Is Semaglutide HSA/FSA Eligible? (+ How to Buy Online)

Yulia Derdemezis

Head of Marketing at Flex

Updated: February 17, 2026

🚀 Fast Facts: Is semaglutide HSA or FSA eligible?

When part of a prescribed treatment plan, semaglutide can qualify for payment using an HSA or FSA

In most cases, semaglutide requires a Letter of Medical Necessity (LMN) explaining its role in treatment

It’s ideal to purchase these products directly from an HSA/FSA eligible shop where the product is likely to qualify

When part of a prescribed treatment plan, semaglutide can qualify for payment using an HSA or FSA

In most cases, semaglutide requires a Letter of Medical Necessity (LMN) explaining its role in treatment

It’s ideal to purchase these products directly from an HSA/FSA eligible shop where the product is likely to qualify

When part of a prescribed treatment plan, semaglutide can qualify for payment using an HSA or FSA

In most cases, semaglutide requires a Letter of Medical Necessity (LMN) explaining its role in treatment

It’s ideal to purchase these products directly from an HSA/FSA eligible shop where the product is likely to qualify

When part of a prescribed treatment plan, semaglutide can qualify for payment using an HSA or FSA

In most cases, semaglutide requires a Letter of Medical Necessity (LMN) explaining its role in treatment

It’s ideal to purchase these products directly from an HSA/FSA eligible shop where the product is likely to qualify

Semaglutide has become one of the most talked-about prescription medications in recent years, especially for people managing chronic health conditions tied to weight and metabolic health.

If you have money set aside in your Health Savings Account (HSA) or Flexible Spending Account (FSA), you may wonder whether you can use those pre-tax dollars to cover the cost. This guide walks you through how semaglutide fits into HSA and FSA rules, when documentation matters, and how to find options that make purchasing simpler.

Do you always need a Letter of Medical Necessity to buy semaglutide with your HSA/FSA?

Types of medical conditions that qualify semaglutide to be HSA and FSA eligible

How to buy semaglutide using your HSA or FSA directly or with reimbursement

3 HSA & FSA approved semaglutide products you can buy with your HSA/FSA

Understanding eligibility rules upfront can save you time, money, and frustration, especially with a high-cost prescription like semaglutide. Let’s start by answering the most common question people ask before they try to pay with their benefits card.

Semaglutide has become one of the most talked-about prescription medications in recent years, especially for people managing chronic health conditions tied to weight and metabolic health.

If you have money set aside in your Health Savings Account (HSA) or Flexible Spending Account (FSA), you may wonder whether you can use those pre-tax dollars to cover the cost. This guide walks you through how semaglutide fits into HSA and FSA rules, when documentation matters, and how to find options that make purchasing simpler.

Do you always need a Letter of Medical Necessity to buy semaglutide with your HSA/FSA?

Types of medical conditions that qualify semaglutide to be HSA and FSA eligible

How to buy semaglutide using your HSA or FSA directly or with reimbursement

3 HSA & FSA approved semaglutide products you can buy with your HSA/FSA

Understanding eligibility rules upfront can save you time, money, and frustration, especially with a high-cost prescription like semaglutide. Let’s start by answering the most common question people ask before they try to pay with their benefits card.

Semaglutide has become one of the most talked-about prescription medications in recent years, especially for people managing chronic health conditions tied to weight and metabolic health.

If you have money set aside in your Health Savings Account (HSA) or Flexible Spending Account (FSA), you may wonder whether you can use those pre-tax dollars to cover the cost. This guide walks you through how semaglutide fits into HSA and FSA rules, when documentation matters, and how to find options that make purchasing simpler.

Do you always need a Letter of Medical Necessity to buy semaglutide with your HSA/FSA?

Types of medical conditions that qualify semaglutide to be HSA and FSA eligible

How to buy semaglutide using your HSA or FSA directly or with reimbursement

3 HSA & FSA approved semaglutide products you can buy with your HSA/FSA

Understanding eligibility rules upfront can save you time, money, and frustration, especially with a high-cost prescription like semaglutide. Let’s start by answering the most common question people ask before they try to pay with their benefits card.

