Can You Lose Unspent HSA Money At Year End?: Explained

Yulia Derdemezis

Head of Marketing at Flex

Updated: December 18, 2025

🚀 Fast Facts: How to use your HSA funds before year-end

Your HSA funds do not expire at the end of the year, and instead carry over year to year

You can use your HSA to make eligible payments, even ones you’ve made years in the past

Find ways to spend your HSA funds with an exclusively HSA-eligible shop

Your HSA funds do not expire at the end of the year, and instead carry over year to year

You can use your HSA to make eligible payments, even ones you’ve made years in the past

Find ways to spend your HSA funds with an exclusively HSA-eligible shop

Your HSA funds do not expire at the end of the year, and instead carry over year to year

You can use your HSA to make eligible payments, even ones you’ve made years in the past

Find ways to spend your HSA funds with an exclusively HSA-eligible shop

Your HSA funds do not expire at the end of the year, and instead carry over year to year

You can use your HSA to make eligible payments, even ones you’ve made years in the past

Find ways to spend your HSA funds with an exclusively HSA-eligible shop

Health Savings Accounts (HSAs) can feel confusing at the end of the year. As deadlines approach, many people wonder whether they need to rush to the pharmacy or book appointments before December 31. This guide clears up the confusion and helps you decide what to do with your HSA dollars as the year winds down.

Creative ideas for how to spend your HSA money before the end of the year

25 popular products and services you can buy at the end of the year with your HSA

Understanding how HSAs actually work makes it easier to plan confidently, whether you plan to spend now or save for later. Let’s start by answering the biggest question people ask every fall.

Health Savings Accounts (HSAs) can feel confusing at the end of the year. As deadlines approach, many people wonder whether they need to rush to the pharmacy or book appointments before December 31. This guide clears up the confusion and helps you decide what to do with your HSA dollars as the year winds down.

Creative ideas for how to spend your HSA money before the end of the year

25 popular products and services you can buy at the end of the year with your HSA

Understanding how HSAs actually work makes it easier to plan confidently, whether you plan to spend now or save for later. Let’s start by answering the biggest question people ask every fall.

Health Savings Accounts (HSAs) can feel confusing at the end of the year. As deadlines approach, many people wonder whether they need to rush to the pharmacy or book appointments before December 31. This guide clears up the confusion and helps you decide what to do with your HSA dollars as the year winds down.

Creative ideas for how to spend your HSA money before the end of the year

25 popular products and services you can buy at the end of the year with your HSA

Understanding how HSAs actually work makes it easier to plan confidently, whether you plan to spend now or save for later. Let’s start by answering the biggest question people ask every fall.

Do you have to use your HSA by the end of the year?

As the end of the year approaches, many HSA holders worry about deadlines and potential forfeitures. The good news is that Health Savings Accounts (HSAs) follow very different rules from other workplace health benefits, and understanding those rules can remove a lot of unnecessary stress.

Can you lose unspent HSA funds?

No, you do not lose unspent HSA funds at the end of the year. Health Savings Accounts do not operate under a “use it or lose it” model, like a Flexible Spending Account (FSA) does. Any money left in your HSA automatically carries over into future years with no action required on your part.

An HSA is owned by you, not your employer or insurance company. This means the balance stays intact even if you change jobs, retire, or switch health plans. Funds remain available for eligible medical expenses for as long as the account exists.

While unused funds do not expire, annual contribution limits still apply. These limits reset each calendar year and are set by the IRS. Leaving money unspent does not reduce your ability to contribute in future years, as long as you remain eligible.

Why you may still want to spend your HSA dollars before the end of the year

Even though your HSA balance rolls over, there are situations where spending funds before year-end can make sense. If you already anticipate healthcare expenses, using HSA dollars now can reduce immediate out-of-pocket costs. Prescription refills, vision care, or planned treatments can be easier to manage financially when paid with pre-tax funds.

Some people also prefer to minimize recordkeeping complexity. Reimbursing expenses close to when they occur can simplify receipt tracking and reduce the risk of misplaced documentation years down the road.

Changes in coverage can also play a role. If you expect to move to a non-HSA-eligible health plan in the coming year, you can still spend existing HSA funds, but you may not be able to make new contributions. Using funds for known needs can feel practical in that scenario.

Lastly, healthcare prices tend to rise over time. Purchasing eligible items you know you will use—such as medical supplies or durable equipment—can help manage future costs without rushing into unnecessary spending.

Spending your HSA before year-end is optional, not mandatory. The choice should reflect your financial comfort level, healthcare needs, and long-term planning strategy.

As the end of the year approaches, many HSA holders worry about deadlines and potential forfeitures. The good news is that Health Savings Accounts (HSAs) follow very different rules from other workplace health benefits, and understanding those rules can remove a lot of unnecessary stress.

