Where To Get HSA/FSA Eligible Red Light Therapy

Yulia Derdemezis

Head of Marketing at Flex

Updated: December 16, 2025

🚀 Fast Facts: Is red light therapy HSA/FSA eligible?

Red light therapy can be covered by your HSA/FSA, as long as it’s for an approved medical condition

In most cases, an LMN is required to justify the expense as part of your treatment plan

Buying these devices online from an HSA/FSA eligible shop is the most convenient way to get them

Red light therapy can be covered by your HSA/FSA, as long as it’s for an approved medical condition

In most cases, an LMN is required to justify the expense as part of your treatment plan

Buying these devices online from an HSA/FSA eligible shop is the most convenient way to get them

Red light therapy can be covered by your HSA/FSA, as long as it’s for an approved medical condition

In most cases, an LMN is required to justify the expense as part of your treatment plan

Buying these devices online from an HSA/FSA eligible shop is the most convenient way to get them

Red light therapy can be covered by your HSA/FSA, as long as it’s for an approved medical condition

In most cases, an LMN is required to justify the expense as part of your treatment plan

Buying these devices online from an HSA/FSA eligible shop is the most convenient way to get them

Red light therapy has gained attention as a non-invasive treatment used to support pain relief, skin health, muscle recovery, and inflammation management. As interest grows, many people want to know whether red light therapy devices can be purchased using pre-tax dollars from a Health Savings Account (HSA) or Flexible Spending Account (FSA).

This guide explains when red light therapy may qualify as an HSA- or FSA-eligible expense, what documentation may be required, and how to purchase approved devices directly using your benefits.

7 medical conditions that qualify red light therapy to be HSA and FSA eligible

How to buy red light therapy equipment using your HSA or FSA

9 HSA & FSA approved red light therapy devices you can buy using your plan directly

Now, let’s start by breaking down how HSA and FSA rules apply to red light therapy and when these devices qualify as an eligible medical expense.

Red light therapy has gained attention as a non-invasive treatment used to support pain relief, skin health, muscle recovery, and inflammation management. As interest grows, many people want to know whether red light therapy devices can be purchased using pre-tax dollars from a Health Savings Account (HSA) or Flexible Spending Account (FSA).

This guide explains when red light therapy may qualify as an HSA- or FSA-eligible expense, what documentation may be required, and how to purchase approved devices directly using your benefits.

7 medical conditions that qualify red light therapy to be HSA and FSA eligible

How to buy red light therapy equipment using your HSA or FSA

9 HSA & FSA approved red light therapy devices you can buy using your plan directly

Now, let’s start by breaking down how HSA and FSA rules apply to red light therapy and when these devices qualify as an eligible medical expense.

Red light therapy has gained attention as a non-invasive treatment used to support pain relief, skin health, muscle recovery, and inflammation management. As interest grows, many people want to know whether red light therapy devices can be purchased using pre-tax dollars from a Health Savings Account (HSA) or Flexible Spending Account (FSA).

This guide explains when red light therapy may qualify as an HSA- or FSA-eligible expense, what documentation may be required, and how to purchase approved devices directly using your benefits.

7 medical conditions that qualify red light therapy to be HSA and FSA eligible

How to buy red light therapy equipment using your HSA or FSA

9 HSA & FSA approved red light therapy devices you can buy using your plan directly

Now, let’s start by breaking down how HSA and FSA rules apply to red light therapy and when these devices qualify as an eligible medical expense.

Is red light therapy HSA and FSA eligible?

Red light therapy can be HSA and FSA eligible when it is used to diagnose, treat, mitigate, or prevent a specific medical condition under IRS guidelines. To qualify, the primary purpose must be medical care rather than general wellness, relaxation, or routine fitness recovery.

Because red light therapy devices are commonly marketed for both medical and general wellness purposes, eligibility depends on how the device is used and whether there is a documented medical need. When a healthcare provider recommends red light therapy to address pain, inflammation, skin disorders, or injury recovery, the expense may qualify.

In contrast, red light therapy equipment purchased solely for aesthetic goals, fitness recovery without a diagnosis, or everyday wellness typically does not qualify. HSA and FSA administrators focus on intent and documentation, not marketing claims or product features.