Is GLP-1 or semaglutide HSA and FSA eligible?

GLP-1 and semaglutide can be HSA and FSA eligible, but only when it meets IRS rules for qualified medical expenses. Eligibility depends on having a valid prescription, the medical reason for treatment, and how the expense is documented by the pharmacy or provider processing payment at checkout online.

In simple terms, semaglutide qualifies when a licensed healthcare provider prescribes it to treat a diagnosed medical condition. When that standard is met, you can typically use funds from your HSA or FSA to cover the cost.

Eligibility can change based on how the prescription is categorized and how your plan administrator reviews the claim. Knowing those details upfront helps you avoid denied card transactions or delayed reimbursements.

Before you try to pay with your HSA or FSA, it’s important to understand when additional documentation may be required.

GLP-1 and semaglutide can be HSA and FSA eligible, but only when it meets IRS rules for qualified medical expenses. Eligibility depends on having a valid prescription, the medical reason for treatment, and how the expense is documented by the pharmacy or provider processing payment at checkout online.

In simple terms, semaglutide qualifies when a licensed healthcare provider prescribes it to treat a diagnosed medical condition. When that standard is met, you can typically use funds from your HSA or FSA to cover the cost.

Eligibility can change based on how the prescription is categorized and how your plan administrator reviews the claim. Knowing those details upfront helps you avoid denied card transactions or delayed reimbursements.

Before you try to pay with your HSA or FSA, it’s important to understand when additional documentation may be required.

GLP-1 and semaglutide can be HSA and FSA eligible, but only when it meets IRS rules for qualified medical expenses. Eligibility depends on having a valid prescription, the medical reason for treatment, and how the expense is documented by the pharmacy or provider processing payment at checkout online.

In simple terms, semaglutide qualifies when a licensed healthcare provider prescribes it to treat a diagnosed medical condition. When that standard is met, you can typically use funds from your HSA or FSA to cover the cost.

Eligibility can change based on how the prescription is categorized and how your plan administrator reviews the claim. Knowing those details upfront helps you avoid denied card transactions or delayed reimbursements.

Before you try to pay with your HSA or FSA, it’s important to understand when additional documentation may be required.

Do you always need a Letter of Medical Necessity to buy semaglutide with your HSA/FSA?

You do not always need a Letter of Medical Necessity (LMN) to use HSA or FSA funds for semaglutide. In many cases, the prescription alone satisfies eligibility requirements because prescription medications qualify as medical expenses under IRS guidelines.

You are less likely to need an LMN when:

GLP-1 is prescribed for type 2 Diabetes

The medication is filled through a standard pharmacy

The charge clearly appears as a prescription drug

An LMN is more commonly required when semaglutide is prescribed for conditions that plan administrators may classify as dual-purpose. In those situations, the letter helps confirm the medication treats a medical condition rather than a general health goal.

Some platforms simplify this step by offering LMNs as part of the purchase or care process. That convenience can make it easier to stay compliant if your plan later requests documentation.

With eligibility basics covered, the next step is understanding which medical conditions most often support using HSA and FSA funds for GLP-1.

You do not always need a Letter of Medical Necessity (LMN) to use HSA or FSA funds for semaglutide. In many cases, the prescription alone satisfies eligibility requirements because prescription medications qualify as medical expenses under IRS guidelines.

You are less likely to need an LMN when:

GLP-1 is prescribed for type 2 Diabetes

The medication is filled through a standard pharmacy

The charge clearly appears as a prescription drug

An LMN is more commonly required when semaglutide is prescribed for conditions that plan administrators may classify as dual-purpose. In those situations, the letter helps confirm the medication treats a medical condition rather than a general health goal.

Some platforms simplify this step by offering LMNs as part of the purchase or care process. That convenience can make it easier to stay compliant if your plan later requests documentation.

With eligibility basics covered, the next step is understanding which medical conditions most often support using HSA and FSA funds for GLP-1.

You do not always need a Letter of Medical Necessity (LMN) to use HSA or FSA funds for semaglutide. In many cases, the prescription alone satisfies eligibility requirements because prescription medications qualify as medical expenses under IRS guidelines.

