How To Buy Food with Your HSA/FSA (And When You Can)

Yulia Derdemezis

Head of Marketing at Flex

Updated: February 14, 2026

🚀 Fast Facts: Is food HSA and FSA eligible?

Food does not typically automatically qualify for purchase with an HSA or FSA payment card

In almost all cases, a Letter of Medical Necessity is required to make a purchase eligible

There are a few exceptions where food can qualify under an HSA or FSA plan

Food does not typically automatically qualify for purchase with an HSA or FSA payment card

In almost all cases, a Letter of Medical Necessity is required to make a purchase eligible

There are a few exceptions where food can qualify under an HSA or FSA plan

Food does not typically automatically qualify for purchase with an HSA or FSA payment card

In almost all cases, a Letter of Medical Necessity is required to make a purchase eligible

There are a few exceptions where food can qualify under an HSA or FSA plan

Food does not typically automatically qualify for purchase with an HSA or FSA payment card

In almost all cases, a Letter of Medical Necessity is required to make a purchase eligible

There are a few exceptions where food can qualify under an HSA or FSA plan

You’ve probably looked at your grocery bill and wondered if any of that food could qualify for your Health Savings Account (HSA) or Flexible Spending Account (FSA). Because some goods qualify and others don’t, and some people qualify while others don’t, you want to make sure you are following IRS guidelines if you expense any food items to your HSA or FSA account.

This guide breaks down when food can be HSA/FSA-eligible, when you need extra documentation, and how you can actually buy eligible food without jumping through hoops. You’ll also learn how to find approved options online and pay with your benefits in a faster, simpler way. Here’s what you’ll learn in this guide:

Types of medical conditions that qualify food to be HSA and FSA eligible

How to buy food using your HSA or FSA directly or through reimbursement

10 HSA & FSA approved food you can buy using your plan directly

Understanding the rules upfront can save you time, money, and frustration. With that foundation in mind, let’s start by answering the most common question people ask about food and HSA or FSA eligibility.

You’ve probably looked at your grocery bill and wondered if any of that food could qualify for your Health Savings Account (HSA) or Flexible Spending Account (FSA). Because some goods qualify and others don’t, and some people qualify while others don’t, you want to make sure you are following IRS guidelines if you expense any food items to your HSA or FSA account.

This guide breaks down when food can be HSA/FSA-eligible, when you need extra documentation, and how you can actually buy eligible food without jumping through hoops. You’ll also learn how to find approved options online and pay with your benefits in a faster, simpler way. Here’s what you’ll learn in this guide:

Types of medical conditions that qualify food to be HSA and FSA eligible

How to buy food using your HSA or FSA directly or through reimbursement

10 HSA & FSA approved food you can buy using your plan directly

Understanding the rules upfront can save you time, money, and frustration. With that foundation in mind, let’s start by answering the most common question people ask about food and HSA or FSA eligibility.

You’ve probably looked at your grocery bill and wondered if any of that food could qualify for your Health Savings Account (HSA) or Flexible Spending Account (FSA). Because some goods qualify and others don’t, and some people qualify while others don’t, you want to make sure you are following IRS guidelines if you expense any food items to your HSA or FSA account.

This guide breaks down when food can be HSA/FSA-eligible, when you need extra documentation, and how you can actually buy eligible food without jumping through hoops. You’ll also learn how to find approved options online and pay with your benefits in a faster, simpler way. Here’s what you’ll learn in this guide:

Types of medical conditions that qualify food to be HSA and FSA eligible

How to buy food using your HSA or FSA directly or through reimbursement

10 HSA & FSA approved food you can buy using your plan directly

Understanding the rules upfront can save you time, money, and frustration. With that foundation in mind, let’s start by answering the most common question people ask about food and HSA or FSA eligibility.

Is food HSA and FSA eligible?

Typically, everyday groceries do not qualify as HSA/FSA eligible, but certain foods can become eligible when they directly treat or manage a diagnosed medical condition. Food and grocery items confuse many HSA and FSA users because you buy them every day, yet the IRS treats most food as a personal expense.

As a baseline rule, standard food for daily living is not HSA/FSA eligible. That includes items like produce, pantry staples, snacks, and beverages purchased for normal consumption. Choosing organic, low-carb, or “clean” options does not change eligibility.

Food can qualify when it serves a medical purpose instead of general nutrition, but it must be used to treat, manage, or alleviate a diagnosed medical condition. The IRS draws a clear line between treatment and lifestyle. If the food supports general health, fitness goals, or preventive wellness, it remains ineligible. Even if your doctor recommends eating a certain way, the food itself usually does not qualify unless it treats a medical condition.

When food may qualify as an eligible HSA/FSA expense

Food can qualify when it functions as part of medical care for a documented condition, with a clear connection as treatment for that condition. This usually applies in situations where standard food options cannot meet your health needs.

Common examples include:

Medical foods or formulas designed for specific conditions

Enteral nutrition used under medical supervision

Specialized dietary products required due to a diagnosed illness

In many cases, these products fall under what the IRS considers “medical nutrition therapy.” That classification separates eligible food from groceries you would buy for general wellness.

