How To Buy An Oura Ring with HSA/FSA Eligible Funds

Yulia Derdemezis

Head of Marketing at Flex

Updated: December 12, 2025

🚀 Fast Facts: Is the Oura Ring HSA/FSA eligible?

Oura Rings and most Oura products are HSA/FSA eligible, including the Oura Ring 4

You can even pay for the Oura Ring with an HSA/FSA card right at checkout if you have one

There are some specific and important rules you should know before purchasing an Oura Ring with HSA/FSA funds

Oura Rings and most Oura products are HSA/FSA eligible, including the Oura Ring 4

You can even pay for the Oura Ring with an HSA/FSA card right at checkout if you have one

There are some specific and important rules you should know before purchasing an Oura Ring with HSA/FSA funds

Oura Rings and most Oura products are HSA/FSA eligible, including the Oura Ring 4

You can even pay for the Oura Ring with an HSA/FSA card right at checkout if you have one

There are some specific and important rules you should know before purchasing an Oura Ring with HSA/FSA funds

Oura Rings and most Oura products are HSA/FSA eligible, including the Oura Ring 4

You can even pay for the Oura Ring with an HSA/FSA card right at checkout if you have one

There are some specific and important rules you should know before purchasing an Oura Ring with HSA/FSA funds

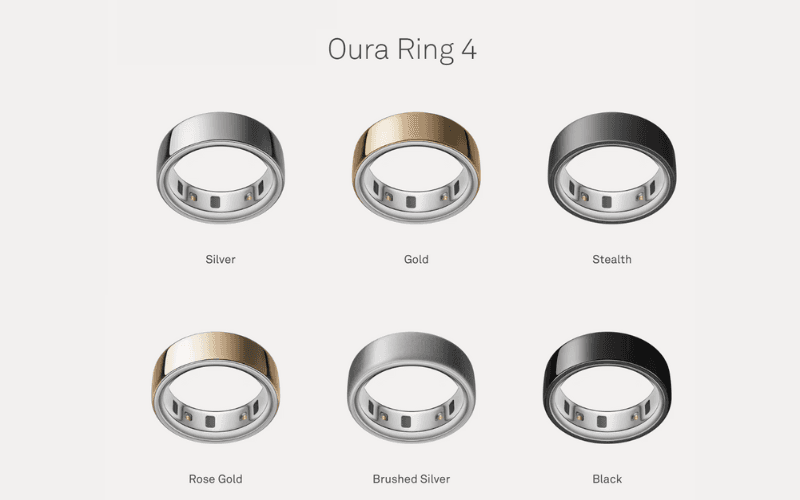

Oura Rings are some of the most popular products in the wearable health market—and for good reason. Oura Rings can track your sleep habits, your cardio health, your stress and readiness levels, and so much more. If you’re taking a deep look into your health, it can even track things like SpO2 levels, your metabolic health, and even your fertility.

An Oura Ring is a great investment, but if you have an HSA or FSA account, you should consider whether you can use your HSA/FSA funds to buy your Oura Ring or Oura Membership. We have answers to all your questions, and will cover the key information you need to make sure your purchase is eligible, including:

Do I need a Letter of Medical Necessity for an Oura Ring to be HSA/FSA eligible?

How to submit an Oura Ring to your HSA/FSA for reimbursement

5 critical things to know before buying an Oura Ring with HSA/FSA funds

Oura Rings are now available in the Flex Marketplace, or you can purchase them through a direct link right here. For now, let’s start with some clear answers to the most important questions about exactly how the Oura Ring is HSA/FSA eligible:

Oura Rings are some of the most popular products in the wearable health market—and for good reason. Oura Rings can track your sleep habits, your cardio health, your stress and readiness levels, and so much more. If you’re taking a deep look into your health, it can even track things like SpO2 levels, your metabolic health, and even your fertility.

An Oura Ring is a great investment, but if you have an HSA or FSA account, you should consider whether you can use your HSA/FSA funds to buy your Oura Ring or Oura Membership. We have answers to all your questions, and will cover the key information you need to make sure your purchase is eligible, including:

Do I need a Letter of Medical Necessity for an Oura Ring to be HSA/FSA eligible?