Can you lose unspent HSA funds?

No, you do not lose unspent HSA funds at the end of the year. Health Savings Accounts do not operate under a “use it or lose it” model, like a Flexible Spending Account (FSA) does. Any money left in your HSA automatically carries over into future years with no action required on your part.

An HSA is owned by you, not your employer or insurance company. This means the balance stays intact even if you change jobs, retire, or switch health plans. Funds remain available for eligible medical expenses for as long as the account exists.

While unused funds do not expire, annual contribution limits still apply. These limits reset each calendar year and are set by the IRS. Leaving money unspent does not reduce your ability to contribute in future years, as long as you remain eligible.

Why you may still want to spend your HSA dollars before the end of the year

Even though your HSA balance rolls over, there are situations where spending funds before year-end can make sense. If you already anticipate healthcare expenses, using HSA dollars now can reduce immediate out-of-pocket costs. Prescription refills, vision care, or planned treatments can be easier to manage financially when paid with pre-tax funds.

Some people also prefer to minimize recordkeeping complexity. Reimbursing expenses close to when they occur can simplify receipt tracking and reduce the risk of misplaced documentation years down the road.

Changes in coverage can also play a role. If you expect to move to a non-HSA-eligible health plan in the coming year, you can still spend existing HSA funds, but you may not be able to make new contributions. Using funds for known needs can feel practical in that scenario.

Lastly, healthcare prices tend to rise over time. Purchasing eligible items you know you will use—such as medical supplies or durable equipment—can help manage future costs without rushing into unnecessary spending.

Spending your HSA before year-end is optional, not mandatory. The choice should reflect your financial comfort level, healthcare needs, and long-term planning strategy.

As the end of the year approaches, many HSA holders worry about deadlines and potential forfeitures. The good news is that Health Savings Accounts (HSAs) follow very different rules from other workplace health benefits, and understanding those rules can remove a lot of unnecessary stress.

Can you lose unspent HSA funds?

No, you do not lose unspent HSA funds at the end of the year. Health Savings Accounts do not operate under a “use it or lose it” model, like a Flexible Spending Account (FSA) does. Any money left in your HSA automatically carries over into future years with no action required on your part.

An HSA is owned by you, not your employer or insurance company. This means the balance stays intact even if you change jobs, retire, or switch health plans. Funds remain available for eligible medical expenses for as long as the account exists.

While unused funds do not expire, annual contribution limits still apply. These limits reset each calendar year and are set by the IRS. Leaving money unspent does not reduce your ability to contribute in future years, as long as you remain eligible.

Why you may still want to spend your HSA dollars before the end of the year

Even though your HSA balance rolls over, there are situations where spending funds before year-end can make sense. If you already anticipate healthcare expenses, using HSA dollars now can reduce immediate out-of-pocket costs. Prescription refills, vision care, or planned treatments can be easier to manage financially when paid with pre-tax funds.

Some people also prefer to minimize recordkeeping complexity. Reimbursing expenses close to when they occur can simplify receipt tracking and reduce the risk of misplaced documentation years down the road.

Changes in coverage can also play a role. If you expect to move to a non-HSA-eligible health plan in the coming year, you can still spend existing HSA funds, but you may not be able to make new contributions. Using funds for known needs can feel practical in that scenario.

Lastly, healthcare prices tend to rise over time. Purchasing eligible items you know you will use—such as medical supplies or durable equipment—can help manage future costs without rushing into unnecessary spending.

Spending your HSA before year-end is optional, not mandatory. The choice should reflect your financial comfort level, healthcare needs, and long-term planning strategy.

Creative ideas for how to spend your HSA money before the end of the year

If you choose to use some of your HSA funds before December 31, a structured plan can help you avoid rushed or unnecessary purchases. Below are practical and thoughtful ways to spend HSA dollars while staying aligned with eligible medical expenses.

1. Schedule preventive and routine care appointments

Year-end can be a good time to book appointments you may have been postponing. Annual physicals, follow-up visits recommended by a provider, vision exams, and certain diagnostic screenings qualify as eligible expenses. Using HSA funds for these visits helps cover care you already need while reducing out-of-pocket costs.

2. Stock up on everyday medical supplies

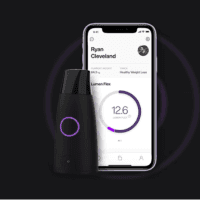

Many commonly used health items qualify for HSA spending. First aid kits, bandages, thermometers, blood pressure monitors, glucose testing supplies, and contact lens solution are all eligible when used for medical purposes. Purchasing these items ahead of time ensures you have essentials on hand without dipping into future cash flow. At-home testing devices like the Lumen can help you meet your health goals in the new year.