In many cases, eligibility is clear when red light therapy is part of a treatment plan for a recognized condition. In other situations, additional documentation may be required to support medical necessity, which leads to whether or not you need a Letter of Medical Necessity.

Do you need a Letter of Medical Necessity to buy red light therapy equipment with your HSA/FSA?

A Letter of Medical Necessity (LMN) is not always required to purchase red light therapy equipment with an HSA or FSA, but it is often recommended. Because red light therapy devices are commonly used for both medical treatment and general wellness, many plan administrators request an LMN to confirm medical intent.

An LMN is typically required when the device is used to treat a diagnosed condition such as chronic pain, inflammation, joint disorders, or skin conditions. The letter should explain the medical condition being treated, how red light therapy supports care, and the duration of recommended use. This documentation helps establish eligibility under IRS guidelines.

In some cases, smaller or condition-specific devices may be approved without an LMN when purchased through an HSA/FSA-eligible retailer. However, having an LMN on file can reduce the risk of claim denial, reimbursement delays, or future audit issues, especially for higher-cost equipment.

Is there any difference in HSA/FSA eligibility between at-home red light therapy devices and in-person services?

Generally no, the device or service itself has no effect on the eligibility. An at-home red light therapy mask or getting a treatment in person have the same HSA/FSA eligibility criteria, and would be eligible for you as long as you have a qualifying medical condition and documentation with a Letter of Medical Necessity to support it.

Red light therapy can be HSA and FSA eligible when it is used to diagnose, treat, mitigate, or prevent a specific medical condition under IRS guidelines. To qualify, the primary purpose must be medical care rather than general wellness, relaxation, or routine fitness recovery.

Because red light therapy devices are commonly marketed for both medical and general wellness purposes, eligibility depends on how the device is used and whether there is a documented medical need. When a healthcare provider recommends red light therapy to address pain, inflammation, skin disorders, or injury recovery, the expense may qualify.

In contrast, red light therapy equipment purchased solely for aesthetic goals, fitness recovery without a diagnosis, or everyday wellness typically does not qualify. HSA and FSA administrators focus on intent and documentation, not marketing claims or product features.

In many cases, eligibility is clear when red light therapy is part of a treatment plan for a recognized condition. In other situations, additional documentation may be required to support medical necessity, which leads to whether or not you need a Letter of Medical Necessity.

Do you need a Letter of Medical Necessity to buy red light therapy equipment with your HSA/FSA?

A Letter of Medical Necessity (LMN) is not always required to purchase red light therapy equipment with an HSA or FSA, but it is often recommended. Because red light therapy devices are commonly used for both medical treatment and general wellness, many plan administrators request an LMN to confirm medical intent.

An LMN is typically required when the device is used to treat a diagnosed condition such as chronic pain, inflammation, joint disorders, or skin conditions. The letter should explain the medical condition being treated, how red light therapy supports care, and the duration of recommended use. This documentation helps establish eligibility under IRS guidelines.

In some cases, smaller or condition-specific devices may be approved without an LMN when purchased through an HSA/FSA-eligible retailer. However, having an LMN on file can reduce the risk of claim denial, reimbursement delays, or future audit issues, especially for higher-cost equipment.

Is there any difference in HSA/FSA eligibility between at-home red light therapy devices and in-person services?

Generally no, the device or service itself has no effect on the eligibility. An at-home red light therapy mask or getting a treatment in person have the same HSA/FSA eligibility criteria, and would be eligible for you as long as you have a qualifying medical condition and documentation with a Letter of Medical Necessity to support it.

Red light therapy can be HSA and FSA eligible when it is used to diagnose, treat, mitigate, or prevent a specific medical condition under IRS guidelines. To qualify, the primary purpose must be medical care rather than general wellness, relaxation, or routine fitness recovery.

Because red light therapy devices are commonly marketed for both medical and general wellness purposes, eligibility depends on how the device is used and whether there is a documented medical need. When a healthcare provider recommends red light therapy to address pain, inflammation, skin disorders, or injury recovery, the expense may qualify.