How to submit an Oura Ring to your HSA/FSA for reimbursement

5 critical things to know before buying an Oura Ring with HSA/FSA funds

Oura Rings are now available in the Flex Marketplace, or you can purchase them through a direct link right here. For now, let’s start with some clear answers to the most important questions about exactly how the Oura Ring is HSA/FSA eligible:

Oura Rings are some of the most popular products in the wearable health market—and for good reason. Oura Rings can track your sleep habits, your cardio health, your stress and readiness levels, and so much more. If you’re taking a deep look into your health, it can even track things like SpO2 levels, your metabolic health, and even your fertility.

An Oura Ring is a great investment, but if you have an HSA or FSA account, you should consider whether you can use your HSA/FSA funds to buy your Oura Ring or Oura Membership. We have answers to all your questions, and will cover the key information you need to make sure your purchase is eligible, including:

Do I need a Letter of Medical Necessity for an Oura Ring to be HSA/FSA eligible?

How to submit an Oura Ring to your HSA/FSA for reimbursement

5 critical things to know before buying an Oura Ring with HSA/FSA funds

Oura Rings are now available in the Flex Marketplace, or you can purchase them through a direct link right here. For now, let’s start with some clear answers to the most important questions about exactly how the Oura Ring is HSA/FSA eligible:

Is the Oura Ring HSA and FSA eligible?

Yes, the Oura Ring is HSA and FSA eligible, as it supports many health-related functions and benefits for the user. All of Oura’s products and memberships you can buy from their shop are HSA/FSA eligible at checkout or for reimbursement (including shipping and taxes), except their 2-year or 3-year Extended Protection Plans.

Why is the Oura Ring HSA/FSA eligible?

The Oura Ring has numerous tracking functions that support different aspects of health, and it can be used to help manage or treat certain health conditions. The Oura Ring tracks sleep, activity, daytime stress and resilience, and heart heart—among other things. Managing or treating certain health conditions is empowered with the tracking that the Oura Ring can provide.

The Oura Ring also supports preventative healthcare, meaning the insights you gain from tracking with it can identify health issues early, and before they become severe or unmanageable. If you recently had a cardiovascular-related health incident for example, using an Oura Ring to track your heart rate and heart health can help prevent further incidents.

Is the Oura Ring Membership also HSA/FSA eligible?

Yes, the Oura Membership is also HSA/FSA eligible. Memberships unlock deeper tracking and health insights including SpO2 monitoring, workout heart rate tracking, and health trends over time, and this added functionality might be integral to the condition that makes Oura HSA/FSA eligible for you personally.

Is any Oura product not HSA/FSA eligible?

The only Oura services currently not eligible for HSA/FSA reimbursement or purchase are the 2-year and 3-year Extended Protection Plans, which offer a warranty on your products. The Oura Ring, an Oura Membership, membership Health Panels, extra chargers, shipping, and taxes are all eligible for reimbursement.

When did Oura Rings become HSA/FSA eligible?

Oura Rings purchased in 2023 or later may be eligible for HSA/FSA reimbursement, and Oura Memberships purchased as of December 2023. You can only submit eligible expenses in your current plan year, so check your personal HSA/FSA plan rules to see if you have any carryover balance or grace period to spend funds early in the following year. (This might make your Oura Ring purchase still eligible!)

Yes, the Oura Ring is HSA and FSA eligible, as it supports many health-related functions and benefits for the user. All of Oura’s products and memberships you can buy from their shop are HSA/FSA eligible at checkout or for reimbursement (including shipping and taxes), except their 2-year or 3-year Extended Protection Plans.

Why is the Oura Ring HSA/FSA eligible?

The Oura Ring has numerous tracking functions that support different aspects of health, and it can be used to help manage or treat certain health conditions. The Oura Ring tracks sleep, activity, daytime stress and resilience, and heart heart—among other things. Managing or treating certain health conditions is empowered with the tracking that the Oura Ring can provide.

The Oura Ring also supports preventative healthcare, meaning the insights you gain from tracking with it can identify health issues early, and before they become severe or unmanageable. If you recently had a cardiovascular-related health incident for example, using an Oura Ring to track your heart rate and heart health can help prevent further incidents.