Do you always need a Letter of Medical Necessity to buy food with your HSA/FSA?

In most cases, yes, you need a Letter of Medical Necessity (LMN) to buy food with your Health Savings Account (HSA) or Flexible Spending Account (FSA). This is because food almost never qualifies on its own and typically only becomes eligible when it treats a specific, diagnosed medical condition.

Food nearly always falls into the “dual-purpose” category. It can nourish someone without a diagnosis, which triggers the need for medical documentation. Food rarely qualifies by default, but it can become HSA/FSA eligible when tied directly to medical care.

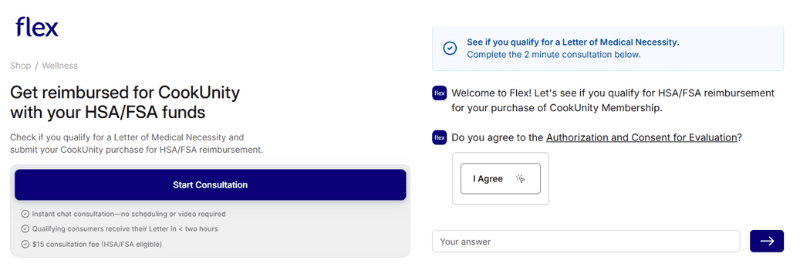

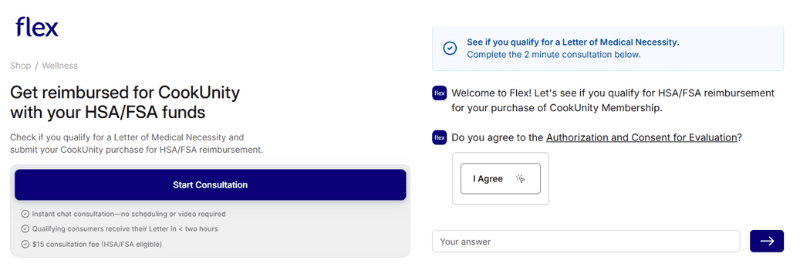

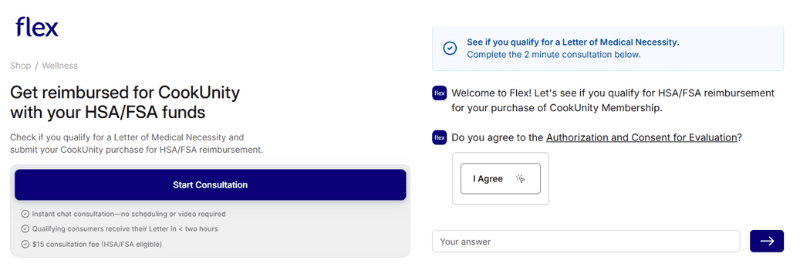

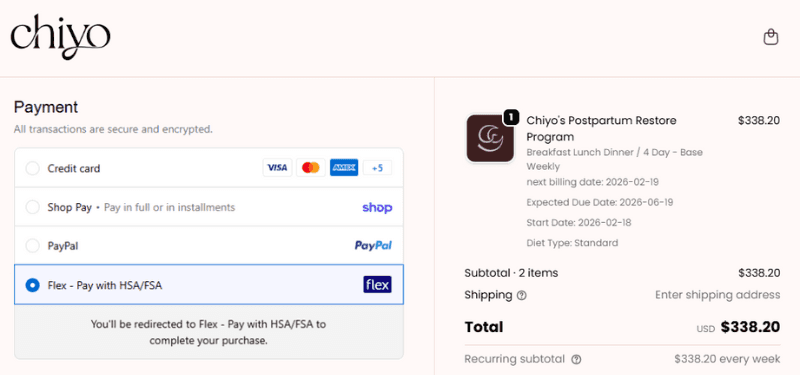

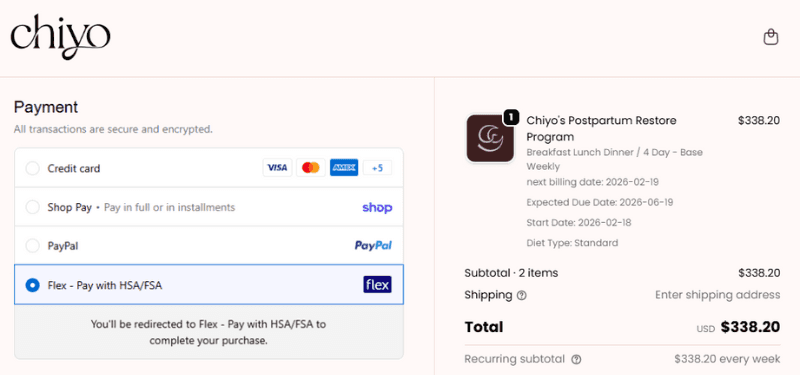

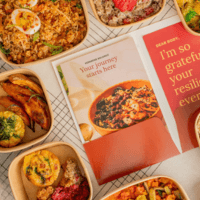

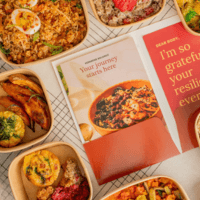

Some online stores in the Flex Marketplace can help you get a Letter of Medical Necessity for your food purchase right at checkout, to make sure you qualify before you make the purchase. See how easy it is with CookUnity:

In the next section, you’ll learn which medical conditions most often qualify food as an eligible expense and how those rules apply in real life.