In contrast, red light therapy equipment purchased solely for aesthetic goals, fitness recovery without a diagnosis, or everyday wellness typically does not qualify. HSA and FSA administrators focus on intent and documentation, not marketing claims or product features.

In many cases, eligibility is clear when red light therapy is part of a treatment plan for a recognized condition. In other situations, additional documentation may be required to support medical necessity, which leads to whether or not you need a Letter of Medical Necessity.

Do you need a Letter of Medical Necessity to buy red light therapy equipment with your HSA/FSA?

A Letter of Medical Necessity (LMN) is not always required to purchase red light therapy equipment with an HSA or FSA, but it is often recommended. Because red light therapy devices are commonly used for both medical treatment and general wellness, many plan administrators request an LMN to confirm medical intent.

An LMN is typically required when the device is used to treat a diagnosed condition such as chronic pain, inflammation, joint disorders, or skin conditions. The letter should explain the medical condition being treated, how red light therapy supports care, and the duration of recommended use. This documentation helps establish eligibility under IRS guidelines.

In some cases, smaller or condition-specific devices may be approved without an LMN when purchased through an HSA/FSA-eligible retailer. However, having an LMN on file can reduce the risk of claim denial, reimbursement delays, or future audit issues, especially for higher-cost equipment.

Is there any difference in HSA/FSA eligibility between at-home red light therapy devices and in-person services?

Generally no, the device or service itself has no effect on the eligibility. An at-home red light therapy mask or getting a treatment in person have the same HSA/FSA eligibility criteria, and would be eligible for you as long as you have a qualifying medical condition and documentation with a Letter of Medical Necessity to support it.

7 medical conditions that qualify red light therapy to be HSA and FSA eligible

Red light therapy may qualify as an HSA- or FSA-eligible expense when it is used to treat or manage a diagnosed medical condition. Eligibility depends on whether the therapy supports medical care rather than general wellness, and whether it is recommended by a healthcare provider.

Common medical conditions that may qualify include:

Chronic pain conditions: These conditions involve ongoing pain, such as arthritis or musculoskeletal discomfort, that may benefit from red light therapy to help reduce symptoms and improve function.

Inflammatory conditions: These conditions include issues like tendonitis and bursitis, where inflammation causes pain and stiffness that may be managed with light therapy.

Muscle and joint injuries: These injuries include strains, sprains, or surgical recovery, where red light therapy may be used to support healing and mobility.

Skin conditions: These conditions include acne, eczema, psoriasis, or wound healing needs, where red light therapy may support skin repair and symptom management.

Neuropathy and nerve pain: These conditions involve nerve-related pain or sensitivity that may be addressed as part of a structured pain management plan.

Circulatory issues: These conditions affect blood flow and tissue health, where red light therapy may be used to support circulation under medical guidance.

Post-operative recovery: This condition refers to the healing period following surgery, where red light therapy may be used to reduce pain and support recovery.

To qualify, red light therapy must be used with the intent to treat or alleviate symptoms tied to one of these conditions. Devices purchased for general skincare, athletic recovery without a diagnosis, or everyday wellness typically fall outside eligibility guidelines.

Medical documentation, such as a diagnosis or treatment recommendation, helps establish that the expense meets HSA and FSA requirements and can reduce the risk of claim denial or audit issues.

Red light therapy may qualify as an HSA- or FSA-eligible expense when it is used to treat or manage a diagnosed medical condition. Eligibility depends on whether the therapy supports medical care rather than general wellness, and whether it is recommended by a healthcare provider.

Common medical conditions that may qualify include:

Chronic pain conditions: These conditions involve ongoing pain, such as arthritis or musculoskeletal discomfort, that may benefit from red light therapy to help reduce symptoms and improve function.

Inflammatory conditions: These conditions include issues like tendonitis and bursitis, where inflammation causes pain and stiffness that may be managed with light therapy.

Muscle and joint injuries: These injuries include strains, sprains, or surgical recovery, where red light therapy may be used to support healing and mobility.

Skin conditions: These conditions include acne, eczema, psoriasis, or wound healing needs, where red light therapy may support skin repair and symptom management.