Is the Oura Ring Membership also HSA/FSA eligible?

Yes, the Oura Membership is also HSA/FSA eligible. Memberships unlock deeper tracking and health insights including SpO2 monitoring, workout heart rate tracking, and health trends over time, and this added functionality might be integral to the condition that makes Oura HSA/FSA eligible for you personally.

Is any Oura product not HSA/FSA eligible?

The only Oura services currently not eligible for HSA/FSA reimbursement or purchase are the 2-year and 3-year Extended Protection Plans, which offer a warranty on your products. The Oura Ring, an Oura Membership, membership Health Panels, extra chargers, shipping, and taxes are all eligible for reimbursement.

When did Oura Rings become HSA/FSA eligible?

Oura Rings purchased in 2023 or later may be eligible for HSA/FSA reimbursement, and Oura Memberships purchased as of December 2023. You can only submit eligible expenses in your current plan year, so check your personal HSA/FSA plan rules to see if you have any carryover balance or grace period to spend funds early in the following year. (This might make your Oura Ring purchase still eligible!)

Yes, the Oura Ring is HSA and FSA eligible, as it supports many health-related functions and benefits for the user. All of Oura’s products and memberships you can buy from their shop are HSA/FSA eligible at checkout or for reimbursement (including shipping and taxes), except their 2-year or 3-year Extended Protection Plans.

Why is the Oura Ring HSA/FSA eligible?

The Oura Ring has numerous tracking functions that support different aspects of health, and it can be used to help manage or treat certain health conditions. The Oura Ring tracks sleep, activity, daytime stress and resilience, and heart heart—among other things. Managing or treating certain health conditions is empowered with the tracking that the Oura Ring can provide.

The Oura Ring also supports preventative healthcare, meaning the insights you gain from tracking with it can identify health issues early, and before they become severe or unmanageable. If you recently had a cardiovascular-related health incident for example, using an Oura Ring to track your heart rate and heart health can help prevent further incidents.

Is the Oura Ring Membership also HSA/FSA eligible?

Yes, the Oura Membership is also HSA/FSA eligible. Memberships unlock deeper tracking and health insights including SpO2 monitoring, workout heart rate tracking, and health trends over time, and this added functionality might be integral to the condition that makes Oura HSA/FSA eligible for you personally.

Is any Oura product not HSA/FSA eligible?

The only Oura services currently not eligible for HSA/FSA reimbursement or purchase are the 2-year and 3-year Extended Protection Plans, which offer a warranty on your products. The Oura Ring, an Oura Membership, membership Health Panels, extra chargers, shipping, and taxes are all eligible for reimbursement.

When did Oura Rings become HSA/FSA eligible?

Oura Rings purchased in 2023 or later may be eligible for HSA/FSA reimbursement, and Oura Memberships purchased as of December 2023. You can only submit eligible expenses in your current plan year, so check your personal HSA/FSA plan rules to see if you have any carryover balance or grace period to spend funds early in the following year. (This might make your Oura Ring purchase still eligible!)

Do I need a Letter of Medical Necessity for an Oura Ring to be HSA/FSA eligible?

Generally, you do not need a Letter of Medical Necessity (LMN) for an Oura Ring; however, some plans may require you to get one for Oura to be HSA/FSA eligible. The IRS definition of eligible medical expenses includes things that can diagnose, cure, mitigate, treat, or prevent disease, which the Oura Ring does in many capacities. However, your plan may require clarity on the specific condition the Oura Ring is being used for.

A Letter of Medical Necessity should include specific diagnosis, a treatment plan, and an explanation of how the Oura Ring would contribute to the management or treatment of your condition. You can obtain one from your healthcare provider if it is required for your plan to make an Oura Ring HSA or FSA-eligible.

If a letter is required, make sure it is issued to you prior to making any Oura Ring or Oura Membership purchase in your current plan year, as you would need to have the LMN before making the purchase to make the Oura Ring eligible on your specific HSA/FSA plan.