3. Plan ahead for prescription and treatment needs

If you take ongoing medications or use medical treatments regularly, refilling prescriptions or purchasing supplies before year-end can be a practical move. HSA funds can be used for prescription medications and certain over-the-counter drugs, helping you start the new year prepared.

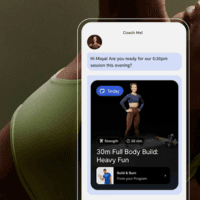

4. Invest in physical care and recovery services

Services such as physical therapy, chiropractic care, or rehabilitative treatments may qualify when recommended by a healthcare professional. Using HSA funds for these services can support recovery, mobility, and pain management rather than delaying care due to cost concerns. The Flowell Advanced Compression Therapy device can be a great at-home device to help with numerous health conditions.

5. Use HSA funds for mental and behavioral health care

Therapy sessions, counseling, and other mental health services provided by licensed professionals are eligible HSA expenses. Paying for these services with HSA dollars can support consistent care and make ongoing treatment easier to maintain.

6. Reimburse yourself for past qualified expenses

One unique feature of an HSA is the ability to reimburse yourself for qualified medical expenses at any time, as long as the expense was incurred after your HSA was first established. There is no requirement to request reimbursement in the same year the expense occurred. If you paid out of pocket for eligible medical care and kept your receipts, you can use your HSA funds later to repay yourself, making this a flexible option for managing healthcare costs while allowing your balance to grow in the meantime.

7. Purchase eligible durable medical equipment

Items designed for longer-term medical use, such as braces, orthotic inserts, mobility aids, or even pill and medication cases like the Ikigai often qualify for HSA spending. Buying these before year-end can help address ongoing needs and reduce future healthcare expenses.

Using your HSA before the end of the year does not require urgency or excess. A thoughtful approach allows you to support your health while keeping your financial plan steady and organized.

If you choose to use some of your HSA funds before December 31, a structured plan can help you avoid rushed or unnecessary purchases. Below are practical and thoughtful ways to spend HSA dollars while staying aligned with eligible medical expenses.

1. Schedule preventive and routine care appointments

Year-end can be a good time to book appointments you may have been postponing. Annual physicals, follow-up visits recommended by a provider, vision exams, and certain diagnostic screenings qualify as eligible expenses. Using HSA funds for these visits helps cover care you already need while reducing out-of-pocket costs.

2. Stock up on everyday medical supplies

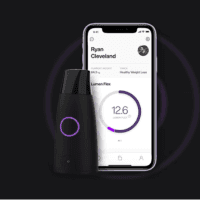

Many commonly used health items qualify for HSA spending. First aid kits, bandages, thermometers, blood pressure monitors, glucose testing supplies, and contact lens solution are all eligible when used for medical purposes. Purchasing these items ahead of time ensures you have essentials on hand without dipping into future cash flow. At-home testing devices like the Lumen can help you meet your health goals in the new year.

3. Plan ahead for prescription and treatment needs

If you take ongoing medications or use medical treatments regularly, refilling prescriptions or purchasing supplies before year-end can be a practical move. HSA funds can be used for prescription medications and certain over-the-counter drugs, helping you start the new year prepared.

4. Invest in physical care and recovery services

Services such as physical therapy, chiropractic care, or rehabilitative treatments may qualify when recommended by a healthcare professional. Using HSA funds for these services can support recovery, mobility, and pain management rather than delaying care due to cost concerns. The Flowell Advanced Compression Therapy device can be a great at-home device to help with numerous health conditions.

5. Use HSA funds for mental and behavioral health care

Therapy sessions, counseling, and other mental health services provided by licensed professionals are eligible HSA expenses. Paying for these services with HSA dollars can support consistent care and make ongoing treatment easier to maintain.

6. Reimburse yourself for past qualified expenses

One unique feature of an HSA is the ability to reimburse yourself for qualified medical expenses at any time, as long as the expense was incurred after your HSA was first established. There is no requirement to request reimbursement in the same year the expense occurred. If you paid out of pocket for eligible medical care and kept your receipts, you can use your HSA funds later to repay yourself, making this a flexible option for managing healthcare costs while allowing your balance to grow in the meantime.

7. Purchase eligible durable medical equipment

Items designed for longer-term medical use, such as braces, orthotic inserts, mobility aids, or even pill and medication cases like the Ikigai often qualify for HSA spending. Buying these before year-end can help address ongoing needs and reduce future healthcare expenses.

Using your HSA before the end of the year does not require urgency or excess. A thoughtful approach allows you to support your health while keeping your financial plan steady and organized.

If you choose to use some of your HSA funds before December 31, a structured plan can help you avoid rushed or unnecessary purchases. Below are practical and thoughtful ways to spend HSA dollars while staying aligned with eligible medical expenses.