Neuropathy and nerve pain: These conditions involve nerve-related pain or sensitivity that may be addressed as part of a structured pain management plan.

Circulatory issues: These conditions affect blood flow and tissue health, where red light therapy may be used to support circulation under medical guidance.

Post-operative recovery: This condition refers to the healing period following surgery, where red light therapy may be used to reduce pain and support recovery.

To qualify, red light therapy must be used with the intent to treat or alleviate symptoms tied to one of these conditions. Devices purchased for general skincare, athletic recovery without a diagnosis, or everyday wellness typically fall outside eligibility guidelines.

Medical documentation, such as a diagnosis or treatment recommendation, helps establish that the expense meets HSA and FSA requirements and can reduce the risk of claim denial or audit issues.

Red light therapy may qualify as an HSA- or FSA-eligible expense when it is used to treat or manage a diagnosed medical condition. Eligibility depends on whether the therapy supports medical care rather than general wellness, and whether it is recommended by a healthcare provider.

Common medical conditions that may qualify include:

Chronic pain conditions: These conditions involve ongoing pain, such as arthritis or musculoskeletal discomfort, that may benefit from red light therapy to help reduce symptoms and improve function.

Inflammatory conditions: These conditions include issues like tendonitis and bursitis, where inflammation causes pain and stiffness that may be managed with light therapy.

Muscle and joint injuries: These injuries include strains, sprains, or surgical recovery, where red light therapy may be used to support healing and mobility.

Skin conditions: These conditions include acne, eczema, psoriasis, or wound healing needs, where red light therapy may support skin repair and symptom management.

Neuropathy and nerve pain: These conditions involve nerve-related pain or sensitivity that may be addressed as part of a structured pain management plan.

Circulatory issues: These conditions affect blood flow and tissue health, where red light therapy may be used to support circulation under medical guidance.

Post-operative recovery: This condition refers to the healing period following surgery, where red light therapy may be used to reduce pain and support recovery.

To qualify, red light therapy must be used with the intent to treat or alleviate symptoms tied to one of these conditions. Devices purchased for general skincare, athletic recovery without a diagnosis, or everyday wellness typically fall outside eligibility guidelines.

Medical documentation, such as a diagnosis or treatment recommendation, helps establish that the expense meets HSA and FSA requirements and can reduce the risk of claim denial or audit issues.

How to buy red light therapy equipment using your HSA or FSA

There are two primary ways to use your HSA or FSA to purchase red light therapy equipment: paying directly with your benefits at checkout or paying out of pocket and submitting a reimbursement claim. The best option depends on where you shop and how your plan is administered.

Understanding how each method works can help you choose the most convenient option while staying compliant with plan rules and IRS requirements.