Generally, you do not need a Letter of Medical Necessity (LMN) for an Oura Ring; however, some plans may require you to get one for Oura to be HSA/FSA eligible. The IRS definition of eligible medical expenses includes things that can diagnose, cure, mitigate, treat, or prevent disease, which the Oura Ring does in many capacities. However, your plan may require clarity on the specific condition the Oura Ring is being used for.

A Letter of Medical Necessity should include specific diagnosis, a treatment plan, and an explanation of how the Oura Ring would contribute to the management or treatment of your condition. You can obtain one from your healthcare provider if it is required for your plan to make an Oura Ring HSA or FSA-eligible.

If a letter is required, make sure it is issued to you prior to making any Oura Ring or Oura Membership purchase in your current plan year, as you would need to have the LMN before making the purchase to make the Oura Ring eligible on your specific HSA/FSA plan.

Generally, you do not need a Letter of Medical Necessity (LMN) for an Oura Ring; however, some plans may require you to get one for Oura to be HSA/FSA eligible. The IRS definition of eligible medical expenses includes things that can diagnose, cure, mitigate, treat, or prevent disease, which the Oura Ring does in many capacities. However, your plan may require clarity on the specific condition the Oura Ring is being used for.

A Letter of Medical Necessity should include specific diagnosis, a treatment plan, and an explanation of how the Oura Ring would contribute to the management or treatment of your condition. You can obtain one from your healthcare provider if it is required for your plan to make an Oura Ring HSA or FSA-eligible.

If a letter is required, make sure it is issued to you prior to making any Oura Ring or Oura Membership purchase in your current plan year, as you would need to have the LMN before making the purchase to make the Oura Ring eligible on your specific HSA/FSA plan.

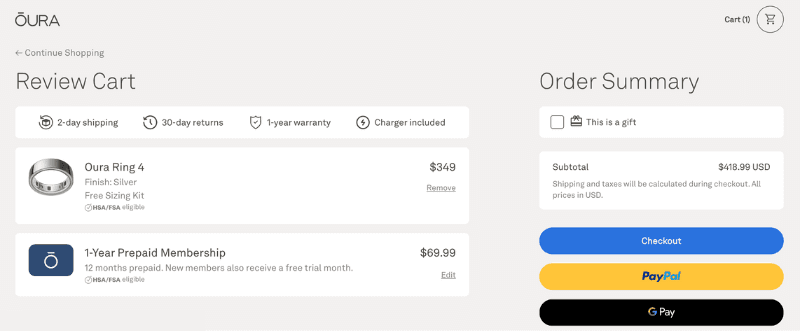

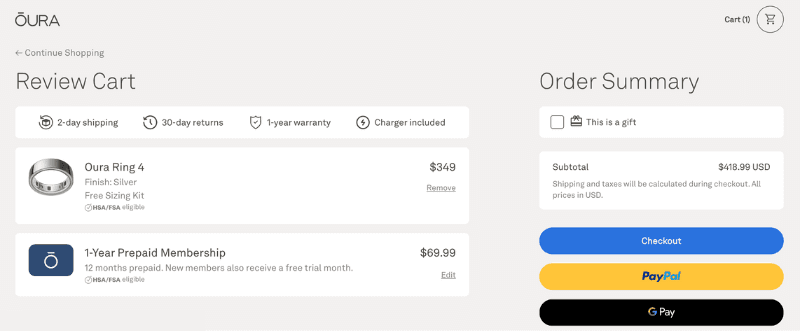

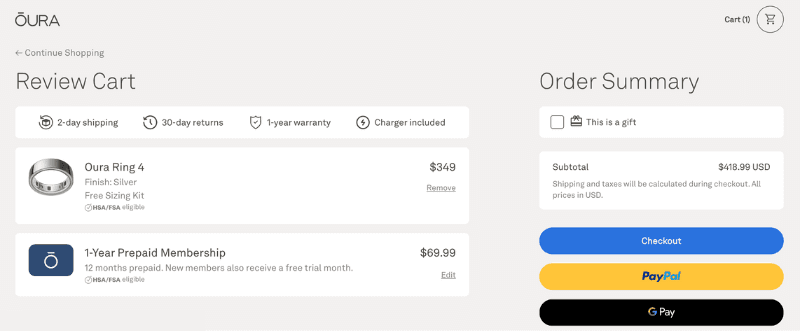

How to buy an Oura Ring with your HSA or FSA card directly

If you have an HSA/FSA card, you can purchase the Oura Ring directly with funds from your account—right at checkout. Here’s what to do:

Go to the Oura shop and select your Ring, and add it to your cart

If you are subscribing to a membership, make sure this is included in your cart at this stage as well

Make sure there are no ineligible items in your cart, like the Extended Protection Package

Select “HSA/FSA Cards” at checkout as your payment method

Enter your HSA or FSA card payment information (like you would with a credit card) and submit the payment

This is the quickest and easiest way to buy an Oura Ring—and you don’t have to pay out of pocket! Go to the Oura Ring shop to see how adding the Oura Ring 4 to your life can improve your sleep, your stress level, your cardio health, and so much more.

If you have an HSA/FSA card, you can purchase the Oura Ring directly with funds from your account—right at checkout. Here’s what to do:

Go to the Oura shop and select your Ring, and add it to your cart

If you are subscribing to a membership, make sure this is included in your cart at this stage as well

Make sure there are no ineligible items in your cart, like the Extended Protection Package

Select “HSA/FSA Cards” at checkout as your payment method

Enter your HSA or FSA card payment information (like you would with a credit card) and submit the payment

This is the quickest and easiest way to buy an Oura Ring—and you don’t have to pay out of pocket! Go to the Oura Ring shop to see how adding the Oura Ring 4 to your life can improve your sleep, your stress level, your cardio health, and so much more.

If you have an HSA/FSA card, you can purchase the Oura Ring directly with funds from your account—right at checkout. Here’s what to do:

Go to the Oura shop and select your Ring, and add it to your cart

If you are subscribing to a membership, make sure this is included in your cart at this stage as well

Make sure there are no ineligible items in your cart, like the Extended Protection Package

Select “HSA/FSA Cards” at checkout as your payment method

Enter your HSA or FSA card payment information (like you would with a credit card) and submit the payment

This is the quickest and easiest way to buy an Oura Ring—and you don’t have to pay out of pocket! Go to the Oura Ring shop to see how adding the Oura Ring 4 to your life can improve your sleep, your stress level, your cardio health, and so much more.

How to submit an Oura Ring to your HSA/FSA for reimbursement

If you don’t have an HSA/FSA card you can use to buy the Oura Ring online, you can pay for it out of pocket, and then submit it for reimbursement. Here’s how to collect all the paperwork you need, and submit the expense:

Go to the Oura shop and select your Ring, and add it to your cart

If you are subscribing to a membership, make sure this is included in your cart at this stage as well

Make sure there are no ineligible items in your cart, like the Extended Protection Package

Choose your payment method, like a credit card or PayPal, and submit the payment

Go to your email and download the order invoice, which will contain the receipt for your purchase

If you purchased a membership, log into the Oura Membership Hub, and download the invoice for your membership

If your benefits provider requires a Letter of Medical Necessity, make sure you have a copy, and that it was issued prior to the purchase you made

Submit the receipts and documentation above for reimbursement through your HSA/FSA account portal—the way you normally would

If you don’t have an HSA/FSA card you can use to buy the Oura Ring online, you can pay for it out of pocket, and then submit it for reimbursement. Here’s how to collect all the paperwork you need, and submit the expense:

Go to the Oura shop and select your Ring, and add it to your cart

If you are subscribing to a membership, make sure this is included in your cart at this stage as well

Make sure there are no ineligible items in your cart, like the Extended Protection Package

Choose your payment method, like a credit card or PayPal, and submit the payment

Go to your email and download the order invoice, which will contain the receipt for your purchase

If you purchased a membership, log into the Oura Membership Hub, and download the invoice for your membership

If your benefits provider requires a Letter of Medical Necessity, make sure you have a copy, and that it was issued prior to the purchase you made

Submit the receipts and documentation above for reimbursement through your HSA/FSA account portal—the way you normally would

If you don’t have an HSA/FSA card you can use to buy the Oura Ring online, you can pay for it out of pocket, and then submit it for reimbursement. Here’s how to collect all the paperwork you need, and submit the expense:

Go to the Oura shop and select your Ring, and add it to your cart

If you are subscribing to a membership, make sure this is included in your cart at this stage as well

Make sure there are no ineligible items in your cart, like the Extended Protection Package

Choose your payment method, like a credit card or PayPal, and submit the payment

Go to your email and download the order invoice, which will contain the receipt for your purchase

If you purchased a membership, log into the Oura Membership Hub, and download the invoice for your membership

If your benefits provider requires a Letter of Medical Necessity, make sure you have a copy, and that it was issued prior to the purchase you made

Submit the receipts and documentation above for reimbursement through your HSA/FSA account portal—the way you normally would

6 critical things to know before buying an Oura Ring with HSA/FSA funds

If you want some more information, you can check out Oura’s website for more information on HSAs/FSAs, but here is some very important information you should review before purchasing an Oura Ring with HSA/FSA funds:

1. Oura doesn’t currently support split payments

This means you need to have a balance in your HSA/FSA account or on your card that can support the entire purchase in one transaction. You cannot use what’s remaining in your HSA/FSA account, and then put the rest on a credit card. If your current funds balance can’t cover the whole purchase, you will have to pay out of pocket, and then submit the purchase for reimbursement instead.

Pssst: many of our checkouts for stores in the Flex Marketplace support split payments, and we feature hundreds of brands selling HSA & FSA-eligible items. After you buy your Oura Ring, go check out some other products you can spend your HSA/FSA money on before you lose it this year!

2. You cannot have ineligible items in the cart when you make the purchase

If you want to buy the Oura Ring with your HSA/FSA card right at checkout, the transaction will not go through or be eligible if you have ineligible items in your cart, which includes the 2-year or 3-year Extended Protection Plans. If you want to purchase the Extended Protection Plans, you will have to pay for them out of pocket with no reimbursement.

If you want to use your HSA/FSA card at the Oura checkout, you will have to purchase the Extended Protection Plan separately, so it isn’t in the same cart where you purchase your Oura Ring or membership.

3. You cannot purchase the Oura Ring as a gift, but you can purchase it for a Qualifying Dependent

The IRS does not permit gift-giving with HSAs/FSAs, because the funds need to be used for yourself, or a Qualifying Dependent. You would not be able to purchase an Oura Ring for your friends or other people in your life in general, and have the expense be HSA/FSA-eligible.

However, you can purchase Oura Rings for any Qualifying Dependents, like your children. The way the IRS defines Qualifying Dependents varies based on what type of dependent they are, so review their documentation in full to ensure you are covered. Here are some more common ways you might be eligible to purchase an Oura Ring for a Qualifying Dependent:

You are buying an Oura Ring for your child: If they are directly related to you as your child, are under 19 (or under 24 and a student or any age and permanently disabled), they primarily live with you, and they get more than half of their financial support from you

You are buying an Oura Ring for a relative: If they aren’t the Qualifying Child of someone else, they live with you all year as a member of your household, they have a gross income of less than $5050, and they get more than half of their financial support from you

4. Can I get a refund if I pay for an Oura Ring with an HSA/FSA card or funds?

Yes, you can, but refunds need to go back to the same HSA or FSA card or account that made the purchase, and for the refund to be processed, it still needs to be in accordance with Oura’s refund and exchange policy. If your HSA/FSA account was closed since you made the purchase, you would not be able to receive the refund at all.

To return a product purchased with HSA/FSA account funds, you should contact Oura’s Member Care team directly to get the process started.

5. What should I do if my HSA/FSA card purchase isn’t working at the Oura checkout?

If your HSA/FSA card transaction isn’t working at the Oura checkout, try troubleshooting the issue in this order:

Check that you have adequate funds in your HSA/FSA account, and available on your card for the current plan year

Check your HSA/FSA card information to make sure it was entered correctly

Check that you don’t have any ineligible items in your cart, like the Extended Protection Plan

Check that you aren’t trying to do a split payment, covering part of the purchase with another card

Try the purchase again in case it was an isolated issue

Try checking with your HSA/FSA provider to see why the transaction won’t go through

Pay for the purchase out of pocket, and submit it for reimbursement, instead of paying with an HSA/FSA card directly

That should answer all of your questions on Oura Ring HSA/FSA eligibility! If you want to purchase an Oura Ring, check out the Oura Ring 4 in the Oura Shop. You can also check out the rest of the Flex Marketplace, where we have hundreds of stores that sell HSA and FSA-eligible items. We have lots of Fitness-related stores, and more that can help improve your overall health.