1. Schedule preventive and routine care appointments

Year-end can be a good time to book appointments you may have been postponing. Annual physicals, follow-up visits recommended by a provider, vision exams, and certain diagnostic screenings qualify as eligible expenses. Using HSA funds for these visits helps cover care you already need while reducing out-of-pocket costs.

2. Stock up on everyday medical supplies

Many commonly used health items qualify for HSA spending. First aid kits, bandages, thermometers, blood pressure monitors, glucose testing supplies, and contact lens solution are all eligible when used for medical purposes. Purchasing these items ahead of time ensures you have essentials on hand without dipping into future cash flow. At-home testing devices like the Lumen can help you meet your health goals in the new year.

3. Plan ahead for prescription and treatment needs

If you take ongoing medications or use medical treatments regularly, refilling prescriptions or purchasing supplies before year-end can be a practical move. HSA funds can be used for prescription medications and certain over-the-counter drugs, helping you start the new year prepared.

4. Invest in physical care and recovery services

Services such as physical therapy, chiropractic care, or rehabilitative treatments may qualify when recommended by a healthcare professional. Using HSA funds for these services can support recovery, mobility, and pain management rather than delaying care due to cost concerns. The Flowell Advanced Compression Therapy device can be a great at-home device to help with numerous health conditions.

5. Use HSA funds for mental and behavioral health care

Therapy sessions, counseling, and other mental health services provided by licensed professionals are eligible HSA expenses. Paying for these services with HSA dollars can support consistent care and make ongoing treatment easier to maintain.

6. Reimburse yourself for past qualified expenses

One unique feature of an HSA is the ability to reimburse yourself for qualified medical expenses at any time, as long as the expense was incurred after your HSA was first established. There is no requirement to request reimbursement in the same year the expense occurred. If you paid out of pocket for eligible medical care and kept your receipts, you can use your HSA funds later to repay yourself, making this a flexible option for managing healthcare costs while allowing your balance to grow in the meantime.

7. Purchase eligible durable medical equipment

Items designed for longer-term medical use, such as braces, orthotic inserts, mobility aids, or even pill and medication cases like the Ikigai often qualify for HSA spending. Buying these before year-end can help address ongoing needs and reduce future healthcare expenses.

Using your HSA before the end of the year does not require urgency or excess. A thoughtful approach allows you to support your health while keeping your financial plan steady and organized.

25 popular products and services you can buy at the end of the year with your HSA

HSAs can be used for a wide range of products and services that support medical care, recovery, and condition management at home. Eligibility depends on intended use and IRS guidelines, so keeping receipts and any supporting documentation is important. The brands below are commonly explored by HSA users because their products often align with health-related needs rather than purely lifestyle purchases.

Fitness and exercise products & services

Fitness-related purchases may qualify when they support rehabilitation, injury recovery, mobility improvement, or a provider-directed exercise plan.

Product | Description |

|---|---|

| YourReformer offers Pilates reformers designed for controlled, low-impact movement. These systems are often used for physical therapy-style workouts that focus on core strength, joint stability, posture, and flexibility. Such training can support recovery from injury, chronic pain management, or mobility limitations when used for medical purposes. |

| Powerblock specializes in adjustable dumbbells that replace large sets of free weights. Their products support progressive strength training, which is commonly recommended for bone density support, joint stability, and rehabilitation programs following injury or surgery. |

| Tempo provides smart strength-training equipment paired with guided coaching and form feedback. The platform emphasizes safe, structured movement, making it useful for individuals following provider-recommended strength or mobility programs tied to specific health goals. |

![iFit guided workouts]](https://framerusercontent.com/images/nGai35XDXSh9ActXkqne6bhTre0.png) | iFit is a digital fitness subscription offering guided workouts across strength, cardio, flexibility, and recovery. These programs are often used alongside treadmills, bikes, or rowers as part of medically advised exercise routines focused on weight management, cardiovascular health, or injury-safe movement. |

| Ampfit focuses on electrical muscle stimulation and recovery-oriented fitness tools. These products are commonly used to support muscle activation, pain management, and rehabilitation efforts, especially for individuals recovering from injury or managing chronic muscle issues. |

Sleep wellness products

Sleep-related products may qualify when they address medical sleep issues, stress-related symptoms, or recovery needs tied to diagnosed conditions.