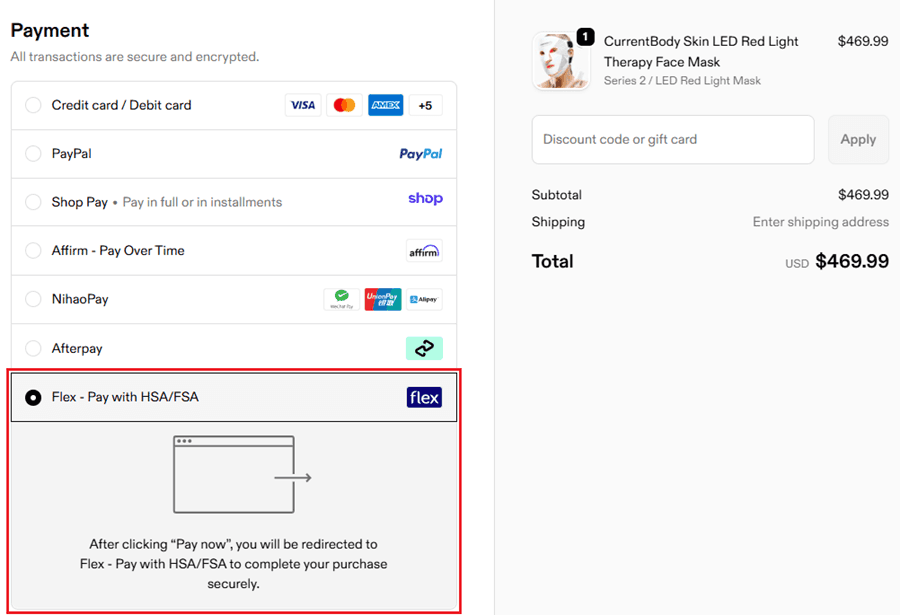

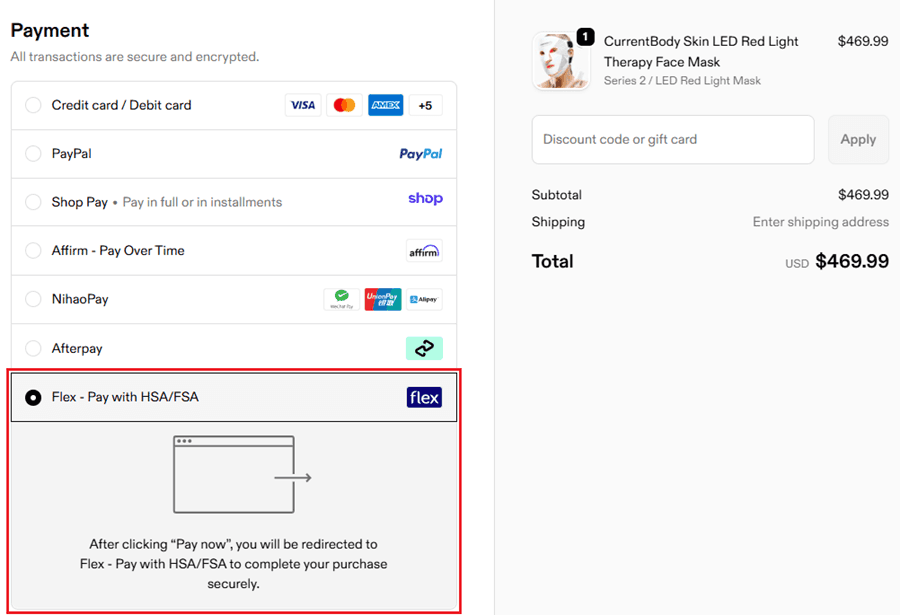

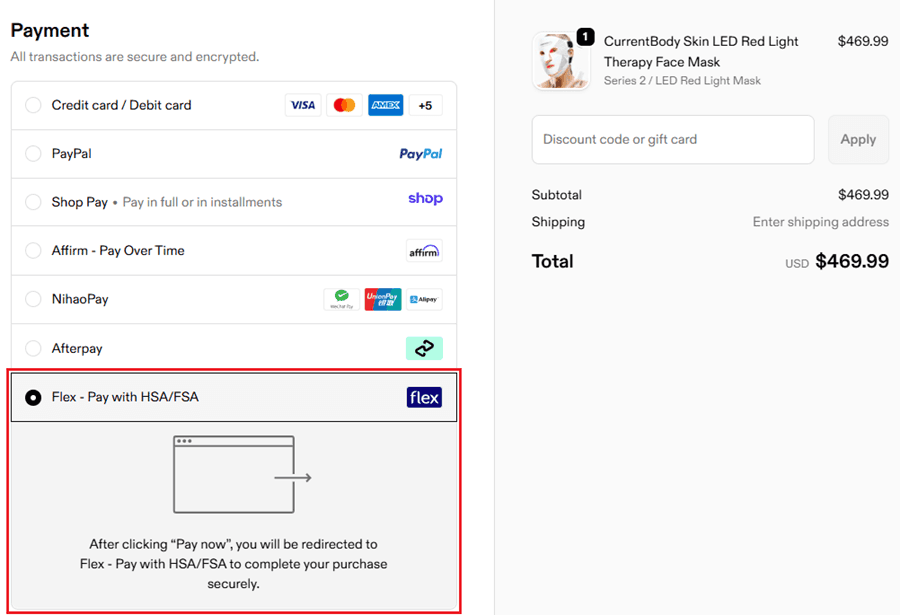

1. Pay with your HSA/FSA directly at checkout

When shopping online for HSA/FSA eligible red light therapy devices, you can sometimes use your HSA/FSA card at checkout just like a credit card. Eligible red light therapy devices are typically labeled clearly, helping ensure that your purchase is processed without issues.