You are less likely to need an LMN when:

GLP-1 is prescribed for type 2 Diabetes

The medication is filled through a standard pharmacy

The charge clearly appears as a prescription drug

An LMN is more commonly required when semaglutide is prescribed for conditions that plan administrators may classify as dual-purpose. In those situations, the letter helps confirm the medication treats a medical condition rather than a general health goal.

Some platforms simplify this step by offering LMNs as part of the purchase or care process. That convenience can make it easier to stay compliant if your plan later requests documentation.

With eligibility basics covered, the next step is understanding which medical conditions most often support using HSA and FSA funds for GLP-1.

Types of medical conditions that qualify semaglutide to be HSA and FSA eligible

Semaglutide qualifies for HSA and FSA use when your prescription treats a diagnosed medical condition recognized under IRS rules. Plan administrators focus on whether the medication addresses medical care, not general wellness or appearance-related goals.

Below are common qualifying conditions and how each one affects eligibility.

Type 2 Diabetes: Semaglutide prescribed to manage blood sugar levels for type 2 Diabetes generally qualifies as an eligible medical expense. In most cases, your prescription alone supports HSA and FSA use without added documentation.

Insulin Resistance: When a provider prescribes GLP-1 to treat insulin resistance or related metabolic issues, it may qualify for HSA and FSA coverage. Some plans request supporting documentation to confirm the diagnosis and treatment purpose.

Obesity (with a documented diagnosis): Obesity can qualify when your provider documents it as a medical condition and not a lifestyle concern. An LMN often helps confirm medical necessity for HSA or FSA approval.

Weight-related conditions (tied to other diagnoses): Semaglutide may qualify when excess weight contributes to conditions such as high blood pressure, sleep apnea, or cardiovascular risk. Eligibility focuses on treating the underlying medical condition rather than weight alone.

Metabolic Syndrome: When GLP-1 treats metabolic syndrome diagnosed by a healthcare provider, HSA and FSA eligibility becomes more likely. Clear documentation strengthens approval if your plan reviews the expense.

Keeping copies of your prescription, receipts, and any LMN makes it easier to support eligibility if your plan administrator asks questions later. With qualifying conditions covered, the next step is understanding how to actually pay for semaglutide using your HSA or FSA, either directly or through reimbursement.

Semaglutide qualifies for HSA and FSA use when your prescription treats a diagnosed medical condition recognized under IRS rules. Plan administrators focus on whether the medication addresses medical care, not general wellness or appearance-related goals.

Below are common qualifying conditions and how each one affects eligibility.

Type 2 Diabetes: Semaglutide prescribed to manage blood sugar levels for type 2 Diabetes generally qualifies as an eligible medical expense. In most cases, your prescription alone supports HSA and FSA use without added documentation.

Insulin Resistance: When a provider prescribes GLP-1 to treat insulin resistance or related metabolic issues, it may qualify for HSA and FSA coverage. Some plans request supporting documentation to confirm the diagnosis and treatment purpose.

Obesity (with a documented diagnosis): Obesity can qualify when your provider documents it as a medical condition and not a lifestyle concern. An LMN often helps confirm medical necessity for HSA or FSA approval.

Weight-related conditions (tied to other diagnoses): Semaglutide may qualify when excess weight contributes to conditions such as high blood pressure, sleep apnea, or cardiovascular risk. Eligibility focuses on treating the underlying medical condition rather than weight alone.

Metabolic Syndrome: When GLP-1 treats metabolic syndrome diagnosed by a healthcare provider, HSA and FSA eligibility becomes more likely. Clear documentation strengthens approval if your plan reviews the expense.

Keeping copies of your prescription, receipts, and any LMN makes it easier to support eligibility if your plan administrator asks questions later. With qualifying conditions covered, the next step is understanding how to actually pay for semaglutide using your HSA or FSA, either directly or through reimbursement.

Semaglutide qualifies for HSA and FSA use when your prescription treats a diagnosed medical condition recognized under IRS rules. Plan administrators focus on whether the medication addresses medical care, not general wellness or appearance-related goals.

Below are common qualifying conditions and how each one affects eligibility.