Product | Description |

|---|---|

| BedJet offers temperature-regulating bedding systems that actively heat or cool the bed throughout the night. These products are often used to manage night sweats, temperature sensitivity, or sleep disruption related to hormonal changes or medical conditions. |

| Pulsetto produces wearable devices designed to stimulate the vagus nerve, which plays a role in stress regulation and sleep quality. These devices are frequently associated with managing anxiety, sleep disturbances, and nervous system regulation. |

| Ozlo Sleep develops wearable sleep technology that tracks sleep cycles and supports sleep improvement strategies. These tools are often used to better understand sleep patterns tied to fatigue, recovery, or ongoing health concerns. |

| Hostage Tape offers medical-grade mouth tape designed to support nasal breathing during sleep. These products are often used by individuals managing snoring, dry mouth, mouth breathing, or sleep disruption related to airway and breathing concerns. |

| Coop Sleep Goods specializes in adjustable pillows designed to support proper spinal alignment. These pillows are often used for neck pain, shoulder discomfort, and posture-related sleep issues. |

Footwear, clothing, or home wellness products

Certain apparel and home wellness items qualify when they provide medical support, protection, or posture correction rather than fashion-driven use.

Product | Description |

|---|---|

| Forme creates posture-correcting apparel designed to support spinal alignment and muscle engagement. These garments are often used to reduce back pain, improve posture awareness, and support musculoskeletal health during daily activities. |

| Ribcap designs discreet protective headwear for individuals at risk of falls or head injuries. Their products are commonly used by people managing balance issues, neurological conditions, or recovery from prior head trauma. |

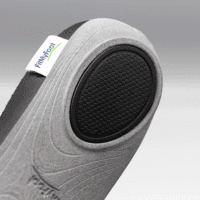

| FitMyFoot offers custom orthotic insoles created from foot scans. These insoles are designed to address foot pain, gait issues, plantar fasciitis, and posture-related discomfort linked to foot alignment. |

| CurrentBody sells home-use wellness and light therapy devices often associated with pain relief, muscle recovery, and skin-related medical treatments. Many of their products are designed for therapeutic use rather than cosmetic enhancement. |

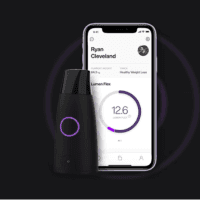

| Lumen is a handheld metabolic tracking device that measures breath to provide insights into energy utilization. It is often used in structured metabolic health or weight management programs guided by healthcare professionals. |

Supplements and nutrition products

Supplements may qualify for HSA spending when recommended by a healthcare provider to treat or manage a specific condition. General wellness supplements typically require medical justification.

Product | Description |

|---|---|

| Wellspring Meds offers practitioner-guided supplements formulated to address hormone balance, nutrient deficiencies, and condition-specific needs. These products are often used as part of structured treatment plans. |

| The Pause Life develops products aimed at managing menopause-related symptoms such as sleep disruption, joint discomfort, and hormonal changes, often under provider guidance. |

| Biome Secret focuses on gut-health supplements designed to support digestive conditions. Their formulations are commonly used alongside dietary or medical protocols for gastrointestinal health. |

| Rootless offers supplements focused on metabolic health and blood sugar regulation. These products are often used in nutrition plans tied to insulin sensitivity or metabolic conditions. |

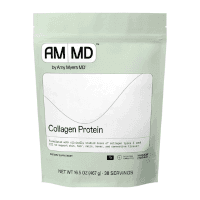

| Amy Myers MD provides physician-formulated supplements designed to support autoimmune, thyroid, and digestive health. These products are frequently used as part of condition-specific care plans. |

Skincare products

Skincare products can qualify when they treat or manage medical skin conditions rather than aesthetic concerns.

Product | Description |

|---|---|

| Freaks of Nature offers skin protection and recovery products designed to support barrier repair, sun protection, and irritation management, particularly for active or outdoor-related skin stress. |

| Lure Essentials produces skincare tools and cleansing products focused on maintaining skin health in dermatologist-directed routines, often tied to acne or sensitivity management. |

| PMD Beauty creates skincare devices designed for cleansing and treatment. These tools are often used to support acne management, exfoliation for medical skin conditions, or provider-recommended skincare routines. |

| Certain Clé de Peau Beauté products may qualify when used under medical guidance for treating specific dermatological conditions rather than cosmetic enhancement. |

| Popmask offers self-heating eye masks designed to support dry eye symptoms, eye strain, and relaxation. These masks are often used by individuals managing screen-related eye discomfort, tension headaches, or medically related eye fatigue. |

This expanded view can help you evaluate end-of-year HSA spending with clarity, focusing on products and services that genuinely support health needs while remaining compliant with HSA guidelines.

HSAs can be used for a wide range of products and services that support medical care, recovery, and condition management at home. Eligibility depends on intended use and IRS guidelines, so keeping receipts and any supporting documentation is important. The brands below are commonly explored by HSA users because their products often align with health-related needs rather than purely lifestyle purchases.