This option is ideal for those who want a faster experience and fewer administrative steps. Purchasing through an HSA/FSA-focused shop also reduces the likelihood of purchasing non-eligible equipment by mistake.

Checkout our featured skincare brands in the Flex Marketplace. CurrentBody is one of our favorites!

2. Make a reimbursement claim

If a retailer does not accept HSA or FSA cards, you can pay out of pocket and submit a reimbursement claim to your plan administrator. This process usually requires an itemized receipt showing the product name, purchase date, and amount paid.

In some cases, a Letter of Medical Necessity may be required to support eligibility. Submitting complete documentation helps ensure your claim is reviewed smoothly and approved without unnecessary delays.

There are two primary ways to use your HSA or FSA to purchase red light therapy equipment: paying directly with your benefits at checkout or paying out of pocket and submitting a reimbursement claim. The best option depends on where you shop and how your plan is administered.

Understanding how each method works can help you choose the most convenient option while staying compliant with plan rules and IRS requirements.

1. Pay with your HSA/FSA directly at checkout

When shopping online for HSA/FSA eligible red light therapy devices, you can sometimes use your HSA/FSA card at checkout just like a credit card. Eligible red light therapy devices are typically labeled clearly, helping ensure that your purchase is processed without issues.

This option is ideal for those who want a faster experience and fewer administrative steps. Purchasing through an HSA/FSA-focused shop also reduces the likelihood of purchasing non-eligible equipment by mistake.

Checkout our featured skincare brands in the Flex Marketplace. CurrentBody is one of our favorites!

2. Make a reimbursement claim

If a retailer does not accept HSA or FSA cards, you can pay out of pocket and submit a reimbursement claim to your plan administrator. This process usually requires an itemized receipt showing the product name, purchase date, and amount paid.

In some cases, a Letter of Medical Necessity may be required to support eligibility. Submitting complete documentation helps ensure your claim is reviewed smoothly and approved without unnecessary delays.

There are two primary ways to use your HSA or FSA to purchase red light therapy equipment: paying directly with your benefits at checkout or paying out of pocket and submitting a reimbursement claim. The best option depends on where you shop and how your plan is administered.

Understanding how each method works can help you choose the most convenient option while staying compliant with plan rules and IRS requirements.

1. Pay with your HSA/FSA directly at checkout

When shopping online for HSA/FSA eligible red light therapy devices, you can sometimes use your HSA/FSA card at checkout just like a credit card. Eligible red light therapy devices are typically labeled clearly, helping ensure that your purchase is processed without issues.

This option is ideal for those who want a faster experience and fewer administrative steps. Purchasing through an HSA/FSA-focused shop also reduces the likelihood of purchasing non-eligible equipment by mistake.

Checkout our featured skincare brands in the Flex Marketplace. CurrentBody is one of our favorites!

2. Make a reimbursement claim

If a retailer does not accept HSA or FSA cards, you can pay out of pocket and submit a reimbursement claim to your plan administrator. This process usually requires an itemized receipt showing the product name, purchase date, and amount paid.

In some cases, a Letter of Medical Necessity may be required to support eligibility. Submitting complete documentation helps ensure your claim is reviewed smoothly and approved without unnecessary delays.

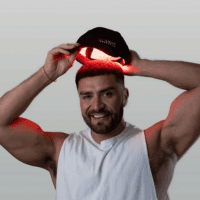

9 HSA & FSA approved red light therapy devices you can buy using your plan directly

The following brands offer red light therapy devices that are commonly purchased using HSA or FSA funds when used to treat a qualifying medical condition. Eligibility depends on intended medical use and, in some cases, supporting documentation.