Typically, everyday groceries do not qualify as HSA/FSA eligible, but certain foods can become eligible when they directly treat or manage a diagnosed medical condition. Food and grocery items confuse many HSA and FSA users because you buy them every day, yet the IRS treats most food as a personal expense.

As a baseline rule, standard food for daily living is not HSA/FSA eligible. That includes items like produce, pantry staples, snacks, and beverages purchased for normal consumption. Choosing organic, low-carb, or “clean” options does not change eligibility.

Food can qualify when it serves a medical purpose instead of general nutrition, but it must be used to treat, manage, or alleviate a diagnosed medical condition. The IRS draws a clear line between treatment and lifestyle. If the food supports general health, fitness goals, or preventive wellness, it remains ineligible. Even if your doctor recommends eating a certain way, the food itself usually does not qualify unless it treats a medical condition.

When food may qualify as an eligible HSA/FSA expense

Food can qualify when it functions as part of medical care for a documented condition, with a clear connection as treatment for that condition. This usually applies in situations where standard food options cannot meet your health needs.

Common examples include:

Medical foods or formulas designed for specific conditions

Enteral nutrition used under medical supervision

Specialized dietary products required due to a diagnosed illness

In many cases, these products fall under what the IRS considers “medical nutrition therapy.” That classification separates eligible food from groceries you would buy for general wellness.

Do you always need a Letter of Medical Necessity to buy food with your HSA/FSA?

In most cases, yes, you need a Letter of Medical Necessity (LMN) to buy food with your Health Savings Account (HSA) or Flexible Spending Account (FSA). This is because food almost never qualifies on its own and typically only becomes eligible when it treats a specific, diagnosed medical condition.

Food nearly always falls into the “dual-purpose” category. It can nourish someone without a diagnosis, which triggers the need for medical documentation. Food rarely qualifies by default, but it can become HSA/FSA eligible when tied directly to medical care.

Some online stores in the Flex Marketplace can help you get a Letter of Medical Necessity for your food purchase right at checkout, to make sure you qualify before you make the purchase. See how easy it is with CookUnity:

In the next section, you’ll learn which medical conditions most often qualify food as an eligible expense and how those rules apply in real life.

Typically, everyday groceries do not qualify as HSA/FSA eligible, but certain foods can become eligible when they directly treat or manage a diagnosed medical condition. Food and grocery items confuse many HSA and FSA users because you buy them every day, yet the IRS treats most food as a personal expense.

As a baseline rule, standard food for daily living is not HSA/FSA eligible. That includes items like produce, pantry staples, snacks, and beverages purchased for normal consumption. Choosing organic, low-carb, or “clean” options does not change eligibility.

Food can qualify when it serves a medical purpose instead of general nutrition, but it must be used to treat, manage, or alleviate a diagnosed medical condition. The IRS draws a clear line between treatment and lifestyle. If the food supports general health, fitness goals, or preventive wellness, it remains ineligible. Even if your doctor recommends eating a certain way, the food itself usually does not qualify unless it treats a medical condition.

When food may qualify as an eligible HSA/FSA expense

Food can qualify when it functions as part of medical care for a documented condition, with a clear connection as treatment for that condition. This usually applies in situations where standard food options cannot meet your health needs.

Common examples include:

Medical foods or formulas designed for specific conditions

Enteral nutrition used under medical supervision

Specialized dietary products required due to a diagnosed illness

In many cases, these products fall under what the IRS considers “medical nutrition therapy.” That classification separates eligible food from groceries you would buy for general wellness.

Do you always need a Letter of Medical Necessity to buy food with your HSA/FSA?

In most cases, yes, you need a Letter of Medical Necessity (LMN) to buy food with your Health Savings Account (HSA) or Flexible Spending Account (FSA). This is because food almost never qualifies on its own and typically only becomes eligible when it treats a specific, diagnosed medical condition.

Food nearly always falls into the “dual-purpose” category. It can nourish someone without a diagnosis, which triggers the need for medical documentation. Food rarely qualifies by default, but it can become HSA/FSA eligible when tied directly to medical care.

Some online stores in the Flex Marketplace can help you get a Letter of Medical Necessity for your food purchase right at checkout, to make sure you qualify before you make the purchase. See how easy it is with CookUnity:

In the next section, you’ll learn which medical conditions most often qualify food as an eligible expense and how those rules apply in real life.

Types of medical conditions that qualify food to be HSA and FSA eligible

Food can qualify for payment with your HSA or FSA when it directly treats or manages a diagnosed medical condition, like these:

Phenylketonuria (PKU): PKU is a genetic metabolic disorder that prevents the body from processing phenylalanine. Low-protein medical foods and formulas required to manage PKU are commonly HSA- and FSA-eligible because standard food options cannot meet treatment needs.