Type 2 Diabetes: Semaglutide prescribed to manage blood sugar levels for type 2 Diabetes generally qualifies as an eligible medical expense. In most cases, your prescription alone supports HSA and FSA use without added documentation.

Insulin Resistance: When a provider prescribes GLP-1 to treat insulin resistance or related metabolic issues, it may qualify for HSA and FSA coverage. Some plans request supporting documentation to confirm the diagnosis and treatment purpose.

Obesity (with a documented diagnosis): Obesity can qualify when your provider documents it as a medical condition and not a lifestyle concern. An LMN often helps confirm medical necessity for HSA or FSA approval.

Weight-related conditions (tied to other diagnoses): Semaglutide may qualify when excess weight contributes to conditions such as high blood pressure, sleep apnea, or cardiovascular risk. Eligibility focuses on treating the underlying medical condition rather than weight alone.

Metabolic Syndrome: When GLP-1 treats metabolic syndrome diagnosed by a healthcare provider, HSA and FSA eligibility becomes more likely. Clear documentation strengthens approval if your plan reviews the expense.

Keeping copies of your prescription, receipts, and any LMN makes it easier to support eligibility if your plan administrator asks questions later. With qualifying conditions covered, the next step is understanding how to actually pay for semaglutide using your HSA or FSA, either directly or through reimbursement.

How to buy semaglutide using your HSA or FSA directly or with reimbursement

Even though semaglutide is a prescription medication, the way you pay for it with your HSA or FSA follows the same two methods used for many eligible healthcare purchases. You either pay directly at checkout with your benefits card or pay out of pocket and submit a reimbursement claim later.

Understanding both options helps you choose the approach that fits your situation, your plan rules, and where you buy semaglutide. The good news is that newer checkout solutions make the direct payment option much easier than it used to be.