Product | Description |

|---|---|

| CurrentBody offers a range of FDA-cleared red and near-infrared light therapy devices designed for skin health, pain relief, and recovery. Their masks and panels are often used as part of treatment plans for skin conditions, inflammation, and joint discomfort. |

| Omnilux specializes in professional-grade LED light therapy masks used in dermatology and clinical settings. These devices are frequently recommended for acne, inflammation, and other skin-related conditions, which can support HSA or FSA eligibility with medical intent. |

| Kineon combines red light therapy with compression and heat to support knee pain relief and joint health. Its systems are commonly used for arthritis, injury recovery, and chronic joint pain, making them strong candidates for HSA or FSA use when medically indicated. |

| Lumivisage focuses on red light therapy devices aimed at skin concerns such as acne and irritation. When used to manage diagnosed skin conditions rather than cosmetic goals, Lumivisage products may qualify as eligible medical expenses. |

| American Wellness Authority offers red light therapy panels and systems intended for pain management, inflammation reduction, and tissue support. These products are often used in home treatment plans for musculoskeletal and chronic pain conditions. |

| RedLight Innovation provides full-body panels and targeted therapy devices designed to support recovery, circulation, and pain relief. When incorporated into treatment for diagnosed conditions, these devices may meet eligibility requirements. |

| SOLshine Photo Nutrition produces red and near-infrared light therapy panels used for pain, inflammation, and healing support. Their products are commonly chosen for home therapy under medical guidance. |

| Ulike ReGlow is an LED light therapy mask designed for skin treatment, including acne and irritation management. When used to address a diagnosed skin condition rather than general skincare, it may qualify for HSA or FSA use. |

As you explore these red light therapy options, it’s helpful to confirm how each device fits into your specific treatment plan and benefit rules. With a clear understanding of eligibility and purchasing methods, you can move forward knowing how to use your HSA or FSA efficiently and with confidence.

The following brands offer red light therapy devices that are commonly purchased using HSA or FSA funds when used to treat a qualifying medical condition. Eligibility depends on intended medical use and, in some cases, supporting documentation.

Product | Description |

|---|---|

| CurrentBody offers a range of FDA-cleared red and near-infrared light therapy devices designed for skin health, pain relief, and recovery. Their masks and panels are often used as part of treatment plans for skin conditions, inflammation, and joint discomfort. |

| Omnilux specializes in professional-grade LED light therapy masks used in dermatology and clinical settings. These devices are frequently recommended for acne, inflammation, and other skin-related conditions, which can support HSA or FSA eligibility with medical intent. |

| Kineon combines red light therapy with compression and heat to support knee pain relief and joint health. Its systems are commonly used for arthritis, injury recovery, and chronic joint pain, making them strong candidates for HSA or FSA use when medically indicated. |

| Lumivisage focuses on red light therapy devices aimed at skin concerns such as acne and irritation. When used to manage diagnosed skin conditions rather than cosmetic goals, Lumivisage products may qualify as eligible medical expenses. |

| American Wellness Authority offers red light therapy panels and systems intended for pain management, inflammation reduction, and tissue support. These products are often used in home treatment plans for musculoskeletal and chronic pain conditions. |

| RedLight Innovation provides full-body panels and targeted therapy devices designed to support recovery, circulation, and pain relief. When incorporated into treatment for diagnosed conditions, these devices may meet eligibility requirements. |

| SOLshine Photo Nutrition produces red and near-infrared light therapy panels used for pain, inflammation, and healing support. Their products are commonly chosen for home therapy under medical guidance. |

| Ulike ReGlow is an LED light therapy mask designed for skin treatment, including acne and irritation management. When used to address a diagnosed skin condition rather than general skincare, it may qualify for HSA or FSA use. |

As you explore these red light therapy options, it’s helpful to confirm how each device fits into your specific treatment plan and benefit rules. With a clear understanding of eligibility and purchasing methods, you can move forward knowing how to use your HSA or FSA efficiently and with confidence.

The following brands offer red light therapy devices that are commonly purchased using HSA or FSA funds when used to treat a qualifying medical condition. Eligibility depends on intended medical use and, in some cases, supporting documentation.