Maple Syrup Urine Disease (MSUD): MSUD affects how the body processes certain amino acids. Specialized medical formulas and restricted-protein foods used to manage this condition often qualify as eligible medical expenses under HSAs and FSAs.

Other inherited metabolic disorders: Conditions that impair normal nutrient metabolism may require prescription-grade or specialty medical foods. These products frequently qualify for HSA or FSA use because they replace standard food as part of treatment.

Crohn’s Disease: Crohn’s disease can limit nutrient absorption and may require enteral nutrition or elemental formulas. When used as part of medical care, these food products may qualify, often with a Letter of Medical Necessity (LMN).

Ulcerative Colitis: Ulcerative colitis may require specialized nutrition during flare-ups or recovery periods. Certain medical nutrition products can qualify for HSA or FSA reimbursement when tied to treatment.

Short Bowel Syndrome: Short bowel syndrome reduces the body’s ability to absorb nutrients from regular food. Enteral formulas or specialized nutrition products used to maintain health often qualify as eligible expenses.

Severe food allergies: Severe allergies, such as milk protein allergy, may require hypoallergenic or amino acid–based formulas. These products can qualify for HSA or FSA use when standard substitutes are not medically safe, often with an LMN.

Clinically diagnosed food intolerances: In some cases, intolerances documented by a provider may require specific medical foods. Eligibility depends on whether the product treats the condition rather than supporting general wellness.

Diabetes: Diabetes management sometimes includes specialized nutrition products recommended as part of treatment. These foods may qualify when supported by medical documentation and used for disease management.

Chronic Kidney Disease: Kidney disease can require strict dietary control, including specialized low-protein or electrolyte-managed foods. Certain products may qualify for HSA or FSA use when medically necessary.

Neurological or swallowing disorders: Conditions that affect chewing or swallowing may require texture-modified foods or liquid nutrition. These products often qualify when they replace standard food due to medical need.

Failure To Thrive: Failure to thrive may require prescribed nutrition to support weight gain and development. Medical formulas and supplements used in treatment can qualify as eligible expenses.

Clinically diagnosed eating disorders: When food products are prescribed as part of treatment for eating disorders, they may qualify for HSA or FSA use due to their therapeutic role.

Food qualifies for HSA and FSA use when it treats a diagnosed medical condition and functions as part of medical care. Knowing how your condition fits into these categories helps you determine eligibility before spending your benefits.

Food can qualify for payment with your HSA or FSA when it directly treats or manages a diagnosed medical condition, like these:

Phenylketonuria (PKU): PKU is a genetic metabolic disorder that prevents the body from processing phenylalanine. Low-protein medical foods and formulas required to manage PKU are commonly HSA- and FSA-eligible because standard food options cannot meet treatment needs.

Maple Syrup Urine Disease (MSUD): MSUD affects how the body processes certain amino acids. Specialized medical formulas and restricted-protein foods used to manage this condition often qualify as eligible medical expenses under HSAs and FSAs.

Other inherited metabolic disorders: Conditions that impair normal nutrient metabolism may require prescription-grade or specialty medical foods. These products frequently qualify for HSA or FSA use because they replace standard food as part of treatment.

Crohn’s Disease: Crohn’s disease can limit nutrient absorption and may require enteral nutrition or elemental formulas. When used as part of medical care, these food products may qualify, often with a Letter of Medical Necessity (LMN).

Ulcerative Colitis: Ulcerative colitis may require specialized nutrition during flare-ups or recovery periods. Certain medical nutrition products can qualify for HSA or FSA reimbursement when tied to treatment.

Short Bowel Syndrome: Short bowel syndrome reduces the body’s ability to absorb nutrients from regular food. Enteral formulas or specialized nutrition products used to maintain health often qualify as eligible expenses.

Severe food allergies: Severe allergies, such as milk protein allergy, may require hypoallergenic or amino acid–based formulas. These products can qualify for HSA or FSA use when standard substitutes are not medically safe, often with an LMN.

Clinically diagnosed food intolerances: In some cases, intolerances documented by a provider may require specific medical foods. Eligibility depends on whether the product treats the condition rather than supporting general wellness.

Diabetes: Diabetes management sometimes includes specialized nutrition products recommended as part of treatment. These foods may qualify when supported by medical documentation and used for disease management.

Chronic Kidney Disease: Kidney disease can require strict dietary control, including specialized low-protein or electrolyte-managed foods. Certain products may qualify for HSA or FSA use when medically necessary.

Neurological or swallowing disorders: Conditions that affect chewing or swallowing may require texture-modified foods or liquid nutrition. These products often qualify when they replace standard food due to medical need.

Failure To Thrive: Failure to thrive may require prescribed nutrition to support weight gain and development. Medical formulas and supplements used in treatment can qualify as eligible expenses.

Clinically diagnosed eating disorders: When food products are prescribed as part of treatment for eating disorders, they may qualify for HSA or FSA use due to their therapeutic role.