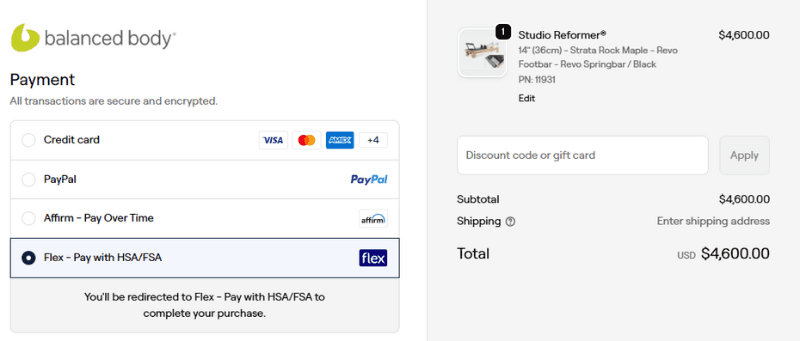

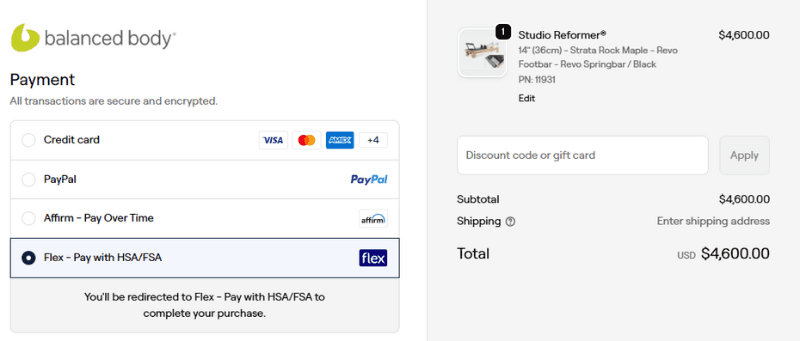

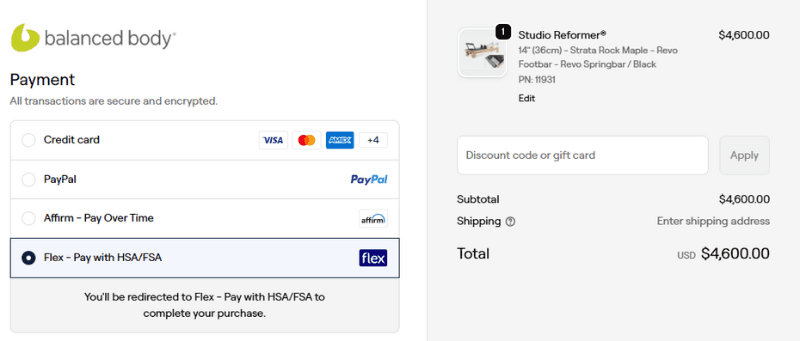

1. Buy semaglutide with your HSA/FSA directly at checkout

Paying directly with your HSA or FSA card is the simplest option when it’s available. You use your benefits card at checkout, and the funds come straight out of your account.

This method works best when:

The seller accepts HSA and FSA cards online

The prescription clearly qualifies as a medical expense

Any required documentation, such as an LMN, is handled upfront

Platforms like the Flex Marketplace make this process easier by bringing together stores and providers that already support HSA and FSA payments. Instead of guessing whether your card will work, you can browse options that are designed to accept your benefits at checkout.

Direct payment also reduces paperwork. Since the transaction happens within an eligible system, you are less likely to receive follow-up requests from your plan administrator.

If direct payment is not an option where you buy semaglutide, reimbursement offers a backup.

2. Make a reimbursement claim for semaglutide after paying out of pocket

Reimbursement works when you pay with a personal credit or debit card first and then ask your HSA or FSA administrator to pay you back. This method takes more time, but it still allows you to use pre-tax funds.

The reimbursement process usually looks like this:

Purchase semaglutide out of pocket

Save your receipt and prescription details

Submit a claim through your HSA or FSA portal

Include an LMN if your plan requires one

Approval times vary by plan, and missing documents can slow things down.

GLP-1/semaglutide can be expensive, and that’s why many people prefer shopping through the Flex Marketplace. Eligible products and documentation support are built right into your checkout experience, and you can use your HSA/FSA funds upfront, rather than waiting for reimbursement later.

Once you know how to pay, the final step is finding semaglutide options that work smoothly with your HSA or FSA from the start.

Even though semaglutide is a prescription medication, the way you pay for it with your HSA or FSA follows the same two methods used for many eligible healthcare purchases. You either pay directly at checkout with your benefits card or pay out of pocket and submit a reimbursement claim later.

Understanding both options helps you choose the approach that fits your situation, your plan rules, and where you buy semaglutide. The good news is that newer checkout solutions make the direct payment option much easier than it used to be.

1. Buy semaglutide with your HSA/FSA directly at checkout

Paying directly with your HSA or FSA card is the simplest option when it’s available. You use your benefits card at checkout, and the funds come straight out of your account.

This method works best when:

The seller accepts HSA and FSA cards online

The prescription clearly qualifies as a medical expense

Any required documentation, such as an LMN, is handled upfront

Platforms like the Flex Marketplace make this process easier by bringing together stores and providers that already support HSA and FSA payments. Instead of guessing whether your card will work, you can browse options that are designed to accept your benefits at checkout.

Direct payment also reduces paperwork. Since the transaction happens within an eligible system, you are less likely to receive follow-up requests from your plan administrator.

If direct payment is not an option where you buy semaglutide, reimbursement offers a backup.

2. Make a reimbursement claim for semaglutide after paying out of pocket

Reimbursement works when you pay with a personal credit or debit card first and then ask your HSA or FSA administrator to pay you back. This method takes more time, but it still allows you to use pre-tax funds.

The reimbursement process usually looks like this:

Purchase semaglutide out of pocket

Save your receipt and prescription details

Submit a claim through your HSA or FSA portal

Include an LMN if your plan requires one

Approval times vary by plan, and missing documents can slow things down.

GLP-1/semaglutide can be expensive, and that’s why many people prefer shopping through the Flex Marketplace. Eligible products and documentation support are built right into your checkout experience, and you can use your HSA/FSA funds upfront, rather than waiting for reimbursement later.

Once you know how to pay, the final step is finding semaglutide options that work smoothly with your HSA or FSA from the start.

Even though semaglutide is a prescription medication, the way you pay for it with your HSA or FSA follows the same two methods used for many eligible healthcare purchases. You either pay directly at checkout with your benefits card or pay out of pocket and submit a reimbursement claim later.

