a diagnosed medical condition and supported by proper documentation. While everyday vitamins and wellness products usually do not qualify, condition-specific supplements recommended by a healthcare provider often meet IRS guidelines when used as part of treatment or symptom management.

Shop through the Flex Marketplace to see our featured brands that accept HSA/FSA payments.

When shopping for supplements through HSA or FSA channels, always confirm eligibility, keep receipts, and retain any required medical documentation. This approach helps ensure compliant purchases and smoother reimbursement if needed.

Supplements can qualify for HSA and FSA use when they are tied to a diagnosed medical condition and supported by proper documentation. While everyday vitamins and wellness products usually do not qualify, condition-specific supplements recommended by a healthcare provider often meet IRS guidelines when used as part of treatment or symptom management.

Shop through the Flex Marketplace to see our featured brands that accept HSA/FSA payments.

When shopping for supplements through HSA or FSA channels, always confirm eligibility, keep receipts, and retain any required medical documentation. This approach helps ensure compliant purchases and smoother reimbursement if needed.

Supplements can qualify for HSA and FSA use when they are tied to a diagnosed medical condition and supported by proper documentation. While everyday vitamins and wellness products usually do not qualify, condition-specific supplements recommended by a healthcare provider often meet IRS guidelines when used as part of treatment or symptom management.

Shop through the Flex Marketplace to see our featured brands that accept HSA/FSA payments.

Related content from Flex

More content from Flex

HSA/FSA ELIGIBLE SHOPPING

Shop the Flex HSA/FSA Marketplace

Discover HSA/FSA-eligible brands and products

Use your pre-tax HSA/FSA dollars at checkout

Improve your health and wellness with products you’ll love

Shop Now

Shop Now

Shop Now