Food qualifies for HSA and FSA use when it treats a diagnosed medical condition and functions as part of medical care. Knowing how your condition fits into these categories helps you determine eligibility before spending your benefits.

Food can qualify for payment with your HSA or FSA when it directly treats or manages a diagnosed medical condition, like these:

Phenylketonuria (PKU): PKU is a genetic metabolic disorder that prevents the body from processing phenylalanine. Low-protein medical foods and formulas required to manage PKU are commonly HSA- and FSA-eligible because standard food options cannot meet treatment needs.

Maple Syrup Urine Disease (MSUD): MSUD affects how the body processes certain amino acids. Specialized medical formulas and restricted-protein foods used to manage this condition often qualify as eligible medical expenses under HSAs and FSAs.

Other inherited metabolic disorders: Conditions that impair normal nutrient metabolism may require prescription-grade or specialty medical foods. These products frequently qualify for HSA or FSA use because they replace standard food as part of treatment.

Crohn’s Disease: Crohn’s disease can limit nutrient absorption and may require enteral nutrition or elemental formulas. When used as part of medical care, these food products may qualify, often with a Letter of Medical Necessity (LMN).

Ulcerative Colitis: Ulcerative colitis may require specialized nutrition during flare-ups or recovery periods. Certain medical nutrition products can qualify for HSA or FSA reimbursement when tied to treatment.

Short Bowel Syndrome: Short bowel syndrome reduces the body’s ability to absorb nutrients from regular food. Enteral formulas or specialized nutrition products used to maintain health often qualify as eligible expenses.

Severe food allergies: Severe allergies, such as milk protein allergy, may require hypoallergenic or amino acid–based formulas. These products can qualify for HSA or FSA use when standard substitutes are not medically safe, often with an LMN.

Clinically diagnosed food intolerances: In some cases, intolerances documented by a provider may require specific medical foods. Eligibility depends on whether the product treats the condition rather than supporting general wellness.

Diabetes: Diabetes management sometimes includes specialized nutrition products recommended as part of treatment. These foods may qualify when supported by medical documentation and used for disease management.

Chronic Kidney Disease: Kidney disease can require strict dietary control, including specialized low-protein or electrolyte-managed foods. Certain products may qualify for HSA or FSA use when medically necessary.

Neurological or swallowing disorders: Conditions that affect chewing or swallowing may require texture-modified foods or liquid nutrition. These products often qualify when they replace standard food due to medical need.

Failure To Thrive: Failure to thrive may require prescribed nutrition to support weight gain and development. Medical formulas and supplements used in treatment can qualify as eligible expenses.

Clinically diagnosed eating disorders: When food products are prescribed as part of treatment for eating disorders, they may qualify for HSA or FSA use due to their therapeutic role.

Food qualifies for HSA and FSA use when it treats a diagnosed medical condition and functions as part of medical care. Knowing how your condition fits into these categories helps you determine eligibility before spending your benefits.

How to buy food using your HSA or FSA directly or through reimbursement

Once you know a food item qualifies as HSA/FSA eligible, the next challenge is figuring out how to pay for it correctly. This step trips up many people because not every store handles HSA and FSA payments the same way.

You generally have two options: paying with your HSA or FSA card at checkout, or paying out of pocket and submitting a reimbursement claim. Understanding when to use each option helps you avoid denied transactions and wasted time.

1. Pay for food with your HSA/FSA directly at checkout

Paying directly at checkout is the simplest and fastest option when it’s available. This method works best when the seller can verify eligibility before the purchase goes through.

When direct payment works well:

You know the product will be HSA or FSA eligible for you

Your eligibility is confirmed at checkout

Any required documentation, such as an LMN, is handled during the purchase

This is where shopping through a dedicated benefits marketplace makes a real difference. The Flex Marketplace lets you browse food and nutrition products that qualify for HSA and FSA use and pay with your benefits card instantly. You avoid guessing, saving receipts, or wondering whether the purchase will go through.

Another advantage of buying through Flex is convenience. You can shop from hundreds of trusted online brands in one place and check out knowing eligibility rules are already accounted for. That removes friction and keeps you from dealing with reimbursement paperwork later.

2. Make a reimbursement claim for food after paying out of pocket

Reimbursement works when direct HSA or FSA payment is not an option. This approach requires a bit more effort, but it still allows you to use your benefits.

The reimbursement process usually looks like this:

You pay for the food using a personal credit or debit card

You collect an itemized receipt showing the product and date

You submit a claim through your HSA or FSA administrator

You provide an LMN if required

Your plan reimburses you after approval

Reimbursement often comes up when buying from smaller retailers or specialty brands that do not accept HSA or FSA cards directly. It can also apply when eligibility depends on your specific diagnosis.

The biggest downside is the uncertainty of wondering if your claim will be approved (when you’ve already spent the money), and the concern of needing to pay upfront, as the continued need for specialized food and nutrition tends to be costly.

This is why many people prefer shopping through the Flex Marketplace even when reimbursement is possible. Flex reduces the risk of denied claims by guiding you toward products designed for HSA and FSA spending and supporting direct payment whenever possible.