Fitness and exercise products & services

Fitness-related purchases may qualify when they support rehabilitation, injury recovery, mobility improvement, or a provider-directed exercise plan.

Product | Description |

|---|---|

| YourReformer offers Pilates reformers designed for controlled, low-impact movement. These systems are often used for physical therapy-style workouts that focus on core strength, joint stability, posture, and flexibility. Such training can support recovery from injury, chronic pain management, or mobility limitations when used for medical purposes. |

| Powerblock specializes in adjustable dumbbells that replace large sets of free weights. Their products support progressive strength training, which is commonly recommended for bone density support, joint stability, and rehabilitation programs following injury or surgery. |

| Tempo provides smart strength-training equipment paired with guided coaching and form feedback. The platform emphasizes safe, structured movement, making it useful for individuals following provider-recommended strength or mobility programs tied to specific health goals. |

![iFit guided workouts]](https://framerusercontent.com/images/nGai35XDXSh9ActXkqne6bhTre0.png) | iFit is a digital fitness subscription offering guided workouts across strength, cardio, flexibility, and recovery. These programs are often used alongside treadmills, bikes, or rowers as part of medically advised exercise routines focused on weight management, cardiovascular health, or injury-safe movement. |

| Ampfit focuses on electrical muscle stimulation and recovery-oriented fitness tools. These products are commonly used to support muscle activation, pain management, and rehabilitation efforts, especially for individuals recovering from injury or managing chronic muscle issues. |

Sleep wellness products

Sleep-related products may qualify when they address medical sleep issues, stress-related symptoms, or recovery needs tied to diagnosed conditions.

Product | Description |

|---|---|

| BedJet offers temperature-regulating bedding systems that actively heat or cool the bed throughout the night. These products are often used to manage night sweats, temperature sensitivity, or sleep disruption related to hormonal changes or medical conditions. |

| Pulsetto produces wearable devices designed to stimulate the vagus nerve, which plays a role in stress regulation and sleep quality. These devices are frequently associated with managing anxiety, sleep disturbances, and nervous system regulation. |

| Ozlo Sleep develops wearable sleep technology that tracks sleep cycles and supports sleep improvement strategies. These tools are often used to better understand sleep patterns tied to fatigue, recovery, or ongoing health concerns. |

| Hostage Tape offers medical-grade mouth tape designed to support nasal breathing during sleep. These products are often used by individuals managing snoring, dry mouth, mouth breathing, or sleep disruption related to airway and breathing concerns. |

| Coop Sleep Goods specializes in adjustable pillows designed to support proper spinal alignment. These pillows are often used for neck pain, shoulder discomfort, and posture-related sleep issues. |

Footwear, clothing, or home wellness products

Certain apparel and home wellness items qualify when they provide medical support, protection, or posture correction rather than fashion-driven use.

Product | Description |

|---|---|

| Forme creates posture-correcting apparel designed to support spinal alignment and muscle engagement. These garments are often used to reduce back pain, improve posture awareness, and support musculoskeletal health during daily activities. |

| Ribcap designs discreet protective headwear for individuals at risk of falls or head injuries. Their products are commonly used by people managing balance issues, neurological conditions, or recovery from prior head trauma. |

| FitMyFoot offers custom orthotic insoles created from foot scans. These insoles are designed to address foot pain, gait issues, plantar fasciitis, and posture-related discomfort linked to foot alignment. |

| CurrentBody sells home-use wellness and light therapy devices often associated with pain relief, muscle recovery, and skin-related medical treatments. Many of their products are designed for therapeutic use rather than cosmetic enhancement. |

| Lumen is a handheld metabolic tracking device that measures breath to provide insights into energy utilization. It is often used in structured metabolic health or weight management programs guided by healthcare professionals. |

Supplements and nutrition products

Supplements may qualify for HSA spending when recommended by a healthcare provider to treat or manage a specific condition. General wellness supplements typically require medical justification.

Product | Description |

|---|---|

| Wellspring Meds offers practitioner-guided supplements formulated to address hormone balance, nutrient deficiencies, and condition-specific needs. These products are often used as part of structured treatment plans. |

| The Pause Life develops products aimed at managing menopause-related symptoms such as sleep disruption, joint discomfort, and hormonal changes, often under provider guidance. |

| Biome Secret focuses on gut-health supplements designed to support digestive conditions. Their formulations are commonly used alongside dietary or medical protocols for gastrointestinal health. |

| Rootless offers supplements focused on metabolic health and blood sugar regulation. These products are often used in nutrition plans tied to insulin sensitivity or metabolic conditions. |

| Amy Myers MD provides physician-formulated supplements designed to support autoimmune, thyroid, and digestive health. These products are frequently used as part of condition-specific care plans. |

Skincare products

Skincare products can qualify when they treat or manage medical skin conditions rather than aesthetic concerns.