Product | Description |

|---|---|

| CurrentBody offers a range of FDA-cleared red and near-infrared light therapy devices designed for skin health, pain relief, and recovery. Their masks and panels are often used as part of treatment plans for skin conditions, inflammation, and joint discomfort. |

| Omnilux specializes in professional-grade LED light therapy masks used in dermatology and clinical settings. These devices are frequently recommended for acne, inflammation, and other skin-related conditions, which can support HSA or FSA eligibility with medical intent. |

| Kineon combines red light therapy with compression and heat to support knee pain relief and joint health. Its systems are commonly used for arthritis, injury recovery, and chronic joint pain, making them strong candidates for HSA or FSA use when medically indicated. |

| Lumivisage focuses on red light therapy devices aimed at skin concerns such as acne and irritation. When used to manage diagnosed skin conditions rather than cosmetic goals, Lumivisage products may qualify as eligible medical expenses. |

| American Wellness Authority offers red light therapy panels and systems intended for pain management, inflammation reduction, and tissue support. These products are often used in home treatment plans for musculoskeletal and chronic pain conditions. |

| RedLight Innovation provides full-body panels and targeted therapy devices designed to support recovery, circulation, and pain relief. When incorporated into treatment for diagnosed conditions, these devices may meet eligibility requirements. |

| SOLshine Photo Nutrition produces red and near-infrared light therapy panels used for pain, inflammation, and healing support. Their products are commonly chosen for home therapy under medical guidance. |

| Ulike ReGlow is an LED light therapy mask designed for skin treatment, including acne and irritation management. When used to address a diagnosed skin condition rather than general skincare, it may qualify for HSA or FSA use. |

As you explore these red light therapy options, it’s helpful to confirm how each device fits into your specific treatment plan and benefit rules. With a clear understanding of eligibility and purchasing methods, you can move forward knowing how to use your HSA or FSA efficiently and with confidence.

In summary

Red light therapy can qualify as an HSA/FSA-eligible expense when it is used to treat, manage, or alleviate a diagnosed medical condition. Eligibility depends on medical intent, proper documentation, and how the device is used rather than how it is marketed. When therapy is part of a care plan for pain, inflammation, joint issues, or skin conditions, these purchases often meet IRS guidelines.

Shopping through an HSA/FSA-eligible shop — like the Flex Marketplace — makes the process simpler by clearly identifying qualifying products and allowing direct payment with your HSA/FSA funds. This approach helps reduce paperwork, avoid reimbursement delays, and ensures your pre-tax dollars are used confidently for approved red light therapy solutions.

Red light therapy can qualify as an HSA/FSA-eligible expense when it is used to treat, manage, or alleviate a diagnosed medical condition. Eligibility depends on medical intent, proper documentation, and how the device is used rather than how it is marketed. When therapy is part of a care plan for pain, inflammation, joint issues, or skin conditions, these purchases often meet IRS guidelines.

Shopping through an HSA/FSA-eligible shop — like the Flex Marketplace — makes the process simpler by clearly identifying qualifying products and allowing direct payment with your HSA/FSA funds. This approach helps reduce paperwork, avoid reimbursement delays, and ensures your pre-tax dollars are used confidently for approved red light therapy solutions.

Red light therapy can qualify as an HSA/FSA-eligible expense when it is used to treat, manage, or alleviate a diagnosed medical condition. Eligibility depends on medical intent, proper documentation, and how the device is used rather than how it is marketed. When therapy is part of a care plan for pain, inflammation, joint issues, or skin conditions, these purchases often meet IRS guidelines.

Shopping through an HSA/FSA-eligible shop — like the Flex Marketplace — makes the process simpler by clearly identifying qualifying products and allowing direct payment with your HSA/FSA funds. This approach helps reduce paperwork, avoid reimbursement delays, and ensures your pre-tax dollars are used confidently for approved red light therapy solutions.

Related content from Flex

More content from Flex

HSA/FSA ELIGIBLE SHOPPING

Shop the Flex HSA/FSA Marketplace

Discover HSA/FSA-eligible brands and products

Use your pre-tax HSA/FSA dollars at checkout

Improve your health and wellness with products you’ll love

Shop Now

Shop Now

Shop Now