Reimbursement works, but it adds steps and delays. Direct checkout through a trusted marketplace simplifies the experience and keeps your benefits easy to use.

Next, you’ll see real examples of HSA/FSA-approved food you can often buy directly using your plan, so you know what to look for when you start shopping.

Once you know a food item qualifies as HSA/FSA eligible, the next challenge is figuring out how to pay for it correctly. This step trips up many people because not every store handles HSA and FSA payments the same way.

You generally have two options: paying with your HSA or FSA card at checkout, or paying out of pocket and submitting a reimbursement claim. Understanding when to use each option helps you avoid denied transactions and wasted time.

1. Pay for food with your HSA/FSA directly at checkout

Paying directly at checkout is the simplest and fastest option when it’s available. This method works best when the seller can verify eligibility before the purchase goes through.

When direct payment works well:

You know the product will be HSA or FSA eligible for you

Your eligibility is confirmed at checkout

Any required documentation, such as an LMN, is handled during the purchase

This is where shopping through a dedicated benefits marketplace makes a real difference. The Flex Marketplace lets you browse food and nutrition products that qualify for HSA and FSA use and pay with your benefits card instantly. You avoid guessing, saving receipts, or wondering whether the purchase will go through.

Another advantage of buying through Flex is convenience. You can shop from hundreds of trusted online brands in one place and check out knowing eligibility rules are already accounted for. That removes friction and keeps you from dealing with reimbursement paperwork later.

2. Make a reimbursement claim for food after paying out of pocket

Reimbursement works when direct HSA or FSA payment is not an option. This approach requires a bit more effort, but it still allows you to use your benefits.

The reimbursement process usually looks like this:

You pay for the food using a personal credit or debit card

You collect an itemized receipt showing the product and date

You submit a claim through your HSA or FSA administrator

You provide an LMN if required

Your plan reimburses you after approval

Reimbursement often comes up when buying from smaller retailers or specialty brands that do not accept HSA or FSA cards directly. It can also apply when eligibility depends on your specific diagnosis.

The biggest downside is the uncertainty of wondering if your claim will be approved (when you’ve already spent the money), and the concern of needing to pay upfront, as the continued need for specialized food and nutrition tends to be costly.

This is why many people prefer shopping through the Flex Marketplace even when reimbursement is possible. Flex reduces the risk of denied claims by guiding you toward products designed for HSA and FSA spending and supporting direct payment whenever possible.

Reimbursement works, but it adds steps and delays. Direct checkout through a trusted marketplace simplifies the experience and keeps your benefits easy to use.

Next, you’ll see real examples of HSA/FSA-approved food you can often buy directly using your plan, so you know what to look for when you start shopping.

Once you know a food item qualifies as HSA/FSA eligible, the next challenge is figuring out how to pay for it correctly. This step trips up many people because not every store handles HSA and FSA payments the same way.

You generally have two options: paying with your HSA or FSA card at checkout, or paying out of pocket and submitting a reimbursement claim. Understanding when to use each option helps you avoid denied transactions and wasted time.

1. Pay for food with your HSA/FSA directly at checkout

Paying directly at checkout is the simplest and fastest option when it’s available. This method works best when the seller can verify eligibility before the purchase goes through.

When direct payment works well:

You know the product will be HSA or FSA eligible for you

Your eligibility is confirmed at checkout

Any required documentation, such as an LMN, is handled during the purchase

This is where shopping through a dedicated benefits marketplace makes a real difference. The Flex Marketplace lets you browse food and nutrition products that qualify for HSA and FSA use and pay with your benefits card instantly. You avoid guessing, saving receipts, or wondering whether the purchase will go through.

Another advantage of buying through Flex is convenience. You can shop from hundreds of trusted online brands in one place and check out knowing eligibility rules are already accounted for. That removes friction and keeps you from dealing with reimbursement paperwork later.

2. Make a reimbursement claim for food after paying out of pocket

Reimbursement works when direct HSA or FSA payment is not an option. This approach requires a bit more effort, but it still allows you to use your benefits.

The reimbursement process usually looks like this:

You pay for the food using a personal credit or debit card

You collect an itemized receipt showing the product and date

You submit a claim through your HSA or FSA administrator

You provide an LMN if required

Your plan reimburses you after approval

Reimbursement often comes up when buying from smaller retailers or specialty brands that do not accept HSA or FSA cards directly. It can also apply when eligibility depends on your specific diagnosis.

The biggest downside is the uncertainty of wondering if your claim will be approved (when you’ve already spent the money), and the concern of needing to pay upfront, as the continued need for specialized food and nutrition tends to be costly.

This is why many people prefer shopping through the Flex Marketplace even when reimbursement is possible. Flex reduces the risk of denied claims by guiding you toward products designed for HSA and FSA spending and supporting direct payment whenever possible.

Reimbursement works, but it adds steps and delays. Direct checkout through a trusted marketplace simplifies the experience and keeps your benefits easy to use.

Next, you’ll see real examples of HSA/FSA-approved food you can often buy directly using your plan, so you know what to look for when you start shopping.