Product | Description |

|---|---|

| Freaks of Nature offers skin protection and recovery products designed to support barrier repair, sun protection, and irritation management, particularly for active or outdoor-related skin stress. |

| Lure Essentials produces skincare tools and cleansing products focused on maintaining skin health in dermatologist-directed routines, often tied to acne or sensitivity management. |

| PMD Beauty creates skincare devices designed for cleansing and treatment. These tools are often used to support acne management, exfoliation for medical skin conditions, or provider-recommended skincare routines. |

| Certain Clé de Peau Beauté products may qualify when used under medical guidance for treating specific dermatological conditions rather than cosmetic enhancement. |

| Popmask offers self-heating eye masks designed to support dry eye symptoms, eye strain, and relaxation. These masks are often used by individuals managing screen-related eye discomfort, tension headaches, or medically related eye fatigue. |

This expanded view can help you evaluate end-of-year HSA spending with clarity, focusing on products and services that genuinely support health needs while remaining compliant with HSA guidelines.

HSAs can be used for a wide range of products and services that support medical care, recovery, and condition management at home. Eligibility depends on intended use and IRS guidelines, so keeping receipts and any supporting documentation is important. The brands below are commonly explored by HSA users because their products often align with health-related needs rather than purely lifestyle purchases.

Fitness and exercise products & services

Fitness-related purchases may qualify when they support rehabilitation, injury recovery, mobility improvement, or a provider-directed exercise plan.

Product | Description |

|---|---|

| YourReformer offers Pilates reformers designed for controlled, low-impact movement. These systems are often used for physical therapy-style workouts that focus on core strength, joint stability, posture, and flexibility. Such training can support recovery from injury, chronic pain management, or mobility limitations when used for medical purposes. |

| Powerblock specializes in adjustable dumbbells that replace large sets of free weights. Their products support progressive strength training, which is commonly recommended for bone density support, joint stability, and rehabilitation programs following injury or surgery. |

| Tempo provides smart strength-training equipment paired with guided coaching and form feedback. The platform emphasizes safe, structured movement, making it useful for individuals following provider-recommended strength or mobility programs tied to specific health goals. |

![iFit guided workouts]](https://framerusercontent.com/images/nGai35XDXSh9ActXkqne6bhTre0.png) | iFit is a digital fitness subscription offering guided workouts across strength, cardio, flexibility, and recovery. These programs are often used alongside treadmills, bikes, or rowers as part of medically advised exercise routines focused on weight management, cardiovascular health, or injury-safe movement. |

| Ampfit focuses on electrical muscle stimulation and recovery-oriented fitness tools. These products are commonly used to support muscle activation, pain management, and rehabilitation efforts, especially for individuals recovering from injury or managing chronic muscle issues. |

Sleep wellness products

Sleep-related products may qualify when they address medical sleep issues, stress-related symptoms, or recovery needs tied to diagnosed conditions.

Product | Description |

|---|---|

| BedJet offers temperature-regulating bedding systems that actively heat or cool the bed throughout the night. These products are often used to manage night sweats, temperature sensitivity, or sleep disruption related to hormonal changes or medical conditions. |

| Pulsetto produces wearable devices designed to stimulate the vagus nerve, which plays a role in stress regulation and sleep quality. These devices are frequently associated with managing anxiety, sleep disturbances, and nervous system regulation. |

| Ozlo Sleep develops wearable sleep technology that tracks sleep cycles and supports sleep improvement strategies. These tools are often used to better understand sleep patterns tied to fatigue, recovery, or ongoing health concerns. |

| Hostage Tape offers medical-grade mouth tape designed to support nasal breathing during sleep. These products are often used by individuals managing snoring, dry mouth, mouth breathing, or sleep disruption related to airway and breathing concerns. |

| Coop Sleep Goods specializes in adjustable pillows designed to support proper spinal alignment. These pillows are often used for neck pain, shoulder discomfort, and posture-related sleep issues. |

Footwear, clothing, or home wellness products

Certain apparel and home wellness items qualify when they provide medical support, protection, or posture correction rather than fashion-driven use.

Product | Description |

|---|---|

| Forme creates posture-correcting apparel designed to support spinal alignment and muscle engagement. These garments are often used to reduce back pain, improve posture awareness, and support musculoskeletal health during daily activities. |

| Ribcap designs discreet protective headwear for individuals at risk of falls or head injuries. Their products are commonly used by people managing balance issues, neurological conditions, or recovery from prior head trauma. |

| FitMyFoot offers custom orthotic insoles created from foot scans. These insoles are designed to address foot pain, gait issues, plantar fasciitis, and posture-related discomfort linked to foot alignment. |

| CurrentBody sells home-use wellness and light therapy devices often associated with pain relief, muscle recovery, and skin-related medical treatments. Many of their products are designed for therapeutic use rather than cosmetic enhancement. |

| Lumen is a handheld metabolic tracking device that measures breath to provide insights into energy utilization. It is often used in structured metabolic health or weight management programs guided by healthcare professionals. |

Supplements and nutrition products

Supplements may qualify for HSA spending when recommended by a healthcare provider to treat or manage a specific condition. General wellness supplements typically require medical justification.