Understanding both options helps you choose the approach that fits your situation, your plan rules, and where you buy semaglutide. The good news is that newer checkout solutions make the direct payment option much easier than it used to be.

1. Buy semaglutide with your HSA/FSA directly at checkout

Paying directly with your HSA or FSA card is the simplest option when it’s available. You use your benefits card at checkout, and the funds come straight out of your account.

This method works best when:

The seller accepts HSA and FSA cards online

The prescription clearly qualifies as a medical expense

Any required documentation, such as an LMN, is handled upfront

Platforms like the Flex Marketplace make this process easier by bringing together stores and providers that already support HSA and FSA payments. Instead of guessing whether your card will work, you can browse options that are designed to accept your benefits at checkout.

Direct payment also reduces paperwork. Since the transaction happens within an eligible system, you are less likely to receive follow-up requests from your plan administrator.

If direct payment is not an option where you buy semaglutide, reimbursement offers a backup.

2. Make a reimbursement claim for semaglutide after paying out of pocket

Reimbursement works when you pay with a personal credit or debit card first and then ask your HSA or FSA administrator to pay you back. This method takes more time, but it still allows you to use pre-tax funds.

The reimbursement process usually looks like this:

Purchase semaglutide out of pocket

Save your receipt and prescription details

Submit a claim through your HSA or FSA portal

Include an LMN if your plan requires one

Approval times vary by plan, and missing documents can slow things down.

GLP-1/semaglutide can be expensive, and that’s why many people prefer shopping through the Flex Marketplace. Eligible products and documentation support are built right into your checkout experience, and you can use your HSA/FSA funds upfront, rather than waiting for reimbursement later.

Once you know how to pay, the final step is finding semaglutide options that work smoothly with your HSA or FSA from the start.

3 HSA & FSA approved semaglutide products you can buy with your HSA/FSA

If you want to use HSA or FSA funds for semaglutide without dealing with reimbursement headaches, choosing the right provider matters. Some brands focus on weight management programs that combine prescriptions, medical oversight, and tools that support long-term results.

Product | Description |

| Joi + Blokes offers medically guided weight management programs that may include semaglutide prescriptions. Their approach focuses on metabolic health, body composition, and sustainable weight loss, making it easier to justify HSA and FSA eligibility when prescribed for a qualifying condition. |

| Lumen supports weight management by helping you understand and improve your metabolism. When paired with provider-led treatment plans that include semaglutide, Lumen’s data-driven approach reinforces medical use tied to weight-related conditions that often qualify for HSA and FSA spending. |

| Hume Health focuses on body fat, muscle mass, and metabolic markers that play a key role in weight management. Their tools support clinically guided programs where GLP-1 may be prescribed, strengthening the medical basis for using HSA or FSA funds. |

Shopping with Flex brings these types of weight-focused health brands into one place, so you can quickly find options designed to work with HSA and FSA dollars. That simplicity makes it easier to put your pre-tax funds toward medically supported weight management without unnecessary friction.

In Summary

Semaglutide can be a powerful tool for weight management when it’s prescribed to treat a qualifying medical condition, and in many cases, you can use your HSA or FSA funds to help cover the cost. The key is understanding how eligibility works, when documentation matters, and where you shop.

Choosing providers that support medical oversight and HSA/FSA payments at checkout makes the process much easier. When you use the Flex Marketplace to find weight management brands that accept HSA and FSA cards directly, you reduce paperwork, avoid reimbursement delays, and put your pre-tax dollars to work right away.

Flex is not a medical provider of GLP-1/semaglutide products, so if you’re looking for a prescription, you should speak to your doctor. And then Flex is here to help facilitate you getting your GLP-1/semaglutide after you are eligible.

If you have unused HSA or FSA funds, semaglutide-based weight management programs may be a practical way to invest those dollars in your long-term health while staying within IRS guidelines.

If you want to use HSA or FSA funds for semaglutide without dealing with reimbursement headaches, choosing the right provider matters. Some brands focus on weight management programs that combine prescriptions, medical oversight, and tools that support long-term results.