10 HSA & FSA approved food you can buy using your plan directly

Finding food-related products that work with your HSA or FSA gets easier when you know which brands support eligibility and direct checkout. Below are trusted brands that offer food, nutrition, or food alternatives commonly used for medical or digestive support.

Product | Description |

| CookUnity offers chef-prepared meals, including medically tailored options designed for specific dietary needs. When meals support a diagnosed condition and meet plan rules, they may qualify with proper documentation. |

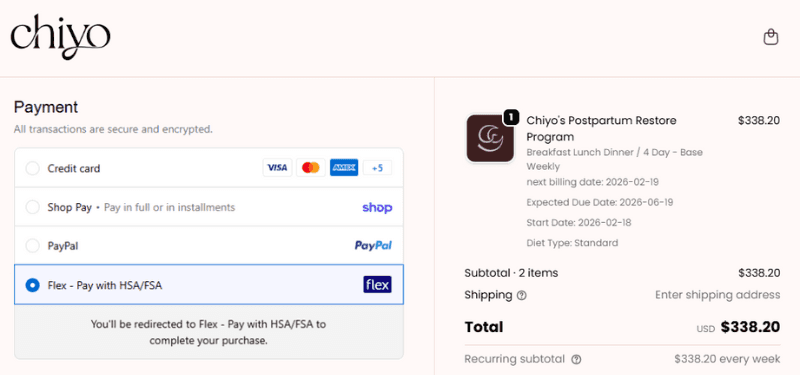

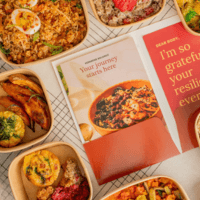

| Chiyo provides functional meals and broths focused on hormonal and reproductive health. These food-based products are often used as nutrition support during pregnancy or postpartum care. |

| DinnerTime Rewards supports structured nutrition programs that encourage medically guided food choices. Certain programs may qualify when tied to treatment or care plans. |

| Foodom connects you with personal chefs who prepare meals based on medical or dietary needs. When meals support treatment for a condition, related services may qualify with documentation. |

| Wellspring Meds offers medically supervised programs that may include nutrition guidance and food alternatives used alongside treatment for weight-related conditions. |

| Biome Secret focuses on gut health through food-based protocols and functional nutrition. These products act as alternatives to everyday food when managing digestive conditions. |

| Rootless creates nutrition products designed to replace or support meals for digestive and metabolic health. These options may qualify when used as part of medical nutrition therapy. |

| Amy Myers MD offers food alternatives, powders, and gut-focused nutrition products used in clinical protocols. These products often support digestive and autoimmune-related conditions. |

| GutPersonal provides customized nutrition blends tailored to gut health needs. These food alternatives are commonly used to manage digestive conditions under care guidance. |

| Osh Wellness offers functional nutrition products designed to replace or supplement food during treatment for digestive and metabolic concerns. |

Food and food alternatives can qualify for HSA and FSA use when they support medical care instead of everyday eating. Shopping through approved brands and marketplaces that allow direct payment helps you use your benefits with clarity and confidence.

Finding food-related products that work with your HSA or FSA gets easier when you know which brands support eligibility and direct checkout. Below are trusted brands that offer food, nutrition, or food alternatives commonly used for medical or digestive support.

Product | Description |

| CookUnity offers chef-prepared meals, including medically tailored options designed for specific dietary needs. When meals support a diagnosed condition and meet plan rules, they may qualify with proper documentation. |

| Chiyo provides functional meals and broths focused on hormonal and reproductive health. These food-based products are often used as nutrition support during pregnancy or postpartum care. |

| DinnerTime Rewards supports structured nutrition programs that encourage medically guided food choices. Certain programs may qualify when tied to treatment or care plans. |

| Foodom connects you with personal chefs who prepare meals based on medical or dietary needs. When meals support treatment for a condition, related services may qualify with documentation. |

| Wellspring Meds offers medically supervised programs that may include nutrition guidance and food alternatives used alongside treatment for weight-related conditions. |

| Biome Secret focuses on gut health through food-based protocols and functional nutrition. These products act as alternatives to everyday food when managing digestive conditions. |

| Rootless creates nutrition products designed to replace or support meals for digestive and metabolic health. These options may qualify when used as part of medical nutrition therapy. |

| Amy Myers MD offers food alternatives, powders, and gut-focused nutrition products used in clinical protocols. These products often support digestive and autoimmune-related conditions. |

| GutPersonal provides customized nutrition blends tailored to gut health needs. These food alternatives are commonly used to manage digestive conditions under care guidance. |

| Osh Wellness offers functional nutrition products designed to replace or supplement food during treatment for digestive and metabolic concerns. |

Food and food alternatives can qualify for HSA and FSA use when they support medical care instead of everyday eating. Shopping through approved brands and marketplaces that allow direct payment helps you use your benefits with clarity and confidence.

Finding food-related products that work with your HSA or FSA gets easier when you know which brands support eligibility and direct checkout. Below are trusted brands that offer food, nutrition, or food alternatives commonly used for medical or digestive support.