If you want some more information, you can check out Oura’s website for more information on HSAs/FSAs, but here is some very important information you should review before purchasing an Oura Ring with HSA/FSA funds:

1. Oura doesn’t currently support split payments

This means you need to have a balance in your HSA/FSA account or on your card that can support the entire purchase in one transaction. You cannot use what’s remaining in your HSA/FSA account, and then put the rest on a credit card. If your current funds balance can’t cover the whole purchase, you will have to pay out of pocket, and then submit the purchase for reimbursement instead.

Pssst: many of our checkouts for stores in the Flex Marketplace support split payments, and we feature hundreds of brands selling HSA & FSA-eligible items. After you buy your Oura Ring, go check out some other products you can spend your HSA/FSA money on before you lose it this year!

2. You cannot have ineligible items in the cart when you make the purchase

If you want to buy the Oura Ring with your HSA/FSA card right at checkout, the transaction will not go through or be eligible if you have ineligible items in your cart, which includes the 2-year or 3-year Extended Protection Plans. If you want to purchase the Extended Protection Plans, you will have to pay for them out of pocket with no reimbursement.

If you want to use your HSA/FSA card at the Oura checkout, you will have to purchase the Extended Protection Plan separately, so it isn’t in the same cart where you purchase your Oura Ring or membership.

3. You cannot purchase the Oura Ring as a gift, but you can purchase it for a Qualifying Dependent

The IRS does not permit gift-giving with HSAs/FSAs, because the funds need to be used for yourself, or a Qualifying Dependent. You would not be able to purchase an Oura Ring for your friends or other people in your life in general, and have the expense be HSA/FSA-eligible.

However, you can purchase Oura Rings for any Qualifying Dependents, like your children. The way the IRS defines Qualifying Dependents varies based on what type of dependent they are, so review their documentation in full to ensure you are covered. Here are some more common ways you might be eligible to purchase an Oura Ring for a Qualifying Dependent:

You are buying an Oura Ring for your child: If they are directly related to you as your child, are under 19 (or under 24 and a student or any age and permanently disabled), they primarily live with you, and they get more than half of their financial support from you

You are buying an Oura Ring for a relative: If they aren’t the Qualifying Child of someone else, they live with you all year as a member of your household, they have a gross income of less than $5050, and they get more than half of their financial support from you

4. Can I get a refund if I pay for an Oura Ring with an HSA/FSA card or funds?

Yes, you can, but refunds need to go back to the same HSA or FSA card or account that made the purchase, and for the refund to be processed, it still needs to be in accordance with Oura’s refund and exchange policy. If your HSA/FSA account was closed since you made the purchase, you would not be able to receive the refund at all.

To return a product purchased with HSA/FSA account funds, you should contact Oura’s Member Care team directly to get the process started.

5. What should I do if my HSA/FSA card purchase isn’t working at the Oura checkout?

If your HSA/FSA card transaction isn’t working at the Oura checkout, try troubleshooting the issue in this order:

Check that you have adequate funds in your HSA/FSA account, and available on your card for the current plan year

Check your HSA/FSA card information to make sure it was entered correctly

Check that you don’t have any ineligible items in your cart, like the Extended Protection Plan

Check that you aren’t trying to do a split payment, covering part of the purchase with another card

Try the purchase again in case it was an isolated issue

Try checking with your HSA/FSA provider to see why the transaction won’t go through

Pay for the purchase out of pocket, and submit it for reimbursement, instead of paying with an HSA/FSA card directly

That should answer all of your questions on Oura Ring HSA/FSA eligibility! If you want to purchase an Oura Ring, check out the Oura Ring 4 in the Oura Shop. You can also check out the rest of the Flex Marketplace, where we have hundreds of stores that sell HSA and FSA-eligible items. We have lots of Fitness-related stores, and more that can help improve your overall health.