Product | Description |

| Joi + Blokes offers medically guided weight management programs that may include semaglutide prescriptions. Their approach focuses on metabolic health, body composition, and sustainable weight loss, making it easier to justify HSA and FSA eligibility when prescribed for a qualifying condition. |

| Lumen supports weight management by helping you understand and improve your metabolism. When paired with provider-led treatment plans that include semaglutide, Lumen’s data-driven approach reinforces medical use tied to weight-related conditions that often qualify for HSA and FSA spending. |

| Hume Health focuses on body fat, muscle mass, and metabolic markers that play a key role in weight management. Their tools support clinically guided programs where GLP-1 may be prescribed, strengthening the medical basis for using HSA or FSA funds. |

Shopping with Flex brings these types of weight-focused health brands into one place, so you can quickly find options designed to work with HSA and FSA dollars. That simplicity makes it easier to put your pre-tax funds toward medically supported weight management without unnecessary friction.

In Summary

Semaglutide can be a powerful tool for weight management when it’s prescribed to treat a qualifying medical condition, and in many cases, you can use your HSA or FSA funds to help cover the cost. The key is understanding how eligibility works, when documentation matters, and where you shop.

Choosing providers that support medical oversight and HSA/FSA payments at checkout makes the process much easier. When you use the Flex Marketplace to find weight management brands that accept HSA and FSA cards directly, you reduce paperwork, avoid reimbursement delays, and put your pre-tax dollars to work right away.

Flex is not a medical provider of GLP-1/semaglutide products, so if you’re looking for a prescription, you should speak to your doctor. And then Flex is here to help facilitate you getting your GLP-1/semaglutide after you are eligible.

If you have unused HSA or FSA funds, semaglutide-based weight management programs may be a practical way to invest those dollars in your long-term health while staying within IRS guidelines.

If you want to use HSA or FSA funds for semaglutide without dealing with reimbursement headaches, choosing the right provider matters. Some brands focus on weight management programs that combine prescriptions, medical oversight, and tools that support long-term results.

Product | Description |

| Joi + Blokes offers medically guided weight management programs that may include semaglutide prescriptions. Their approach focuses on metabolic health, body composition, and sustainable weight loss, making it easier to justify HSA and FSA eligibility when prescribed for a qualifying condition. |

| Lumen supports weight management by helping you understand and improve your metabolism. When paired with provider-led treatment plans that include semaglutide, Lumen’s data-driven approach reinforces medical use tied to weight-related conditions that often qualify for HSA and FSA spending. |

| Hume Health focuses on body fat, muscle mass, and metabolic markers that play a key role in weight management. Their tools support clinically guided programs where GLP-1 may be prescribed, strengthening the medical basis for using HSA or FSA funds. |

Shopping with Flex brings these types of weight-focused health brands into one place, so you can quickly find options designed to work with HSA and FSA dollars. That simplicity makes it easier to put your pre-tax funds toward medically supported weight management without unnecessary friction.

In Summary

Semaglutide can be a powerful tool for weight management when it’s prescribed to treat a qualifying medical condition, and in many cases, you can use your HSA or FSA funds to help cover the cost. The key is understanding how eligibility works, when documentation matters, and where you shop.

Choosing providers that support medical oversight and HSA/FSA payments at checkout makes the process much easier. When you use the Flex Marketplace to find weight management brands that accept HSA and FSA cards directly, you reduce paperwork, avoid reimbursement delays, and put your pre-tax dollars to work right away.

Flex is not a medical provider of GLP-1/semaglutide products, so if you’re looking for a prescription, you should speak to your doctor. And then Flex is here to help facilitate you getting your GLP-1/semaglutide after you are eligible.

If you have unused HSA or FSA funds, semaglutide-based weight management programs may be a practical way to invest those dollars in your long-term health while staying within IRS guidelines.

Related content from Flex

More content from Flex

HSA/FSA ELIGIBLE SHOPPING

Shop the Flex HSA/FSA Marketplace

Discover HSA/FSA-eligible brands and products

Use your pre-tax HSA/FSA dollars at checkout

Improve your health and wellness with products you’ll love

Shop Now

Shop Now

Shop Now