Product | Description |

| CookUnity offers chef-prepared meals, including medically tailored options designed for specific dietary needs. When meals support a diagnosed condition and meet plan rules, they may qualify with proper documentation. |

| Chiyo provides functional meals and broths focused on hormonal and reproductive health. These food-based products are often used as nutrition support during pregnancy or postpartum care. |

| DinnerTime Rewards supports structured nutrition programs that encourage medically guided food choices. Certain programs may qualify when tied to treatment or care plans. |

| Foodom connects you with personal chefs who prepare meals based on medical or dietary needs. When meals support treatment for a condition, related services may qualify with documentation. |

| Wellspring Meds offers medically supervised programs that may include nutrition guidance and food alternatives used alongside treatment for weight-related conditions. |

| Biome Secret focuses on gut health through food-based protocols and functional nutrition. These products act as alternatives to everyday food when managing digestive conditions. |

| Rootless creates nutrition products designed to replace or support meals for digestive and metabolic health. These options may qualify when used as part of medical nutrition therapy. |

| Amy Myers MD offers food alternatives, powders, and gut-focused nutrition products used in clinical protocols. These products often support digestive and autoimmune-related conditions. |

| GutPersonal provides customized nutrition blends tailored to gut health needs. These food alternatives are commonly used to manage digestive conditions under care guidance. |

| Osh Wellness offers functional nutrition products designed to replace or supplement food during treatment for digestive and metabolic concerns. |

Food and food alternatives can qualify for HSA and FSA use when they support medical care instead of everyday eating. Shopping through approved brands and marketplaces that allow direct payment helps you use your benefits with clarity and confidence.

In Summary

Food and grocery eligibility under Health Savings Accounts (HSAs) and Flexible Spending Accounts (FSAs) can feel unclear, but the rules follow a consistent pattern. Most everyday food does not qualify, while specific food becomes eligible when it directly treats or manages a diagnosed medical condition and meets IRS requirements.

The biggest takeaway is that medical purpose drives eligibility. When food functions as treatment and not general nutrition, it may qualify, sometimes with a Letter of Medical Necessity (LMN). Knowing this upfront helps you avoid denied claims and wasted benefits.

How you buy eligible food matters just as much as what you buy. Paying directly with your HSA or FSA card at checkout saves time and removes paperwork, while reimbursement adds steps and uncertainty. That is why many people choose to shop through the Flex Marketplace, where you can browse food and nutrition products designed for HSA and FSA use and pay instantly with your benefits.

If you still have funds left in your account, food-related medical expenses can be a practical way to use them before deadlines hit. Starting with a trusted marketplace like Flex makes it easier to find eligible options, check out with confidence, and put your HSA or FSA dollars to work without stress.

Food and grocery eligibility under Health Savings Accounts (HSAs) and Flexible Spending Accounts (FSAs) can feel unclear, but the rules follow a consistent pattern. Most everyday food does not qualify, while specific food becomes eligible when it directly treats or manages a diagnosed medical condition and meets IRS requirements.

The biggest takeaway is that medical purpose drives eligibility. When food functions as treatment and not general nutrition, it may qualify, sometimes with a Letter of Medical Necessity (LMN). Knowing this upfront helps you avoid denied claims and wasted benefits.

How you buy eligible food matters just as much as what you buy. Paying directly with your HSA or FSA card at checkout saves time and removes paperwork, while reimbursement adds steps and uncertainty. That is why many people choose to shop through the Flex Marketplace, where you can browse food and nutrition products designed for HSA and FSA use and pay instantly with your benefits.

If you still have funds left in your account, food-related medical expenses can be a practical way to use them before deadlines hit. Starting with a trusted marketplace like Flex makes it easier to find eligible options, check out with confidence, and put your HSA or FSA dollars to work without stress.

Food and grocery eligibility under Health Savings Accounts (HSAs) and Flexible Spending Accounts (FSAs) can feel unclear, but the rules follow a consistent pattern. Most everyday food does not qualify, while specific food becomes eligible when it directly treats or manages a diagnosed medical condition and meets IRS requirements.

The biggest takeaway is that medical purpose drives eligibility. When food functions as treatment and not general nutrition, it may qualify, sometimes with a Letter of Medical Necessity (LMN). Knowing this upfront helps you avoid denied claims and wasted benefits.

How you buy eligible food matters just as much as what you buy. Paying directly with your HSA or FSA card at checkout saves time and removes paperwork, while reimbursement adds steps and uncertainty. That is why many people choose to shop through the Flex Marketplace, where you can browse food and nutrition products designed for HSA and FSA use and pay instantly with your benefits.

If you still have funds left in your account, food-related medical expenses can be a practical way to use them before deadlines hit. Starting with a trusted marketplace like Flex makes it easier to find eligible options, check out with confidence, and put your HSA or FSA dollars to work without stress.

Related content from Flex

HSA/FSA ELIGIBLE SHOPPING

Shop the Flex HSA/FSA Marketplace

Discover HSA/FSA-eligible brands and products

Use your pre-tax HSA/FSA dollars at checkout

Improve your health and wellness with products you’ll love

Shop Now

Shop Now

Shop Now