If you want some more information, you can check out Oura’s website for more information on HSAs/FSAs, but here is some very important information you should review before purchasing an Oura Ring with HSA/FSA funds:

1. Oura doesn’t currently support split payments

This means you need to have a balance in your HSA/FSA account or on your card that can support the entire purchase in one transaction. You cannot use what’s remaining in your HSA/FSA account, and then put the rest on a credit card. If your current funds balance can’t cover the whole purchase, you will have to pay out of pocket, and then submit the purchase for reimbursement instead.

Pssst: many of our checkouts for stores in the Flex Marketplace support split payments, and we feature hundreds of brands selling HSA & FSA-eligible items. After you buy your Oura Ring, go check out some other products you can spend your HSA/FSA money on before you lose it this year!

2. You cannot have ineligible items in the cart when you make the purchase

If you want to buy the Oura Ring with your HSA/FSA card right at checkout, the transaction will not go through or be eligible if you have ineligible items in your cart, which includes the 2-year or 3-year Extended Protection Plans. If you want to purchase the Extended Protection Plans, you will have to pay for them out of pocket with no reimbursement.

If you want to use your HSA/FSA card at the Oura checkout, you will have to purchase the Extended Protection Plan separately, so it isn’t in the same cart where you purchase your Oura Ring or membership.

3. You cannot purchase the Oura Ring as a gift, but you can purchase it for a Qualifying Dependent

The IRS does not permit gift-giving with HSAs/FSAs, because the funds need to be used for yourself, or a Qualifying Dependent. You would not be able to purchase an Oura Ring for your friends or other people in your life in general, and have the expense be HSA/FSA-eligible.

However, you can purchase Oura Rings for any Qualifying Dependents, like your children. The way the IRS defines Qualifying Dependents varies based on what type of dependent they are, so review their documentation in full to ensure you are covered. Here are some more common ways you might be eligible to purchase an Oura Ring for a Qualifying Dependent:

You are buying an Oura Ring for your child: If they are directly related to you as your child, are under 19 (or under 24 and a student or any age and permanently disabled), they primarily live with you, and they get more than half of their financial support from you

You are buying an Oura Ring for a relative: If they aren’t the Qualifying Child of someone else, they live with you all year as a member of your household, they have a gross income of less than $5050, and they get more than half of their financial support from you

4. Can I get a refund if I pay for an Oura Ring with an HSA/FSA card or funds?

Yes, you can, but refunds need to go back to the same HSA or FSA card or account that made the purchase, and for the refund to be processed, it still needs to be in accordance with Oura’s refund and exchange policy. If your HSA/FSA account was closed since you made the purchase, you would not be able to receive the refund at all.

To return a product purchased with HSA/FSA account funds, you should contact Oura’s Member Care team directly to get the process started.

5. What should I do if my HSA/FSA card purchase isn’t working at the Oura checkout?

If your HSA/FSA card transaction isn’t working at the Oura checkout, try troubleshooting the issue in this order:

Check that you have adequate funds in your HSA/FSA account, and available on your card for the current plan year

Check your HSA/FSA card information to make sure it was entered correctly

Check that you don’t have any ineligible items in your cart, like the Extended Protection Plan

Check that you aren’t trying to do a split payment, covering part of the purchase with another card

Try the purchase again in case it was an isolated issue

Try checking with your HSA/FSA provider to see why the transaction won’t go through

Pay for the purchase out of pocket, and submit it for reimbursement, instead of paying with an HSA/FSA card directly

That should answer all of your questions on Oura Ring HSA/FSA eligibility! If you want to purchase an Oura Ring, check out the Oura Ring 4 in the Oura Shop. You can also check out the rest of the Flex Marketplace, where we have hundreds of stores that sell HSA and FSA-eligible items. We have lots of Fitness-related stores, and more that can help improve your overall health.

Related content from Flex

More content from Flex

HSA/FSA ELIGIBLE SHOPPING

Shop the Flex HSA/FSA Marketplace

Discover HSA/FSA-eligible brands and products

Use your pre-tax HSA/FSA dollars at checkout

Improve your health and wellness with products you’ll love

Shop Now

Shop Now

Shop Now