Product | Description |

|---|---|

| Wellspring Meds offers practitioner-guided supplements formulated to address hormone balance, nutrient deficiencies, and condition-specific needs. These products are often used as part of structured treatment plans. |

| The Pause Life develops products aimed at managing menopause-related symptoms such as sleep disruption, joint discomfort, and hormonal changes, often under provider guidance. |

| Biome Secret focuses on gut-health supplements designed to support digestive conditions. Their formulations are commonly used alongside dietary or medical protocols for gastrointestinal health. |

| Rootless offers supplements focused on metabolic health and blood sugar regulation. These products are often used in nutrition plans tied to insulin sensitivity or metabolic conditions. |

| Amy Myers MD provides physician-formulated supplements designed to support autoimmune, thyroid, and digestive health. These products are frequently used as part of condition-specific care plans. |

Skincare products

Skincare products can qualify when they treat or manage medical skin conditions rather than aesthetic concerns.

Product | Description |

|---|---|

| Freaks of Nature offers skin protection and recovery products designed to support barrier repair, sun protection, and irritation management, particularly for active or outdoor-related skin stress. |

| Lure Essentials produces skincare tools and cleansing products focused on maintaining skin health in dermatologist-directed routines, often tied to acne or sensitivity management. |

| PMD Beauty creates skincare devices designed for cleansing and treatment. These tools are often used to support acne management, exfoliation for medical skin conditions, or provider-recommended skincare routines. |

| Certain Clé de Peau Beauté products may qualify when used under medical guidance for treating specific dermatological conditions rather than cosmetic enhancement. |

| Popmask offers self-heating eye masks designed to support dry eye symptoms, eye strain, and relaxation. These masks are often used by individuals managing screen-related eye discomfort, tension headaches, or medically related eye fatigue. |

This expanded view can help you evaluate end-of-year HSA spending with clarity, focusing on products and services that genuinely support health needs while remaining compliant with HSA guidelines.

In summary

As the end of the year approaches, it helps to remember that an HSA does not come with a countdown clock. Your balance rolls over, stays with you through job changes, and remains available for qualified medical expenses whenever you need it. That flexibility gives you the freedom to choose whether spending now or saving for later fits your situation best.

For some people, using HSA funds before year-end makes practical sense. Covering planned care, stocking up on eligible health supplies, or investing in supportive products can reduce future out-of-pocket costs and help you start the new year prepared. For others, letting funds accumulate for long-term medical needs or future healthcare expenses may feel like a better path.

If spending your HSA funds this year makes sense for you, use the Flex Marketplace to browse for HSA-eligible products.

As the end of the year approaches, it helps to remember that an HSA does not come with a countdown clock. Your balance rolls over, stays with you through job changes, and remains available for qualified medical expenses whenever you need it. That flexibility gives you the freedom to choose whether spending now or saving for later fits your situation best.

For some people, using HSA funds before year-end makes practical sense. Covering planned care, stocking up on eligible health supplies, or investing in supportive products can reduce future out-of-pocket costs and help you start the new year prepared. For others, letting funds accumulate for long-term medical needs or future healthcare expenses may feel like a better path.

If spending your HSA funds this year makes sense for you, use the Flex Marketplace to browse for HSA-eligible products.

As the end of the year approaches, it helps to remember that an HSA does not come with a countdown clock. Your balance rolls over, stays with you through job changes, and remains available for qualified medical expenses whenever you need it. That flexibility gives you the freedom to choose whether spending now or saving for later fits your situation best.

For some people, using HSA funds before year-end makes practical sense. Covering planned care, stocking up on eligible health supplies, or investing in supportive products can reduce future out-of-pocket costs and help you start the new year prepared. For others, letting funds accumulate for long-term medical needs or future healthcare expenses may feel like a better path.

If spending your HSA funds this year makes sense for you, use the Flex Marketplace to browse for HSA-eligible products.

Related content from Flex

HSA/FSA ELIGIBLE SHOPPING

Shop the Flex HSA/FSA Marketplace

Discover HSA/FSA-eligible brands and products

Use your pre-tax HSA/FSA dollars at checkout

Improve your health and wellness with products you’ll love

Shop Now

Shop Now

Shop Now